Market Index

Used in finance to evaluate the market or a market segment.

What Is a Market Index?

A portfolio of assets that reflect a certain stock market sector is referred to as a market index. Securities that are a member of a specific index frequently have specific features.

A stock index, sometimes known as a stock market index, is used in finance to evaluate the market or a market segment and assist investors in comparing current stock prices to historical prices to determine market performance.

Investors can purchase a stock index by buying an index fund, which may be set up as either a mutual fund or an exchange-traded fund, and "track" an index.

Tracking error is the amount of performance variance between an index fund and the index.

A hypothetical portfolio of investment holdings known as a market index represents a certain area of the financial market.

The prices of the underlying holdings are used to calculate the index value. Some indices are valued according to market capitalization, revenue, float, and fundamental weighting.

The individual influence of each component in an index can be changed by weighting.

To track market trends, investors monitor various market indices.

The Dow Jones Industrial Average (DJIA), S&P 500 Index, and Nasdaq Composite Index are the three stock indices most frequently used to monitor the performance of the American market.

The Bloomberg U.S. Aggregate Bond Index is one of the most widely used substitutes for U.S. bonds in the bond market, where Bloomberg is a key provider of market indexes.

These portfolios are frequently used as benchmarks or for creating index funds because investors cannot invest directly in an index.

Key Takeaways

- Market indices offer a diverse and inclusive representation of financial assets.

- A statistical indicator known as the market index worldwide provides investors with a thorough analysis of the performance of several stocks in a certain industry or market.

- Individual indexes are built using a variety of methodologies, although almost all computations are based on weighted average theory.

- Indexes serve as standards for measuring the performance and movement of market segments.

- A portfolio of assets that reflect a certain sector of the stock market or the entire market is referred to as a market index.

- It is a fictitious portfolio whose value is determined by the prices of the underlying stocks.

- The S&P 500, Nasdaq Composite, and Dow Jones are the three most well-known indexes in the US.

- Weighted average mathematics is the most popular approach for calculating indices.

- Some indexes, like the NASDAQ Composite, place a lot of emphasis on a single market or industry. Thus, they help investors interested in buying stocks from businesses that operate.

- Investors use market indices, fictitious portfolios of financial holdings, to gauge market activity. Market indices come in a wide variety of forms.

- A basket of assets can be purchased by investors instead of a single stock when index funds are made using market indices.

Understanding a Market Index

A market index measures a portfolio of securities with certain market characteristics. The index provider calculates and maintains each index according to its methodology. Market capitalization or price will often be used to weight index algorithms.

A wide range of investors uses market indices to track the financial markets and manage their investment portfolios.

Indexes have a stronghold in the investment management industry, serving as a benchmark for funds.

In 1884, Charles Dow released the Dow Jones Railroad Average, a forerunner to the Dow Jones Industrial Average. Nine railway firms, a steamship company, and Western Union made up the average.

Individual investors cannot invest in an index without purchasing each of the individual assets, which is typically prohibitively expensive from a trading standpoint.

As a result, index funds are a low-cost method for investors to participate in an extensive index portfolio and have exposure to a particular market sector of their choice.

Index funds employ an index replication technique that involves purchasing and holding every component of an index. The fund's expense ratio still includes some management and trading charges, although these fees are considerably less than those for actively managed funds.

Investors frequently choose index investing over individual stock holdings in a diversified portfolio. Investing in a portfolio of index funds is an excellent method to maximize profits while managing risk.

Investors can also employ market index funds to invest in developing growth industries. The following are a few well-known emerging growth indexes and the associated exchange-traded funds (ETFs):

Some Examples include the Aditya Birla Sun Life Nifty Next 50 ETF, the DSP Nifty 50 ETF, and the Motilal Oswal Midcap 100 ETF.

The oldest ETF program in India is Nippon India ETF Nifty BeES, one of numerous ETF investing options.

Market Index Functions

Investors can identify broad price changes in the stock market using market indices. It demonstrates its usefulness in several ways.

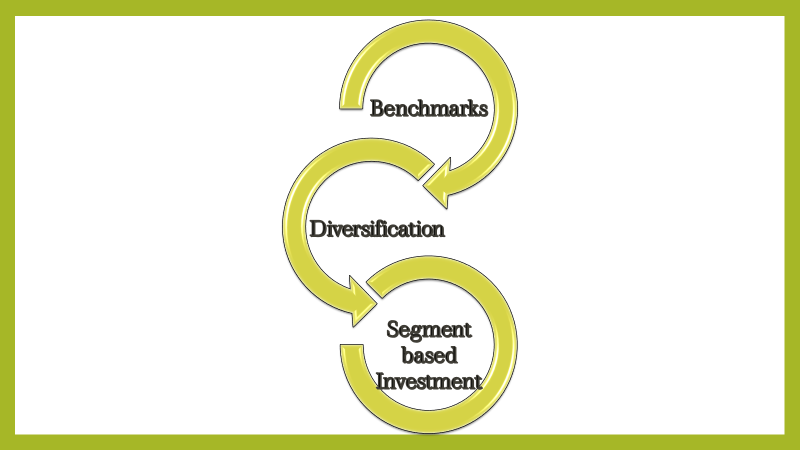

1. Benchmarks

It is a tool that investors can use in a variety of ways. Every managed fund will have a standard benchmark against which to compare its performance. Investors can also utilize benchmarking to go beyond the standard.

When evaluating performance and making investment-related choices, managers of investment funds utilize indices as benchmarks. An index may also be used as a benchmark by mutual funds.

The benchmarks serve as a stand-in for a fund's performance for institutional fund managers. The commission paid to fund managers is also calculated using them.

