Absolute Valuation

Seeks to determine an investment's inherent worth based solely on fundamentals

What Is Absolute Valuation?

Analysts use valuation to establish the intrinsic value of a stock, business, or asset. Calculating an asset's intrinsic value is known as valuation in finance. Absolute valuation and relative valuation are the two main categories of valuation models.

Absolute valuation ignores the market value of other comparable assets in favor of focusing solely on the features of the support that has to be valued, such as free cash flow, to estimate its intrinsic worth.

Relative valuation is the antithesis of absolute valuation. Relative valuation assesses the value of a corporation based on the value of other comparable assets or businesses rather than the company's intrinsic value.

Key Takeaways

- Absolute valuation focuses on intrinsic value, while relative valuation compares to market value of comparable assets.

- DCF is a reliable method for estimating intrinsic value but has some uncertainty due to future projections.

- Absolute valuation models offer advantages like stable dividends and accurate cash flow calculation.

- Selecting the appropriate valuation method requires considering the company's characteristics and the analyst's perspective.

- Multiple valuation models may be used for a comprehensive assessment.

Understanding absolute valuation

Absolute valuation determines an investment's inherent worth based solely on fundamentals. Looking at fundamentals means concentrating on items like dividends, cash flow, and the growth rate for a specific company.

An absolute valuation model can be identified by the fact that in this model, the asset's value is entirely determined by its attributes. The market value of other comparable traded assets is not considered.

In most cases, a total value estimate is estimated by computing the present value of the company's anticipated future free cash flows.

By comparing a firm's share price to what it should be given its absolute value, investors can evaluate if a stock is now under or overvalued.

This approach aids in estimating a company's financial worth in light of its anticipated cash flows. Absolute valuation models identify the intrinsic cost of a given item and provide a point estimate of value that may be contrasted with the market price.

The dividend discount model, discounted cash flow model, residual income model, and capital asset-based pricing model (CAPM) are valuation models that fit into this category.

It isn't easy to figure out a stock's absolute value. Free cash flow growth rates, duration, and the rate at which they should be discounted to the present are difficult to predict for a firm.

Example:

- Consider the $500-per-share stock of Fidelity National Information Services Inc. An analyst determined the absolute worth of the company to be $300 after doing a DCF analysis of its projected future cash flows.

- This creates a selling opportunity for an investor who is led to believe by the numbers from the DCF analysis that Company X is overvalued.

Types of Absolute Valuation Methods

The dividend discount model, Discounted cash flow model, Residual income model, and Economic Profit Model are all models that strive to calculate absolute valuation.

1. Dividend Discount Model

The dividend discount model is often only employed when a corporation has a track record of consistently paying dividends connected to earnings.

It is decided whether an investment is worthwhile given its current market price based on the dividends anticipated to be collected in the future. In this model, the stock price is the present value of all future dividend payments.

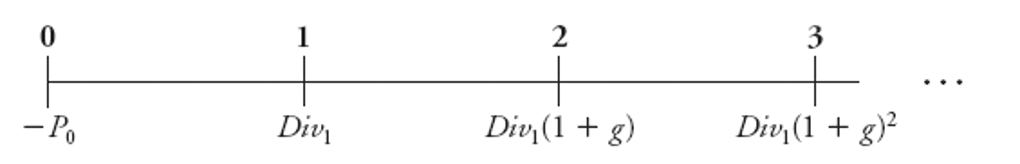

A. One-Stage Dividend Discount Model

Where,

- Re = Cost of Equity (Ke)

- g = Earnings growth = Dividend growth rate if the dividend payout ratio is fixed, i.e., the company pays the same fraction of earnings as dividends over time.

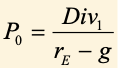

B. Two-Stage Dividend Discount Model

The two-stage model is frequently used to ascertain the intrinsic value of a stock issued by a business that is expanding quickly.

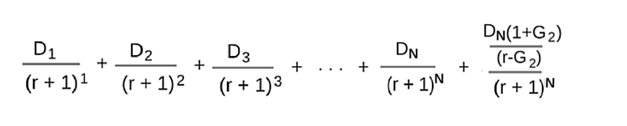

C. Three-Stage Dividend Discount Model

As the name suggests, the three-stage model accounts for three different growth stages. It can also involve a set of dividend de growth; this model works great for cyclical companies

2. Discounted Cash Flow Model

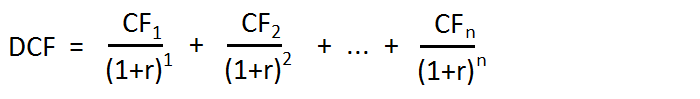

Discounted cash flow (DCF) analysis is a method of valuing security, project, company, or assets using the concepts of the time value of money.

DCF uses the present value of the sum of expected future cash flows and discounts them back at the appropriate cost of capital to arrive at an intrinsic value.

This method is employed by professional investors and analysts working on calculating the fair price to pay for a firm, whether it be for purchasing individual shares of stock or the organization as a whole.

Where,

- CF = The total cash flow for a given year. CF1 is for the first year, CF2 is for the second year, and so on.

- r = The discount rate in decimal form. The discount rate is the target rate of return that you want on the investment.

The company's enterprise value is determined using FCFF in DCF valuation. The sum remains for all of the company's investors, including bondholders and stockholders.

FCFE is also used in DCF valuation to determine a company's equity value or its intrinsic value for common equity shareholders. FCFE is the sum that is still left over for the company's joint equity holders.

In DCF, WACC determines how much it costs a company to raise capital from bonds, long-term debt, common stock, and preferred stock.

