Mortgage Rate

An interest that applies to a mortgage loan.

What Is a Mortgage Rate?

A mortgage rate is an interest that applies to a mortgage loan. The rate is adjusted according to the benchmark rate, credit score, and down payment to determine the overall risk subjected to the creditors.

Mortgages can be fixed-rate or adjustable-rate, depending on the borrower's preference. It is a risk that could work in favor of the borrower or not, as interest rates vary over the years, and mortgages with an adjustable-rate policy would be exposed to those shifts.

The lowest average rate banks can offer on credit is the prime rate. The prime rate correlates with the federal funds rate but is approximately 3% higher for the added risk and servicing fees.

Interbank lending utilizes the prime rate and may be presented to the highest credit quality borrowers. However, a mortgage is necessary for our current economy as house prices rise well above the affordability of an average annual salary.

A mortgage enables home buyers to own their property by borrowing a large sum of money from banks, to pay it back over an extended period.

In return, the bank requires interest on the amount it has lent for the servicing of the loan and risks they endure, including the large sum of money being transacted at once and the contingency in place if the borrower were to default on his payments.

Mortgages must be appropriately assessed and regulated by professionals, as we have learned from the past in the Financial Crisis of 2008.

However, qualifying for a mortgage has become more difficult due to the growing house prices and the disparity between wealthier and lower-income classes.

Mortgage Rates and Housing

The demand for homes has increased rapidly, and so have the prices. Usually, the size of the house and the location determine its value, with homes within a city being more expensive than homes outside the city.

Cities are rapidly developing areas and provide the convenience of everyday items nearby. However, they tend to provide limited space for homes as many properties are owned or rented as businesses or offices.

With less space available to build new properties, supply remains stagnant while demand for homes within the city continues to increase.

Demand can be spurred through many factors, including economic drivers such as low-interest rates and monetary stimulus.

Low-interest rates provide favorable conditions to consumers and encourage spending, reducing overall mortgage costs.

However, low-interest rates create a high demand as many people would like to take advantage of the circumstance to buy a house, making the market more competitive.

Similarly, economic stimulus, or extreme measures such as quantitative easing, injects new liquidity into financial institutions or the population to promote growth or financial well-being.

As banks have more liquidity, this enables them to provide more loans at attractive rates in competition with other banks.

Likewise, the public will have to provide more capital for a standard down payment on a house. However, wealthier individuals are most likely to capitalize on this as they experience more tremendous success during times of economic growth.

Building materials to construct houses and the manual labor necessary are essential to factor in the price. Periods of limited resource supplies can lead to the cost of a home increasing by significant amounts, for instance, a limited timber supply since a considerable quantity is needed.

Labor shortages would decrease the work capacity for construction and therefore increase the prices of homes as fewer houses will be built, unable to meet the demand.

Mortgage Financial institutions

Mortgages are typically issued by retail banks and other specialized institutions. As well as generating revenue for the business they must ensure a limited risk before proposing mortgage loans by adequately assessing the client's ability to make successful payments and financial stability.

If the client's risk is too high, they could be rejected immediately or be granted a loan with a high-interest rate to reflect the amount of risk the bank will endure lending out the sum of money.

Largest US Mortgage lenders of 2020 (Provider - Total number of loans - Total dollar value of loans):

- Quicken Loans - 1,142,638 - $313,411,550

- United Shore Financial - 560,798 - $182,820,410

- Freedom Mortgage - 389,146 - $99,235,390

- Wells Fargo - 320,026 - $137,148,860

- LoanDepot.com - 294,467 - $100,528,925

- JPMorgan Chase - 229,061 - $108,009,825

- Caliber Home Loans - 228,633 - $70,600,845

- Fairway Independent Mortgage - 228,154 - $64,957,500

- Bank of America - 184,118 - $77,665,140

- US Bank - 180,649 - $58,611,185

Benchmark/reference rates are factored into the mortgage interest rate to provide a standard of the risks associated with crediting money in the current market economy. Standard rates used include the Fed Funds rate and US Treasury Yields.

The Fed Fund Rate is the interest rate the Fed pays banks for their reserve holdings. Subsequently, this sets the rate banks to use to borrow from each other when there is a shortfall in a bank's Federal Reserve deposit.

