Enterprise Value (EV)

The value of the entire firm

What is Enterprise Value (EV)?

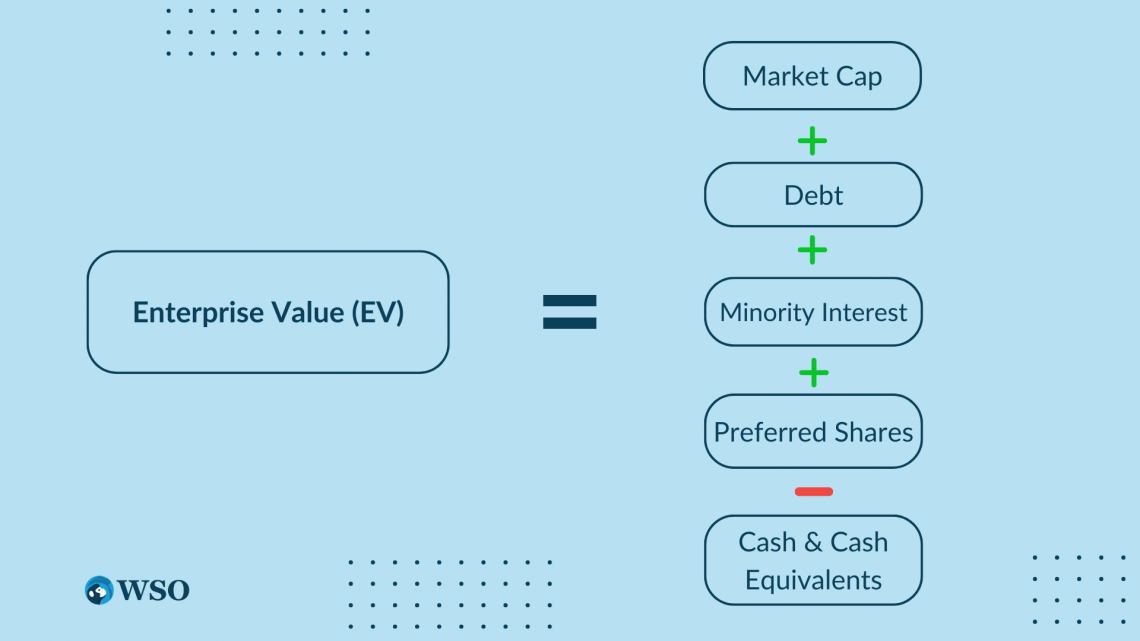

Enterprise Value (EV) is a measure of the entire market value of a firm (not just equity). It is calculated by taking a company’s market capitalization, adding debt, minority interest, and preferred stock, and then subtracting out cash & cash equivalents.

This measure attempts to provide a more accurate valuation of a firm's value relative to its market capitalization. Because EV accounts for debt whereas market capitalization does not, enterprise value is the choice of preference for measuring a company’s value within:

- Portfolio Analysis

- Mergers and Acquisitions

- Risk Analysis

- Business Valuation

How can an analyst properly assess the value of a firm? While there are many different metrics to choose from, enterprise value offers a comparable and simple metric for deriving a company’s value.

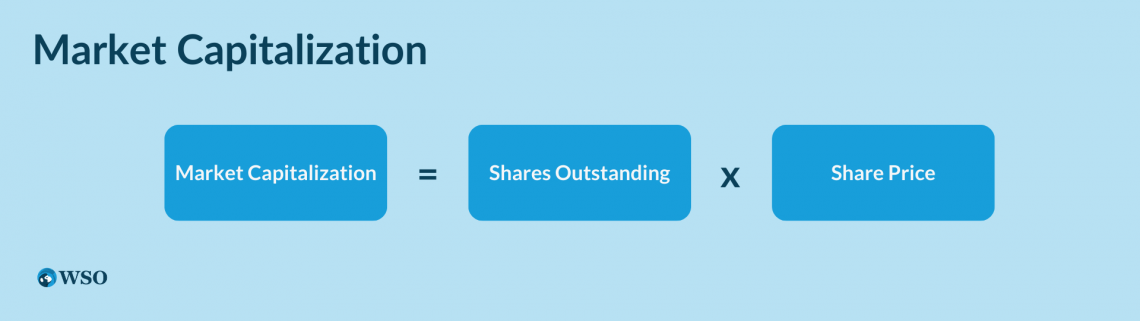

Market capitalization is found by multiplying shares outstanding by the current price of a company’s stock. While this is a great way to measure the value of a company’s equity, it does not take into account any claims on the business, such as those from creditors and preferred shareholders.

