Roll Yield

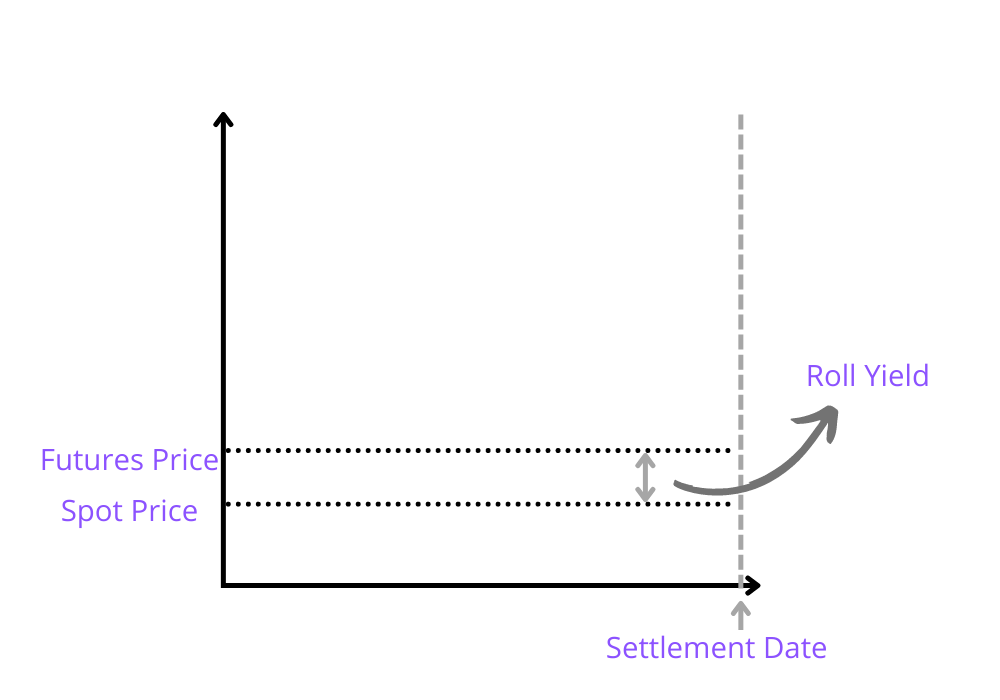

It is the amount of profit made in the futures market after an investor rolls a short-term contract into a long-term contract and profits from the futures price convergence toward a higher spot or cash price.

What Is Roll Yield?

The amount of profit made in the futures market after an investor rolls a short-term contract into a long-term contract and profits from the futures price convergence toward a higher spot or cash price is called roll yield.

When a futures market is backward, which occurs as a futures contract trades at a higher price as it approaches expiration than when it is further away from expiration, the roll yield is positive.

The difference in price between futures contracts with various expiration dates might result in a profit when investing in the futures market.

Unlike fixed income or dividend yields, a roll yield does not give a cash payment and, in some situations, may not be considered a profit if it accounts for the underlying asset's cost-of-carry.

Nonetheless, the roll yield is frequently described as a return earned by a futures investor in addition to the price movement of the underlying asset of a futures contract.

Understanding Roll yield

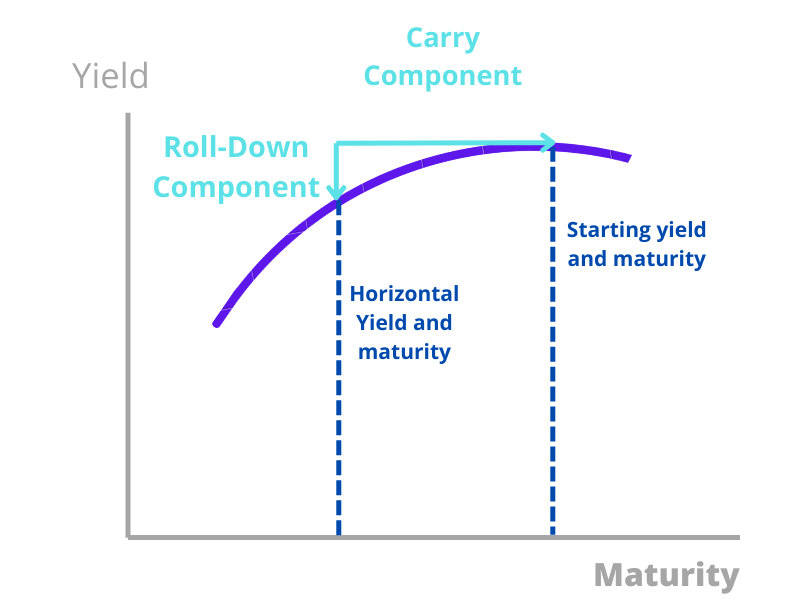

The Theory of Storage explains it as a combination of storage expenses, convenience yield, asset yield, or a total cost-of-carry.

An investment strategy of retaining the underlying asset and paying its cost-of-carry should be no more or less profitable than investing in a futures contract in a notional efficient market equilibrium with no barriers to arbitrage.

If one of these strategies is more profitable, players in the other strategy will transfer resources to arbitrage the more profitable approach until the return advantage vanishes.

