Energy Hedging 101: The Frac Spread

Afternoon Monkeys,

Sometimes you have to stop worrying, wondering, and doubting. Have faith that things will work out, maybe not how you planned, but just how it’s meant to be. Other times, you have to try and understand the Natural Gas Liquids markets and their respective price relationships to oil so that you can impress people, because, let’s face it: Frac Spreads drive the ladies wild.

A couple weeks back I did a little piece on the crack spread, or, the margin extracted from refining crude oil into distillates and why it’s important to more than just oil refineries. This time, I’m shifting gears a bit, and touching on a ratio that is less commonly known to the layman but is increasingly important to natural gas refiners (midstream firms), or speculative ngas traders: the frac spread, short for fractionation spread, or NGL spread. Dictator of the NGL world.

Listen: before you understand what the frac spread is, it’s important to know who uses it and why. The petroleum and gas industry is segmented into three parts: Upstream, midstream, and downstream. Though it has elements of both upstream and downstream involved, midstream firms are responsible for the gathering, refining, and transportation of natural gas. They gather wet natural gas from wellheads at shale plays (Marcellus shale, Woodford shale, etc), separate the methane, leaving only NGLs (natural gas liquids) behind. These NGLs typically include propane, butane, isobutene, and condensates. Midstream firms then transport and market these heavier liquids (sometimes fee-based, other times POP contracts), from which they derive their profits and operating model.

Listen: The Frac Spread is simply the value gained from the sale of NGLs (C3, IC4, NC4, C5+) less the cost of the natural gas used to fractionate the liquids. It’s a profit margin for a gas processor, whereby your input price (natural gas = COGS) is subtracted from your output (NGLs = revenue). For processors, this is extremely important, because if natural gas prices increase dramatically while NGL prices remain stagnant (as happened post-Katrina), your frac spread will decrease dramatically—sometimes even becoming negative. If midstream firms don’t protect their spread, they’ll inevitably be ruined.

Practical Application

Since the energy markets are about as predictable as John McAfee’s behavior as of late, gas processors and midstream firms use the capital markets to hedge their price risk. They will buy natural gas futures (since they are inherently short), and sell propane futures at a predetermined ratio. It’s important to note that outputs aren’t limited to propane; isobutene, butane, and natural gasoline futures are all part of the equation, but as I’ll discuss later, aren’t very liquid or cost effective for a trader. Using a frac spread, hedgers lock in both their input and output prices and are thus impervious to market movements (both up and downside.)

Trading a Frac Spread

The frac spread is quoted in heating value terms, dollars per mmBtu, to equate propane to natural gas. The natural gas futures contract is composed of 10,000 MMBtu, and is quoted in dollars and cents per mmBtu. Propane futures are quoted in cents per gallon and traded in units of 42,000 gallons (1,000 barrels). One gallon in gaseous form contains approximately 91,500 Btus or 0.0915 mmBtu per gallon. Dividing the price of propane by 0.0915 gives the equivalent price per mmBtu. If propane were trading at 35¢ per gallon, the cost would be $3.825 per mmBtu. As far as I’m aware, the two most popular ratios used to create a balance heating value position are a 3:1 or 5:2 propane to natural gas spread.

At this point, the fractionator has only paid for the value of natural gas consumed, or reduced, in processing. There are many additional costs including processing, transportation, fractionation, and marketing that mustbe paid out of the gross manufacturing margin.

Listen: It’s extremely important to note that in these instances, midstream firms are locking in their sale and purchase prices; they are unable to participate in any upside movement in NGL prices that might take place afterwards. Think of it as an insurance policy. It’s a hedge; not a speculative position.

You might be thinking to yourself, “well, I’m not a gas processing plant or midstream firm, so I don’t care bro. I’m short AAPL because they’re out of innovative ideas, or something. Been trading since I was 15.” That’s fine. If you want to understand the drastic effect an energy firm’s hedging policy has on its bottom line, take a look at MWE’s Q3 earnings report. If not for its frac spread hedging policy (see: additional income from derivatives), its bottom line would have been absolutely clobbered by depressed crude and NGL prices. But, because of futures contracts it had been entering since 2009, it was instead profitable. The same goes for WMX, DCP Midstream, or any midstream component of a fully integrated petroleum company.

