Calendar Spread

An options strategy that involves multiple legs

What Is a Calendar Spread?

A calendar spread is an options strategy that involves multiple legs. It involves buying and selling contracts at the same strike price but expiring on different dates. This spread is considered an advanced options strategy.

It is a strategy used by investors who think the security price will be close to the strike price at expiration.

The strategy becomes less profitable as the underlying price varies farther from the strike at expiration. In cases where the market price at the end is far from the strike price, the investor begins to incur a loss.

This strategy's profit and loss graph describes the shorter-term leg's expiration date. For a traditional calendar spread, this leg is the contract that is sold, which comes with fulfillment rights.

When this leg expires, the investor will use their long position to fulfill the short obligation if exercised. If the short expires worthless, the investor can either close the spread by selling their long or choose to hold their long position and speculate on subsequent price shifts.

There are a few key components to remember:

- The investor should be confident about a price range at the first leg's expiration.

- The strategy can be used if an investor is neutral, mildly bullish, and mildly bearish on the underlying stock.

- The system is flexible; if the first leg expires from the money, the spread can be closed, or the investor can choose to hold onto their out-of-the-money long position.

Options Rundown

An investor must understand the core components of options contracts to use advanced spreads effectively. This strategy profits explicitly on differences in implied volatility and time value.

At a basic level, there are two types of options contracts. These include:

- Call options - right to buy

- Put options - right to sell

A call option gives the contract owner the right to buy 100 shares of the underlying security at the strike price at or before the expiration date.

A put option gives the owner the right to buy 100 shares of the underlying security at the strike price at or before the expiration date.

The seller of the contract has fulfillment obligations. Therefore, if exercised, they either sell shares or purchase them from the contact owners.

An option contract value is given by the premium, which is both the price to buy and to sell (these may vary a little from the brokerage spread) in the contract.

The value of the contract can be divided into two components, its intrinsic value and extrinsic value.

The intrinsic value is based on how much the contract would be worth if exercised on that day. For example, if the market price of a security was $107 and the strike price of a call option was $105, there would be $2 of intrinsic value in the contract.

The extrinsic value is the difference between the option contract price and its intrinsic value. For example, if the contract price were $3, the extrinsic value would be $1.

The extrinsic value is significant because it considers the possibility of price movement. The extraneous value drivers are the time until expiration and the implied volatility.

- More time before expiration means a more significant opportunity for price movement. This can change the contract's moneyness and is therefore accounted for in the contract's price.

- Similarly, implied volatility changes the possibility of the price expiring in the money. If the underlying has more price volatility, there is more chance of the contract expiring in the capital. This is also accounted for in the contract price.

For calendar spreads, the difference in extrinsic value is the key to determining profitability. The maximum profit is realized when the short contract expires worthless, but the long-term contract's extrinsic value is maximized.

What is important to realize is that extrinsic value is highest when the underlying is close to the strike price. For example, for the 165 call option on AAPL expiring on August 19, 2022, the intrinsic value is 3.025.

At prices where the underlying is far below the strike (or far above the strike for puts), there is little extrinsic value because it is unlikely that the contract will expire in the money.

At prices where the underlying is far above the strike (or far below for puts), a more significant portion of the option contract is driven by intrinsic value. The time value of the option contract is less relevant because the warranty is already in the money.

Because both options in this type of spread are at the same strike price, they will always have the same intrinsic value. The difference in contract value is, therefore, the difference in extrinsic value.

Because extrinsic value becomes less of a value driver for in-the-money contracts, contracts being further in the money lowers the value of the spread overall!

