Capital Structure

The mix of various forms of external funds, known as capital, used to finance a business

What is a Capital Structure?

Capital Structure (CS) refers to a company's proportion of debt and equity used by it to finance its operations.

It is necessary for a business to determine the composition of its financial structure. It entails deciding how much money to raise from each source of funding. In short, it helps the company decide on the kinds of securities to be issued and their relative proportion in the capital.

There are two sources of business finance:

- Owners’ funds or Equity.

- Borrowed funds or Debt.

Equity refers to the amount of capital owned by the owners, i.e., the company's shareholders. It consists of:

- Equity Share Capital

- Preference Share Capital

- Retained Earnings or Reserves

- Surplus

Debt refers to the amount of money owed by the business to outsiders, i.e., people other than the owners of the company. It is in the form of loans, debentures, public deposits, etc., and can be borrowed from:

- Banks

- Other Financial Institutions

- Debenture Holders

- Public

Both debt and equity can be found on the company’s balance sheet. The company’s assets also found on the balance sheet, are financed by both these sources. Financial structure is the mix between borrowed funds (debt) and owners’ funds (equity).

The company's short-term and long-term debt are considered in deciding the combination. The ratio of debt and equity in the financial structure is measured by the debt-to-equity or debt-to-capital ratio. It shows the extent to which debt is covered by equity and indicates the riskiness of a lender.

The greater the debt, the riskier the business is. Since lenders earn on assured return and repayment of capital, their risk is lower than that of equity shareholders, and thus, they require a lower rate of return as compared to the latter.

Further, interest paid on debt is a deductible expense for computation of tax liability, whereas dividends on equity are paid out of after-tax profits. Therefore, increased use of debt lowers the overall cost of capital if the cost of equity remains unaffected.

But, debt is riskier as compared to equity because interest payment and return of principal amount are obligatory. Any default in making these commitments may force the business to go into liquidation. On the other hand, equity is considered riskless as there is no such compulsion.

So, increased use of debt increases the financial risk of a business. Thus, the capital structure of a business affects both profitability and financial risk.

Key Takeaways

- Capital structure involves the mix of debt and equity a company uses to fund its operations. Debt is borrowed, while equity comes from owners.

- The choice of capital structure affects a company's risk and cost of capital. More debt means higher risk but lower cost due to interest tax deductions.

- Various factors impact capital structure decisions, including cash flow, industry norms, interest coverage ratio, tax rates, cost of debt, and more.

- The goal is to find an optimal mix that minimizes the Weighted Average Cost of Capital (WACC), considering risk and return.

- Capital structure changes in M&A and leveraged buyouts impact financial risk, cost, and ownership, influencing financial performance and decisions.

Factors Affecting the Choice of Capital Structure

Deciding about the financial structure of a firm involves determining the relative proportion of various types of funds, which depends on various factors like:

1. Cash Flow Position

While deciding on the financial structure, the future cash flow position should be considered. Cash flows must not only cover fixed cash payment obligations but there should be a sufficient surplus too.

A firm must have enough cash to meet normal business operations, for investment in fixed assets, and for meeting debt service commitments, i.e., payment of interest and repayment of capital.

If a company has a strong cash flow position, then it may opt for debt. In the event of a weak cash flow position, equity is recommended.

4. Capital Structure of Other Companies

The pattern of CS and the debt-equity ratio of other companies in the same industry acts as the guiding principle when making a decision. However, the industry norms should be molded as per the requirements of the company under consideration.

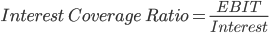

5. Interest Coverage Ratio (ICR)

It refers to the number of times earnings before interest and taxes (EBIT) cover the interest obligation. It is calculated as:

It indicates how many times EBIT covers or can repay interest obligations. A higher ratio implies that a company can have more debt as the risk of meeting the interest payment obligation is less. In case of a lower ratio, the company should use less debt.

However, this ratio is not a suitable measure as it does not consider the cash's ability to meet the repayment obligations. A firm may have a higher EBIT but a low cash balance.

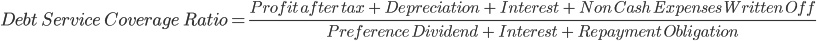

6. Debt Service Coverage Ratio (DSCR)

This ratio takes care of the drawback of ICR. The cash profits generated by the operations are compared with the total cash required for the service of debt and preference share capital. It is calculated as:

A higher ratio indicates a better ability to fulfill obligations. So, the company can raise more debt. However, in the case of a lower ratio, equity should be preferred.

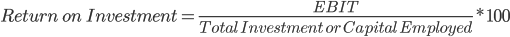

7. Return on Investment (ROI)

ROI helps determine the profits made on an investment over a period of time. It is an important element in deciding an optimal financial structure. It is calculated as:

If ROI is greater than the rate of interest on debt, then the company should prefer debt over equity. However, if ROI is less than the interest rate, then the company should use more equity. So, ROI assists in deciding the proportion of debt and equity to increase EPS.

