Cash Flow from Operations

Refers to a business's cash inflow and outflow due to its routine operations, such as selling products or paying for ongoing expenses

What Is Cash Flow From Operating Activities (CFO)?

A business's cash inflow and outflow due to its routine operations, such as selling products or paying for ongoing expenses, is known as cash flow from operating activities. It functions as an accurate predictor of the company’s financial health.

Operating activities include the company’s day-to-day activities that create revenues, such as selling inventory and providing services, and other activities not classified as investing or financing.

The cash flow (CFs) from operations is one of the three parts of the Cash Flow Statement (CFS).

The CFS provides information about a company’s cash income and expenditures during an accounting period. The cash flow statement provides cash-based data, complementing the accrual-based data presented in the income statement.

If a company cannot generate enough cash from its business operations, it must resort to other financing sources, like a loan. This can put additional pressure on the company and is unsustainable.

Key Takeaways

- Cash Flow From Operating Activities (CFO) tracks a company's cash inflow and outflow from its routine operations, excluding financing and investing activities.

- It is a key indicator of a company's financial health and operational efficiency, helping investors assess its ability to generate cash.

- CFO includes earnings, changes in working capital, cash paid to suppliers, and other operational cash flows.

- It can be calculated using the indirect method, which adjusts net income for non-cash items and changes in working capital, or the direct method, which lists actual cash inflows and outflows.

- CFO is vital for understanding a company's liquidity, sustainability of cash flows, ability to pay dividends, and overall financial strength.

Understanding Cash Flow From Operations

Operating cash flow (OCF) measures the cash generated or consumed by a company's operating activities, accounting for accruals and reflecting its fundamental business operations.

One must review the company's financial statements before analyzing the positive and negative items from operating activities. The financial statements include three components:

- Balance sheet

- Income Statement

- Cash Flow Statement

Note

The operating cash flow reflects the cash generated or consumed by a company's fundamental business operations, including changes in working capital.

What is a Cash Flow Statement (CFS)?

Let's understand what the cash flow statement indicates before delving into how the cash flow from operations functions.

The cash flow statement details the cash movements during a specific accounting period. The statement is one of the primary financial statements commonly presented by businesses at the end of a financial period.

The statement shows the ability of an organization to be liquid in the long and short term, based on the inflows and outflows of cash during a period. The statement is usually divided into 3 sections:

- Operating activities

- Investing activities

- Financing activities

Cash flow from operating activities arises from inflow and outflow from daily activities such as sales and operating expenses.

Investing activities include cash inflow or outflow from selling and purchasing assets such as buildings and machinery. Financing activities include cash flow from the issuance of equity and taking debt.

Note

The cash flow statement does not consider accruals, which is how it differs from the income statement and the balance sheet. It shows only the real inflows and outflows of cash.

Uses

It helps an analyst determine whether the company can maintain the requirements and expand its existing business operations.

As the name suggests, the CFO only restricts itself to operating cash flows; thus, it would not record any cash flows that interest the financing or investing side of the cash flow statement. For example, interest paid on a bank loan and gains on investments won't be recorded in this statement.

Sources

CFO generates money through activities that include:

- Earnings (also known as sales, revenue)

- Depreciation expenses

- Changes in accounts receivables

- Changes in accounts payables

- Changes in current assets such as inventory, prepaid expenses, raw materials

- Cash paid to suppliers

- Other cash operating expenses and incomes

Non-cash expenses such as depreciation or amortization of assets are included in the CFO's calculation because they represent non-cash expenses and reduce the company's actual cash position.

Cash flow from operations is usually recorded in the first section of the cash flow statement. Although it does not provide much information to the organization's potential investors, it is highly used by the management to track their operational performance.

Methods for Calculating Cash Flow from Operations (CFO)

There are two ways for a business to show its CFO in the cash flow statement:

- Indirect Approach

- Direct Method

The direct technique, which simply lists all positive and negative operating cash flow, maybe a more intuitive way to record items. Analysts also favor this approach.

Contrary to the implication, the indirect method adjusts net income for non-cash items and operating accruals changes to reconcile net income with operating cash flow.

1. The Indirect Method

For all non-cash items, the net income is adjusted in this case. Adjustments are performed for non-cash items, non-operating items, and net changes in operating accruals to reconcile net income with operating cash flow.

The indirect method's primary advantage is that it explains the discrepancies between operating cash flows and net profits.

Another rationale for this strategy is its process of starting with net income and then adjusting for non-cash items and changes in operating accruals to derive operating cash flow. However, it is not directly linked to forecasting strategies.

Many businesses support this method because it is simpler and less expensive than reporting information in a direct format. However, the cost-effectiveness of this procedure compared to the direct method, particularly in light of technological advancements, remains uncertain.

Formula

The indirect method is calculated as follows:

Net income +/- changes in the closing balances of assets and liabilities + non-cash expenditures equal operating cash flow

Net income can be determined on the income statement, but non-cash components need extra investigation. This category of costs includes stock-based compensation, amortization, depletion, and other charges.

