Pre-Money Valuation

Refers to the value of a company before any new outside investment or financing

What Is Pre-Money Valuation?

A pre-money valuation refers to the value of an organization before it goes public or obtains different ventures like outside subsidizing or funding. It is the company’s worth before new sources of financing are added to its balance sheet.

In simple words, an organization's pre-money valuation is how much money it is worth before any additional investments or funding come into play. The term pre-money valuation was coined during the emergence of stock markets, which was in the 17th century.

The technique of pre-money valuation is preferred over others primarily due to its simplicity, making it easily accessible and understandable to a wide range of individuals.

Another reason is that pre-money valuations allow both investors and entrepreneurs to negotiate on the equity to be exchanged, making it a fairground. It also acts as a means to assess a business’s value without having to rely on past performance, making it a useful measure for early-stage startups.

Key Takeaways

- Pre-Money Valuation represents a company's worth before receiving external investments or going public.

- Pre-Money Valuation is dynamic and can change with each funding round, making it essential for startup financing and ownership calculations.

- Pre-Money Valuation signifies a company's worth before external investments, whereas Post-Money Valuation represents its value after such investments, influencing ownership percentages and funding amounts.

- Pre-Money Valuation plays a pivotal role in "up round" and "down round" funding, shaping an organization's financial trajectory and potential for recovery.

Understanding Pre-Money Valuation

Pre-money is the valuation of an organization before any rounds of funding and provides financial backers with an image of what the organization's ongoing worth might be. In any case, it's anything but a static figure, implying it can change.

That is because the company is still up in the air before each round of funding, whether it is private or public speculation. Pre-money can be resolved before an organization is exchanged in open business sectors.

One can likewise utilize this valuation before seed, Angel, or venture funding is funded into an organization. This valuation might be a figure proposed by a possible financial backer.

The number could then be utilized for how much financing they will give and how many proprietorships they expect.

The organization's administration could dismiss pre-valuations proposed by others until they arrive at a sum that matches the organization's desires.

These valuations are mostly used for startups, as startups conduct many rounds of funding to raise funds from private investors to meet their operational needs. The calculations of pre-money and post-money valuations for each round of funding ease investors' risk.

The formula is as follows:

Pre-Money valuation = Post-Money Valuation - Investment Amount

Where,

- Post-Money Valuation = New Investment * (Total Post Investment Shares Outstanding / Shares Issued For New Investment)

Pre-Money Valuation = (Investment Amount) / Percentage of Company Bought) - Investment Amount

Pre-Money Valuation Examples

Let's see the first example:consider a company wanting to raise seed funding from investors. The founder of the company holds 100% equity shares. The total outstanding shares of the company are 1 million. The company has set a pre-Money Valuation of $5M.

The company raised $1M by issuing 200K new shares to the investors. In this example, we will find the role of pre-Money Valuation in determining share price, percentage dilution, etc.

Therefore, the data given is as follows:

- Outstanding shares = $1M

- Pre-Money Valuation= $5M

- New shares issued = $200 K

The pre-fundraising share price of the company will be:

Share Price = Valuation / Total Shares

= $5M / 1M = $5

Total outstanding shares post fundraising = 1M + 0.20M = 1.2M

Post-money valuation = $5M + $1M = $6M

Post fundraise share price = $6M / 1.2M = $5

Post fundraise founder ownership = founder shares / total shares = 1M / 1.2M = 83.33%

Percentage dilution of shares by founder = 100% - 83.33% = 16.67%

To understand it clearer, we'll see another example:

Consider a company with a pre-Money Valuation of $100M and total outstanding shares equal to 2M. The founder of the company has 35% ownership. The company raised $52M in a fundraising round from investors issuing 1.04M shares to the investors.

Therefore, the data given is as follows:

- Total outstanding shares = $2M

- Pre-Money Valuation= $100 M

- Founder Ownership = 35%

- New shares raised = $52 M

In this example, we will calculate post-money valuation, post-fundraise share price, founder's shareholding percentage, and percentage dilution by the founder.

