Short Call

An options position entered by selling a call option

What Is A Short Call?

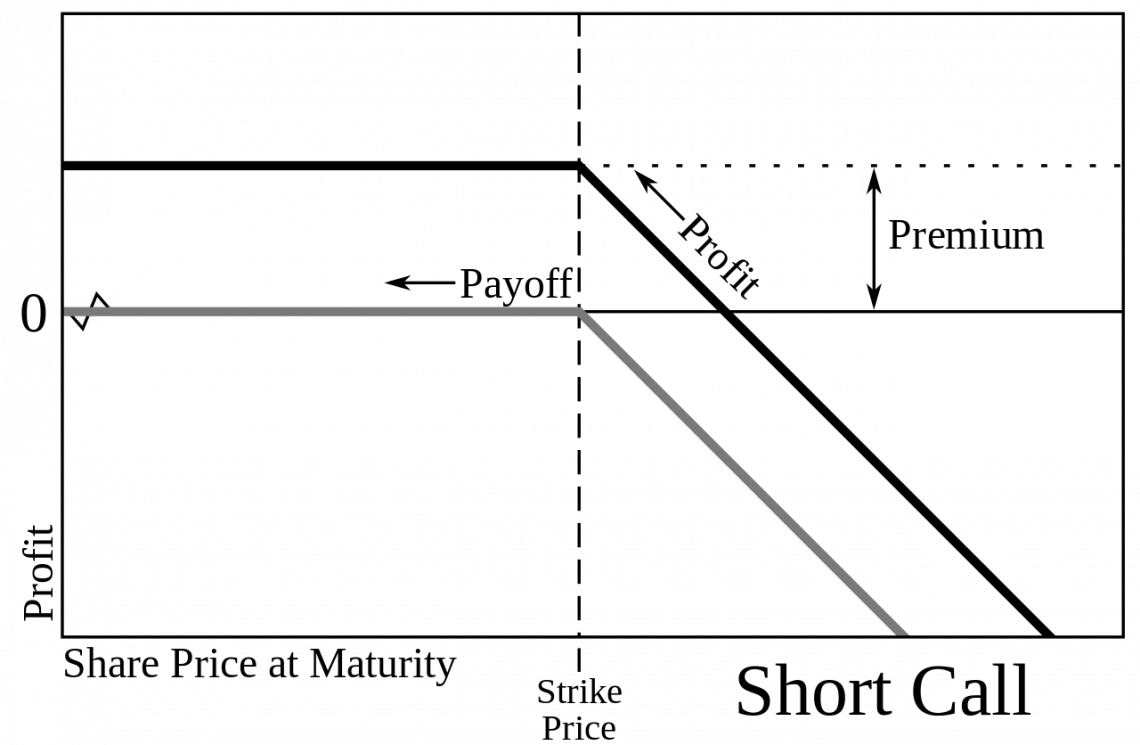

A short call is an options position entered by selling a call option. It can be part of a trading strategy when a trader anticipates a decline in the underlying asset price. As a result, it is viewed as a bearish trading technique.

Short calls offer a small profit margin and a theoretically endless loss risk. Typically, only seasoned traders and investors employ them.

A contract is established between the option writer (the seller and party obtaining a short-call position) and the option buyer (holder) through the short-call approach. The agreement allows the holder to purchase the underlying asset at a predetermined price (the strike price) by a predetermined date (expiration date).

The holder is not required to purchase the underlying asset by the expiration date (exercising the option); hence no obligation is imposed on them. However, the holder will exercise his option if the underlying asset's price is higher than the strike price on the expiration date.

As a result, the writer is obligated to sell the asset to the buyer at the predetermined price, which will now be less than the market value.

As a result, the writer incurs a loss while the holder reaps an equivalent benefit (net of the premium paid by the holder and received by the writer).

The holder will not exercise his option if the stock price of the underlying asset is less than or equal to the strike price at the expiration date.