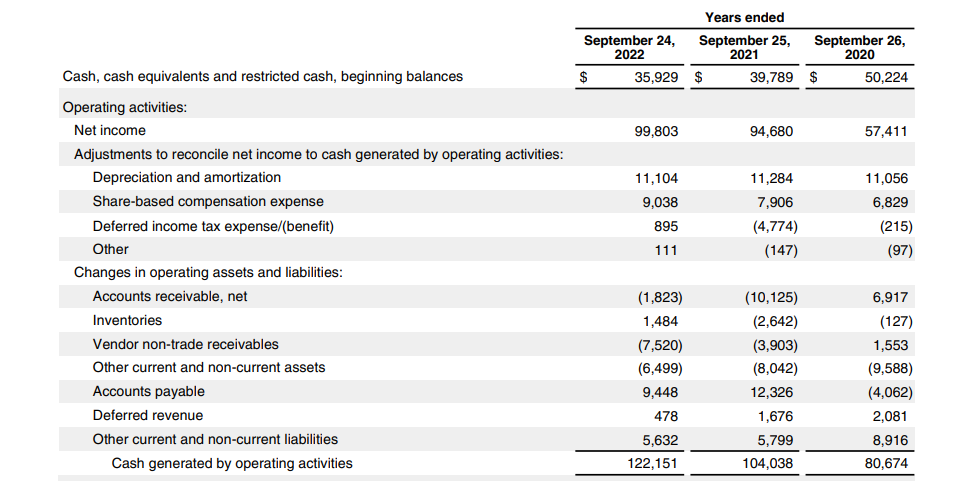

You must calculate the change in working capital for your company's operations after non-cash items have been included in the net income. Below is an example of a CFO using the indirect method from Apple Inc.'s books.

2. The Direct Method

In the second method, the company records all transactions on a cash basis. It displays information using the actual cash inflows and outflows during the accounting period.

It also provides specific information on the operating cash receipts and payments, similar to the former method shown above. In simpler terms, this method eliminates the impact of accruals on the statement and shows only cash expenses and receipts.

The argument for using this method is that information for specific income and expenditures is more useful to analysts than just knowing the net result, i.e., net income.

This method helps analysts get more detailed information about the company's cash flows than the indirect method. This additional information is useful for predicting future CFs and the company's financial strength.

Note

IFRS and US GAAP recommend using the direct method for reporting cash flows, although they allow using the indirect method.

Example

Below is a hypothetical example of a CFO using the direct method:

| Cash Flows from operating activities | |

|---|---|

| Cash provided by donations | 3,000,000 |

| Cash provided by interest | 495,000 |

| Cash provided by dividends | 640,000 |

| Cash used to pay program authorizations | (1,075,000) |

| Cash used to pay salaries | (1,275,000) |

| Cash used to pay health insurance | (400,000) |

| Cash used to pay operating expenses | (585,000) |

| Net cash flow from operating activities | 800,000 |

Importance of Cash Flow from Operations (CFO)

There are various reasons why one can find the use of a CFO statement an extremely important metric. These reasons are mentioned below:

- It is a primary measure of a company’s ability to generate cash flow from its core operations. Negative cash flows indicate that a company is not generating adequate cash from its operation to sustain its expenses. Positive cash flow indicates that it is excess cash over its expenses

- It provides information about a company’s ability to generate “sustainable” cash flows. It indicates whether the company has a consistent cash flow from its operations or relies only on one-time events to yield cash

- The CFO presents the company’s financial health. Positive cash flow tells us that the company is not struggling to pay its expenses, fund all operations, and service its debt

- It indicates the company’s ability to pay its shareholder's dividends. A negative CFO indicates that the company cannot cover its expenses; hence, there are limited chances that it will pay dividends

- In addition to indicators like EBITDA and net income, the CFO gives a detailed analysis of the actual use of cash in the business, which shows the current state of the business and its financial position

Example of Cash Flow From Operations

Let us look at a hypothetical indirect method example by analyzing the cash flow details below

- The net income reported is $ 45.5 Billion

- The depreciation is $8.5 Billion

- Changes in Working capital is -12.3 Billion

- Non-cash charges for share-based compensation are $ 5 Billion

- Changes in trade payables are $ -9 Billion

- Changes in inventories account for $ 20 Billion

Let us look at the solution to this question:

Cash Flow from Operating Activities = Net Income + Depreciation, Depletion, & Amortization + Adjustments To Net Income + Changes In Accounts Receivables + Changes In Liabilities + Changes in Inventories + Changes In Other Operating Activities.

Therefore, CFO = 45.5 + 8.5 + 12.3 + 5 - 9 - 20 = 42.3

Hence, the Cash flow from Operations is $42.3 Billion, which indicates that the company is in good financial condition and will not have any issues servicing debt, expanding its business operations, or paying its expenses.

Example

Look at another hypothetical direct method example by analyzing the cash flow details below

- Cash paid for electricity expenses is $ 5 Billion

- Cash sales of $ 29 Billion

- Depreciation expense of $ 10 Billion

- Purchased stationery worth $ 10 billion

- Cash received by renting an asset for a short term was $ 0.5 Billion

- Repairing charges to the damaged inventory were $ 8 billion

Let us take a look at the solution to this question:

| Cash Flow from operations | ||

|---|---|---|

| Sales | 29 | |

| Electricity expenses | -5 | |

| Stationery purchases | -11 | |

| Income from renting the asset | 0.5 | |

| Repairing charges | -8 | |

| Net cash provided by CFO | 5.5 |

Note

Depreciation expense is not added to the statement prepared using the direct method because it is a non-cash expenditure, and thus, it does not affect cash flow from operations using the direct method.

Cash Flow From Operations FAQs

Changes in expenses and income arising out of operating activities affect the CFO. Changes in expenses and income arising out of operating activities affect the CFO, but changes in net income may not directly impact it.

The cash flow in this statement can be easily manipulated by inflating the receivables or payables. By manipulating receivables or payables, one can affect the balance sheet but not necessarily manipulate Cash Flow From Operations (CFO).

If the statement shows a negative bottom line, it shows that a company has excess operating expenses over its income and thus suffers a loss. This is considered a negative sign when one analyzes the statement.

Operating cash flow does not include interest. This statement indicates how strong the organization’s operating activities are. Interest earned would come under the investing activities, and interest paid would be placed under financing activities.

Operating cash flow indicates the company’s financial strength through its operating activities. This statement indicates how strong the organization’s operating activities are.

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?