EV is essentially a more thorough and complete alternative to measuring value compared to market capitalization.

Within the mergers and acquisitions process, EVs can be used for finding a precise target price for buying another company. Companies can vary widely in their capital structure based upon which particular industry they operate in. Some industries require a business to have a large amount of debt, while others may not require much debt at all.

Here, EV allows comparability across companies because it factors in debt to the valuation.

It is important for a potential buyer of a company to be aware of a company’s capital structure in the acquisition process. The buyer will be required to make payments on the debt that is acquired. In some M&A transactions, the buyer may decide to pay off the existing debt altogether.

With market capitalization, the degree to which a company is leveraged with debt would go unnoticed, but with enterprise value debt can be factored into a company’s value allowing for a more accurate price to be derived.

Key Takeaways

- Enterprise Value (EV) is a comprehensive measure of a company's total market value, including equity, debt, minority interest, and preferred stock, minus cash and cash equivalents.

- EV is preferred for portfolio analysis, mergers and acquisitions, risk analysis, and business valuation, providing a more accurate assessment of a company's true value.

- It considers a company's capital structure, including debt, for better comparison between companies with different financial obligations.

- EV is commonly used with valuation multiples like EV/EBITDA, EV/EBIT, and EV/Revenue, providing insights into a company's financial health and performance.

- However, EV has limitations, such as excluding off-balance sheet debt and being less suitable for early-stage growth companies.

Understanding Enterprise Value (EV)

Enterprise Value (also known as EV) is a metric that attempts to reflect the market value of a firm. It can be used as an alternative to market capitalization. Essentially, Enterprise Value attempts to provide a more accurate valuation aimed at a buyer.

Whilst a firm’s market capitalization will indicate share price x share quantity, the firm may have a lot of debt which the acquirer would need to pay off (thereby adding the price of the transaction). The calculation for Enterprise Value is:

Market Capitalization + Debt + Minority Interest + Preferred Shares – Cash & Cash Equivalents

Enterprise Value is a far better metric when considering mergers and acquisitions as it provides a ‘truer’ valuation of a company by considering more factors than market capitalization, the main one being debt.

An important reason for using the EV in most valuation calculations is the fact that EBITDA is the most commonly used value driver. Since EBITDA includes earnings available to both debtors and equity holders, it is used often with EV as part of multiple analyses, hence its popularity.

Please check out the following video from our valuation course that goes into more detail on Enterprise and Equity Value.

Formula for Enterprise Value (EV)

The formula for calculating enterprise value is:

EV = Market Capitalization + Debt + Minority Interest + Preferred Shares - Cash & Cash Equivalents

A) Market Cap

- Short for market capitalization. This metric is calculated by multiplying shares outstanding by the current share price.

- This number can fluctuate as share prices go up or down and as the number of shares outstanding changes based upon various corporate actions such as new issues via secondary offerings, share buybacks, and employees of a company exercising their stock options.

B) Debt

- Money lent to a company by a lender that requires interest payments to be made. Within the EV formula, debt is calculated by adding short term debt and long-term debt together.

- The more debt a company holds, the higher the EV will be. Likewise, the less debt a company holds, the lower the EV will be.

- If an analyst is unable to identify the market value of a company’s debt, they can use the book value of a company’s debt as an alternative.

C) Minority Interest

- Represents a non-controlling interest in another company. For ownership to classify as a minority interest, the ownership must be less than 50% of the total available ownership of a company.

- Minority interest within the EV formula accounts for the value of the small shareholders who have no control over the company.