In this situation, it will become worthless when it expires. This yields a gain for the writer and a corresponding loss for the holder (equal to the price paid for the call option).

How Does A Short Call Work?

The short call is one of two straightforward methods option traders might take bearish positions. Buying put options, or puts, is another method.

The right to purchase the underlying security at a predetermined price (strike price) before the option contract expires is provided by calls to the option holder.

The premium the buyer pays for the call goes to the seller, or writer, of the call option. If the call buyer exercises the option, the seller must provide the underlying shares to the call buyer.

The option contract must expire worthless for the short-call strategy to be successful. In this manner, the trader can keep the premium profit. The buyer's account will no longer have the expired option.

The underlying security price must decrease below the strike price for this to occur. The buyer won't exercise the option if it does.

The option will be exercised if the market price is above the strike price since the buyer can purchase the shares at the strike price and then sell them for a profit at the higher market price.

For the duration that the option is active, the seller has unrestricted exposure. This is because the underlying security price could increase and remain above the strike price throughout this period. At some point, prior to expiration, the option would be exercised.

When that occurs, the seller must enter the market and purchase the shares at the going rate. The buyer will pay the strike price, even though the market price may be substantially higher.

A naked short call is sold by a call seller who does not already hold the option's underlying security.

Some traders will sell a call while holding the underlying security to reduce losses. This is called a covered call.

The seller might also close out their naked short position, assuming a loss likely smaller than what they would have lost if the option had been assigned (exercised).

Let's say that the price of XYZ's stock is around $50 and is experiencing a sharp increase in value. However, a trader thinks XYZ is overvalued based on a mix of fundamental and technical analysis. They predict that it will eventually reach $25 per share.

In light of this, the trader chooses to sell a call with a $0.50 premium and a $55 strike price. They are given a $50 net premium credit ($0.50 multiplied by 100 shares).

The price of XYZ's shares ultimately decreases. Unused and worthless, the calls expire. The entire premium is turned over to the trader as profit. The plan was successful.

However, things could also go wrong. For example, share prices for XYZ could rise further rather than decline. The call writer now faces a potentially infinite risk as a result.

Take the case when the shares increase to $100 within a short period of time. By using the option, the call holder purchases the shares at the $55 strike price.

The call holder must receive the shares. As soon as the call writer enters the market, he purchases 100 shares at the going rate of $100 a share.

This is how the trader fared:

- First, $10,000 is paid to purchase 100 shares at $100 each.

- Received from the buyer at $55 per share: $5,500

- The trader's loss is $10,000 minus $5,500: $4,500.

- A $50 premium is received by the trader, leaving a total loss of $5,450.

Short Call FAQs

A short call is an options position placed when a trader anticipates a decline in the price of the underlying asset.

Investors who anticipate a decline in an asset's price may sell calls on that security purely for profit.

Therefore, they will only benefit from the premium they earned for selling the option. The option must, however, expire with a strike price above the market price in order for the plan to be successful.

A “naked short call” occurs when a trader sells a call option but does not possess the underlying securities that they would be required to deliver if the buyer exercised the option.

Let’s assume a buyer exercises the option because the market price for the security has risen above the option’s strike price. The seller must then enter the market to purchase the securities at a price higher than what they will be paying for them (the strike price).

One of the two fundamental options-based bearish strategies is the short call strategy, as was already mentioned. The alternative is to buy puts.

Put options provide the right to sell an asset at a specified price and within a certain time frame. When one purchases a put, they effectively also bet that prices will decline, but the tactic is different.

Say that our trader continues to think that the price of shares will decline. They decide to pay a $0.50 premium to purchase a put with a strike price of $45. Even if the market price drops to $25, the trader pays $50 for the right to sell shares at a price of $45.

Naturally, the trader will have lost the premium paid for the contract if the price does not go below $45.

You can read about the regulations here.

or Want to Sign up with your social account?