Enterprise Value vs Equity Value

The former represents the company's value attributable to all investors, while the latter represents a portion available to shareholders.

What Is Enterprise Value Vs. Equity Value?

In mergers or acquisitions, a company's worth is often assessed using two primary metrics: enterprise value and equity value, also known as net asset value. Both may be employed in a company's assessment or sale, but each presents a somewhat different perspective.

Enterprise value represents the company's value attributable to all stakeholders. Also known as Firm Value, it comprises more than just the dominant Net Asset Value.

It is the total value of a company in monetary terms. It results in a calculation of shareholders and the debt holders, attributing all investors (debt, Equity, preference, etc.).

On the other hand, equity value represents the value of a company's common shares.

It is the number the public sees. It comprises the value of total shares in the business (attributing equity investors) and gives a precise estimation of current and latent future value.

The Valuation of a business using unlevered free cash flow (UFCF) in a DCF model would be commensurate with the calculation of Enterprise Value. It helps compare firms with divergent capital structures and reveals how much a business is worth.

Key Takeaways

-

Enterprise Value (EV) represents the total value of a company in monetary terms, including all investors (debt, equity, preference, etc.), while Equity Value represents the value attributed solely to equity investors.

-

EV is used to compare firms with different capital structures and is a crucial metric for mergers and acquisitions, as it accounts for debt and cash in addition to market capitalization.

-

Equity Value is calculated by multiplying the price per share by the number of fully diluted shares outstanding or as EV minus total debt and cash. It provides a more accurate measure of a company's worth for equity investors.

-

Understanding the concepts of debt, preferred shares, minority interest, and cash and cash equivalents is essential for comprehending the difference between EV and Equity Value and their significance in company valuation.

Understanding Enterprise Value (EV)

Enterprise Value, also known as Firm Value, is a crucial metric used to evaluate a company's performance. It is useful in comparing firms with different capital structures, which do not influence the firm's value. Enterprise value represents the true value of the company defined in terms of financing.

It shows the amount needed to acquire another company. Another perception is that if a company's total cash and cash equivalent value exceeds the combined total of its market capitalization and debts, the EV would appear negative.

A negative EV implies that a company is not using too much cash. The extra cash can be used for many things that could profit the company, such as:

- Expanding the business

- Eliminating debts

- Establishing cash reserves

Since EV ignores the capital structure of the company, EBITDA

(EBITDA= Net Income + Interest + Taxes Paid + Depreciation & Amortization)

It happens to be its best value driver, as it removes the effects of differences in capital structure since the capital structure doesn't affect the firm's value.

A common multiple used in relative value comparisons is EV/EBITDA. Other common EV multiples include EV/EBIT, EV/Revenue, and EV/EBITDAR.

Similar to this, there is P/E ( Price-to-earnings), also known as Price or earnings multiple. This multiple indicates the company's growth potential on the current market price basis. But this metric is only useful when the companies are in the same industry or field.

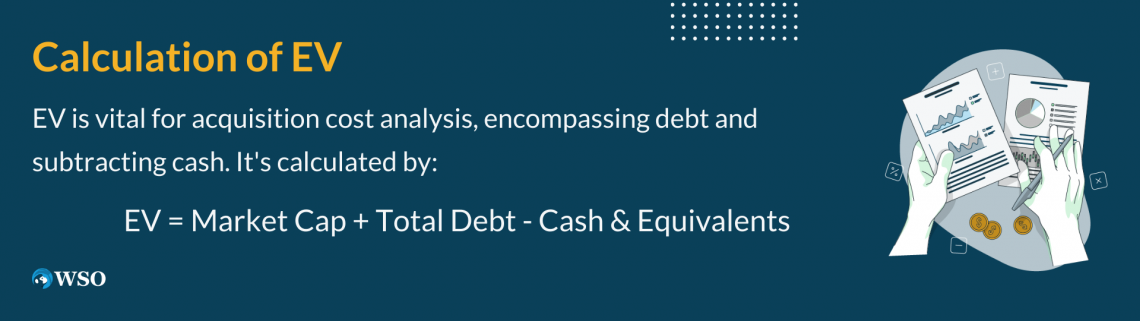

Calculation of Enterprise Value

Businesses use EV to measure the cost of acquiring an establishment or business because it accounts for more than its outstanding shares by adding debt and subtracting cash from the cost. Here's how EV is calculated:

EV measures a firm's entire market value. It is calculated by considering the company's Market Capitalization, adding debt, minority interests, and preferred stock, and then subtracting cash and cash equivalents.

