Financial Economics

A branch of economics involving money (finances)

What Is Financial Economics?

Financial economics is a branch of economics involving money (finances) that defines the connection between different financial variables, mostly involving financial markets and the allotment of financial resources.

Its focus areas are investment decision-making according to an assessment of pertinent information, time, price, uncertainty (risk), and returns.

The decision-making is usually influenced by macroeconomic factors such as business cycles and policies.

It applies microeconomics, accounting, probability, and statistics as its core & financial modeling tools to evaluate risks. Its primary focus areas are asset pricing and corporate finance, which deals with suitable capital attainment and utilization.

The scope of financial economics includes the following:

-

Financial markets deal with the trading and pricing of securities & derivatives at low transactional costs.

-

The financial decisions are also made as per the asset pricing, business cycles, microstructure, and regulation of markets both nationally and internationally.

-

Corporate Finance deals with the financial structure, security design, and corporate decisions such as going public, control, and governance

-

Banking is the financial intermediation where the bank supervises and regulates the banking, financial markets, and economic activity.

Market Equilibrium in Financial Economics:

-

To achieve an equivalent state of an asset to reach the market equilibrium, the rate of return and present value are the two important conditions.

-

The tools utilized to maximize the rate of return are risk management & diversification.

-

If the following are true, then the two conditions for equilibrium are considered to be equivalent

a. Asset Price = Present Value (Expected Future Payment)

b. Rate of Return = Market Interest Rate (Expected Rate of Return)

Relevant terms discussed further are as follows:

- Return on investment → The profit made on the investment

- Expected rate of return → Expected return on investment during a period

- Present value → Current value discounted against a future payment at a particular rate of return

- Discount factor → Used to calculate the present value against the future payment

-

Financial economics involves the variables relating to the financial market and the allotment of financial resources.

- Financial investments are based on decisions influenced by macroeconomic factors such as business cycles, policies, etc.

- Market equilibrium involves the rate of return equal to the market interest rate and the present value equivalent to the asset price.

- The rate of return can be maximized through risk management & risk diversification.

- There are specific risks associated with a particular industry or sector that can be managed. Still, the same doesn't apply to market risks caused due to uncontrollable factors like business cycles.

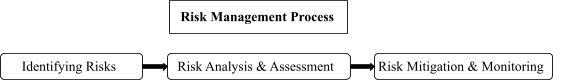

- Risk management involves the identification, analysis, evaluation, mitigation, and monitoring of threats to investment to maximize returns or payoffs.

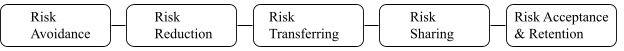

- Risk diversification concerns avoidance, reduction, transferring, sharing, acceptance, and retention of risk

- Present value is calculated by discounting the future value at a given interest rate for a period.

- The principles of financial economics involve portfolio restrictions, positive pricing, one-law pricing for equilibrium, valuation, and managing expected utility for minimizing risk.

- Optimal portfolios are achieved through risk diversification and Pareto-optimal allocations of risk in complete and incomplete markets at an equilibrium pricing.

- Mean-variance analysis, Capital Asset Pricing Model, and Factor Pricing Model are some of the tools used to mathematical represent a diversified portfolio and estimate risks.

- For the gradual resolution of uncertainty and the re-trading of securities multidate security market model is utilized.

- In the probability theory, the strategy of the martingale property is operated to evaluate event prices, risk-neutral probabilities, and the pricing kernel to maximize payoffs.

Elements of financial economics

Studying the financial system in which investments are made, or savings are transformed into investments is the focus of financial economics. Microeconomics, fundamental accounting concepts, economic theories, mathematics, and statistics are all important in this field of study.

It also emphasizes how crucial mathematics is to the study of financial economics. Its comprehension and use are crucial because, by examining future markets, it assists investors in mitigating risk before they make investments in securities and diverse portfolios.

Below, we discuss some of the elements of Financial Economics

Risk management

There are two types of risks in financial markets:

-

Specific risks apply to particular industries, sectors, investments, companies, etc.; they influence the value of any corresponding assets and can be managed to avoid the risk.

