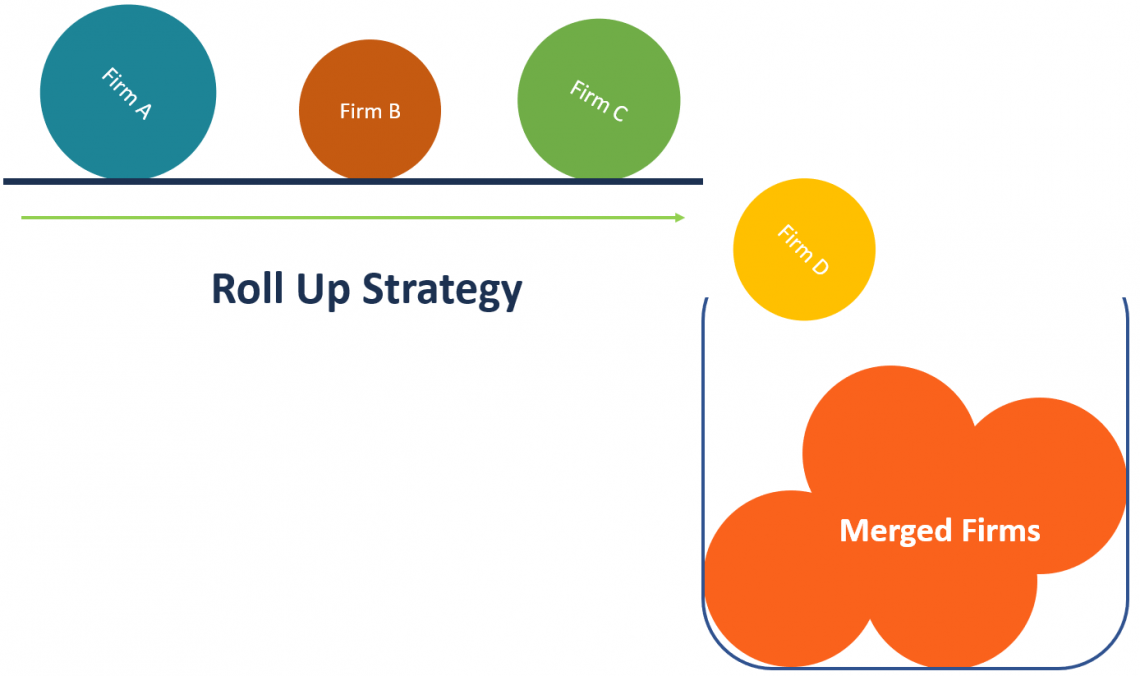

Roll Up Strategy

A consolidation in which smaller corporations are rolled together to produce a much larger entity

What is a Roll Up Strategy?

Rather than focusing on eye-catching 'big bang' transactions, pursuing a series of more minor agreements with total values close to the acquiring company's market capitalization tends to yield significantly greater value.

The study recommended this strategy for corporations contemplating mergers & acquisitions (M&A).

A roll-up merger is a consolidation in which smaller corporations are rolled together to produce a much larger entity. They are sometimes pursued by investors such as private equity firms.

They are frequently employed in new market sectors and help organizations grow and flourish. Because large companies are commonly valued higher than smaller ones, private equity firms can extract value from a sale of a new business or a floatation via an Initial Public Offer (IPO).

It can benefit the proprietors of a new firm. In exchange for their equity, the owners of the firms being merged receive cash and shares. In addition, improved access to new clients, technology, and markets can all benefit the new company's owners.

This strategy is a robust acquisition strategy that entails the acquisition of several smaller companies (sometimes known as 'bolt-on acquisitions).

This method is more typical in fragmented industries, but it can occur anywhere that these bolt-on acquisition opportunities present themselves.

The merged company can broaden its geographic reach to include markets previously served by smaller firms.

In addition, it can provide a greater range of products and services than a single, smaller company. As a result, investors and shareholders profit from a vast pool of investments.