Long Call Calendar Spread

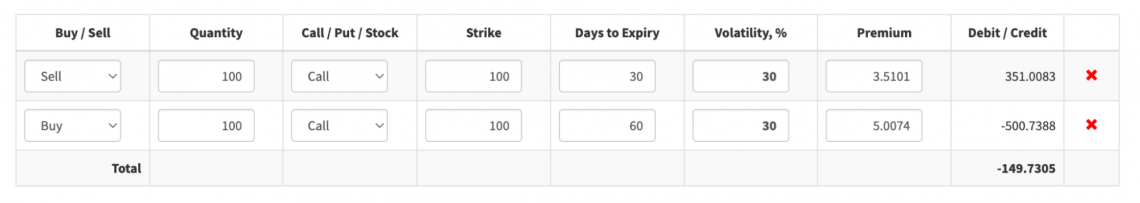

It involves selling a shorter-time call option and purchasing a longer-term call option at the same strike price.

At the beginning of the strategy, the investor must pay a premium. The net premium to the investor is the difference between the premium collected from selling the shorter-term call option and the premium spent purchasing the longer-term call option.

Recall that both options are at the same strike price. The difference in their value is driven by extrinsic value.

Because the shorter-term option has less time value than the longer-term call option, the premium collected from selling the short-term is less than the premium spent by the investor when purchasing the longer-term contract. This is how we arrive at a net cost for the investor.