EV = Market Capitalization + Debt + Minority Interest + Preferred Shares - Cash & Cash Equivalents

The formula above might seem hard to remember. So here's a simpler way:

EV = MC + TD - C

Where,

- MC = Market Capitalization; equal to current stock price multiplied by the number of outstanding stock shares

- TD = Total Debt; the sum of short and long-term debts/liabilities

- C = Cash & Cash Equivalents; a company's liquid assets

Simply put, Enterprise value (also known as Firm Value or Asset value) is the total value of assets of the business (excluding cash).

Various EV Valuation Multiples

Enterprise multiples may vary, subject to the type of industry. For example, one might expect high enterprise value in high-growth industries and vice versa.

A firm may have high levels of debt and preference share; such firms are deemed to be risky.

Investors use a company's multiple to figure out whether a company is undervalued or overvalued to make better resolutions.

In addition, an enterprise multiple is helpful in differentiation internationally as it disregards the misinterpreting effect of individual countries' taxation policies.

EV/EBITDA

This valuation multiple is calculated as EV divided by EBITDA. It is the most common and widely used valuation multiple that involves EVs.

This metric allows investors to compare and contrast returns from comparable companies.

Using EBITDA as a metric for analysis offers investors the opportunity to perceive earnings unaffected by debt costs, depreciation, and amortization expenses.

EV/EBIT

It is calculated as enterprise value divided by earnings before interest and taxes.

EBIT is similar to EBITDA except that it excludes depreciation and amortization. This ratio can be useful for analyzing whether Equity is overvalued or undervalued.

EV/Revenue

This valuation multiple is calculated as EV divided by revenue.

As it ignores profitability and the generation of cash flow, the results may be difficult to interpret.

It can increase difficulty in comparing across companies because different businesses have different revenue recognition philosophies, which can lead to overblown or underperforming sales numbers.

EV/Revenue is a fantastic valuation multiple for companies in their early stages. Early-stage growth companies are often unprofitable or breaking even. Because of this dynamic, EV/EBITDA cannot be used as there are no earnings to account for.

EV/EBITDAR

This valuation multiple includes EBITDAR, which stands for earnings before interest, taxes, depreciation, amortization, and rental costs/restructuring costs. This multiple is calculated by taking EV and dividing it by EBITDAR.

This is a great multiple for comparing companies within the hospitality, transportation, or restaurant industries. Companies within these industries often have high rental costs, which need to be accounted for.

EBITDAR can be a great multiple for comparing companies that have recently incurred many restructuring costs.

Significance of Enterprise Value

Enterprise Value (EV) is a crucial metric for effectively expressing the whole value of a company. It includes the worth of all of a company's assets that are associated with its main lines of business and serve investors of all stripes, including debt, preferred stock, equity, and any noncontrolling interests.

The principal implications are:

1. Estimation of Acquisition and Investment: EV provides an approximation of the possible costs associated with purchasing or investing in a business. It offers clarity on a target company's worth, assisting prospective buyers or investors in making well-informed decisions.

2. Risk Mitigation and Return Comparison: By using EVs, investors can compare projected returns and reduce risk. They can make logical decisions by weighing the possible rewards against the associated risks, taking into account a company's market capitalization, debt, and cash situation.

Note

A healthy EV/EBITDA multiple, typically below ten, indicates the total value of actual earnings, offering insights into a company's financial health.

3. Indication of firm Worth: EV gives stakeholders insightful information about a firm's total value, making it a useful indicator of that worth.

4. Valuation and Comparative Analysis: EV makes it easier to value organizations and compares enterprises with various capital structures. This enables investors to decide on their investments with knowledge after doing thorough analyses.

5. Understanding Company Size and Debt Utilisation: EV assists investors in determining a company's size and evaluating how well it has used its debt in its operations by considering both its assets and debt.

6. Economic Value Representation: EV is a comprehensive measure of a company's value that takes into account a range of financial factors.

Understanding Equity Value

Equity Value is the value of a company's shares and loans that the owners or shareholders have invested in the business. It is the total value of the company that is attributed to equity investors. It calculates the Enterprise value plus all Cash & Cash equivalents, short & long-term investments, and minority interests.

Crucial knowledge about Equity Value

- Equity Value estimation is a basic component of figuring out how much a company or its securities are worth. Investors and stock market participants use equity valuation to help them make wise judgments in the equity market.

- Strong business models enable companies to leverage their market position and command higher equity values, which is an indicator of their strength as a company. In contrast, a company's valuation may drop if its fundamentals are weaker, which would reflect the state of its underlying finances.