For example, if the Fed Fund rate is 1%, banks could charge other banks a 3% rate for borrowing funds to accumulate more interest that would otherwise receive 1% from the central bank.

US Treasury securities are considered the most stable, risk-free bonds. Therefore the yields associated with the longevity of the bond provide an accurate representation of the applied risk when lending money in the current economy.

Mortgage Optimization

To access the best rates possible, borrowers must provide enough evidence of why they are suitable candidates and expose little risk to the financial institution. Prominent methods and statements viewed by the banks include:

Credit Score

A consumer's creditworthiness is determined by their credit score, a number between 300–850, which is subject to change depending on credit histories, such as repayment history and total debt obligations.

A higher score would give borrowers a better outcome for banks to service a loan with favorable conditions, providing evidence of committed scheduled payments and limited risk.

Fair Isaac Corporation (FICO) created the most commonly used credit scoring system adopted by financial institutions.

Credit scores can significantly affect a person's financial credibility and hence the prospects of them being accepted to withdraw a mortgage to purchase a property.

Subprime borrowers are classed as individuals with a credit score below 640, incentivizing lending institutions to penalize them by charging higher rates for subprime mortgages to compensate for the elevated risk.

More frequent scheduled repayments or a co-signer may be added to the conditions of the mortgage to mitigate risk.

Lower interest rates are awarded to borrowers with a credit score of 700 and above, which is advantageous as they will have to pay less money throughout the entire term of the mortgage in comparison to subprime borrowers.

The initial deposit for large purchases may vary for individuals depending on their credit score. The credit limit on a credit card may be capped at a lower amount or presented with a higher interest rate if a person displays an undesirable credit score.

Credit reporting agencies update and store consumers' credit histories. Three of the major US credit rating agencies are:

Information collected and the processing methods by the three credit institutions may differ. However, while calculating credit scores, there are five essential details to be considered:

- Payment history - contributes to ~35% of a credit score, incorporating whether they are capable of paying their obligations on time.

- The total amount owed - contributes to ~30% of a credit score, incorporating the current total credit available to a person and their credit utilization.

- Length of credit history - contributes to ~15% of a credit score; lengthier credit histories provide more support as there is more data.

- Types of credit - contributes to ~10% of a credit score, showing the variety of credit installments from revolving credit to car loans.

- New credit - contributes to ~10% of a credit score, the number of new accounts opened.

Several ways to improve your credit score include repaying loans on time and keeping debt low. A low outstanding debt obligation is beneficial, showing financial stability and less than frivolous spending habits that could become unmaintainable.

A preventative measure could be increasing your credit limit by calling your bank or stopping yourself from closing down unused credit accounts so that your credit limit remains higher and, in effect, your credit utilization will remain low.

Credit repair companies provide their services to individuals who urgently need a loan and do not have time to improve their scores. These companies negotiate with loan providers to offer the best deal for a monthly fee.

Down Payment/Deposit

The initial payment made when purchasing a property is known as the down payment. In other words, it is the capital you have contributed to buying a house. It represents a percentage of the property's price, while the remainder of the money is borrowed from the bank as a mortgage.

The standard percentage for a down payment in the United States is 20%, although it can vary depending on the financial circumstance of the home buyer.

The more you contribute to the house purchase, the more money you save on interest payments over the mortgage, as you would not have to borrow as much from the bank.

For example, if you place a down payment of $20,000 for a $100,000 property, you will borrow $80,000 from a bank. Say the interest is 5% for a fixed term of 20 years. You would be paying interest of $4,000 annually.

However, a down payment of $30,000 under the same conditions will require an interest payment of $3,500 annually, saving you a total of $10,000 over the entire term of the mortgage.

A larger down payment can typically reduce the interest rate of a mortgage, saving even more money than mentioned in the example above, as it poses less risk to the bank if payments are missed for a smaller loan.

Lower than average down payments may require security in private mortgage insurance (PMI) to cover any missed cost. However, this will require an additional monthly fee for the underwriting service.

Another beneficial tactic can be to refinance your initial mortgage and place a larger down payment on the new mortgage to reduce interest payments.