Market Correlations

Unlike crack spread options, the frac spread doesn’t have pre-packaged options one can purchase; and because NGL markets are so thin and illiquid, it’s often times difficult to perfectly hedge your exposure further out than just a few months. A true hedge is perfectly negatively correlated to the underlying asset. Thus, rather than hedging exposure on a product-for-product basis (selling propane swaps to lock-in a future sales price), processors often use a proxy hedge, or, using WTI Crude swaps to hedge their NGL exposure.

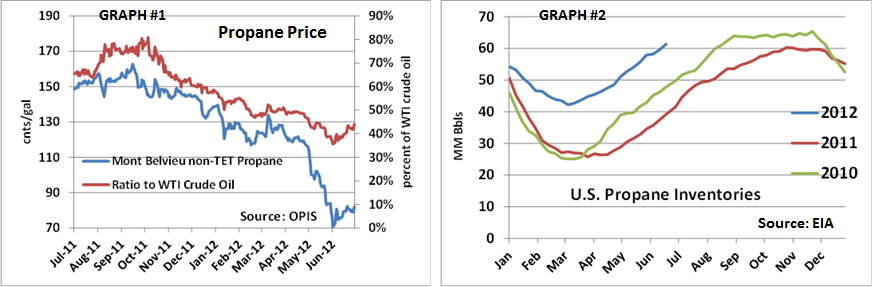

Traditionally, WTI Crude and NGLs have high market correlations, allowing hedgers to use the cheap and highly liquid crude markets in the stead of thin, expensive liquids markets. That’s why a gas firm will follow crude prices almost as closely as NGL prices; they’re usually very similar.

However, the markets for the past 18 or so months have been unlike any markets we’ve seen before. Lumina Investments knows what I’m talking about. NGL prices and crude prices have become so disjoint that using crude as a proxy hedge is simply no longer effective. As BarCap’s Michael Zenker notes, “some producers will lock in an NGL hedge as a percent of oil production, which results in a proxy hedge that may leave them vulnerable to situations when the prices of oil and liquids do not correlate." This is highly problematic for a hedger, for: if your proxy is no longer correlated, your hedge is no longer effective, and your exposure is as if you had never hedged at all. This is referred to as basis risk.

Thus, the crude/NGL proxy hedge is losing its effectiveness as of late, and energy firms are being forced to move into product-for-product hedges, whose markets are less liquid and more costly.

Highlights:

•The Frac Spread is the value of natural gas liquids extracted from raw natural gas. It’s a profit margin.

•The predominant NGLs are propane (C3), isobutene (IC4), butane (NC4), and natural gasoline (C5+). The term “C3+” refers to all four hydrocarbons.

•

Gas processors and midstream firms pay close attention to this spread, since they are the ones doing the processing and subsequent marketing of the product.

•Your frac spread can be tailored to fit your product mix.

•Since the NGL futures markets are illiquid, hedgers often use WTI futures instead, since they are traditionally highly correlated. However, this proxy is increasingly ineffective as price patterns are becoming disjointed, exposing the hedger to basis risk.

•Mont Belvieu in Texas is the leading US gas hub, and its area frac spreads reached all time highs in early 2011 after dipping into negative territory post-Katrina.

Listen: If anything, the frac spread is a great indicator of the direction the gas markets are headed, and thus, where the stock of a midstream firm is headed. If you were to plot the midstream industry’s index (if there was such a thing) price pattern next to the same time period’s frac spread, it’s a solid bet they’d move in close harmony. Chesapeake might be a notable exception to this observation, since their “hedging” strategy has been known to be speculative and not-so-effective (at best). It’s a subject that could be spoken on for hours, but if you have any questions, feel free to PM me or post and I’ll do my best to respond. Hope this helped. Happy hedging everybody.

well that just went way over my head...just tell me if i should be long natural gas or not (cuz i am right now)

sick post man. Thanks!