3. Residual income model

Residual income valuation is a method of valuing equity that explicitly considers the cost of equity capital. This approach is contrasted with the return on investment (ROI) approach.

This model only considers the cash flows due to the company after paying suppliers and other external stakeholders.

Bond and preference shareholder payments are not deducted from the total amount. The remaining cash flow is then discounted to determine the firm's valuation.

There are two different formulas to calculate the Residual Income. This formula is mainly used in Corporate Finance or M&A transactions.

RI = Operating Income - Operating Assets x Target Rate of Return

Also, the residual income is the adjusted net Profit after the cost of equity has been factored in. Equity valuation using Residual Income:

RI = Net Income – Equity Charge

4. Economical Profit Model

Economic Profit is a performance indicator that contrasts net operating Profit with total capital costs. Revenue is reduced by direct and opportunity costs to create financial Profit.

Economic Profit = Net Operating Profit After Tax - (Capital Invested x WACC)

Three elements are required to solve economic Profit, as shown in the formula:

- Invested capital

- The weighted average cost of capital (WAAC)

- Net operating Profit after tax (NOPAT)

The corporation's income statement contains the net operating Profit after tax (NOPAT). The sum of money used to finance a particular project is known as the capital invested.

If the data is not already available, we will also need to calculate the weighted-average cost of capital (WACC).

What makes the discounted cash flow model most reliable?

The discounted cash flow (DCF) method, in its most basic form, aims to estimate the current value of a company based on estimates of its potential cash flows.

There will inevitably be some uncertainty because the DCF valuation approach relies on future projections.

This valuation model offers several clear advantages. One of its key benefits is that the DCF valuation provides the most accurate representation of an intrinsic stock market value for private practices.

It offers several significant benefits, giving financial planning firm owners and other businesses a distinctive perspective on the worth of their companies and the situation of their wealth management.

Investors and companies must estimate future cash flows and the investment's future value when performing a DCF analysis.

For instance, a corporation considering acquiring a new business must project the future cash flows from growing its operations and processes due to the acquisition.

The company's projections might aid in figuring out whether the investment is worthwhile, given the acquisition price.

Investment and finance experts can use the DCF method to develop a future outline that includes predicted returns by performing a DCF analysis, determining the discount rate, and estimating future cash flows.

Investing can be profitable if the results match or exceed a company's initial forecasts for future cash flows.

However, if the discounted cash flow calculation yields a valuation lower than the company's anticipated future returns, the investors might look into other investment options.

Absolute Valuation Advantages and disadvantages

A valuation technique used to assess a company's financial health is an absolute value. The objective of fundamental value methods is to evaluate a company's economic value based on its inherent values or anticipated future cash flows.

Let's look at some of the advantages and disadvantages of using this valuation method:

Some advantages of this method are:

- The benefit of applying the dividend discount model is that since distributions tend to remain stable over extended periods, there are fewer assumptions to make when valuing the company.

- The components of free cash flow, the discount rate, and the terminal value are only a few of the numerous moving parts of a DCF. This enables the appraiser to narrow down their estimation of the value of the company being appraised using their best judgment and the relevant case data.

- After accounting for taxes, capital expenses, working capital, and other expenses, free cash flow is widely regarded as the most accurate way to calculate the cash flow accessible to shareholders & in some cases, to debtholders as well.

- Residual income methods are the most suitable when a corporation doesn't pay dividends or anticipates a negative cash flow.

- The CAPM model assumes the investor has a diversified portfolio, similar to a market portfolio. Unsystematic (specific) risk is eliminated by diversifying your holdings.

Some disadvantages of this method are:

- In the case of dividend discount valuation, regardless of how successful or cash flow efficient a company's operations are if it pays no dividends at all, this model cannot be used to value the company.

- A DCF is created utilizing predictions of a company's potential performance based on current knowledge. This fact must be recognized by the valuer, who must then select an appropriate discount rate in light of it. When utilizing a DCF, value can easily be overstated because the inputs are delicate.

- The accounting data that the residual income approach is primarily built on is easily manipulable.

- Many criticize the CAPM model for being unrealistic since it relies on too many assumptions. As a result, it might not produce accurate findings.

Choosing a Valuation Method

The variety of stock valuation methods accessible to investors might easily overwhelm someone choosing one to evaluate a stock for the first time.

While some valuation techniques are relatively simple, others are more intricate and difficult. Each company is unique, and each industry or sector has distinctive qualities that may call for various valuation techniques.

Since valuation is an art, we have rules we can abide by when choosing a particular valuation model.

1. Characteristics of the Company

The first stage in the valuation process is to understand the business. When we comprehend the industry, we comprehend its resources' nature and how it uses those resources to generate value.

For instance, the asset valuation model needs to be discarded if the organization has assets that only they can buy and benefit from or if the assets are primarily intangible.

The qualities of the investor are another essential factor to consider when deciding which model to use for the valuation process.

2. Purpose or perspective of Analyst & Investors

The analyst's point of view is another important consideration when selecting a valuation model. For instance, the ownership perspective can affect the selection of the valuation methodology.

Analysts must consider various biases when analyzing information created by others, such as why this particular appraisal method was selected. Are the inputs and valuation models reasonable?

Sometimes investors buy private businesses intending to sell them later by going public. In such a situation, the valuation will entirely depend on the retail investor's opinion of the company's worth.

3. Multiple Methods of valuation

It's vital to keep in mind that investors frequently employ numerous valuation models rather than just one to determine a company's value.

The benefit of using many models is that the analyst may check to see if all models produce the same or comparable value measurements.

Researched and authored by Shriya Chapagain | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?