Total outstanding shares post fundraise will be -

2M + 1.04M = 3.04M

Post-money valuation = $100M + $52M = $152M

Share Price Post Fund Raise = Post-Money Valuation/ Total Shares

= $152M / 3.04M = $50

Pre fundraise founder's ownership - 35%

2M * 0.35 shares = 0.70M shares

Post fundraise shares of founder = 0.70M (unchanged)

Founder’s Ownership Post Fund Raise = (Founder’s Shareholding/ Total Shares) * 100%

= (0.70M/ 3.04M) * 100% = 23%

Percentage dilution of founder’s ownership = 35% - 23% = 12%

Factors Affecting Pre-Money Valuation

Pre-Money Valuation is frequently attached to a monetary valuation of the organization. However, this valuation is eventually shown by the exchange between the organization and the financial backers.

In funding financings, financial backers frequently propose a pre-Money Valuation subject to specific necessities, for example:

- The number of securities accessible to be allowed under an organization's equity incentive plan as a level of the post-fund raising fully diluted capitalization of the organization.

- Specified share vesting provisions occupied by founders of the company.

The last arranged esteem came to the parties and utilized in the price estimation ordinarily factors any current inconsistency or inability to fulfill any of these necessities. Different variables can likewise influence the discussions over the valuation.

Variables increasing the valuation are:

- Exorbitant premium from multiple financial backers.

- Great founding members.

- Anti-dilution protection favors the investors.

Variables decreasing the valuation are:

- Dull interest from the investors.

- Great quality investors.

- Higher risk-return ratio.

- Explicit company dangers.

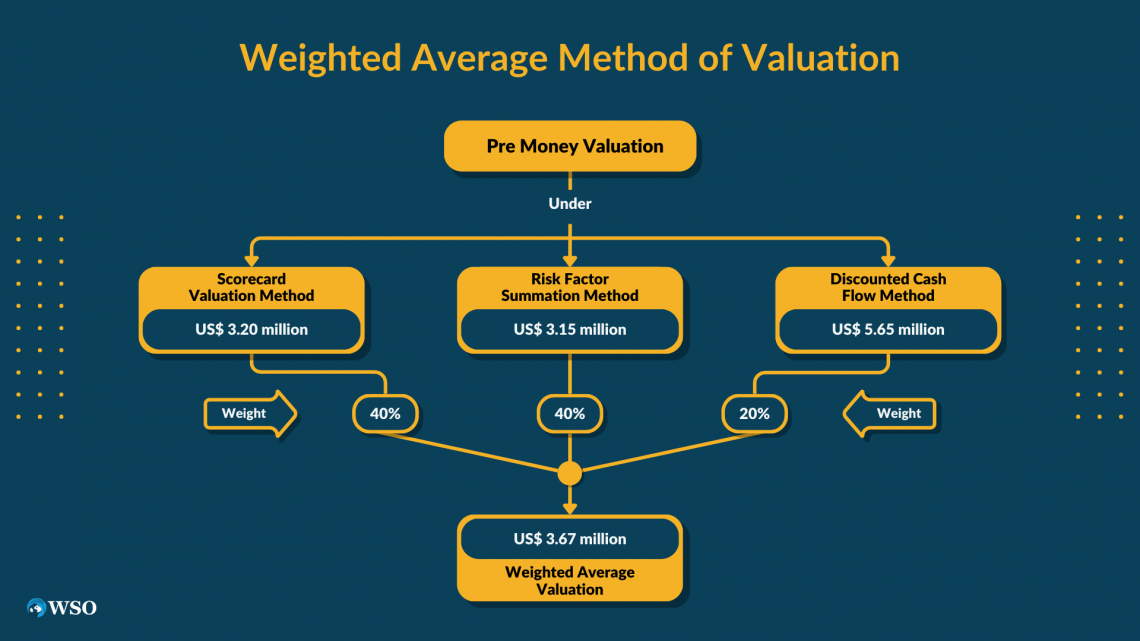

Pre-Money Valuation Methods

There are a couple of measurements financial backers use while proposing a pre-Money Valuation when financials are not promptly free. They are as per the following:

- Comparable Businesses: This depends on a correlation of the organization to other more settled organizations in the commercial center. They will quantify the income and market worth of more experienced organizations to measure a startup's true capacity.