- It is essential for efficiently allocating limited capital resources within the economy. By precisely determining a company's worth, stakeholders can allocate investments strategically.

- It is the overall worth of all firm assets, with a focus on common shareholders and other equity investors. While vulnerable to swings in the volatile stock market, it provides insights into possible future growth and value prospects.

Calculation of Equity Value

The overall value of a company that may be attributed to its shareholders is known as equity value. There are several ways to perform equity valuation. The valuation models include DCF, asset-based approach, book value approach, and many more.

Before you start with the calculations, remember a few things. It is the most challenging part. Valuation should broadly account for these parameters as pre-defined standards for accurate results:

- Understand the macroeconomic factors and the industry

- Forecast the company's performance

- Consider the appropriate valuation method/model

- Arrive at the Valuation based on forecasting

- Initiate action based on the arrived valuation

Here's how Equity Value is calculated:

Equity value = Price per share x fully diluted shares outstanding

(Or)

Equity value = EV - (total debt + cash)

Equity value comes in two forms:

- Basic equity value

- Diluted equity value

The only difference is the number used for outstanding shares. Diluted shares outstanding are shares outstanding, including any diluted from options, convertible bonds, etc.

Net Asset Value can be calculated using either the intrinsic value method or the fair market value method. The fair market value method more accurately captures the value of out-of-the-money securities.

Enterprise Value Vs. Equity Value

Investors can better grasp the varied roles and implications of enterprise value and equity value in financial analysis and decision-making by referring to this table, which highlights these disparities.

| Aspect | Enterprise Value (EV) | Equity Value |

|---|---|---|

| Definition | Represents the total value of a company, including debt, cash equivalents, and other financial factors. | Signifies the value attributed to equity investors in a company, considering net asset value and ownership stakes. |

| Calculation | EV = Market Capitalization + Debt + Minority Interest + Preferred Shares - Cash & Cash Equivalents | Calculated as the company's market capitalization plus any debt minus its cash and cash equivalents. |

| Focus | Focuses on the overall financial health and valuation of the company. | Specifically addresses the value attributed to equity investors. |

| Usefulness | Useful for assessing a company's financial health and valuation, aiding in investment decisions and M&A transactions. | Helps investors understand the potential returns and risks associated with equity ownership in a company. |

| Influence of Debt | Takes into account a company's debt and cash positions, influencing its valuation. | Considers the company's net asset value and ownership stakes, which may be influenced by debt but not directly affected by it. |

| Perspective | Provides a comprehensive perspective on the company's value, suitable for strategic decision-making. | Offers insight into the value available to equity investors, guiding investment strategies. |

Example Of Enterprise And Equity Value

Understanding enterprise value (EV) and equity value is crucial if you're thinking about investing in a $5 million company.

Enterprise Value

EV includes a company's entire value, regardless of how much of it is made up of debt, liquid assets, or net asset value. It's essential for deciding whether to purchase or sell securities since it takes into consideration the company's risk profile by taking into account things like debt and excess cash in the organization.

Let's say you discover a company has a healthy EV, meaning it isn't overpriced or undervalued. If so, evaluating its net asset value will assist in deciding whether or not to make the investment worthwhile. When a business pays off debt, its net asset value rises over time and boosts its equity.

Equity Value

The value that equity investors are assigned to a corporation is known as equity value. It considers the ownership shares and net asset value of the business, regardless of variations in the debt and equity proportions. A company's net asset worth rises over time as it settles its debts, demonstrating positive equity or ownership value.

Considerations

When an investor buys a company, he/she needs to pay not only the common shares but the individual/person has to pay the shareholders of preferred stock. He also assumes the company's debt and receives the cash on the company's balance sheet. As the responsibility of the company lies on working capital.

After acquiring a company, the investor can pay less than the market cap if the company has excess cash than debt, as he owns the cash immediately after settling the transaction/ agreement. So, he doesn't risk his business.

The EV will be negative if the company's net cash exceeds its market cap. In short, the investor is getting the company for free and paying for that.

Calculation

Calculations are based on an existing company for a better understanding of the concept.

Alphabet Inc. is a holding company with Google, the internet media giant, as a wholly owned subsidiary. It is one of the big 5 American Information Technology companies, alongside Amazon, Apple, Meta, and Microsoft.

*The exercise is done concerning Alphabets' Balance sheet for 2021. It is empirically explained the Difference in both Valuations.