As a result, the profit or loss from holding a futures contract to a specific time should be the same as the profit or loss from storing an asset to sell simultaneously and paying the cost-of-carry for that asset.

Because the cost-of-carry is more difficult to notice than the spot price of the underlying asset in most situations, market participants disregard it and compare the profit and loss of futures contracts directly to the spot price of the underlying assets as the roll yield.

Due to arbitrage, the roll yield is equal to the carry cost in this situation. The spot price is the current price at which a financial item is trading. Comparing the short-term contract to the longer-term contract is all it takes to figure out how much the futures price has changed.

The spot price is the current price at which a contract is trading. Comparing the short-term contract to the longer-term contract is all it takes to figure out how much the futures price has changed.

The short-term contract is worth more than the longer-term one when the market is backward. Therefore, it will be positive if the spot price does not fluctuate more than the difference between the futures contracts.

At expiration, futures contracts approach the spot price.

When investors buy futures, they have the right and the responsibility to acquire the asset underlying the futures investment at a future date unless they see their position (to offset the long futures position) before the delivery date.

Most futures investors prefer not to get the physical asset their futures investment represents, so they either close their positions before expiration or roll their near-term future investments into other futures contracts with longer expiration dates.

The investor might keep their investment in the assets by rolling the position instead of taking physical delivery.

Roll return has the added benefit of revealing the predicted price movement of a commodities futures contract, whether a price drop from the contango or a price rise from backwardation.

As a result, normal contango and backwardation relate to a process that cannot be witnessed or demonstrated in real time.

What is Contango?

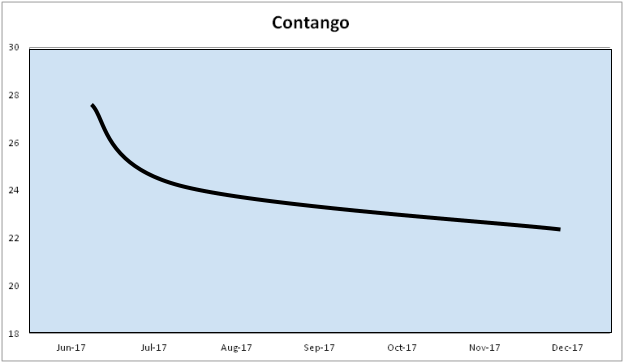

The market is said to be in contango when the prices of longer-dated contracts are higher than those of shorter-dated futures. Contango occurs when a commodity owner charges for holding or storing a certain commodity.

Investors who want to invest in the commodity will purchase a specific contract. In this instance, they will choose a contract with a lengthier term.

From the standpoint of a roll yield, the price of a contract will decline or roll down toward the cost of the next closest contract as time passes. It will then decrease in price until it reaches the price of the next contract, and so on.

It is the term for this process, and in the case of contango, the return is negative because prices are declining. In this instance, the investor must decide whether to sell the present contract or wait to expire to maintain future commodities exposure.

They will then reinvest in a contract with a longer term, thereby continuing the cycle.

What is Backwardation?

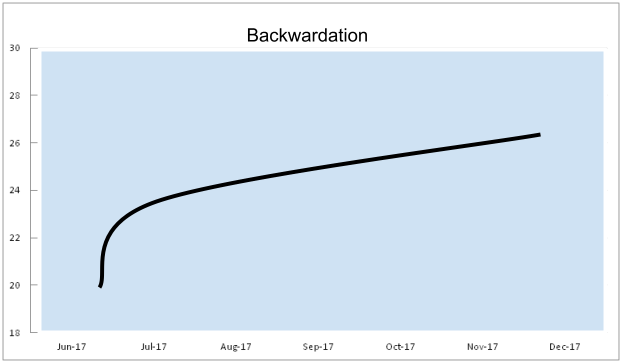

The market is said to be back when the prices of longer-dated contracts are lower than those of shorter-dated contracts. For example, it can happen when a commodity's current inventory level is low.

When the current price of an underlying asset is greater than the prices trading in the futures market, this is known as backwardation.

Backwardation can occur when there is more demand for an asset than contracts expiring in the futures market in the coming months.

Drought or heavy rainfall, for example, can result in a bad agricultural crop. Commodities for the current season would be in limited supply in such instances, causing contracts for this year's crop to rise.

Because a typical investor buying at market price would sell the contract at a somewhat higher price, the price of the longer-dated contract would roll up to the next closest contract. It is how investors might receive a positive roll yield.

Calculating Roll Yield

An investor must know the rates of the two futures contracts and the current price of the underlying asset, which in this example, is a commodity, to compute roll yield.

Assume June tomato futures are trading at $50 and July futures are trading at $45, with the spot price at $50.

Investor X predicted that tomato prices would either stay the same or rise. As a result, she opted to extend the contract until July, although the spot price ($50) remains the same on the expiration date. The roll yield of Investor X would be as follows:

- Change in the Future’s Price = $50 – $45 = $5

- Change in the Spot Price = $50 – $50 = $0

- Roll Yield = $5 – $0 = $5

Researched and authored by Rishav Toshniwal | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?