- Founding Team: Good founding teams are individuals who get things going as they need, have sound regard for the real world, and are determinedly creative. Founders who have a fruitful history of sending off new organizations and have gathered a group of shrewd individuals around them appeal to VCs.

- Deal Interest: If a ton of financial backers need to partake in an arrangement, the organizers have influence. They can drive up the organization's valuation, permitting them to hold more possessions. As it may, assuming an arrangement is undersubscribed (i.e., low interest), the financial backers can direct the organization's valuation.

Pre-Money vs. Post Money Valuations

Pre-Money and Post-Money are often heard together, so it becomes important to know their differences. Post-Money valuation is simply the addition of pre-money valuation and the amount of cash input into the organization during the fundraising.

Pre-Money Valuation = Post-Money Valuation - Investment Amount.

If a company's pre-money valuation is $5M and raises $2M in fundraising from financial backers, its post-money valuation is said to be $7M.

Post-money valuation determines the ownership of an organization's founders or investors. If a company raises $10M from investors at a pre-money valuation of $25M then the ownership of the investors comes out to be 28.6% (($10M / $35M)*100 = 28.6%).

Similarly, if a company raises $10M at a post-money valuation of $25M then the ownership of investors comes out to be 40% (($10M / $25M)*100 = 40%).

Pre-Money Valuation and 'up round', 'down round' funding

Before raising capital, the pre-Money Valuation is not entirely set in stone by existing investors, mostly the organization's founders.

The contrast between the starting valuation and the consummation valuation following the round of funding decides if the supporting was an "up round" or a "down round.":

- An "up round" signifies the valuation of the organization bringing capital has expanded up in contrast with the earlier valuation.

- A "down round" implies the organization's valuation has diminished present funding in examining the first round of support.

An organization can unquestionably recuperate from a negative round of funding, notwithstanding the expanded weakening among investors and expected struggle under the surface after the fruitless round of support.

While many inquiries (and questions) are sure to be raised about the organization's fate and bringing capital up, later on, will become undeniably seriously tested, the capital brought up in a down round might have disposed of the gamble of inescapable insolvency.

Albeit the chances are reasonably stacked against the organizers, the capital might have given it sufficient opportunity to turn the business around. For example, the funding was the lifesaver that the startup expected to stay above water for the present.

Conclusion

The phrase pre-money valuation is widely used in the corporate world. It is predominantly used for private companies and venture capitalists during the fundraising process. It gives a comprehensive idea of a company’s monetary worth before external funding is injected.

The accurate determination of this valuation is of extreme importance as it determines how much money an investor will invest in a particular organization. Additionally, it determines the amount of share percentage investors receive in exchange for providing funding.

If a company’s pre-money valuation is severely undervalued, there will be difficulty in raising the necessary investment in the fundraising event. Another serious outcome of this is the possibility of higher dilution of ownership for the founders and existing shareholders.

On the other hand, a company’s pre-money valuation being severely overvalued creates unrealistic expectations and also increases the pressure to perform at a level that they are incapable of. Overvaluation also makes it difficult to secure the funds needed.

Last but not least, terms such as ‘Up round Funding’ and ‘Down round funding’ are commonly used to determine if a company has had a successful fundraising round. 'Up round' indicates a successful clearing and 'down round' typically means that the company has failed to clear it and this could lead to the dilution of its owners.

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?