Short Put

A short put is a bearish options trading strategy in which the investor sells or writes a put option, hoping for the stock price to rise or to stay the same

What Is A Short Put?

A short put is a bearish options trading strategy in which the investor sells or writes a put option, hoping for the stock price to rise or to stay the same. The put option seller/writer earns a premium and must purchase the underlying asset at the strike price if the buyer wishes to exercise the option.

When a trader engages in an options transaction by writing or selling a put option, the trader who buys the put is said to be in an extended position, while the trader who wrote it is in a short post.

The premium (option cost) is paid to the put option writer (short), and the trade's profit is only as much as that premium.

By collecting the premium connected with a sale in a short put, the concept behind the short put is to profit from a rise in the stock's price. If the stock price rises or stays the same, the option will expire worthless, and the writer will keep the premium.

The option will probably be exercised, forcing the writer to buy the shares at the higher strike price if the stock price falls below the strike price. This makes the short-put approach a higher-risk investing strategy and can lead to substantial losses.

Since the potential losses are unlimited if the stock price drops significantly, this strategy is considered extremely risky. The profit potential, however, is restricted to the amount of the premium that the option seller has received.

Hence, it is critical to remember that you should sell a put option only when you are bullish on the underlying asset or expect that it will not fall significantly.

As a put option seller, you must typically deposit an initial margin with your broker to cover potential losses. The margin serves as a form of collateral or security for the option seller as it helps to ensure that they have sufficient funds to cover any potential losses that may occur if the option is exercised.

Short Put example

Consider an optimistic trader bullish on the shares of ABC Corp., which are now going for $1800 each. The trader is confident that the stock price will increase over the coming few months. The trader may purchase the shares, but ten shares would cost him a whopping $18000.

As a result, he chooses to write a put option rather than purchase the shares in the spot market. If the stock price declines, a put option might result in a loss down the road (as could buying the shares).

However, if the price remains flat or goes up, the put writer will get to keep the premiums he received as profit. In other words, as long as the spot price stays at or above the strike price, put option sellers will make money.

Note

You don't necessarily have to sell a put option when you are bullish on a stock or an index while playing the futures and options game. You have the option of purchasing futures or call options as well. The decision to choose from these choices depends on the trader’s risk appetite, capital available, and the time horizon of the trade.

The trader writes a put option with a strike price of $1800, expiring in three months, at $3. Let us assume that the lot size of ABC Corp’s shares is 100. Therefore, selling 1 lot of the shares would mean selling 100 shares of ABC Corp.

Therefore, the maximum profit potential, the amount received in premiums, equals 300$ (3 x100), which occurs if the stock closes at $1800 or higher on the expiry date.

The maximum loss happens if the underlying drops to $0, and the put option seller must purchase the shares for $3. The premium from selling the option covers a portion of the maximum loss.

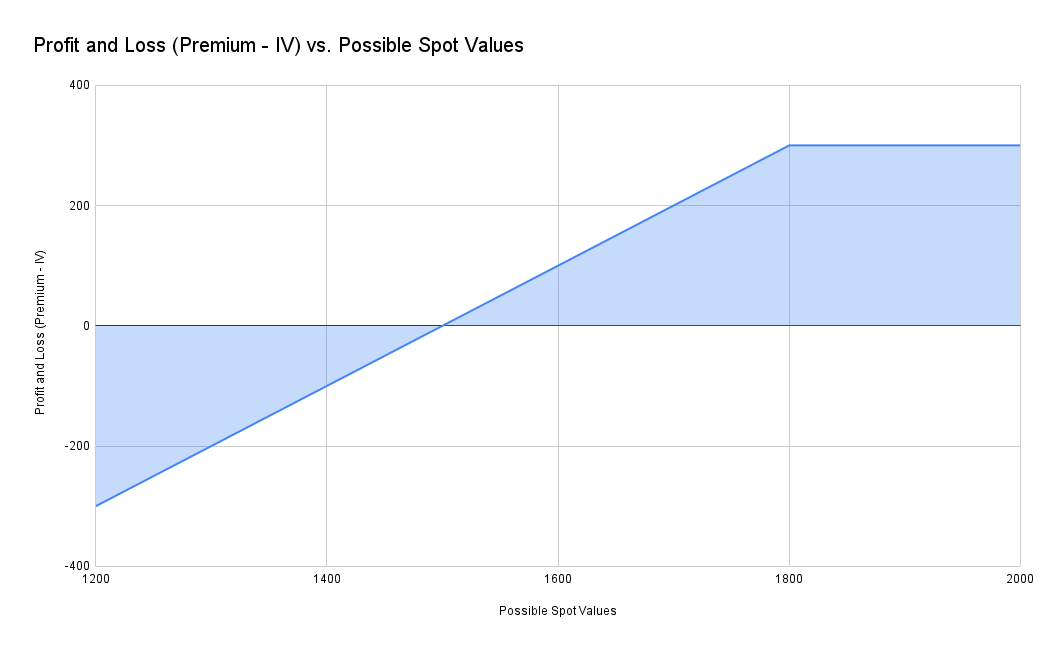

Profit and loss behavior for the put option seller

Let us consider various possible scenarios on the expiry date and figure out how the profit and loss behave for the example we discussed above.