Key Takeaways

- The roll-up strategy focuses on incremental, smaller acquisitions rather than large transactions, yielding greater overall value for acquiring companies.

- Roll-up mergers offer various benefits, including increased market valuation, improved access to clients and technology, and cash/share exchanges for owners of acquired firms.

- Successful execution of the roll-up strategy involves meticulous planning, system development, industry understanding, thorough due diligence, careful hiring, integration, and well-timed implementation.

- Investors favor the roll-up strategy due to potential economies of scale, market influence, cross-selling opportunities, and improved financials, leading to increased profitability for larger merged entities.

Practical Example of a Roll Up Strategy

Assume that Company ABC manufactures computer equipment in North America. The company's revenues increased recently, but its operational costs increased because it sources some computer assembly accessories from other companies.

Company ABC intends to grow its operations by acquiring two minor businesses that produce some components used in its core operations.

The corporation loans $1.2 million to finance the roll-up plan and the monies are used to purchase two lesser enterprises, Company QPR and Company XYZ.

Company QPR manufactures RAM chips, an essential component used in computer assembly by Company ABC. Its yearly revenue is around $300,000. ABC and QPR agree on an acquisition cost of $450,000.

Firm XYZ, which distributes computer accessories and has annual sales of $550,000, is the other target company. It also has a presence in Europe and Southeast Asia. ABC and XYZ agree on an acquisition price of $600,000.

Company ABC will benefit from the acquisitions of Companies QPR and XYZ by lowering operational expenses and expanding operations in Europe and Southeast Asia.

Steps in a Roll Up Strategy

The majority of acquisition roll-up methods are implemented for three to four years.

Generally, the more meticulous your company is about roll-up and its strategies, the more likely it is to achieve a good end.

That being said, when contemplating this strategy as an acquisition strategy, below is a full explanation of crucial steps to begin:

1. Planning

There's a lot of it. But, unfortunately, nobody should think about this strategy until they plan for five years.

At this point, the team should be thinking about the maximum multiple of EBITDA that will be paid for the acquisitions, the regions that the firm is interested in, and the amount of stock it is willing to fork over to each of the acquired companies' owners.

2. Develop Systems

This should be part of the planning process, but it is worth mentioning separately. It should go without saying that a mid-sized corporation needs more systems to function successfully than a tiny, local business.

For example, how easily would the firm be run if the manager of a recently purchased company picked up and left? Systemization is required to ensure zero disruption in cases like this.

3. Understanding The Industry

Scale benefits certain industries more than others. Similarly, specific industries are too fragmented to justify pursuing an acquisition roll-up strategy.

Slow industrial growth or less-than-optimistic future forecasts must also be understood. Understanding the industry, its dynamics, and its future possibilities is critical.

More acquisitions necessitate increased due diligence. As a result, for any corporation implementing such an acquisition plan, due diligence effectively becomes a significant aspect of the company's operations, similar to its finance or human resources departments.

And, as due diligence grows in scope, the purchasing business will need to assemble a larger staff to ensure that it is carried out with the same rigor on every transaction.

5. Careful Hiring

The need for the team driving the roll-out strategy to ensure managerial competency is closely tied to due diligence. The larger the company, the more difficult it is to manage.

Is a level of middle management or regional managers required for the new entity? For example, who is in charge of managing the day-to-day operations of the company's new branches?

6. Integration

All businesses must be well integrated to ensure that the new organization is more than the sum of its parts.

Without post-merger integration and change management, the acquirer risks being left with a collection of separate enterprises (as well as angry managers and employees).

7. Timing

There is no single best time to implement this strategy. As with any acquisition plan, it is preferable if the strategy can be done faster. However, speed is only one of several concerns.

It should not come at the expense of rigorous thought, complete due diligence, appropriate appraisals, etc.