-

Market risks or market volatility destabilize the market due to business cycles, political conflict, interest rates, etc., that influence the performance of an entire portfolio that cannot be managed to avoid the risk.

→ The process of risk management is listed below:

-

Risk identification

-

It is the process of identifying and estimating risks to investment.

-

This process must be cost-effective to create a value that reduces the risk probability.

-

-

Risk analysis

-

The analysis involves defining the risk probability that would potentially impact the returns on investment.

-

Qualitative and quantitative risk analysis involves the firm avoiding hedging costs to reduce risks.

-

-

Risk assessment

-

An assessment compares the extent of risk and ranks them according to importance and impact.

-

Hedging reduces the cash flow, and the expected return on the equity remains the same, resulting in the reduction of the equity value.

-

The above situation is known as the hedging irrelevance proposition, as financial markets are not perfect in most cases.

-

-

Risk mitigation: It is the process of planning, developing methods and creating options for risks, plus the plan in action to deal with them.

Risk diversification

Risk can be diversified in the following ways:

-

Risk avoidance by mitigating risk by not making an investment

-

Risk reduction by minimizing the loss rather than eliminating it while accepting the risk

-

Risk-sharing by transferring the possibility of loss from the individual to the group

-

Transferring risk contractually to a third party

-

Risk acceptance and retention of residual risk remain even after avoidance, transferring, and reduction, as it is virtually impossible to eliminate all.

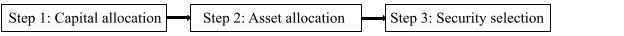

For investing in financial markets, the risk can be diversified in the following ways:

-

Capital allocation

-

It refers to diversifying investments between those that are risky and riskless.

-

Having a diversified portfolio gives a bandwidth for assets to perform differently yet fulfill the overall financial goal with diversified risk.

-

-

-

It determines which asset classes you will invest in based on the relative risk and each asset class's expected returns.

-

-

Security selection

-

It involves selecting specific assets within each asset class and investing in stocks from various sectors and industries.

-

Investing in a diversified portfolio with a collection of financial instruments across a range of industries helps with risk diversification.

-

The multiple risks associated are risks of a specific industry's performance and market volatility.

-

The benefits of risk diversification are:

-

Hedging the susceptibility of risk across different sectors and industries to prevent losses during unfavorable market cycles

-

Diversification across a wide range of investments to lessen volatility and minimize losses

-

Portfolio stability by offsetting negative performance, which allows stable returns

-

Maximizing returns on a diversified portfolio that exposes the investment to a range of growth opportunities

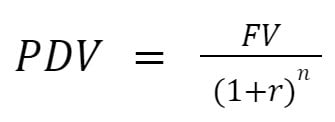

Present Value Discounting (PDV)

It is the value that can be estimated currently (present value) for an expected future payment given the interest rate for a particular time:

Where:

-

Present value: PV

-

Future value: FV

-

Interest rate: r

-

Number of years: n

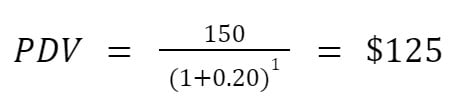

Example 1: Calculating PDV

If the interest rate is 20% and the payment received in a year is $ 150, the present value will be $ 125.

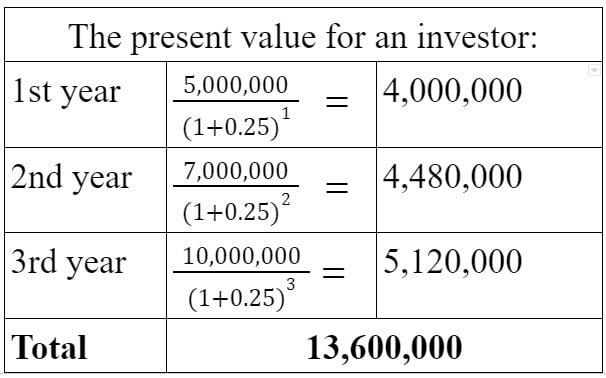

Example 2: Calculating the PDV of a stock

Company XYZ Ltd is selling 100 shares with a current expected return of $ 1 million and $ 5 million in a year, $ 7 million in 2 years, and $ 10 million in 3 years. The interest rate estimate for the investment is 25%.

