NOPAT

It measures a company’s profitability by adjusting for taxes and considering the tax implications of debt.

What Is Net Operating Profit After Tax (NOPAT)?

NOPAT stands for Net Operating Profit After Taxes, and it measures a company’s profitability by adjusting for taxes and considering the tax implications of debt, particularly the tax-deductible interest expenses.

Some of the key points of NOPAT include:

- It is based on the income statement

- Seeks to take off the tax benefit of debt

- It is the building block of unlevered cash flow

To obtain a proxy for a company’s cash generation, we must calculate unlevered cash flow by adding back the interest expense while still considering the tax rate. NOPAT represents operating profit after taxes.

We add back the interest expense because we are interested in assessing the potential of cash flow generation, and a company only pays interest if it has enough cash to do so. Meanwhile, taxes are paid whether the company has the cash or not.

Key Takeaways

- NOPAT (Net Operating Profit After Taxes) is a crucial metric in assessing a company's profitability, considering tax implications and adjusting for interest expenses.

- It serves as a foundation for unlevered cash flow and aids in evaluating cash generation potential.

- Calculated as EBIT * (1 - Tax Rate), NOPAT involves Earnings Before Interest and Taxes (EBIT) as a proxy for operating profit and considers the effective tax rate.

- NOPAT is instrumental in financial modeling, especially in Discounted Cash Flow (DCF) analysis.

- It contributes to projecting future cash flows adjusting for non-cash expenses, capital expenditures, and working capital. The resulting Free Cash Flow to the Firm (FCFF) is a key valuation metric.

NOPAT Formula

The formula is as follows:

NOPAT = EBIT * (1 - Tax Rate)

Regarding finance theory, we would want to consider the company’s capital structure available to all stakeholders, not only the equity owners. That is why we add back the interest expense.

Now, let’s dive into each of these terms:

- EBIT: It stands for Earnings Before Interest and Taxes. It is used as a proxy for Operating Profit since the calculation behind each is pretty much the same.

- Tax rate: The tax rate is calculated by dividing the tax expense by EBT (Earnings Before Taxes). Then, NOPAT is obtained by multiplying EBIT by (1 - Tax Rate).

NOPAT Calculation Example

Find the company’s tax expense (in cash). A company usually discloses this in its income statement.

Now, to calculate we need to:

- Identify the Earnings Before Taxes (EBT) amount

- Divide the tax expense in cash by the EBT figure to arrive at the tax rate

- Find the EBIT figure. EBIT is commonly understood as operating profit, and for our calculation purposes, they are considered equivalent in many cases

- Now multiply the EBIT amount by one minus the tax rate, arriving at NOPAT

Let us take an example to understand it better.

Suppose Company A has an EBT figure of $1,000 and a tax expense of $200. We can quickly conclude that the tax rate is equal to 20%.

Following the steps outlined above, we must now find the EBIT amount. For example, suppose the company has an interest expense of $300. By simply adding this expense to the Earnings Before Taxes, we find that EBIT equals $ 1,300.

Now, we can find Net Operating Profit After Taxes.

By plugging these values into the formula, we obtain:

NOPAT = 1300 * (1 - 0.2)

Which yields:

NOPAT = $1040

That figure represents the company’s profitability after accounting for taxes and includes the interest expenses in the calculation. Notice that it is slightly greater than the EBT amount. The larger the interest expense, the larger the disparity between EBT and NOPAT.

For instance, if we had 400 $ as interest expense. EBIT would equal $ 1400, and NOPAT would be 1120. That is the essence of this calculation.

Uses of NOPAT

NOPAT is used to derive Free Cash Flow to the Firm, which is a figure used in the Discounted Cash Flow to find the intrinsic value of companies.

Now, let’s break down each of these concepts.

1. Free Cash Flow to the Firm (FCFF)

It is a cash flow metric. While NOPAT is taken from the income statement, which follows accrued accounting, FCFF is concerned with cash accounting, which considers proper revenue recognition rules.

However, it focuses on cash flows, not accounting accruals. So, instead, it accounts for each actual entry and exit of cash. It adds back all non-cash expenses to NOPAT and discounts capital expenditures and changes in working capital.

2. Discounted Cash Flow

Money today is worth more than money tomorrow, and this time, the value of money, along with risk considerations, forms the rationale behind DCF.

By taking a series of cash flows into the future and discounting them to present value, we arrive at a theoretical fair value for an asset. The key assumption here is the discount rate, often taken as WACC.

Valuation is a wide-ranging topic. However, it can be broken down into two main areas: intrinsic and comparable valuations. Intrinsic valuation often employs DCF as a main tool, as it helps understand the present value of the future cash flows an asset will generate.

Comparable valuation is performed as a quick method, taking as a proxy the value of assets similar to the one you are trying to value.

For instance, if you are evaluating a house, you’d seek similar houses in the same neighborhood, find out how much they are worth, and then arrive at a fair value for your target.

Now we can see why it is so important.

NOPAT is a key component in valuation analysis. Ultimately, valuation, primarily concerned with cash flow generation, involves making various cash adjustments, including those related to working capital and capital expenditures, leading to the determination of FCFF.

Use of NOPAT in Financial Modeling

To understand how it is used in practice, we must understand how a discounted cash flow analysis works.

It is a valuation method that assumes that an asset’s value is derived from its future cash flows. We need a cash flow metric for that, so we use Net Operating Profits After Taxes (NOPAT).

To project these cash flows far into the future, we must put in place our assumptions to set the path for our financial model.

The number of assumptions will depend on the level of detail we want to achieve with our model. However, it should be enough to satisfy the variables we want to project.

The method by which we set up our assumptions can vary. For example, suppose it’s an assumption related to a macroeconomic variable, such as GDP growth. The analyst will grab a survey and extract an average value in that case.