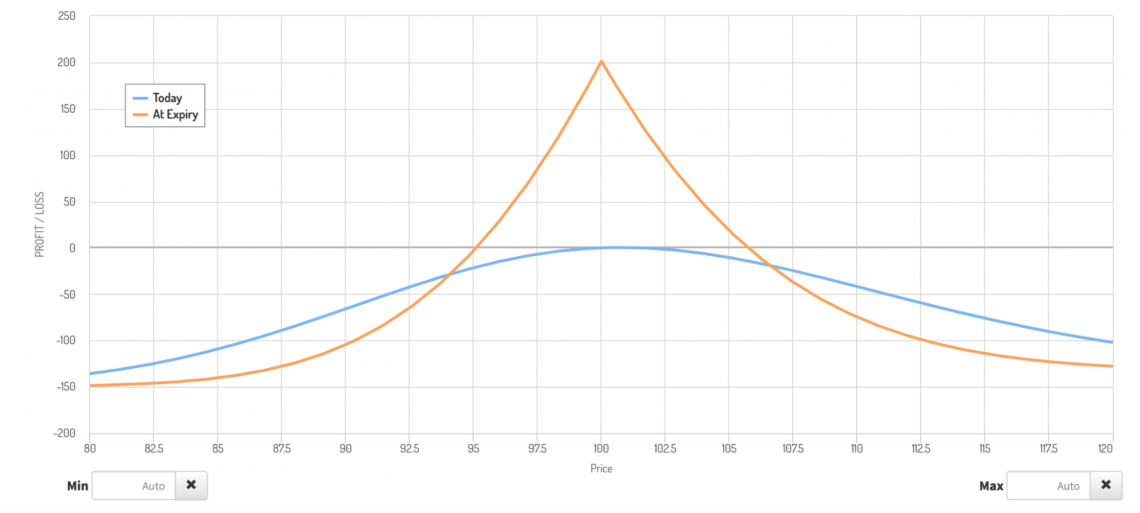

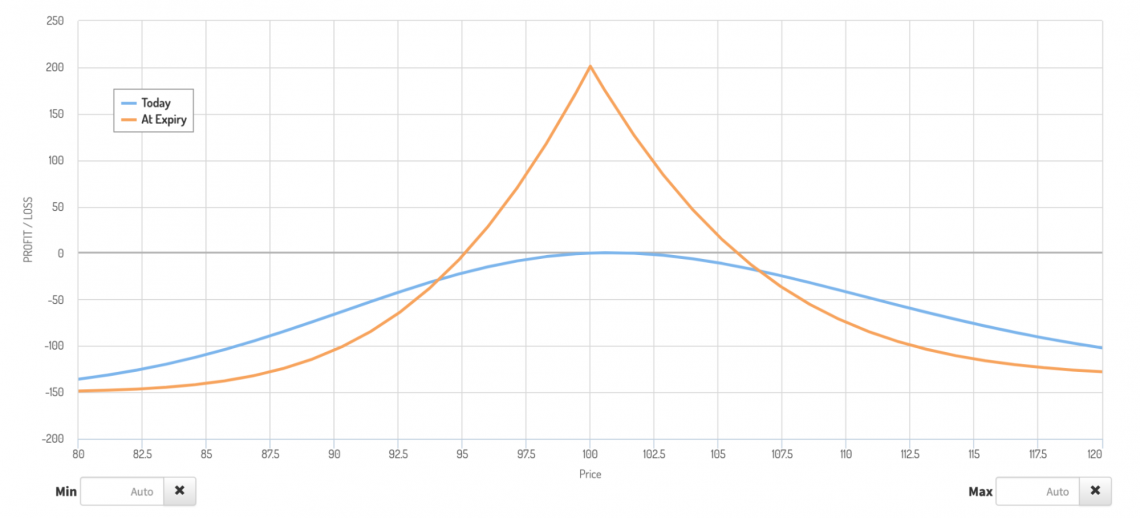

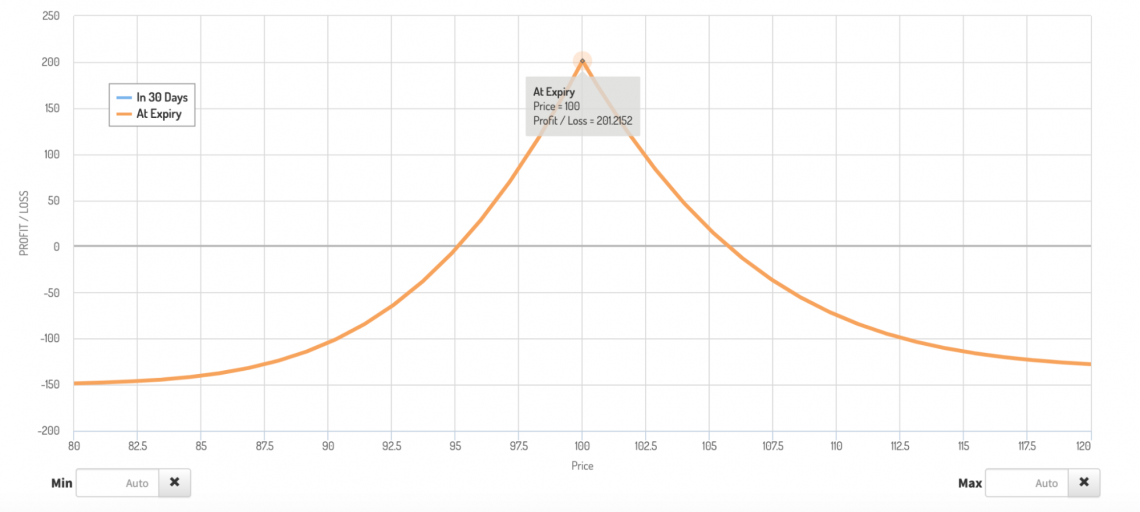

If we look at the profit and loss graph of the long call calendar spread, we can see that profit is maximized when the underlying is at the strike price. This is because the call option sold will expire negative, while the longer-term contract purchased will have maximum time value.

Not only will the investor have the opportunity to close the spread and realize their profits, but they can also choose to hold onto the purchased call option if they think the underlying share price will rise.

The decision-making here would be the same as using a simple long-call strategy. However, the investor would have a lower break-even point overall from collecting a premium from the option contract sold that eventually expired worthless.

As the underlying deviates from the strike price, we see profits diminish, and at prices far enough from the strike, the investor is at a loss. Why is this the case?

As the price of the underlying moves up or down, the two contracts will gain and lose value simultaneously. The investor hopes the contract spread, or price difference, is as high as possible. The distance decreases as the contracts gain and lose weight.

If the underlying rises past the strike, both contracts will increase in value. However, because both contracts will now be in the money, the difference in extrinsic value will be less.

If the difference in extrinsic value drops below the net cost to the investor, they will fail to break even on the strategy.

In this example, the break even on the upper-end point happens to be around $106. Both break-even points fluctuate depending on implied volatility in the longer-term contract.