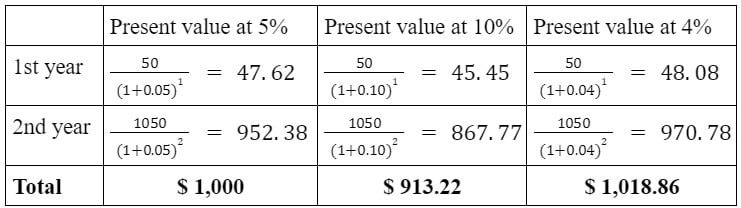

Example 3: Calculating the PDV of a bond

A 2-year bond issued for $ 1,000 at a discounted rate of 5%; the interest will be $50 (1000 x 5%), and for the 2nd year, the bold will be $1050 (face value $ 1000 + interest $ 50)

→Constant discount rate

-

At a 5% interest rate, the value of the bond remains constant at $ 1,000, i.e., the borrower will receive the same PV as the lender.

→Increased discount rate

-

The investor would get a lower rate of return if the discount value increases to 10% after the bond is released, and the interest in the first year won’t change from $50

-

The PV would be discounted at a higher rate than the selling value of $ 913.22, which is less than its face value ($ 1,000)

→Decreased discount rate

-

The investor will get a higher rate of return if the discount value decreases to 4% after the bond is released. The interest in the first year won’t change from $50

-

The PV would be discounted at a lower rate than the selling value of $ 1,018.86, which is more than its face value of $ 1,000

Principles of financial economics

The following are the principles of financial economics:

1. Equilibrium: The equilibrium in security markets is based on the same assumptions of Walrasian equilibrium with an information symmetry. It is assumed that the market is competitive and free of the transaction cost

-

The following properties are applied to achieve equilibrium:

a. Linear pricing: Also known as the law of one price, it is used for maintaining the consistent per unit price for equilibrium and maintains a marginal profit on each unit but can impact achieving the economies of scale

b. Arbitrage and positive pricing: Arbitrage entails taking advantage of the price difference in different markets for a profit and greater returns but comes with risk; arbitrage is limited to attaining equilibrium and positive pricing

c. Portfolio restrictions: There are short sales restrictions (shorting of stock can only be done on an uptick) in addition to the above-limited arbitrage, maintaining positive pricing, and the law of one price for holding a portfolio

2. Valuation: The valuation function is an extension of the payoff pricing function; it is linear and strictly positive as well as excludes strong arbitrage; it assigns values not just to payoffs but to all the contingent claims

-

The following properties are applied for the valuation function:

a. State prices: It is calculated as a strictly positive (limited arbitrage) solution to a linear equation system of relating security prices and their payoffs

b. Risk-neutral probabilities: They are represented by strictly positive chances of the states, and the price of each security equals its expected payoff discounted by the risk-free return

c. Valuation under portfolio restrictions:

→ The payoff pricing function keeps the price of any security greater than or equal to the value of its payoff.

→ A portfolio that yields the same payoff as a specific security at a lower cost creates strict inequality.

→ The security prices exclude unlimited arbitrage due to positive state prices.

→ Short sales restriction leads the security price to exceed the payoff value under state prices.

→ Short sales restriction causes the security price with a temporary sales constraint to exceed the expected payoff discounted by a risk-free return.

→ But when short sales do not restrict it, the price equals its expected payoff discounted by the risk-free return concerning the risk-neutral probabilities.