On the other hand, if it is one related to the company’s specifics, it may be measured by digging into the company’s filings and then drawing a conclusion.

Once we have the assumptions in place, we can project and link the financial statements with our financial model.

By forecasting future earnings and ensuring accurate assumptions, we can project and calculate NOPAT directly from the income statement using the operating profit and tax rate figures.

Adaptations

Now, since it is a metric based on accrual accounting, and we are interested in cash flows, we must make adaptations to it. Some adaptations are:

- Add back D&A expenses: We are adding back non-cash expenses, so we need to add back D&A

- Subtract capital expenditures: We subtract the Capex because we are interested in the cash flow that remains after the company’s operational obligations are met

- Subtract working capital expenses: The same applies to working capital. Both capex and working capital are expenses that the company would not be able to survive without, which is the reason why it is subtracted

Now, we finally arrive at the unlevered cash flow. All we have to do now before performing the DCF is discount future cash flows to present value using an appropriate discount rate, which is usually the WACC.

The value we get by discounting it to present value is the Free Cash Flow to the Firm (FCFF).

However, if it is a public company we are evaluating, we are interested in the per-share value, so we must get to Equity Value, which is obtained by subtracting net debt from Enterprise Value.

Practical Example of NOPAT

Let us take an example of NOPAT to understand the concept better.

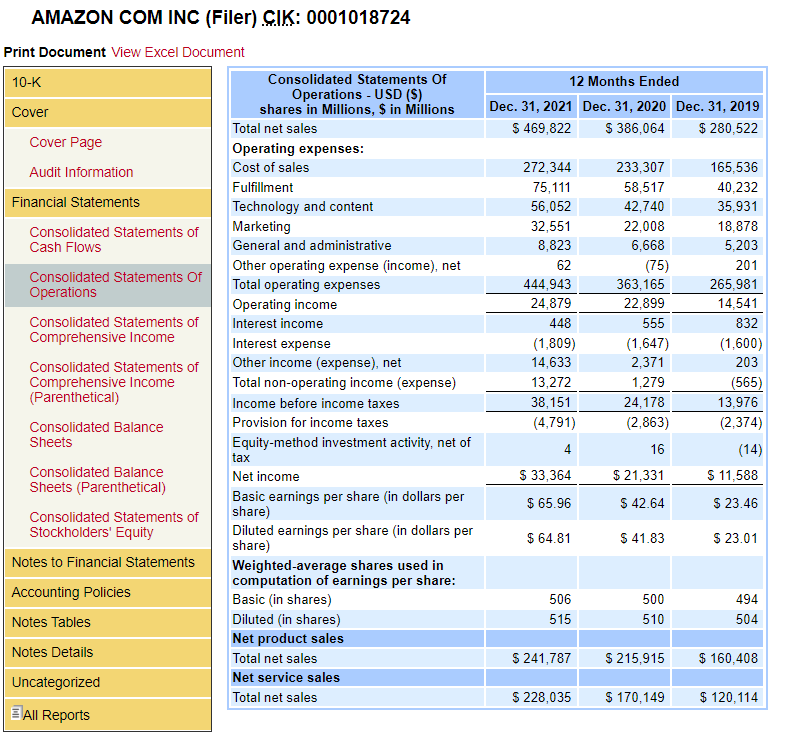

In the above image, we have the latest 10-K filing from Amazon. Now, let’s derive its NOPAT.

We begin by finding the cash tax expense. We can see from the statements that the company laid out $ 4,791 million in taxes.

Now, let’s find the earnings before taxes. In the financial statements, EBT is explicitly reported and, in this case, comes to $ 36,151 million. With both the tax expense and earnings before tax, we can find the effective tax rate for the business:

Tax rate = Tax amount/ EBT

Tax Rate = 4,791/ 36,151

Calculating the tax rate, we get a rate of 13.25%. The EBIT figure is now disclosed as operating income, which is $24,879 million.

After calculating both the EBIT and tax rate, let us apply the formula

NOPAT = 24,879 * (1 - 0.1325)

The NOPAT comes out to be $21,582 million.

It is essential to note the practical application of this calculation and consider using tools like Excel for faster and more efficient computations in real life.

NOPAT FAQs

Financial statements filed by public companies are required to feature explanatory notes, which may provide additional details, but for specific items like interest expense, one should refer to the income statement.

EBIT stands for Earnings Before Interest and Taxes and is usually equal to operating profit. If not explicitly stated, you would move directly to EBT (Earnings Before Taxes).

EBT stands for Earnings Before Taxes. It is net income but before taxes. It is the amount upon which taxes are calculated.

EBITDA stands for Earnings Before Interest, Taxes, Depreciation, & Amortization and equals EBIT plus D&A expenses. While commonly used, it is not a complete proxy for cash flow as it does not consider changes in working capital and capital expenditures.

Once you have the metric in place, you must follow the steps to arrive at free cash flow for the firm to perform the valuation analysis. However, finding accurate information, such as changing working capital and capital expenditures, may get tricky.

First of all, it is vital to understand the financial statements. You must understand the company's capital expenditures and operational cash flow profiles.

The idea is that knowing how the company's financials work allows you to ignore non-recurring items, which must not be considered for the valuation analysis.

Taxes are tricky. The accounting schedule that companies follow often does not match the schedule set out by the tax authorities, which can lead to mismatches.

The company may recognize either a deferred tax asset or liability when such mismatches occur in accounting and tax schedules.

A tax asset is generated when the amount effectively paid is greater than that derived from the tax rule. Conversely, the tax liability is generated when the amount effectively paid is less than that derived from the tax rule.

Researched and authored by Lucas Amorim | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?