In the case of a price increase, it is also important to remember that the investor does not have the freedom to choose whether or not to hold onto the long call. This option must be closed to fulfill the obligation of the short call, which is in the money.

If the strategy is profitable when the price is in a range around the strike, how can the process be neutral, mildly bullish, or mildly bearish?

The investor still has the discretion to choose the strike price that the two contracts are at. If the investor selects a strike that the underlying stock is currently at, they will show neutral sentiment.

A strike chosen above the current price would mean the investor expects the price to increase to the strike, which is an example of a bullish bet. Conversely, a strike below would be bearish for the same reasons.

Being mildly bullish can work well with this strategy, as a worthless expiration of the short call would leave the investor the opportunity to let the long call ride out, especially if the investor becomes more bullish as time passes.

Long Put Calendar Spread

This involves selling a shorter-term put option and purchasing a longer-term put option at the same strike price.

Like the call version of the strategy, the investor pays a premium equal to the net difference in contract premiums from selling and buying.

Once again, profit is maximized for the long put calendar spread when the underlying is precisely at the strike price. The short put expires worthless, and the difference in value between the long and short puts is maximized.

As with the long call counterpart, a worthless expiration of the short contract gives the investor flexibility with the remaining long contract. In this case, the remaining warranty is a long put.

Investors with a shift in expectation and now expect bearish price movement may opt to hold onto their long put rather than closing their position. The value differences in contracts that create a spread work the same way as the long-call version of the spread. However, the directions are switched.

As prices decrease, both contracts will be in the money. Because the value of these contracts becomes increasingly dominated by intrinsic value, they approach parity, and the spread loses value.

On the other hand, as prices increase, both contracts lose value. As a result, the spread once again decreases as both contracts approach zero.

As with the call version, the put spread can be formed in a way that is either bullish, bearish, or neutral. Again, the directional bet of the strategy depends on the strike price chosen when entering the spread and its relation to the current market price.

Furthermore, because a worthless expiration of the short put leaves the investor with a long put, it is intuitive why the strategy can be strategically implemented if the investor is more bearish.

Significantly bearish investors would not opt for the strategy because their profits are capped and can diminish if the price movement is too quick.

Calendar Spread: Final Considerations

For both the call and put calendar spreads, the strategy is based on the passage of time. Therefore, the investor must enter the position with a mindset of patience and a clear conviction of the direction of price movement.

