General Ledger

It is an accounting record that summarizes all financial transactions of debit and credit accounts

What is a General Ledger?

A General Ledger is a core accounting record that tracks all financial transactions of a business, including revenues, expenses, assets, and liabilities, providing a comprehensive financial overview.

An organization utilizes a general ledger (GL) to record its financial activities and generate financial reports. It should include the date, description, and amount for each account. The double-entry bookkeeping ensures that the general ledger accounts balance on each side.

In addition, companies may use spreadsheets or software to prepare general ledgers for them.

It is an accounting record that summarizes all financial transactions using debit and credit accounts. All transaction information required to generate the income statement, balance sheet, and other financial reports are in general ledger accounts.

It is the main source for generating company financial statements and trial balances. The trial balance of the company verifies the reliability of the ledger.

Key Takeaways

- The General Ledger is a fundamental accounting record that tracks all financial transactions, providing a comprehensive view of a business's financial activities.

- The General Ledger summarizes financial transactions, showcasing income, expenses, assets, and liabilities.

- General Ledger records financial transactions in sub-ledgers, ensuring accuracy and completeness for generating financial statements.

- Various ledger types, such as Expense, Revenue, Capital, Asset, and Liability Ledgers, are structured as T-shaped accounts within the accounting records.

Understandings General Ledger

A General Ledger is an accounting record that summarizes financial transactions, showing income, expenses, assets, and liabilities, for reporting and analysis.

The main element is the general ledger account (GL account). This account records all the financial transactions connected with assets, liabilities, revenues, expenses, gains, and losses.

The account balances are reported on the company's Trial Balance. In addition, the transactions recorded using double-entry bookkeeping are summarized in the company's general ledger.

Each transaction under this method affects two accounts: one debit and one credit account. The totals of both debit and credit accounts should be equal. The accounting equation is followed for the representation of the double-entry bookkeeping, which is as follows:

Assets = Liabilities + Shareholder’s Equity

Why do companies use general ledger accounts?

It records all financial transactions within different sub-ledgers and summarizes them into the trial balance. It ensures the accuracy and completeness of the financial information.

According to Renee Greene, it is a chronological record of day-to-day financial transactions, which is then itemized by several accounts.

The trial balance then helps generate financial statements like the users' income statement, balance sheet, cash flow statement, and equity statement. It provides a reliable record of the financial data and makes tax filings easier.

It provides accurate expenses and revenue records to stay on top of spending and helps you recognize unusual accounting transactions. It is also used to spot errors and identify frauds or misinterpretations in financial statements.

According to the blog by Janet Berry-Johnson, general ledgers assist in compiling key financial statements, which are considered vital for evaluating the profitability, liquidity, and financial health of the business.

Business owners or accountants may find and correct accounting errors in their financial statements through ledgers.

According to Janet Berry-Johnson, they are master financial statements that record all the financial transactions of your business. The general ledger has no equal regarding financial accounting and keeping every business transaction accounted for.

Types of general ledger accounts

These are classified for recording different entries with respect to the double-entry bookkeeping system while preparing financial statements and reports for the financial year.

They are classified into the following types:

- Expense Ledgers: All expenses incurred by the company would be recorded in the expense ledger—for example, purchases, rent, electricity, insurance, etc.

- Revenue Ledgers: All income generated by the company would be recorded in the revenue ledger. For example, sales, interest received, etc.

- Capital Ledgers: All transactions related to capital introduced, additional capital, and drawings are recorded in the capital ledger.

- Asset Ledgers: All transactions related to the value of assets are recorded in the asset ledger. For example, furniture, cash, bank, equipment, land and buildings, machinery, debtors, etc.

- Liability Ledgers: All transactions related to the debt and obligations of the company are recorded in the liability ledger, for example, bank loans, creditors (payables), overdrafts, etc.

The above ledgers are structured into T-shaped accounts within the accounting records. A T-shape account shows debit entries on one side and credit entries on the other.

These ledgers will be posted into the trial balance and prepare financial statements for the business.

General Ledger Benefits

The following are the benefits:

- It helps in providing the position of the business at a given time.

- It makes bank reconciliation easier.

- Provides a detailed understanding of the business at a glance to the users of the accounting information.

- Helps in structuring the accounting.

- Assists in preparing financial statements of the company.

- Help to spot errors easily.

- It helps speed up the process of preparing financial statements.