One advantage of being faster and directly tied to the roll-out strategy is that target companies will be less likely to be aware of the strategy and, as a result, will be less likely to seek greater multiples of EBITDA to sell.

Why do Investors love Roll Up Strategy?

Larger companies are frequently more successful than smaller ones and can dominate the industries in which they operate. This is because they provide a broader selection of products or services, may achieve economies of scale, and benefit from increased brand awareness. Consider Apple and Microsoft, for example.

In contrast to marketplaces with a few prominent players, markets with many smaller enterprises operating in specific niches are more fragmented. The restaurant and furniture industries are two examples.

This fragmentation can present an opportunity for investors who perceive the potential for 'rolling up' various companies to form a larger one, resulting in higher profits and enhanced value.

Here are some unique advantages of such mergers:

1. Economies of Scale

One perceived benefit of this merger is that it allows a company to achieve economies of scale by being more efficient, distributing its production expenses across larger quantities, lowering unit costs, and becoming more lucrative.

A business (PQR Pvt. Ltd.) could conduct a series of 'vertical' mergers and acquire several smaller companies that manufacture products critical to its supply chain. It can save money and consolidate its operations by acquiring these companies.

Alternatively, PQR Pvt. Ltd. can seek a 'horizontal' merger, which acquires many small companies operating in the same sector but in distinct markets, possibly in different countries.

It can reduce expenses while getting access to new markets by achieving economies of scale.

2. Market Influence

By acquiring companies, a company can considerably grow its market share. Suppose it makes enough acquisitions to grow its size substantially. In that case, it has the potential to become the dominant player, allowing it to raise prices and thus profits while also cutting expenses through economies of scale.

Because it is now large and powerful, it can negotiate better terms with suppliers, negotiating lower pricing as it purchases larger amounts. It may also be easier to obtain financing on more favorable terms because it is a lower-risk venture.

3. Cross-selling

A company can scale without having to recruit these clients via its marketing efforts by increasing its access to new customers or increasing the quantity or types of products it sells to existing customers.

4. Better Financials

Sometimes a new, merged firm will enhance its financial position by acquiring smaller ones. It may have a better price-to-earnings ratio or a greater overall value than before despite making no changes to its operation.

Why Do Roll Up Strategies Fail?

These mergers can be incredibly lucrative, but they are also extremely risky. Here are some of the major drawbacks:

1. Integration Problems

Mergers and acquisitions are complex deals that necessitate much negotiation and paperwork. In addition, companies that are bought frequently have completely diverse cultures, leadership styles, and business models.

When executives conflict, integration can stall, and making the necessary modifications to capitalize on the merger can be time-consuming.

Furthermore, leadership changes can result in a decline in morale, the loss of talent, and a drop in productivity. To ensure success, the new organization must find a means to bring teams together.

2. Mismatches In Merged Companies

Sometimes the companies being merged are sufficiently distinct that a successful merger proves impossible. For example, perhaps the companies' processes or assets are so dissimilar that economies of scale are difficult to achieve.

Customers may also want to buy locally. For example, shoppers may purchase a car from a local dealership rather than a large and distant consolidated firm.

3. Financials

Mergers can help organizations improve their finances. However, because these better financials are not linked to any actual improvement in the firm's financial status but rather to the possibility for improvement, if the company fails to capitalize on the roll-up, its value might quickly deflate.

Furthermore, a corporation may require substantial financing to complete its roll-up and will be required to service this debt, putting additional strain on its financial condition.

It may also have a poorer credit rating, which can lead to harsher financial circumstances, and the combination of these two elements can swiftly lead to financial difficulties.

If the new firm utilizes equity rather than debt to finance the transaction, it may face problems such as loss of influence over decision-making and dilution of founder interests.

Key Things to Consider While Executing Roll Up Strategy

If you're considering this merger, one of the first things to evaluate is if you understand the market segment you're targeting. The most effective roll-ups have occurred in fragmented industries with few strong companies.

