Cost of Capital

Refers to the minimum return a company expects to generate

Cost of Capital, in simple terms, refers to the minimum return a company expects to generate, which would make a capital budgeting project (for example, a big investment in an outside venture) worth undertaking.

This rate tends to justify the costs of taking up a new project. At times, investors refer back to this rate in order to measure the return from an investment in relation to the costs and risks associated with it.

As most companies around the globe are funded by a mixture of debt and equity funds, the rate used by companies is calculated by taking into account the weightage of both classes of funds in the total investment and is thus known as the weighted average cost of Capital.

Since a company always desires its projects to be prosperous, the new projects should aim to generate a return greater than the capital cost; otherwise, the new investment will not be profitable to the investors.

Calculation of Cost of Capital

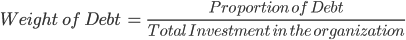

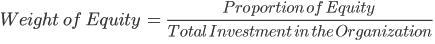

The calculation of the required rate begins with the idea of calculating the cost of debt, the cost of equity, the proportion of debt and equity in the organization, and the weighted average combination of debt and equity.

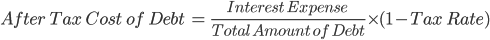

The cost of debt basically refers to the interest rate the lender charges on the borrowed funds. But since the interest expense is tax-deductible, the WACC takes into account the after-tax cost of debt.

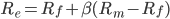

The cost of equity seems to be more complex to determine as it refers to the return demanded by the investors in the organization and is calculated by the capital asset pricing model (CAPM).

where,

Re = Return on Equity

Rf = Risk-Free Rate

Rm= Market Rate of Return

ß= Risk of equity in relation to the market risk

Therefore, the Weighted Average Cost of Capital:

= (Weight of equity x Return on Equity) + (Weight of debt x After-tax Cost of Debt)

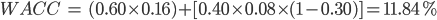

Consider an example of a firm with a capital structure of 60% equity and 40% debt, with a return on equity being 16% and the before-tax cost of debt being 8%. Assuming the company tax rate is 30%, the WACC will be calculated as follows:

Factors Affecting Cost of Capital

There are several factors that affect the capital cost of an organization, and they are listed below:

1. Capital Structure

Capital structure refers to the specific mix of debt and equity used to finance an organization’s assets and operations.

As interest payable on debt is a tax-deductible expense, at times, it makes it more favorable for firms to infuse more debt into the organization rather than issuing new shares.

However, additional debt in the organization increases the Risk of default of the organization as well, and thus in some cases raising funds from equity sources will be a more favorable option for the firm.

Thus, changes in capital structure can affect the capital cost of the organization.

2. Interest Rate

In periods of lower interest rates, it is a more sensible move for an organization to raise funds from debt sources. Increasing funding from debt will therefore cause a change in the capital structure and thus affect the weighted average capital cost of the organization.

3. Dividend Distribution Policy

The distribution of dividends affects the capital structure of the organization.

In case a firm decides not to distribute dividends in a particular financial year, the funds will be retained back into the organization, which will therefore increase the value of equity of the organization, thereby increasing the weighted average rate.

Whereas if a firm distributes dividends, the proportion of equity reduces, thereby reducing the rate.

Importance

The main idea behind every business is to provide the maximum return to its shareholders and continuously expand and grow.

Opportunities such as opening a new factory and purchasing new machinery are examples of growth and expansion for an organization, and the firm for this needs to calculate the capital cost beforehand to determine the profitability of the investment.

This calculation will help to determine the time period the investment will take to cover costs and thereby determine how much the firm will earn in the future. Secondly, it is used to design a balanced and optimal capital structure for the organization.

Moreover, the rate can be used by the firm to evaluate its financial performance, which can be done by comparing the rate of profitability and the rate of capital cost.

Furthermore, the rate can be used to aid in financing decisions such as dividend policy, capitalization of profits, and selection of sources of funds to meet working capital needs.

Relationship between Internal Rate of Return (IRR), Cost of Capital, and Net Present Value (NPV)

Net present value refers to the difference between the present values of cash inflows and the present value of cash outflow over a given period of time. This metric of finance is used to make capital budgeting decisions and to calculate the profitability of a given investment opportunity.