- Analyses the total incomes and expenses over a period of time.

- Assists managers by providing all necessary information for decision-making.

- Learn about financial health.

- Minimizes the chance of errors and omissions.

- Maintains the books of financial statements.

- Ensures business runs smoothly without any issues.

These benefits encourage companies to prepare general ledgers of their accounts. As a result, they are free from any future errors and mistakes while maintaining the company's financial position in front of the users of its financial information like owners, shareholders, creditors, or investors.

General Ledger Maintenance

To understand the maintenance and closing of books process, we'll tale a look at the following steps:

- Record entries into the ledger from the journal.

- Prepare general ledger accounts.

- Balance ledger accounts (debit and credit sides equal)

- Prepare a trial balance

- Balance the trial balance (debit and credit sides should balance or be equal)

- Prepare an adjusted trial balance (after certain adjustments of the ledger accounts)

- Prepare financial statements (income statement or statement of profit and loss, balance sheet or statement of financial position, statement for changes in equity and cash flow statement)

- Prepare notes for the financial statements with all accounting policies stated (updated according to the full disclosure principle)

- Record closing entries in the journal.

General Ledger Examples

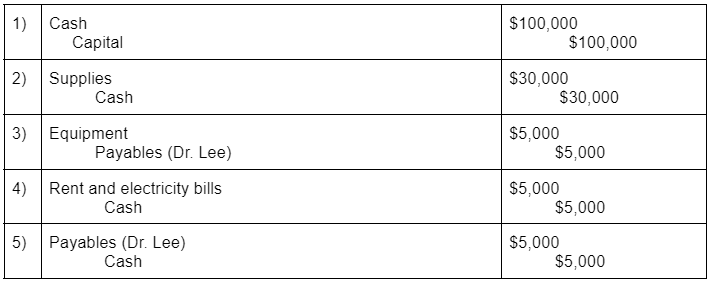

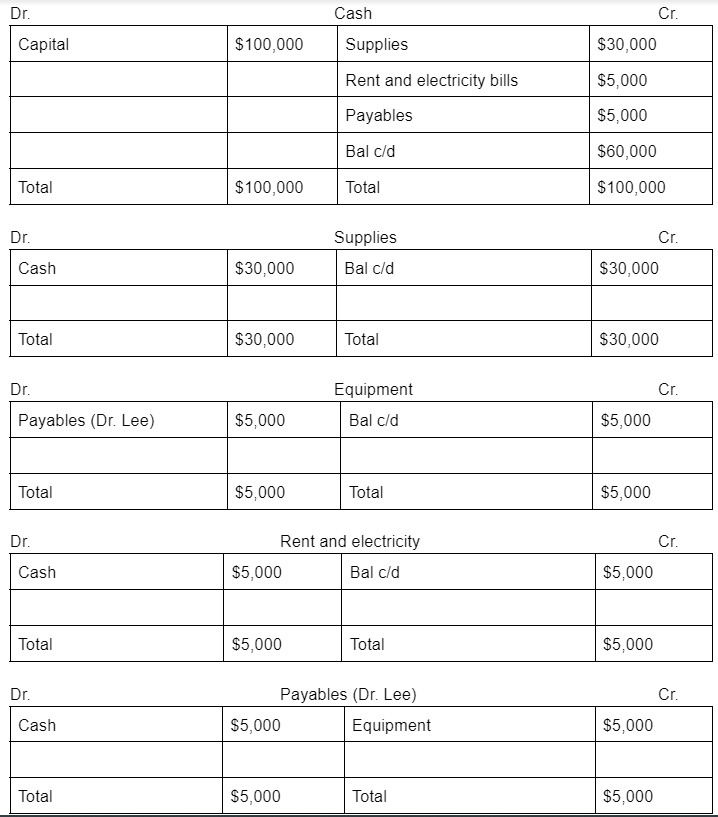

Record journal entries and prepare ledger accounts for XYZ COMPANY for the following transactions:

- Capital introduced by the proprietor to start a business: $100,000

- Supplies purchased in cash from ABC suppliers: $30,000

- Equipment bought on credit from Dr. Lee: $5,000

- Rent and electricity bills paid by cash: $5,000

- Paid to the creditor (Dr. Lee) by cash: $5,000

Journal entries for XYZ Company for the year ended 31st March 20X0:

Ledger accounts for XYZ Company for the year ended 31st March 20X0:

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?