8. Cost of Debt

The cost of debt is directly related to the proportion of debt to be used in the financial structure. Debt is preferred when the cost of debt is less, i.e., the interest rate on debt is less. However, in the case of a higher cost of debt, equity is preferred.

9. Tax Rate

Interest is a tax-deductible expense and helps reduce the company's taxable income, whereas dividends are paid out of earnings available after tax.

So, debt is preferred in case of a higher tax rate. However, if the tax rate is lower, then equity is preferred.

10. Cost of Equity

The rate of return from equity expected by shareholders is affected by the use of debt. If the debt increases in the financial structure, it raises the financial risk faced by shareholders, which in turn increases the desired rate of return.

So, debt should be used only to a limited level. Any use beyond that level also increases the cost of equity, and the share price may decrease despite increased EPS.

11. Floatation Costs

It refers to the cost involved in the issue of securities, like:

- Underwriting Commission

- Brokerage

- Stamp Duty

- Listing Charges, etc.

The cost of raising finance from various sources should be estimated before making a decision, and the one with the minimum floatation costs should be preferred. The floatation cost of raising a loan is generally less compared to shares and debentures.

12. Risk Consideration

Every business faces two kinds of risks:

- Business or Operating Risk, i.e., the risk of inability to meet fixed operating costs like rent, salary, insurance premium, etc.

- Financial Risk, i.e., risk of inability to meet fixed financial charges like interest payment, preference dividend, and repayment obligations.

The total risk is a combination of both of these risks.

If a firm’s operating risk is lower, then the company can take financial risk, i.e., more debt capital can be used. However, in the case of higher business risk, financial risk should be reduced by using less debt.

13. Stock Market Considerations

The financial structure should be designed according to market conditions. During the boom or bullish phase, people are ready to take risks and invest in equity shares, even at a higher price. However, during the bearish phase, investors prefer debt, which carries a fixed rate of return.

14. Regulatory Framework

The regulatory framework has to be followed while deciding about the financial structure. The issue of shares and debentures has to be done as per the guidelines issued by the regulatory body. Loans from banks and other financial institutions also require the fulfillment of various norms.

Those sources of finance are preferred, which have easy and less legal and regulatory requirements.

15. Flexibility

If a firm uses excess debt, it restricts the firm’s potential to raise further debt. Therefore, firms must maintain some borrowing power for unforeseen circumstances to maintain flexibility.

16. Control

The issue of debt does not dilute the control of equity shareholders. So, if the existing shareholders want to retain effective control, then more debt should be used.

On the other hand, a public issue of equity will reduce the control of existing shareholders. It may also increase the chances of a takeover, especially when the current holding of equity shareholders is on the lower side.

Optimal Capital Structure

The optimal structure of a company is the combination of debt and equity that results in the lowest Weighted Average Cost of Capital (WACC) for the company.

The goal is to minimize the cost and maximize the value of the firm. Debt has much less risk if the business deals in essentials rather than if it is a hotel in a tourist town.

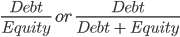

Financial leverage refers to the proportion of debt in the overall capital. It is calculated as follows:

As the financial leverage increases, the cost of funds declines because of the increased use of cheaper debt, but the financial risk also increases. Companies that use more debt than equity have a high leverage ratio and an aggressive CS.

A company with more equity than debt has a low leverage ratio and a conservative CS. Financial leverage, or trading on equity, raises the return or earning per share of equity shareholders by making use of debt in the financial structure of the company.

Cost of Capital

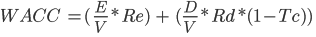

The total cost of capital from all sources, i.e., both debt and equity, is known as the Weighted Average Cost of Capital (WACC).

It is that rate at which the security holders give their money in order to finance the company’s assets.

Where:

- E = Market Value of the Firm’s Equity (Market Capitalization)

- D = Market Value of the Firm’s Debt

- V = Total Value of Capital (Equity+Debt)

- E/V = Percentage of Capital that is Equity

- D/V = Percentage of Capital that is Debt

- Re = Cost of Equity (Required rate of return)

- Rd = Cost of Debt (Yield to maturity on existing debt)

- Tc = Corporate Tax Rate

It is computed by multiplying the cost of debt and equity by their respective relevant weights and then adding the products together.

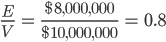

For example, a company borrowed $2,000,000 and obtained $8,000,000 as equity. Then,

Capital Structure by Industry

It differs from industry to industry.

It is advised to the cyclical industries, like mining, not to go into debt as their cash flow is unpredictable, and there is a lot of uncertainty about their ability to repay it.

