Options: Calls and Puts

Equity derivative securities consist of puts and calls, created by investors, and warrants and convertible securities, created by corporations.

What are Options: Calls and Puts?

Options represent a premium on an underlying common stock created by investors and sold to other investors. A call option gives the holder the right to buy shares at a specified price at any time prior to a specified expiration date. A put option gives the buyer the right to sell shares on a specified date and at a predetermined price.

Why do we need an options market?

- Puts and calls expand the opportunity to investors, making risk-return combinations with low investments available.

- In case of calls, investors can control the claim on buying the stock. In the case of puts, an investor can duplicate a short sale without a margin amount.

- Options provide leverage-magnified percentage gains concerning buying the stock; furthermore, options can provide greater leverage than fully margined stock transactions.

- Using options on a market index such as the Standard & Poor's 500 Composite Index (S&P 500), an investor can participate in market movements with a single trading decision.

NOTE

Exercise price depends on factors like spot price, supply-demand relationship, risk-free rate of return, etc.

Key Takeaways

- Options are financial instruments created by investors and sold to others, providing the right to buy (call) or sell (put) shares at a specified price before a set expiration date.

- Key terms include Exercise (strike) price, Expiration date, Option Premium, and Spot price, crucial for understanding and navigating the options market.

- The Options Clearing Corporation (OCC) acts as an intermediary, ensuring contract obligations are met and managing positions for both parties.

- Basic strategies involve buying calls for upward market expectations, selling calls for downward expectations, buying puts for expected declines, and selling puts for a steady or rising market.

Understanding Options Terminology

Options terminology, important options terminology includes

- Exercise (strike) price: The exercise (strike) price is the per-share price at which the common stock may be purchased (in the case of a call) or sold to a writer (in the case of a put). As the stock price changes, options with new exercise prices are added.

- Expiration date: The expiration date is the last date an option can be exercised. All puts and calls are designated by the month of expiration. The expiration dates for options contracts vary from stock to stock but do not exceed nine months.

- Option Premium: The option premium is the price paid by the option buyer to the writer (seller) of the option, whether put or call. The premium is stated on a per-share basis for options on organized exchanges, and since the standard contract is for 100 shares, a $3 premium represents $300.

- Spot price: A spot price is the value of the stock at expiration on which security can be bought and sold in the normal marketplace. An asset can have different spot and strike prices (future prices).

How do Options Work?

A standard call contract gives the buyer the right to purchase 100 shares of a particular stock at a specified exercise price before the expiration date. Both puts and calls are created by sellers who write a particular contract.

The buyer and the seller have opposite expectations about the likely performance of the underlying stock and, therefore, the performance of the option.

- The call writer expects the stock price to remain roughly steady or move down.

- The call buyer expects the stock price to move upward relatively soon.

- The put writer expects the stock price to remain roughly steady or increase.

- The put buyer expects the stock price to move down relatively soon.

The options clearing corporation (OCC) performs the following important functions that contribute to the scene of the secondary market for options:

- It is an intermediary between the brokers presenting the buyers and the writers. It provides a negotiation platform for both parties.

- Call writers contract with the OCC to deliver shares of the particular stock, and buyers of calls receive the right to purchase the shares from the OCC. Thus, guaranteeing that all contract obligations will be met.

- One of the great advantages of a clearinghouse is that it maintains all the positions for buyers and sellers. It can cancel out the obligations of calls and put writers wishing to terminate their positions.

Payoffs from Basic Option Positions

Payoff means the possible profit/loss made on any option plan. The simplest way to determine it is to examine its value at expiration. At the expiration date, an option has an investment value equal to the option's price as determined in the marketplace.

Options are attractive because of the small investment required and the potentially large payoff. However, according to the studies that have been done, the odds favor the sellers. Writing calls produces steady, although not extraordinary, returns.

We can also examine the net profit, which considers the stock price, the option's exercise price, and the option's cost.

Call writing is often profitable, and call buying is often unprofitable. When buying options, investors should generally avoid options that expire in a few weeks-about 75 percent of the option premium disappears in the last three weeks of the option's life. Selling uncovered options can be very risky.

It means that while an option buyer's losses are constrained, their potential gains are limitless. The reward for a writer (seller) is completely the reverse.

NOTE

The reward (premium) does not justify the risk for most investors.

Calls - option to buy

It gives the holder a ‘right to buy’ an underlying asset with the opportunity to make unlimited profits. But, unfortunately, options trading is a zero-sum game. What the option buyer gains, the option writer loses.