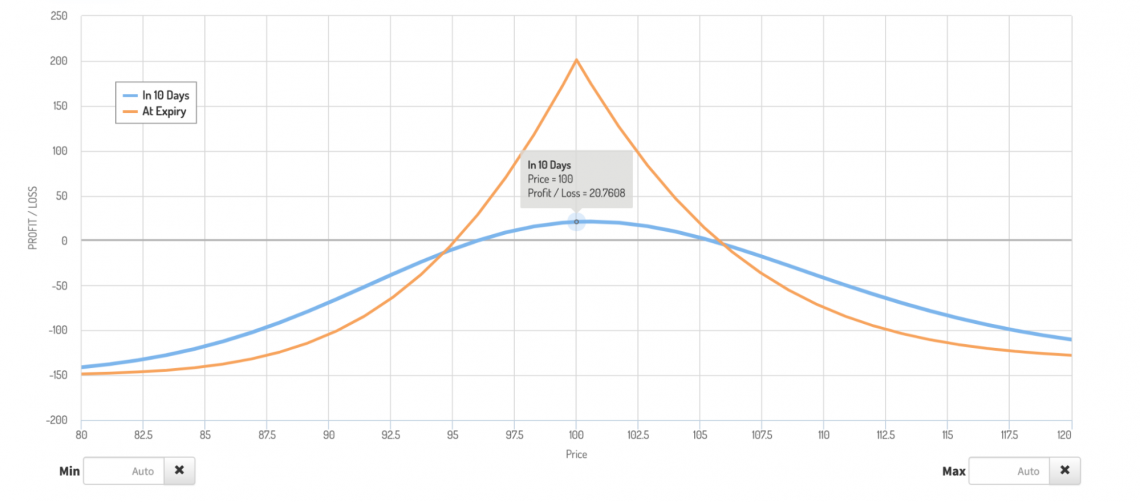

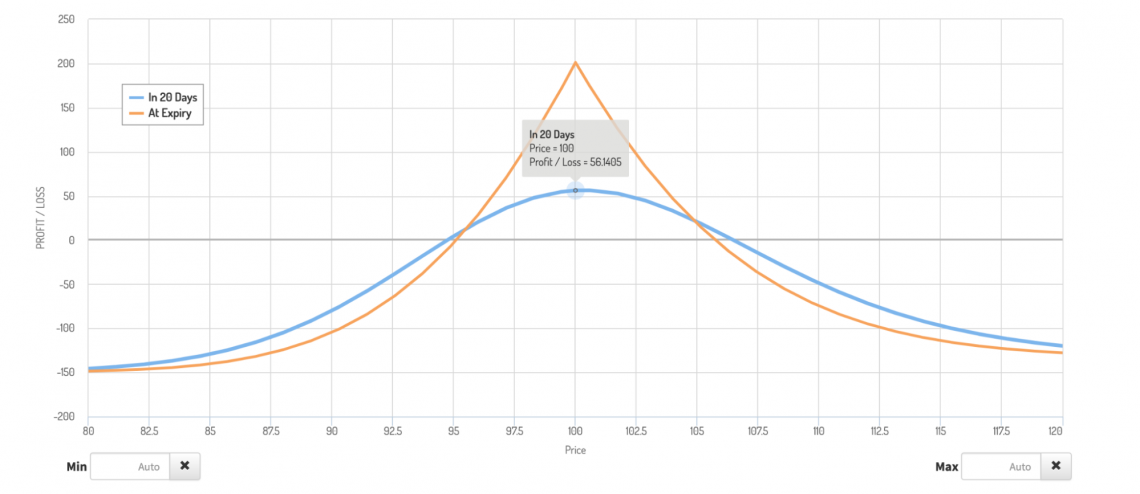

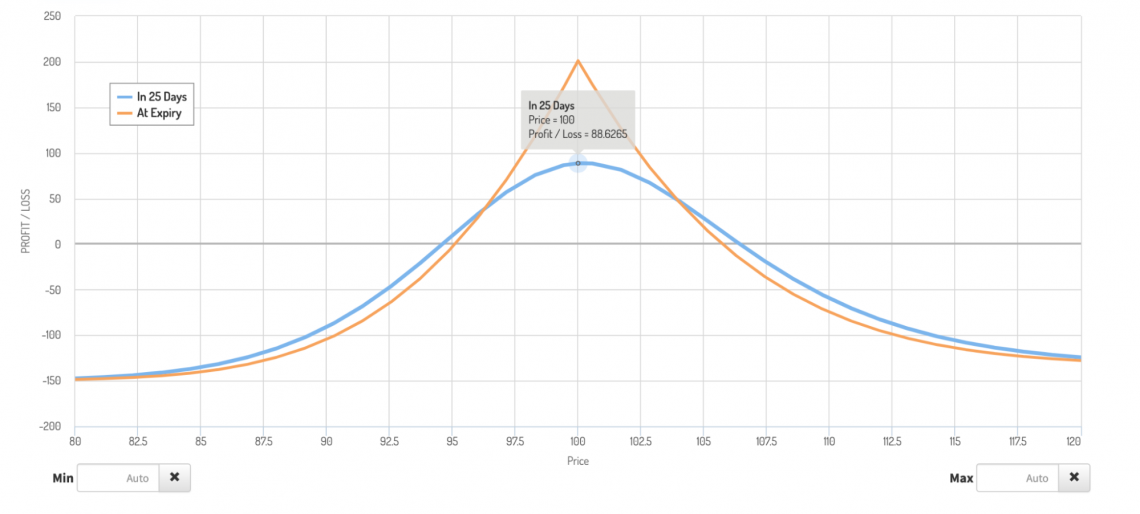

If we look at a time series of the price changes of the call calendar spread we created earlier, we can see that returns are slow to develop compared to losses in the early stages of contract maturity.