Investors benefit from the openness of benchmarks, which are disclosed in each fund's prospectus and included in performance reports.

Fund benchmarks can also be employed to assess the pay and effectiveness of fund managers.

2. Diversification

Index investing is typically preferred over holding individual stocks by investors with diverse portfolios.

They could also decide to spread their exposure across various indices. It's because index investing allows them to maximize profits while taking on the least risk.

3. Segment-based Investment

Another popular strategy for investing in developing industries with significant growth potential is to use. The sectors can also be separated based on location.

The FTSE 100, for instance, keeps track of the 100 most extensive stocks in the UK.

Due to particular criteria, some indexes produce a specific and focused market emphasis. An index can specify maturity in the context of fixed-income securities.

What is the Index Methodology?

A hypothetical portfolio using the index technique gets its worth from the prices of the assets it holds as a base. Indices may calculate this number in a variety of ways.

It means that giving individual securities different weights changes the individual value of each security relative to the index's total worth. The weights might be determined by real market pricing, market capitalization, revenue, or floating-rate prices.

Each index has a unique process for calculating its value depending on the index provider. For instance, the US bond market has indexes provided by Bloomberg Barclays.

The prices of the stocks of the biggest US corporations are included in the three indexes already stated. Due to changes in holding the highest market prices, indices weighted based on price are typically more likely to have a substantial influence.

On the other hand, changes in the largest stock will impact an index weighted based on market capitalization. The degree of influence depends on many factors that are considered while determining weights.

Types of indices by weighting method

Indices used in the stock market may be divided into groups based on how stocks are weighted in the index, regardless of the stocks that make up the index.

For instance, the S&P 500 Equal Weight covers the same class of companies, but the S&P 500 is weighted by market capitalization, while the S&P 500 Equal Weight is an equal weight index.

A selection of popular index weighting techniques is shown below. In reality, many indices will restrict these guidelines, including concentration limitations.

The mean-variance is efficient under the capital asset pricing model, indicating that it generates the maximum return for a given degree of risk.

Under the proper presumptions, tracking portfolios of the market-cap-weighted stock index might also be mean-variance efficient.

Since the largest-cap stocks often have the most liquidity and the greatest ability to manage investor flows, market-cap-weighted indices may also be considered liquidity-weighted indices, and portfolios including such stocks may have extremely high investment potential.

For tightly or strategically held shares not typically traded on the open market, free-float adjusted market-capitalization weighting-based indexes change market-cap index weights depending on the number of shares outstanding for each component.

Governments, linked businesses, founders, and workers may possess such shares. Government-mandated restrictions on foreign ownership could likewise be susceptible to free-float modifications.

These changes alert investors to possible liquidity concerns from these holdings hidden by the bare number of outstanding shares of a firm.

Types of indices by coverage

The index coverage set of stocks allows for the classification and segmentation of stock indexes.

The underlying group of companies that an index is intended to reflect or monitor, often with some justification from their fundamental economics or fundamental investor demand, is known as the coverage of the index.

For instance, an index that includes equities from around the world, such as the MSCI World or the S&P Global 100, serves investor demand for a wide global stock market index.

Stocks from nations with comparable economic development are included in regional indexes that make up the MSCI World index, such as the MSCI Emerging Markets index.

This meets investors' desire for an index of stocks from emerging markets that may have comparable economic factors.

A stock market index's coverage is unrelated to its weighting scheme.

For instance, the 500 biggest stocks from the S&P Total Market Index are covered by the S&P 500 market-cap weighted index, while the S&P 500 equally weighted index provides the same coverage.

Country coverage indexes indicate investor perception about the status of a country's economy by measuring the performance of that country's stock market.

National indices made up of the shares of significant corporations listed on a country's top stock exchanges are the most often mentioned market indexes.

For example, Nikkei 225 in Japan, the DAX in Germany, the NIFTY 50 in India, the FTSE 100 in the United Kingdom, and the S&P 500 Index in the United States.

Regional coverage indexes represent the stock market's performance in a certain geographic region. The FTSE Developed Europe Index and the FTSE Developed Asia Pacific Index are two examples of these indexes.

The success of the world stock market is reflected in global coverage indexes. More than 16,000 firms are represented in the FTSE Global Equity Index Series.

Important points related to the market index

Some important concepts are:

1. The major stock indexes

The USA's top three stock indices are the Dow Jones Industrial Average, the S&P 500, and the Nasdaq Composite.

The Financial Times Stock Exchange 100 Index and the Nikkei 225 Index are well-liked in the British and Japanese stock markets, respectively, on global marketplaces.

2. Why do investors find indexes useful?

Gives an accurate view of the entire market or industry at a glance.

For instance, it would be impractical for a regular investor to analyze hundreds of different stock prices to comprehend how various technological businesses' financial situations change over time.

The average trend for a sector may be seen, though, in a sector-wide index like the NASDAQ-100 Technology Sector Index.

3. Real-world examples of a market index

Examples of the leading indices worldwide include:

- S&P 500 – The top 500 stocks in the USA

- Dow Jones Industrial Average – The top 30 stocks in the US

- Nasdaq Composite – All securities listed on the NASDAQ Exchange

- S&P 100 – The top 100 stocks in the USA

- Russell 1000 – The 100 highest-ranking stocks in the USA

- S&P 400 – The top 400 stocks in the USA

- Russell Mid-Cap – The smallest 800 companies part of the Russell 1000

- FTSE 250 – The 101st to 350th largest stocks listed in the FTSE

- NIFTY 50 – The top 50 stocks of the NSE of India

or Want to Sign up with your social account?