Take a look at the table below:

| Scenario Number | Possible Spot Value | Premium Received | Intrinsic Value (IV)* | Profit and Loss (Premium - IV) |

|---|---|---|---|---|

| 1 | 1200 | +300 | 1800-1200 = 600 | 300-600 = -300 |

| 2 | 1300 | +300 | 1800-1300 = 500 | 300-500 = -200 |

| 3 | 1400 | +300 | 1800-1400 = 400 | 300-400 = -100 |

| 4 | 1500 | +300 | 1800-1500 = 300 | 300-300 = 0 |

| 5 | 1600 | +300 | 1800-1600 = 200 | 300-200 = +100 |

| 6 | 1700 | +300 | 1800-1700 = 100 | 300-100 = +200 |

| 7 | 1800 | +300 | 1800-1800 = 0 | 300-0 = +300 |

| 8 | 1900 | +300 | 1800-1900 = 0 | 300-0 = +300 |

| 9 | 2000 | +300 | 1800-2000 = 0 | 300-0 = +300 |

*Remember, Intrinsic Value (IV) for a put option equals Strike Price - Spot Value. Also, keep in mind that IV can never be negative. It can only be a positive value or zero.

- The point where the put option writer starts making a loss after losing all the premium he has collected is called the breakdown point. In the example above, the breakdown point is $1500 since the trader has lost all the premiums he received at this point.

- Additionally, it is also clearly visible that the put option writers can only benefit while the spot price is at or above the strike price.

- It's also crucial to understand that if the spot price falls below the strike price while the put option is still active, the seller might theoretically sustain an endless loss.

The Short Put payoff diagram

A short put payoff diagram is a graphical representation of the potential profit or loss of a short put option strategy at expiration. It illustrates how the underlying asset's value and the option position's gain or loss are related.

You should take note of the following from the preceding chart (remember that the strike price is 1800):

- Only when the spot price falls below the strike price does the put option seller incur a loss (1800 or below).

- The earnings are limited to the amount of the premium received, although the loss is theoretically limitless.

- The maximum loss potential is unlimited as the underlying asset's price can continue to decline, resulting in a loss equivalent to the difference between the price of the underlying asset on the day of expiry and the strike price.

- A line with a downward slope that crosses the x-axis at the strike price represents the loss potential.

- When the spot price moves above the strike price, the put option seller will make money (to the degree of the premium received).

- The short put payoff diagram will show a limited profit potential equal to the premium received, represented by a flat line at the strike price.

- The seller of the put option is neutral at the breakdown point (1500), making no profit or loss. The full premium he has received is forfeited at this point.

- You can see that the profit and loss graph merely begins to collapse at the breakdown point, moving from a positive zone to a neutral (no profit, no loss) position. Only below this level does the put option seller experience a loss.