Alphabet's (Google) Enterprise Value for the fiscal year that ended in Dec. 2021 is calculated as:

Enterprise Value= Market Cap + Preferred stock + Long-Term Debt & Capital Lease Obligations

= 1,915,910.432 + 0 + 26,206

+ Short-Term Debt & Capital Lease Obligations + Minority Interest - Cash Equivalent Marketable securities

+ 2,189 + 0 - 139,649 = 1,804,656

Alphabet (Google) 's Equity Value for the fiscal year that ended in Dec. 2021 is calculated as:

Common Equity (market value) = Share price × No. of shares of common stock outstanding

= 99.71 × 13,044,000,000

= 1,300,617,240,000

*All numbers are in millions except for per-share data, ratio, and percentage. All currency-related amounts are in USD and indicated in the company's associated stock exchange currency.

Understanding concepts in debt

We understand that individuals come from different backgrounds, professional experiences, and expertise. However, to understand a company's enterprise and net asset value, you must understand each part of the equation.

Here are a few concepts to understand in debt.

1. Market Cap

It is the short form for market capitalization. This metric is calculated by multiplying the outstanding shares by the current share price. Bear in mind that the term is interchangeable with "equity value."

This number can fluctuate as share prices go up or down and as the number of outstanding shares, changes based upon various corporate actions, such as new issues via secondary offerings, share buybacks, and employees of a company exercising their stock options.

2. Debt

Debt is money lent to a company by a lender that requires interest payments. Within the EV formula, debt is calculated by adding short-term and long-term debt together.

The more debt a company holds, the higher the EV will be. Likewise, the less debt a company holds, the lower the EV will be. If an analyst cannot identify the market value of a company's debt, they can use the book value of a company's debt as an alternative.

3. Minority Interest

It represents a non-controlling interest in another company. For ownership to be classified as a minority interest, it must be less than 50% of the company's total available ownership.

Minority interest within the EV formula accounts for the value of the small shareholders who have no control over the company. Generally, It is the portion of a subsidiary company's stock that the parent company does not own.

Therefore, it is found in the non-current liability or equity section of the parent company's balance sheet under GAAP.

Note

By including minority interest within the EV calculation, we can arrive at a more accurate conclusion about a firm's true value. It is a comparison of similar things, such as a company's EV, to numbers such as total sales, EBIT, or EBITDA.

4. Preferred Shares

These are equities with special benefits such as dividend payments and a higher rank in the liquidation process if a company is dissolved.

These types of shares offer the benefits you would get from holding common stock (through a share in dividends) and from holding a fixed-income security (higher rank than Equity).

5. Cash and Cash Equivalents

These include short-term financial instruments on top of already available cash. These short-term financial instruments are highly liquid money market instruments that can easily and quickly convert into cash.

Cash Equivalents include marketable securities, commercial paper, certificates of deposits, repo agreements, and treasury bills.

Final Considerations

The value still available to shareholders after all debts have been settled is the equity value (also known as net asset value). A company's enterprise value is its overall asset value, often known as firm value or asset value (excluding cash).

While the Equity Value is attributed to Equity investors, the Enterprise Value is attributed to all investors. Therefore, equity value is a portion of EV.

As we come to the end of this article, to help you remember the concept in the near future, Below are some of the important considerations to keep in mind.

- EV is the value of the company's assets related to its core business operations but to all investors ( including Equity, debt, preferred, and potential non - controlling interests).

- Equity Value (The Net Asset Value) is the value of all company assets, but only to equity investors (i.e., Common shareholders).

- EV and Net Asset Value concepts are based on the premise that value from a company is calculated from the present value of the future Cash flows.

- No matter how a company is financed, EVs remain the same. Net Asset Value, however, may change depending on the mix of Equity Vs. Debt Vs. Cash.

- Although Net Asset Value is one of the most commonly quoted numbers when discussing a company's value, it is not very useful, as enterprise value reflects a far truer value.

- Investors consider these valuations to make better decisions about whether to invest in a company, watch out for fraudulent acts, and risk themselves.

- EV is also known as a firm value, and The Net Asset Value is the same as the Shareholders' Value.

Enterprise Value vs Equity Value FAQs

To calculate the stock price in EV, take the current share market price and multiply it by the number of outstanding shares from the company's balance sheet and subtract the value of cash and cash equivalents from the company's balance sheet.

Cash is a non-operating asset, and equity value is accountable for it.

A company's Enterprise value is said to be good when it is less than the other company.

EV can be less than Equity Value if a company's debt is negative.

Equity/Net Asset Value is used with Free Cash Flow as a Valuation ratio.

Using enterprise value to measure the value of a company allows an investor to make an apples-to-apples comparison between companies with different capital structures.

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?