On the other side, industries like banking and insurance take the benefit of trading on equity, and their CS contains a massive amount of debt.

Small businesses and private companies have a hard time acquiring debt as the owners need to give a personal guarantee.

How to Recapitalize a Business?

There are mainly three methods by which a firm can change the combination of debt and equity.

The first method is to issue debt and repurchase equity. In this strategy, the company increases debt by borrowing money and then uses the capital to repurchase equity shares, which leads to a decrease in equity on the balance sheet.

The second technique is to issue debt and pay a considerable amount of dividends to equity investors.

In this method, the firm raises debt and then uses that money to pay a one-time special dividend to its common shareholders. This results in the reduction of equity by the value of the dividend and increases debt on the balance sheet.

The third tactic is to issue equity and repay debt. In this approach, the firm increases equity by selling new shares and then uses that amount to repay its debt.

This approach is not preferred since equity is costlier than debt and is only done when a firm is overleveraged and needs to reduce its borrowings.

Tradeoffs Between Debt and Equity

Many trade-offs need to be considered when determining capital structure.

Pros and Cons of Equity

- No fixed interest payment has to be given in the case of equity. Dividends are only distributed when the firm makes profits and the managers want to do so.

- Since the payment of dividends is discretionary, there are no mandatory fixed payments.

- There are no maturity dates when the principal has to be repaid. It is only paid at the winding up of the company after paying all other obligations.

- Equity shareholders have ownership and control over the business. The issue of more shares thus dilutes the control.

- They typically have voting rights.

- The implied cost of capital is usually high.

- Since these shares carry a huge amount of risk, investors expect a high rate of return, too, through dividends and capital appreciation.

- As discussed above, equity shareholders are paid at the end in the event of liquidation.

- Creditors can impose some restrictions on the business's operations regarding the payment of dividends or other operations of the business and thus reduce its operational flexibility.

No such conditions are there in the case of equity.

Pros and Cons of Debt

- Debt typically carries a compulsory fixed payment called interest.

- It also has a fixed repayment schedule.

- In the event of winding up the business, the lenders are the ones who are paid first.

- As discussed before, debt can reduce the operational flexibility of a firm.

- The cost of raising debt is much less than the cost of raising equity.

- Since they carry low risk, they also expect a low rate of return.

Capital Structure in Mergers and Acquisitions

Mergers and Acquisitions (M&A) is a general term that describes all types of financial transactions related to the transfer or consolidation of ownership and assets of a company.

Mergers and Acquisitions have a significant impact on the proportion of debt and equity of the merged companies. The financial structure of the new entity depends on many factors, like the method of financing the transaction.

For instance, if A Ltd. acquired B Ltd. and provided cash as consideration, which is financed by raising debt, it will result in an increase in debt on the resultant firm’s balance sheet.

However, if the transaction has been carried out with shares of the acquiring firm as consideration, it will lead to an increase in the value of equity capital on the new firm’s balance sheet. The M&A financial modeling is concerned with determining the capital structure of the combined entity.

Leveraged Buyouts

In leveraged buyouts, acquisitions are made through the use of heavy debt financing. Assets from both the acquiring and acquired companies are used as collateral. This allows firms to carry out large acquisitions without having to commit a lot of capital, as the target firm's assets can be used against it as collateral by the acquirer.

This tactic is commonly used by private equity firms who want to invest very little equity and finance the transaction with debt. So, the acquiring firm takes the benefit of trading on equity or financial leverage, which increases Earnings Per Share (EPS).

This impact can be known through the analysis of Earnings Before Interest and Taxes (EBIT) and Earnings Per Share (EPS) (also known as EBIT-EPS analysis).

Though an analysis of Return on Investment (ROI) and cost of debt should be done before raising debt, as EPS increases only when ROI is more than the cost of debt.

Capital Structure FAQs

It refers to the proportion of debt and equity used for financing business operations.

Different companies operate in different business environments, which causes differences in their financial structure.

The type and industry in which the business operates also affect its CS.

The combination of debt and equity that results in the lowest Weighted Average Cost of Capital (WACC) for the firm is chosen by the managers as the optimal CS.

No fixed ratio is said to be optimal as it varies from company to company.

The use of a large amount of debt can be seen as risky.

However, using a lot of debt can be seen as the company's underutilization of growth opportunities. It also leads to a huge amount of cost of capital as equity is costlier than debt.

Various factors like the Weighted Average Cost of Capital (WACC), cash flow position, interest coverage ratio, debt service coverage ratio, etc., are used to arrive at the optimal CS.

Knowing the sources of a company’s financial structure is important because each source has different effects on the cost of capital, which consequently affects enterprise value.

The financial structure also depicts the risks of investing or acquiring the company.

Researched and authored by Harveen Kaur Ahluwalia | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?