Control Premium

The additional value the buyer is willing to pay and risk to obtain a controlling interest in a specific company.

What is Control Premium?

The control premium refers to the additional value the buyer is willing to pay and risk to obtain a controlling interest in a specific company. Essentially, it is the additional sum of money a buyer would pay to obtain the ability to influence the strategic direction of a company.

The premium compensates the seller for giving them control of the company, allowing the buyer to shape their target company’s direction.

Appearing in mergers and acquisitions (M&A) transactions, buyers will typically offer a premium to current shareholders of the specific company above the current market share price to persuade them to sell a controlling interest share in the company.

Premiums are an essential determinant for mergers and acquisitions (M&A) transactions and any buyer involved in the deal-making process.

The premium is paid to the existing shareholders of the target company, who may be willing to sell their shares at a higher price if they believe the buyer can bring value to the company through its ownership, thus influencing premiums because the company's value is rising.

Influenced by various factors, the premiums include the target company's financial and strategic performance and potential growth. In addition, premiums are influenced by the competitive landscape, with multiple buyers vying for control of the target company driving up the premium.

All-inclusive, comprehending premiums is critical in M&A transactions for:

- Buyers

- Sellers

- Investors

Understanding premiums can aid decisions about the value of a company and forecast returns on investments by adding value to the M&A.

Ultimately, learning will lead to more successful and smooth deals for buyers and sellers.

According to Wallace Plese + Dreher, the reasons for M&A to increase value for the acquirer are to increase profit and earnings by new and improved service offerings, increase productivity, increase economies of scale, and lower borrowing costs.

Key Takeaways

-

The control premium is the additional amount a buyer is willing to pay to obtain a controlling interest in a company and influence its strategic direction.

-

Control premiums are essential in mergers and acquisitions (M&A) transactions as buyers offer them to persuade shareholders to sell their shares and secure control of the target company.

-

The control premium can be calculated by dividing the offered price per share by the unaffected share price and subtracting 1.

-

Internal factors such as company size, performance, management quality, and synergies, as well as external factors like macroeconomic conditions, regulatory environment, geopolitical risks, and financing conditions, can influence the control premium.

-

Strategic buyers shape control premiums through their industry expertise, synergies, and competition for the target company. Financial buyers focus on financial analysis, cost optimization, leverage, exit strategy, and industry knowledge to influence control premiums.

How to Calculate Control Premium?

Calculating premiums is like uncovering a hidden treasure chest at the heart of every merger or acquisition deal. It's a vital tool for buyers and sellers, allowing them to negotiate a fair price for a company and strike a deal that benefits buyers' and sellers' satisfaction.

Think of it this way: It is the secret sauce that gives a buyer a competitive edge over other potential buyers. By accurately calculating the premium, the buyer can offer a price that beats out other bidders and secures the deal by careful measures.

On the seller's side, knowing the premium can help them get the best possible price for their company while ensuring a smooth ownership transition. With careful measures, more risk is involved if the price is mighty or if the price is too low; the seller will not benefit from the premium.

Moreover, premiums can be a valuable indicator of market trends and overall business valuations. Analyzing the premiums over time can reveal insights into the relative value of different types of businesses and the factors that drive mergers and acquisitions offerings.

NOTE

Calculating the premium surplus is an essential step in any M&A deal, providing the foundation for a successful transaction that can create value for the buyer and seller.

To calculate the premium, we will use the following formula:

Control premium % = offered price per share/ unaffected share price - 1

The formula consists of two inputs:

- Offered price per share (OPS): the price a buyer offers per share of the specific company in a transaction, such as mergers and acquisitions.

- Unaffected share price (USP): the price before any rumors or news of a potential acquisition or other external factors that may affect the value.

The offered per share price is divided by the unaffected share price minus 1.

Based on mergers and acquisitions transactions, the OSP is essential and is a key determinant for the total value of transactions.