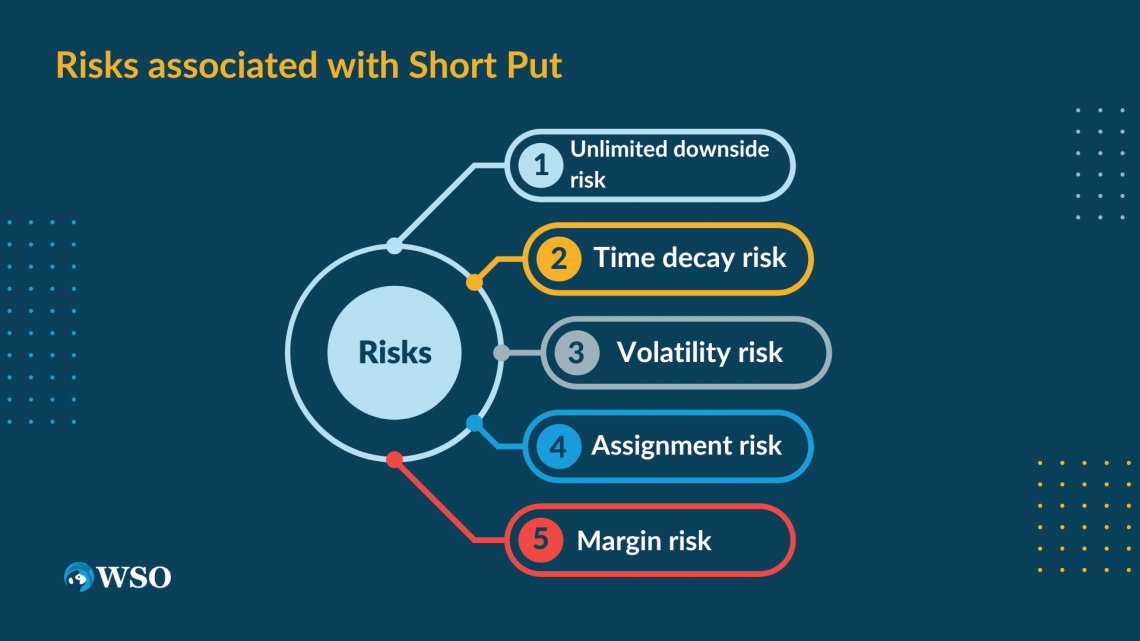

Risks associated with Short Put

Options trading can be a highly rewarding exercise if executed with precision. However, it can also be highly risky, and one can suffer huge losses if things go the other way around.

Below are a few risks associated with selling put options:

1. Unlimited downside risk

Selling a put option involves an unlimited risk of loss since in the event the option is executed, you must purchase the underlying asset at the strike price.

The potential loss is limitless if the underlying asset's price falls noticeably.

2. Time decay risk

The risk associated with time decay is the decline in the option's value as the expiration date draws near. The time value portion of the option's price will drop as it gets closer to expiration, perhaps resulting in a loss.

3. Volatility risk

Volatility is the term used to describe price swings in the underlying asset. The option's price may rise due to rising volatility, which can result in a loss for the trader of short-put options.

4. Assignment risk

If the put option is exercised, the short put option trader will be required to buy the underlying asset at the strike price. This can result in a loss if the underlying asset's price increases significantly.

5. Margin risk

When you sell a put option, you are typically required to maintain a margin account with your broker. If the price of the underlying asset drops, you may be required to deposit additional funds into your margin account to meet margin requirements.

Advantages of selling a put option

Selling puts can be highly risky, but it can also be very rewarding if exercised properly. Below are a few advantages of writing a put option:

1. Immediate generation of capital in the portfolio

Selling puts results in immediate portfolio income for the seller, who keeps the premium if the sold put expires out of the money and is not exercised by the counterparty.

The premium amount depends on the underlying asset's price, the strike price, and the expiration date. The more volatile the underlying asset, the higher the premium.

2. Price protection

The investor may receive some price protection by selling a put option. The investor can sell a put option with a strike price below the asset's current market value if they already possess the underlying asset.

If the option is exercised, the investor will be compelled to buy the asset at the strike price, less than the market value. This means the investor can potentially purchase the asset at a discount.

3. Flexibility

When selling a put option, the option writer can pick the expiration date and strike price. This gives the writer some flexibility since they may select a lower strike price than the current market price if the writer is bullish on the asset.

Note

The writer can also select an expiration date that fits their investment horizon.

4. Hedging

Selling a put option as a hedging technique can be used to guard against downside risk.

If a writer is long a stock but is concerned about a potential decline in the stock's price, they can sell a put option with a strike price below the market price.

It offers some price protection since if the stock price drops, the option will be exercised, requiring the investor to buy the shares at the striking price.

Short Put FAQs

One can buy a call option or sell a put option when their outlook on a share or an index is bullish. However, whether it is better to buy a call or sell a put depends on the attractiveness of the premiums.

It makes sense to buy a call option if the premium is low, whereas if the premium is large, selling the put option and keeping the premium makes sense.

When choosing between the two, it is also important to consider the trader's investment objective and risk tolerance.

While purchasing a call option can be a better alternative for a bullish trader seeking a high-profit possibility, selling a put option can be a better alternative for a risk-averse trader.

Yes, as a put option seller, you can close out the position at any point before expiration by purchasing the exact option that you originally sold. This is called ‘covering’ the short put position or ‘purchasing to close’.

You may lock in any earnings or reduce your prospective losses by exiting the short put position early.

You might be able to buy the put option again for less money than you originally paid, making a profit if the value of the underlying asset has increased in your favor.

Conversely, you can close the trade early to reduce your potential losses if the underlying asset's price has gone against you.

Researched and authored by Shalin Mandhane | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?