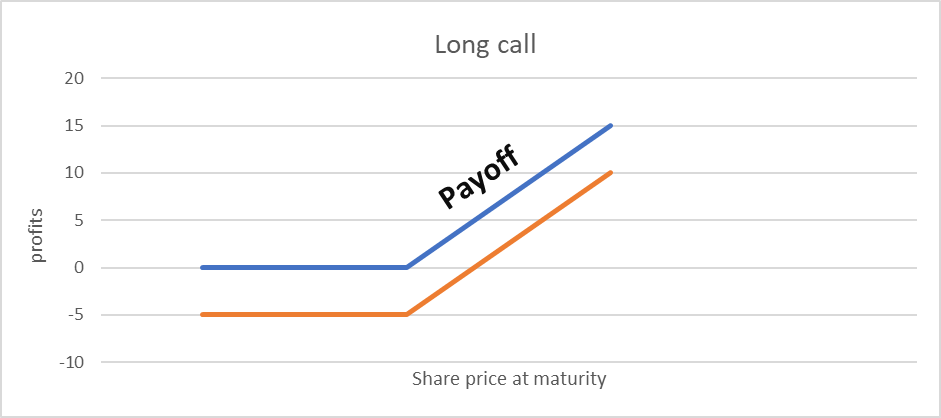

Buying A Call (Long Call)

An investor takes a long call when he expects a stock's price to increase rather than purchasing the stock outright. This is because options are the premium that the investor is paying as a token to buy the underlying securities at a later date (expiry).

Consider first the buyer of a call option from the graph below:

At expiration, the investment value or payoff to the call holder is:

A. If spot price > strike price,

Profit = value of the stock at expiration - the exercise price of an option - premium

B. If spot price ≤ strike price,

Loss = premium paid when purchasing option (fixed and maximum loss).

For example, if the stock price is $48, a six-month call is available with an exercise price of $50 for a premium of $4 (i.e., $400). If this call expires worthless(stop price ≤ strike price), the maximum loss is the $400 premium.

The breakeven point for the investor is the sum of the exercise price and the premium, or $50 + $4 = $54. If the stock price rises above $54, the option will be exercised with profits.

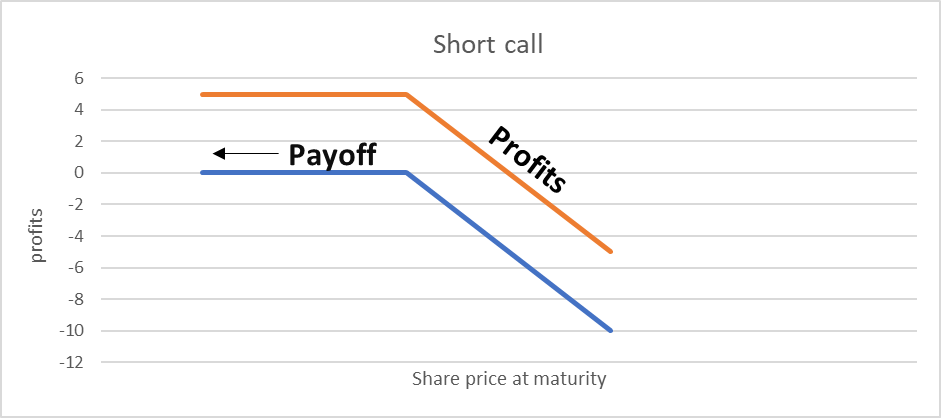

Selling A Call (Short Call)

A seller(writer) takes a short call when he expects a stock's price to decrease. A call writer incurs unlimited potential losses if the stock’s price increases. The seller is obliged to perform the contract at a fixed price.

At expiration, the payoff value will be;

A. If Spot price > Strike price,

Loss = -(value of the stock at expiration - the exercise price of an option - premium)

B. If Spot price ≤ Strike price,

Profit = Premium received at the time of selling option (fixed and maximum profit)

Puts - option to sell

It gives the holder a ‘right to sell’ an underlying asset by a certain date. However, the potential profit of the put buyer is limited since the shares cannot fall below zero.

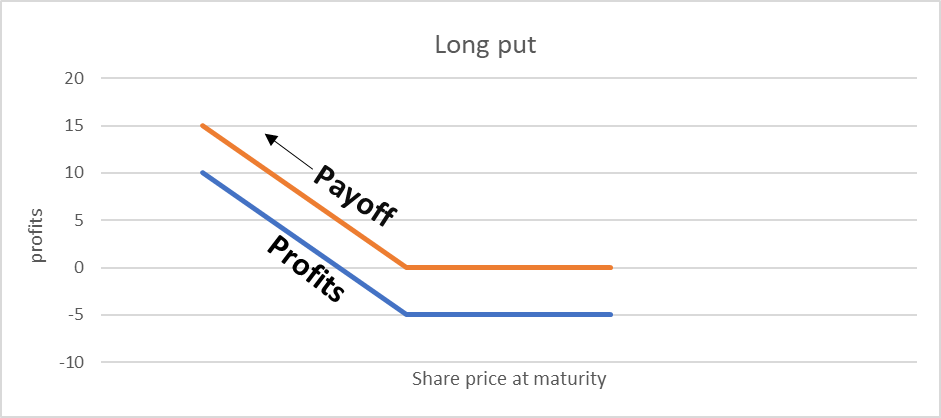

Buying A Put (Long Put)

When the stock's price is expected to decrease, the seller will buy a put option to sell the stock at a fixed price (strike price) later when the spot price is lower than the strike price. However, it is not the obligation of a writer to sell an option.