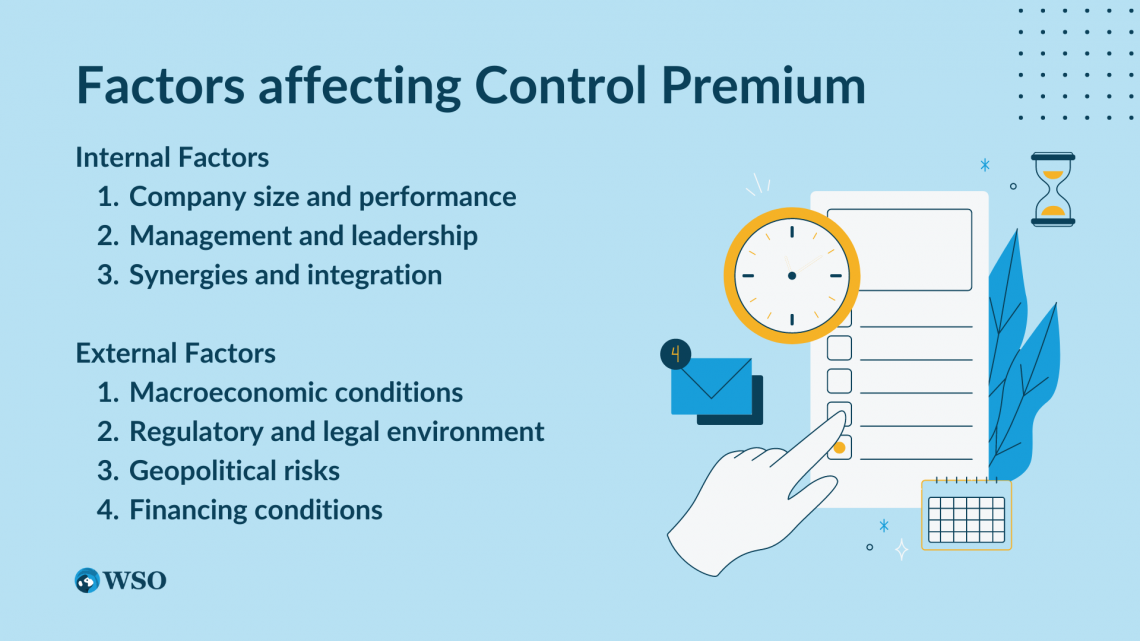

Factors affecting Control Premium

Internal and external factors can influence the control premium.

Some of the internal factors include:

1. Company size and performance

The larger the company, the higher control of the premium will be.

2. Management and leadership

A company's management quality is a key determinant that may influence the premium. Buyers will be more interested and pay more if the quality of management and leadership appears to be strong.

3. Synergies and integration

If the buyer's expectations achieve significant synergies and cost savings by implementing the operations of the target company of its own, this may affect the premium.

On the other hand, the external factors affecting are:

1. Macroeconomic conditions

Economic indicators such as inflation, interest rates, and GDP growth may impact these collected premiums.

2. Regulatory and legal environment

Buyers may or may not take a risk if they are uncertain about various laws or policies regarding the industry or company structure.

3. Geopolitical risks

Political instability, trade tensions between others, and/or other external factors that may cause conflict.

4. Financing conditions

If the rates are favorable/unfavorable and financing is readily available/unavailable, it’ll appear more attractive/unattractive for the buyer.

How can a strategic buyer impact a control premium?

Strategic buyers are like the architects of a building - they shape the entire deal landscape and significantly influence premiums.

These buyers typically have a specific strategic rationale for acquiring a company, such as expanding into a new market, gaining access to new technology, or diversifying offerings.

Strategic buyers can impact the premiums by bringing unique insights and synergies to the table. By leveraging their expertise and resources, they can identify opportunities to unlock value in the acquired company that other buyers may have missed.

For example, a strategic buyer in the tech industry may see potential in a smaller company's cutting-edge technology and be willing to pay a higher premium to acquire it.

Another way that strategic buyers can impact the premiums is by increasing competition for the target company. For example, when multiple strategic buyers are vying for the same acquisition target, premiums can skyrocket as each buyer tries to outbid the others.

In this case, the buyer with the most compelling strategic rationale may be willing to pay the highest premium to secure the deal. For example, acquiring another company will expand the business, enter a new market, or create opportunities to access new technologies or products.

Connected to M&A, a strategic buyer will be more willing to pay the extra dollar than a financial buyer because a strategic organization sees more value in the target company.

The buyer must analyze the company’s characteristics, such as:

- Their intellectual property

- Their target market

- How they distribute its network

Essentially, M&A will drastically ‘overpay’ to purposely gain control of a company to project greater revenue, return on investment, and higher cost savings.