- By including this measure within the EV calculation, we are able to come to a more accurate conclusion on the true value of a firm.

D) Preferred Shares

- Equities come with special benefits such as dividend payments and a higher rank in the liquidation process if a company is being dissolved.

- These types of shares offer both the benefits that you would get from holding common stock (through a share in dividends) and from holding a fixed-income security (higher rank than equity).

E) Cash and Cash Equivalents

- It includes short-term financial instruments on top of already available cash.

- These short-term financial instruments are highly liquid money market instruments that can be easily and quickly converted into cash.

- Cash Equivalents include marketable securities, commercial paper, certificates of deposits, repo agreements, and treasury bills.

Why is Enterprise Value Used?

Using enterprise value to measure the value of a company allows an investor to make an apples-to-apples comparison between two companies with different capital structures.

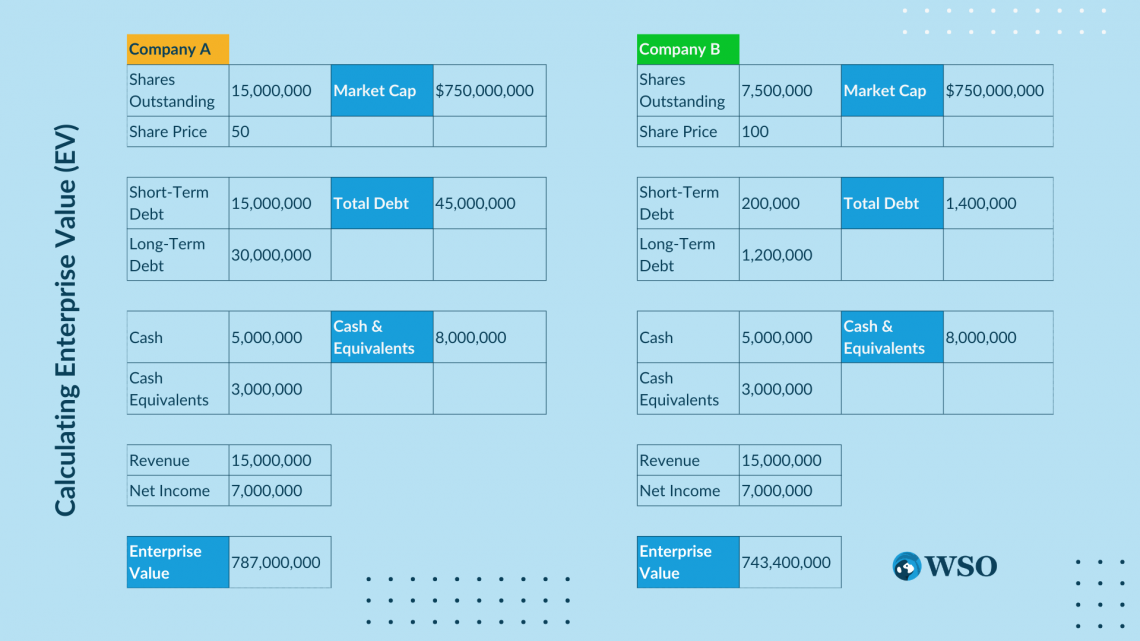

Let's say there are two companies A and B with similar revenue and net income but Company A has significantly more debt than Company B.

Using net income and market cap leads us to believe that Company A has a higher value than Company B (the result of employing financial leverage).

However, by using EV and EBITDA instead of market capitalization and net profit, you can see that Company A is not really better off than Company B because it has more debt while producing the same amount of revenue and net income.

In the above example, Company A and Company B both have the same revenue and the same net income. They both have the same market capitalization as well.

- Company A has $15 million in short term debt and $30 million in long-term debt resulting in $45 million in total debt.

- Company B has $200 thousand in short term debt and $1.2 million in long-term debt resulting in 1.4 million in total debt.

This difference in capital structure leads Company A to be 43.6 million dollars more expensive than Company B despite the fact that both companies have the same market cap with the same revenue and net income.