As we can see, an excellent underlying market price has led to almost no gains in the contract price difference after just ten days.

After 20 days, we can see the situation is quite similar. This is because there are still ten days for the price to move. This means that the difference in time value between the two options is still relatively small.

As the short contract expires, its time value diminishes more rapidly. This is when returns can finally become evident. Because of how the time value of a contract changes over time, this strategy will often appear to be a losing trade up until close to expiration.

This is why the system is considered to be for advanced traders. However, newer traders not understanding this development may quickly sell at a loss.

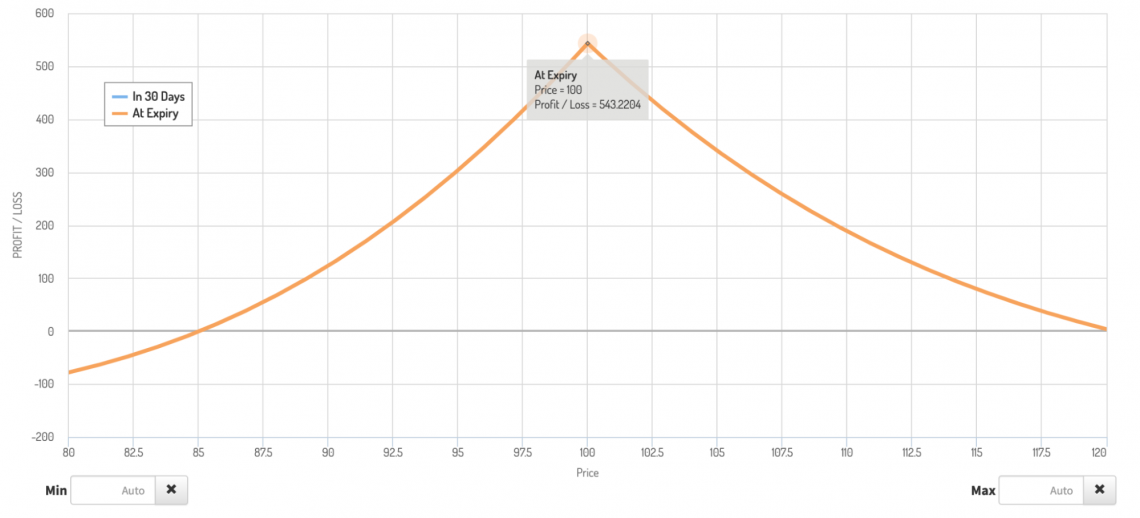

In addition to time, implied volatility plays a vital role in determining the difference in extrinsic value. Because increased implied volatility increases the extrinsic value of the contract, the ideal situation is when the implied volatility of the extended contract increases.

In this situation, the spread will be more significant when the short contract expires, as the long contract now has a more excellent extrinsic value. These two graphs compare implied volatility doubling as the temporary contract expires).

Summary

In summary, calendar spreads can be created with both puts and calls. They are effective IRA trades since they do not deplete much buying power. The strategy involves selling a shorter-term contract and buying a long-term one at the same strike price.

They gain from time passing and an increase in IV as long as the stock remains close to the strikes. They are appropriate for low IV settings (little to no movement in the underlying price).

The strategy is profitable close to the strike. The process takes advantage of differences in extrinsic contract value. The long and short strike prices are the same in a calendar spread, but the expiration dates differ.

These are fantastic for stable markets because they are neutral directional assumption strategies. Still, you can earn money with them if you're optimistic or bearish.

The max loss is the premium paid. The max profit and break-even points depend on individual differences in extrinsic value, influenced by implied volatility.

Developing an advanced strategy depends on an understanding of options as well as the underlying stock.

Researched and authored by Jacob Rounds | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?