When market conditions shift, highly regulated industries can provide appealing pickings. Covid-19, for example, has given rise to the establishment of small businesses delivering testing and track-and-trace technology. Smaller enterprises in this area may benefit from a successful roll-up merger.

The second factor in evaluating is if you have a proven formula for maximizing the value of the merger. Finally, you'll need a strategy for integrating personnel, management structures, assets, sales channels, and information technology.

As with franchise firms, a tried and tested process-driven approach is the best assurance of success. To maximize your prospects, you'll need a lot of organizational discipline.

Third, do you have the necessary funding to complete the transaction? Or, if you're contemplating an IPO to fund it, have you considered the added complexity and regulatory scrutiny involved after the IPO?

This raises an important question: how should we finance our roll-up?

One of the most challenging aspects of implementing this approach is funding. You can use your company's cash, incur more debt, or seek money from private or public equity. In any case, you'll probably need more money than you have. The private equity market is the most popular source of funding.

If you choose private equity to fund your roll-up, you should work with a firm specializing in such transactions. Such mergers need more capital and can be more complex, so you'll need an experienced team.

Another option for funding this strategy is to give up some of the company's equity as part of the transaction. While your company's share price may fall, you may still make money overall.

How To Find The Best Industry For Roll-Ups?

As stated in the preceding sections, understanding an industry's dynamics is critical before implementing a roll-up investment strategy (nationally, if the roll-out strategy is national, and internationally, if it is international or global).

Private equity firms are the most common supporters of these strategies. These companies can spend up to two years determining which industries are suitable for this strategy.

An example is provided here. Take the dairy business, for example. Although most countries have at least one dominating operator, there will be several smaller regional companies producing milk and selecting dairy products for their domestic market.

Some may even have a small export component as a solid but not necessarily a fast-growing industry.

If these enterprises were to be acquired, they would be able to offer a broader range of products (milk, powdered milk, cheese, artisan cheeses, and so on) throughout a much larger geographic area.

There would also be scale advantages, such as greater bargaining power with farmers and supermarkets. Because the brand was now available nationwide, it would have more marketing power. Consider the deal's potential for value addition as well.

Some of the smaller dairy companies may have solely produced liquid milk. What if the new company could turn the extra milk output into higher-value products like gorgonzola, camembert, or brie cheese?

Suddenly, the identical inputs produce 2x to 3x the value. And you can see how, when done correctly, this method may be highly effective.

The prime industries for this strategy could be:

1. Industries with no clear leader or that are fragmented

Industries without a key leader, the top 3-5 companies accounting for less than 40% of market share, are primed for disruption and takeover.

These industries are frequently populated by "mom and pop" firms that can be willing targets.

2. Industries associated with necessities/basic requirements

Porta-potties, medical clinics, dentist offices, and garbage management are some of the most common industries where this approach has been used.

The argument is straightforward: people will always require these commodities and services, which span a vast geographical profile. Indeed, medical facility roll-ups have grown in popularity over the previous decade.

3. Industries that are simpler to comprehend

Because the ultimate goal is speedy integration into the acquirer's portfolio to produce value, these are best suited to less complex enterprises.

Final Thoughts

The decision to use this method, like other M&A activities, must be founded on a robust, evidence-based plan. As each purchase in the roll-up progresses through the deal cycle, smooth integration becomes more difficult, but it remains critical to the strategy's success and value creation.

'You don't need to do anything truly earth-shattering,' Warren Buffett said to a University of Florida audience when asked what measures they needed to take to be great investors.

You need to do a lot of simple things correctly regularly.

This is the logic that underpins this strategy:

Make modest value-adding purchases consistently, and your company will almost surely beat the market in the long run.

On the whole, closing more purchases means greater pitfalls for acquirers. Anyone pursuing a roll-up approach must devote substantial resources to preparation, due diligence, and post-merger integrations.

or Want to Sign up with your social account?