Just because Company A is equally profitable to Company B while employing more debt doesn't necessarily make Company A an undesirable target for acquisition.

Considering the fact that Company A has $45 million in total debt while producing the same net income as Company B can indicate that the management of Company A is not using its capital as efficiently as it could be.

If an acquirer were to implement new procedures and policies to alter this dynamic, Company A could theoretically become far more profitable via efficient and effective use of its available capital.

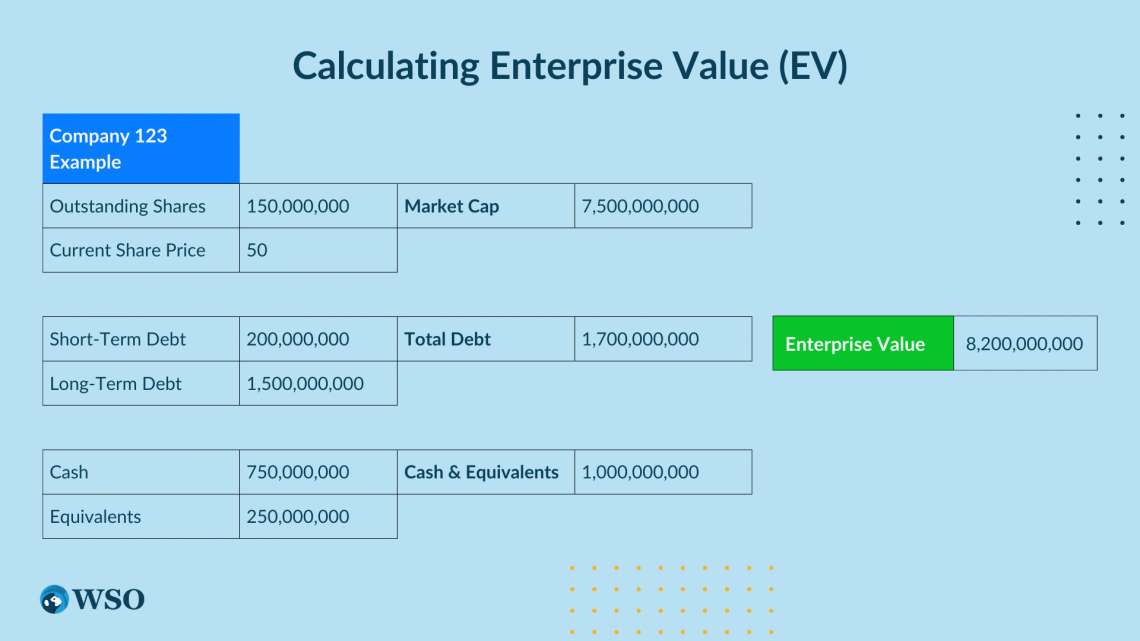

Let's take a look at another example that will highlight why using EV is important. Company 123 has 150 million outstanding shares at a share price of $50. This results in Company 123 having a market capitalization of $7.5 billion.

Meanwhile, by using EV to find Company 123’s true value, we find that it should be valued at 8.2 billion.

The present value of Company 123’s short-term debt is $200 million, and its long-term debt is $1.5 billion resulting in total debt of $1.7 billion. The company has $750 million in cash and $250 million in cash equivalents, which equals $1 billion in cash and cash equivalents (CCE).

The reason for subtracting CCE is the idea that CCE can be used to pay off debt instantly, which reduces the amount of debt by an equivalent amount.

We add short term and long-term debt, and then we subtract CCE. Had we used market capitalization to find Company 123’s value, we would have excluded short-term debt, long-term debt, and CCE from our evaluation.

This inclusion of additional key financial items in the valuation process is what makes EV such a significant and popular metric. While market capitalization accounts for the equity value of a company, EV accounts for both the equity value and the capital structure of a company.

EV Valuation Multiples

One of the most common uses of enterprise value is to use it within a valuation multiple.

The most popular multiple is EV / EBITDA and involves dividing the company's EV by it's EBITDA (earnings before interest, tax, depreciation and amortization). This valuation multiple allows you to compare across multiple different companies.