I would recommend the following posts:

http://www.rbnenergy.com/lets-get-cracking-how-petrochemicals-set-ngl-p…

http://www.rbnenergy.com/lets-get-cracking-part-II

http://www.rbnenergy.com/lets-get-cracking-part-III

Listen: You might be like "I'm an energy trader, been doing it since I was 15. Don't care about anything else bro." Thats fine.

But you might find it interesting what people working in E&P think about this. A few years ago, when the natural gas price started to tank, a BUNCH of oil companies with strong unconventional dry gas/shale positions were caught with their pants down. Not only did they just pour a shit load of money into these developments based on a $5/mcf henry hub planning price, but they also entered into a bunch of long term contracts with oil field service companies securing drilling crews, frac crews, etc. for the next several years.

What that meant (along with a bunch of other reasons that I won't get into) was that they couldn't just lay down all these rig lines and try to ride out the low NG prices until things started picking up again. They had guaranteed work for these rigs and crews and were going to have to pay for it whether they were using it or not.

If they had to keep drilling anyway, what could they do to make the economics a little more attractive? Ah ha!! Gas condensate and NGL prices were looking much better. So they moved all their rigs from plays that were very dry into the areas that were more liquids rich and had high condensate yields and NGLs. Things were looking all fine and dandy until... "What? What!!! Bro come over here, NGLs aren't tracking the WTI price anymore. The f*ck is going on here?"

All of a sudden, there was way more condensate and NGL then the market really demanded and prices of those started to drop and no longer track WTI. So my friend, when you start hearing about E&P companies starting to rig back up in some of the pretty dry unconventional plays, probably is a good indication that NGL prices are going to being rebounding and tracking WTI again.

+1 amigo, I like your style

The bad turnout at Matt Damon's new fracking movie, Promise Land, tells me America is ready for some NGL.

As mentioned above, in 2011 was when we saw the height of what we called the "liquids lift" I remember when certain E&Ps basically said we are only drilling for NGLs and NGLs only, that stuff that comes outs is the residue, we do not care if we sell it for 0, those in the Bakeen and other such plays said just flare that crap, its the liquids we want.

Then when we had a very warm winter in later 2011, the market was totally caught off guard the NGLs market had grown in such size over the last 2-3 years that a warm winter and no global export option killed the prices. It was probably in May 2012 that the Conway-MTI started to really blow out, give credit to Bentek for leading this charge and analysis. As we are having a somewhat normal winter we are starting to see prices rebound, but no where near the great "liquids lift" of the past.

I would have said last year, that shorting NGLs, long natty was a very correct and profitable trade. Unconventional declines were outpacing wet/associated growth, add to it all shut-in of unconventional.

Now not so much, as the exporting options for NGLs are coming about, and the drilling of NGLs has slowed down, I would still not be bullish propane prices, as NAM is still oversupplied in the next little while till mid 2014. I would be a seller of any short-term rally.

Great post, SB'd

amazing post.. thanks for sharing

Wait, so the frac spread has very little to do with actual hydraulic fracturing then? Damn I hate when they recycle keywords :P

Excellent post though, looking forward to more

Iure corporis recusandae aut vel commodi fuga cupiditate. Voluptas nulla et quo dicta corporis. Ut ipsam blanditiis porro.

Excepturi nam atque dolorem quibusdam quia qui est. Illum repellat ab id. Est omnis qui aliquid ut et ipsa beatae sit. Nihil delectus nostrum repellendus odio. Voluptatem quisquam reiciendis eaque incidunt quae. Velit nihil voluptatum velit temporibus quos. Blanditiis aut libero voluptatem ipsum quis exercitationem.

Provident eaque laboriosam qui modi itaque soluta. Iste eum est possimus reiciendis. Aspernatur eveniet sint odit qui. Sed suscipit possimus fugit assumenda et numquam impedit.

Est et provident non et. Necessitatibus odio atque enim facilis neque rerum inventore autem. Saepe accusantium quibusdam sunt distinctio ut. Nulla dolorum quod omnis eum fugiat amet quidem.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...