3. Risk: The consumer can be risk-averse (avoids risk & accepts minimal returns to avoid high risk), risk-neutral (focuses on returns rather than risks), or risk-loving (seeks risk for maximum returns)

→ Expected utility: It provides a framework for the analysis of consumers’ attitudes toward risk and plays a central role in the study of portfolio choice

4. Optimal Portfolios: Risk levels drive the willingness to invest in securities to determine the expected returns; risk can be diversified in a budget-feasible manner in a portfolio in terms of wealth invested in each security instead of in terms of security holdings

→ Securities can be selected to diversify risk as follows:

a. Optimal portfolios with one risky security

b. Optimal portfolios with multiple risky securities

5. Equilibrium prices and allocations: The basis of efficiency of a consumption allocation is if it is Pareto optimal whether a consumption allocation is optimal or not depends on how the aggregate consumption risk is shared

-

The consumption allocation can be made optimal through:

a. Consumption-based security pricing: Links the prices of securities to their returns and the marginal substitution rates (MRS) between the consumer’s consumption

b. Complete markets and Pareto-optimal allocations of risk: If there is no room for reallocation of the aggregate endowment to make a consumer better-off without making the other worse-off, then a consumption allocation is said to be Pareto-optimal

c. Optimality in incomplete security markets: Incomplete markets can be Pareto optimal if there are particular preferences, endowments, and security payoffs with equilibrium consumption allocations

6. Mean-Variance Analysis or Modern Portfolio Theory (MPT): It deals with the mathematical representation of a diversified portfolio that creates maximized expected returns at a certain level of risk

-

The MPT includes the following:

a. The expectations and pricing kernel: The payoff pricing function and the expectations function map every payoff into its expectation, representing the pricing kernel and the expectations kernel

b. The mean-variance frontier payoffs: It minimizes variance subject to constraints on price and expectation, leading to the identification of returns with minimal variance for a given expected return

c. Capital Asset Pricing Model (CAPM): It is operated to examine if a market return is the highest expected return for securities to create risk diversification in a portfolio, and it combines the risk premium on a security to the covariance between the return on that security to the market return

d. Factor Pricing Model: It is similar to CAPM but with factors replacing market return with proxies for macroeconomic factors such as GDP, inflation, etc., and the relation between expected return & the measure of the sensitivity of a security’s return to factor risk is linear

7. Multidate security markets: The multidate model allows for the gradual resolution of uncertainty and the re-trading of securities as new information about security prices as payoffs becomes available

-

Multidate security markets function in the following ways:

a. Equilibrium in multidate security markets: Equilibrium in the multidate model occurs when the plans, prices, and price expectations meet the consumer’s rational anticipations and expectations

b. Multidate arbitrage and positivity: In multidate security markets, linearity and positivity are the two properties of the relation between future payoffs and their current prices that play a vital role

c. Dynamically complete markets: For markets to be dynamically complete, the opportunity to trade securities at future dates indicates that many fewer securities than events are necessary

(dynamically complete = any consumption plan for the future dates can be obtained as a payoff of a portfolio strategy)

d. Valuation: The valuation function assigns a value to every multidate contingent claim and is strictly positive since this property reflects the limited arbitrage

8. Martingale property (probability theory) of security prices: Martingale is a strategy for sequencing random variables at a particular time regardless of all the previous values with the conditional expectation that the next value in the sequence would be equal to the present value

Martingale property of security prices are as follows:

a. Event prices, risk-neutral probabilities, and the pricing kernel:

→Event prices are calculated as a solution to linear equations and replicate state prices in the two-date model; if the event prices are unique, they indicate dynamically complete markets, and strictly positive event prices point to limited arbitrage.

→Risk-neutral probabilities are event prices recalculated by discount factors; knowing event prices helps with the calculation of the cost of any payoff without identifying a particular portfolio strategy that generates a unique level of payoff.

b. Security gains as martingales: There are two martingale representations of gains on securities and portfolios: one concerning risk-neutral probabilities, the other to natural probabilities, and the pricing kernel

c. Conditional consumption-based security pricing: Consumption-based security pricing relates the risk premium on each security or portfolio to the covariance of the security return with a consumer’s intertemporal marginal rate of substitution

d. Conditional beta pricing and the CAPM: The derivation of conditional beta pricing is based on the observation that each nonterminal event and its immediate successor events are formally indistinguishable from the two-date model

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?