A positive net present value signifies a profitable investment, whereas a negative net present value indicates a loss-making investment opportunity. Moreover, NPV takes into account the time value of money and can be used to compare similar investment opportunities.

The discount rate of the project that the NPV relies on may be derived from the cost of capital.

Internal Rate of Return (IRR) refers to a valuation metric (signified by a percentage) at which the net present value of a given project is 0.

It is basically used to determine the profitability of a given investment and is used as a discount rate to discount back cash flows of a particular project whose NPV is 0.

Better financial performance is expected out of a project if it has a higher IRR, thus leading to higher returns for the organization. Moreover, the internal rate of return allows the senior management to compare and rank projects based on their yield.

The internal rate of return is excessively used by private equity and venture capital firms before making an investment, as such investments involve multiple cash outflows over the course of the business and cash inflow at the end of the business through IP or sale of the business.

The rate is the minimum desired return on investment. An investment decision can be based on the following criteria:

-

If NPV is greater than 0, the present value of cash inflows is greater than the present value of cash outflows. This implies that the internal rate of return is greater than the rate, and the project will be a favorable investment opportunity for the organization.

-

If NPV is less than 0, the present value of cash inflows is lower than the present value of cash outflows. This implies that the internal rate of return is lower than the cost of capital, and the project will be an unfavorable investment opportunity for the organization.

-

If NPV is equal to 0, the present value of cash inflows is equal to the present value of cash outflows. This implies that the internal rate of return is the same as the cost of capital, and the project will yield no return to the organization as the firm will just be able to cover its costs and not earn any profit from it.

Relationship between the cost of capital and risk

It is a function of the market's risk-free rate plus a premium for the risk associated with the investment. To increase the overall profitability of the firm, a company will only invest in projects whose desired return is higher than the WACC.

Debt financing, on the one hand, is based on the idea of raising funds by borrowing from different sources, such as acquiring loans or credit card financing; equity financing revolves around the idea of selling shares of common or preferred stock.

It is also affected by market risk as market risk tends to affect the composition of the cost of equity. An increase in market return or beta of the stock will increase the cost of equity, thereby increasing the WACC.

Different forms of risk that tend to impact the capital cost of an organization can be listed as follows:

1. Credit Risk

Credit Risk refers to the possibility of a loss arising from the inability of the borrower to pay back the borrowed amount. In simple terms, it is the risk that implies that the lender will not be able to recover the interest and principal amount.

Credit risk and capital cost have a direct positive relationship. This means that an increase in the credit risk in the economy will lead to an increase in the capital cost of the organization.

2. Market Risk

Market risk refers to the type of risk that implies that the investor will suffer a loss on an investment due to the impact of different market factors.

An increase in the overall market risk leads to an increase in the overall capital cost of the organization implying that there is a direct positive relationship between the two variables.

Other important variables such as Beta, Market Risk Premium, and Risk-free rate also tend to significantly affect the capital cost of an organization.

A higher beta, risk-free rate, and market risk premium indicate an increase in the return on equity, which will, thereby, lead to an increase in the overall capital cost of the organization and vice versa.

Mistakes committed while analyzing the cost of capital

According to Joe Knight, author of HBR Tools: Return on investment, a common mistake that managers make while analyzing the cost of capital is that they consider the number at its face value as some managers claim that the value is too high and it restricts them from taking more investment opportunities.

However, Knight believes that the rate is not something the managers should simply accept; rather should be challenged to take up visionary opportunities. Moreover, managers, at times, tend to pad up the value of the cost of capital.

For example, if the rate calculated is 12%, managers tend to overestimate the value to 15% however should realize that the value already includes that cushion, and the additional 3% will just lead to overestimation.

Key Takeaways

-

The rate is used by the firms to discount back earnings of future projects or investments to decide on whether the investment will be profitable or not.

-

Capital cost is useful for several organizations to determine the time it will be taken to repay the costs associated with the projects and the percentage of return generated by the investments.

-

The rate is useful in determining the optimum capital structure of an organization which plays a crucial role in determining where to procure funds from, at what rate, and at the minimum cost.

-

However, firms should solely not rely on the capital cost to make decisions in the organization as the results can not be accurate and lead to fluctuations in expected return.

or Want to Sign up with your social account?