As the stock declines below the exercise price, the payoff for the put option increases.

A. If spot price ≥ strike price,

Loss = premium paid

B. If spot price < strike price,

Profit = strike price - spot price - premium paid

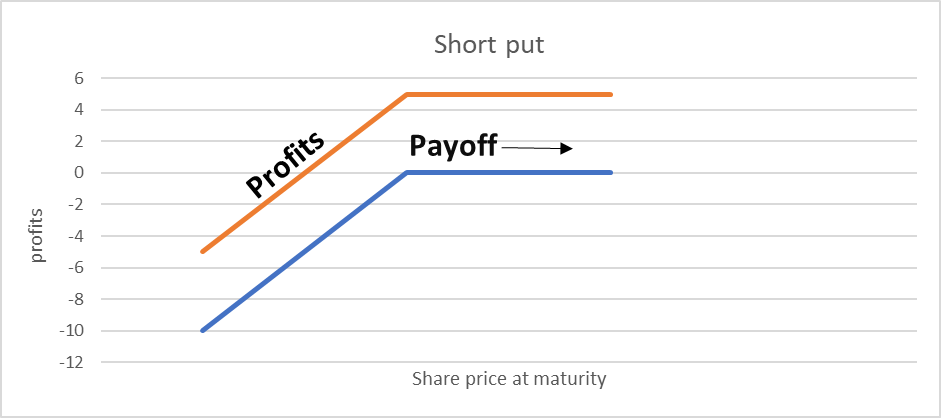

Selling A Put (Short Put)

The put writer retains the premium if the stock prices rise and losses if the stock prices decline. The put writer exchanges a fixed payoff for unknown losses.

A put writer is obliged to perform the contract if the buyer of the put exercises the option at the fixed rate.

A. If spot price ≥ strike price,

profit = premium paid

B. If spot price < strike price,

loss = -(strike price - spot price - premium paid)

For example, a six-month put is sold at an exercise price of $50 for a premium of $4. The naked put seller receives the premium and hopes the stock price remains at or above the exercise price.

As the price of the stock falls, the seller's position declines. The seller begins to lose money below the breakeven point of $50-$4= $46. Losses could be substantial if the price of the stock declined sharply.

Basic Options Strategies

We examined the payoffs and profit/losses for basic uncovered positions involving options (and their underlying stocks). Now, we analyze "covered" positions involving hedges.

A hedge is a combination of an option and its underlying stock designed such that the option protects the stock against loss or the stock protects the option against loss. For example, consider the more popular hedges:

Covered Calls

A covered call involves the purchase of stock and the sale of a call on that stock; that is, it is a long position in the stock and a short position in a call.

The position is "covered" because the writer owns the stock and could deliver it if called to do so as a result of the holder's exercise of the call option.

But the purchase quantity of stock needs to be the same as the standard lot size, which the contract of call option holds; if there is any mismatch will create a loss.

NOTE

The investor is willing to sell the stock at a fixed price, limiting the gains if the stock rises in exchange for cushioning the loss by the amount of the call premium if the stock declines.

Protective Put

A protective put involves buying a stock (or owning it already), and a put for the same stock means a long position in both the stock and a put.

The put acts as insurance against a decline in the underlying stock, guaranteeing an investor a minimum price to sell the stock. In effect, the insurance acts to limit losses or unfavorable outcomes. As a result, the largest profit possible is infinite.

Portfolio Insurance

This term refers to investment strategies designed to hedge portfolio positions by providing a minimum return on the portfolio while simultaneously providing an opportunity for the portfolio to participate in rising security prices.

There are several methods of insuring a portfolio, including options, futures, and the creation of synthetic futures. Synthetic futures act the same as a standard futures contract, but it involves options instead of futures.

Synthetic futures involve buying call options and selling put options as they act as long in futures. The opposite of this act is a short in futures which is short of call and long of put.

NOTE

A protective put can be purchased that allows the portfolio to be sold for a sufficient amount to provide the minimum return.

Conclusion

Equity derivative securities consist of puts and calls, created by investors, and warrants and convertible securities, created by corporations.

A call (put) is an option to buy (sell) shares of a particular stock at a stated price before a specified expiration date. The seller receives a premium for selling either of these options, and the buyer pays the premium.

Advantages of options include a smaller investment than transacting in the stock itself, knowing the maximum loss in advance, leverage, and an expansion of the opportunity set available to investors.

Buyers of calls expect the underlying stock to perform in the opposite direction from the expectations of put buyers. Likewise, the writers of each instrument have opposite expectations from the buyers.

The basic strategies for options involve a call writer and a put buyer expecting the underlying stock price to decline, whereas the call buyer and the put writer expect it to rise. Options may also be used to hedge against a portfolio position by establishing an opposite position in options on that stock.

Investors considering buying options to trade in securities should remember a couple of key points;

- You have approximately a 50% chance of losing your entire investment with options.

- With options, there is a small chance of making a large profit, often 5 to 10 times the original investment.

Given these two points, options may be attractive to some investors and unattractive to others.

or Want to Sign up with your social account?