Ultimately, strategic buyers play a critical role in shaping premiums and driving M&A activity. They can create value for themselves and the acquired company by bringing a unique perspective and deep industry knowledge.

Example of a strategic buyer

Let’s look at an example between pharmaceutical and biotech companies.

A pharmaceutical company is looking to expand its portfolio by acquiring a much smaller biotech company that specializes in developing cancer treatment. Why does the pharmaceutical company want to buy out this smaller biotech company, profit or power?

Because this pharmaceutical company seeks potential in the biotech company due to its proprietary technology and expertise, it increases value, thus increasing power.

As a strategic buyer, the pharmaceutical company brings a unique perspective. It deeply understands the oncology market and the challenges patients and healthcare providers face. Another positive is that it has an extensive network of relationships with regulatory agencies and key opinion leaders in the industry.

By leveraging its strategic advantages, the pharmaceutical company can identify opportunities to drive growth and create synergies in the biotech company; an example is listed below.

It may see the potential to combine the biotech company's technology with its existing product portfolio, creating a suite of complementary treatments for cancer patients.

It may be helpful to have insights into specific geographic markets where the biotech company's products would be particularly effective and be able to tailor its marketing and distribution strategies accordingly.

Knowing your target market and predicting which market will work best will theoretically increase your opportunity rate and revenue.

The pharmaceutical company sees the potential for strong long-term growth in oncology. It is willing to pay a higher premium to acquire the biotech company and gain access to its technology and expertise. However, the pharmaceutical company may run into risk.

Furthermore, the strategic buyer's influence can create a competitive bidding environment for the biotech company, further driving up the control premium.

Other potential buyers in the pharmaceutical industry may see the value in the biotech company's technology and seek to acquire it themselves, forcing the strategic buyer to offer a higher premium to secure the deal by beating other competitors by offering more.

By identifying opportunities for growth and creating synergies in the acquired company, they can justify paying a higher price for the company and create significant value for themselves and their shareholders.

How can a financial buyer influence the control premium?

Financial buyers, typically private equity firms, can influence the premiums in several ways. However, a financial buyer is an acquisition to buy another company in theory to make a return on investment (ROI).

Financial buyers do not benefit from synergies and do not overpay for companies.

The buyer is particularly interested in generating ROI, having access to greater capital, gaining experience in new industries or markets, and flexibility by not having a limit on companies fitting their structure or existing business models.

A financial buyer dictates the control premium in four ways:

1. How due diligence influences premium prices?

The buyer might conduct due diligence on a target company to identify opportunities or potential risks. Financial buyers can predict the target company’s market value and hope to receive a lower premium so that there is less risk involved or to have leftover money.

2. How earnouts or seller finance can dictate the premiums?

An earnout or (seller finance) is a legal provision in a merger or acquisition agreement that determines future payments from the buyer to the seller's shareholders. As a result, premiums can be reduced upfront by additional forms of consideration.

3. How can leverage impact the premium?

To finance the acquisition, leverage may be used by buyers. However, to finance the acquisition, the buyer must borrow funds. Buyers can then reduce the usage of equity, which leads to lower premiums but is risky because the use of borrowing or loaning money must be paid back.

4. Why do financial buyers become aggressive?

Financial buyers are like treasure hunters constantly looking for the next big opportunity. These buyers, such as private equity firms, typically focus on generating returns for their investors and, therefore, are willing to pursue premiums aggressively.

Example of a financial buyer

We will use private equity because they are commonly known as financial buyers.

Private equity firms are investment firms that want to raise their capital through institutional investors. They acquire companies from high-net-worth individuals and operate them to generate significant returns for their investors.

Similar to strategic buyers, a private equity firm acquires an interesting company to obtain the target company through a premium they get to sum to submit an offer.

To obtain control of a company's operations, management, and strategic decisions, the private equity firm must own most of the company’s shares.

When this occurs, the private equity firm is willing to pay the extra premium price tag of the target company to gain control of the steering wheel.

For example, Company A is a publicly traded company with a market capitalization of $1 billion. Company B is seeking out traded companies with relative capital.

Company B perceives Company A as attractive and the perfect company to control, so they offer company A $1.2 billion, representing the extra $200 million of spare change Company B receives to gain control of Company A if the company accepts the offer.

Company A accepts the offer, which is beneficial because Company A minimizes its risks while Company B gets what they want, which is control of a potentially growing company.

or Want to Sign up with your social account?