Other common EV multiples include EV/EBIT, EV/Revenue, and EV/EBITDAR.

A) EV/EBITDA

- This valuation multiple is calculated as EV divided by EBITDA. It is the most common and widely used valuation multiple that involves EV.

- This metric allows investors to compare and contrast returns from comparable companies.

- Using EBITDA as a metric for analysis offers investors the opportunity to perceive earnings unaffected by debt costs and depreciation and amortization expenses.

B) EV/EBIT

- Calculated as enterprise value divided by earnings before interest and taxes.

- EBIT is similar to EBITDA with the exception of including depreciation and amortization.

- This ratio can be great for analyzing whether an equity is overvalued or undervalued.

C) EV/Revenue

- This valuation multiple is calculated as EV divided by revenue.

- It can increase difficulty in comparing across companies because different businesses have different revenue recognition philosophies which can lead to overblown or underperforming sales numbers.

- EV/Revenue is a fantastic valuation multiple for companies that are in their early stages. Early-stage growth companies are often unprofitable or breaking even. Because of this dynamic, EV/EBITDA cannot be used because there are no earnings to account for.

D) EV/EBITDAR

- This valuation multiple includes EBITDAR, which stands for earnings before interest, taxes, depreciation and amortization, and rental costs/restructuring costs. This multiple is calculated by taking EV and dividing it by EBITDAR.

- This is a great multiple to use for comparing companies within the hospitality, transportation, or restaurant industries. Companies within these industries often have high rental costs, which need to be accounted for.

- EBITDAR can also be a great multiple for comparing companies that have recently incurred a large number of restructuring costs.

Why is cash deducted from Enterprise Value?

One thing you might wonder about enterprise value is why cash gets deducted. The idea behind this concept is that if a company has enough assets or liquid assets, they can pay back their debts with them instead of having to take out another loan - which would make the EV bigger than it actually is.

By deducting cash, what's left over will be the total value of the company plus any liquid assets that are available. That way, you're getting a better picture of what the company would be worth if it used its liquid assets to pay off its debts.

Another reason for deducting cash is that companies don't look more valuable than they really are just because they have lots of liquid assets on hand. If we were not to deduct cash, then two companies with comparable capital Structures, revenue, and net income may have entirely different values if one company has chosen to keep a large amount of cash available.

One exception to this rule is when a company has negative cash flow. If a company has negative cash flow, then instead of subtracting cash, any cash on hand should be added to the EV because it is an asset.

In addition, if a company has negative earnings, it may be more useful to use discounted cash flow analysis to value a company because it will allow you to measure the value of expected future cash flows.

Meanwhile, if a company were to have too much cash on hand, this would result in a negative EV. This scenario arises when a company has more than enough cash to purchase all of its outstanding shares and pay off all of its debt.

Limitations of Enterprise Value

While EV can be a fantastic metric for determining a company’s value and potential target acquisition price, it can as well come with some limitations.

Below are a few of the potential issues that can arise when using it.

1) It only takes into account the assets and liabilities that are on the balance sheet. If a company has off-balance sheet debt, then those items will not be included in the EV formula.

Common items that are left off of the balance sheet include pension obligations and leases. Within the acquisition process, it is important to review a company’s 10k to look for various off-balance sheet items that have an effect on a company’s value.

2) It does not take into account changes in interest rates or credit ratings. This can be problematic if there's been an adverse change in either of those factors because it could significantly affect the company's outlook and might even lead to bankruptcy.

3) It may not be the best valuation metric when analyzing startups and early-stage growth companies. Oftentimes the value of these types of companies derives from the expected value of the company’s potential future cash flows.

When analyzing a company that is still in the early stages of growth, a discounted cash flow model may be better for deriving company value.

4) It can vary drastically across different industries. Some industries require businesses to maintain capital structures that incorporate a large amount of debt. This usually includes industries that revolve around gasoline and oil.

In addition, any business that requires consistently large capital expenditures towards property, plant, and equipment will likely require a company to undertake a large amount of debt.

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?