Fixed-rate Mortgage

The interest rate is set for the entirety of the mortgage's term. This simplifies budgeting for homeowners as the total payment will remain the same. However, payments can vary between principle and interest when using an amortization schedule throughout the year.

Fixed rates protect the borrower from increasing interest rates which could hike when the economy contracts and can very likely occur in the lifetime of a mortgage that extends to 30 years. A hike would increase interest payments for non-fixed credit and could drastically inflate.

If the interest rates are currently high, it is more difficult to obtain a fixed-rate mortgage as it becomes less affordable and therefore involves more risk for the bank, who will likely decline the application if it is not exceptional.

Fixed-rate contracts vary little between different providers, illustrating the simplicity of the terms compared to an adjustable rate, mentioned in the next section.

The span of the mortgage can stretch from 15 to 30 years, depending on the financial institution's preference. The most popular choice is a 30-year mortgage, which offers lower monthly payments but will require a higher overall cost for the interest applied to the different years.

A shorter-term mortgage will require a more significant proportion of the principal to be paid monthly. However, it can be offered at a lower interest rate allowing more significant principal payments. This can significantly reduce the amount of interest paid overall.

Adjustable-rate Mortgage (ARM)

Initially, the interest rate on an ARM is fixed at a rate below the expected market rate and increases as the mortgage progresses. However, if the mortgage is held for an extended period, the interest can eventually exceed the rate of a fixed-rate mortgage.

The initial fixed rate of an ARM remains constant for the aforementioned period, can be between one month to 10 years, and adjusts to the new interest rate at predetermined intervals. The resetting of the interest rate then follows the market rate, which will be significantly higher.

ARMs are more complex than fixed-rate loans. They consist of many characteristics such as:

- Adjustment Frequency: The sequential time of interest rate adjustments.

- Adjustment Indexes: A benchmark rate the interest rate adjustments are reflecting could be the 1-year Treasury Note Yield.

- Margin: The percentage added to the benchmark rate for the adjustment period. For example, the rate of the 1-year T-bill plus 3% is the adjustment rate, where 3% is defined as the margin.

- Caps: This limits the interest rate percentage that can increase at each adjustment period.

- Ceiling: The adjustable interest rate is not permitted to surpass the ceiling rate in the loan's lifetime.

ARMs are considerably cheaper than fixed-rate mortgages and enable larger loans to be withdrawn as the initial payments are lower and can remain quiet in a falling interest rate economy. This is based on the current market rate at the time of the rate reset.

The risk of using an ARM is that although you can take out a larger loan, the interest payment can be significantly higher if the market rate spikes. In some circumstances, payments could double in just a few years, depending on the structure of the ARM.

This can induce financial hardship upon the home buyers as their rates rapidly rise, similar to the situation experienced during the subprime mortgage meltdown in 2008 when many homes were foreclosed.

Since then, the government has established new regulations and legislations directed toward financial institutions preventing such crises from reoccurring.

The Consumer Financial Protection Bureau (CFPB) protects consumers from predatory mortgage practices that subdued borrowers with over-indebtedness.

Mortgage Defaults

A mortgage default arises if the borrower fails or misses scheduled repayments to the mortgage provider for an extended period without any reconciliation or correction. For example, the first three to six months would be long enough for the provider to post a default notice.

At this point, the borrowers must finance the missed payments within two weeks or contact the provider to discuss the reasons for the missed payments.

The provider must be notified as they could help readjust the scheduled payments to be more suited to the borrower, provided a valid reason such as losing a job or becoming unwell.

The borrower's credit profile could have recordings of the missed payments, affecting their chances of acquiring another loan in the future. As a result, they could contact the credit rating agency to update their profile and will also confirm with the mortgage provider to ensure the claim is accurate.

Over time, uncontested defaults will slowly disappear and become less influential as long as the missed payments have been amended.

Suppose the reason is inconclusive, or they fail to contact their provider. In that case, they can be legally summoned to a court hearing where the matters are made much worse, requiring them to either convince the jury about their arguments for missing payments or to negotiate a repayment method that could result in foreclosure of the property to pay off the debt.

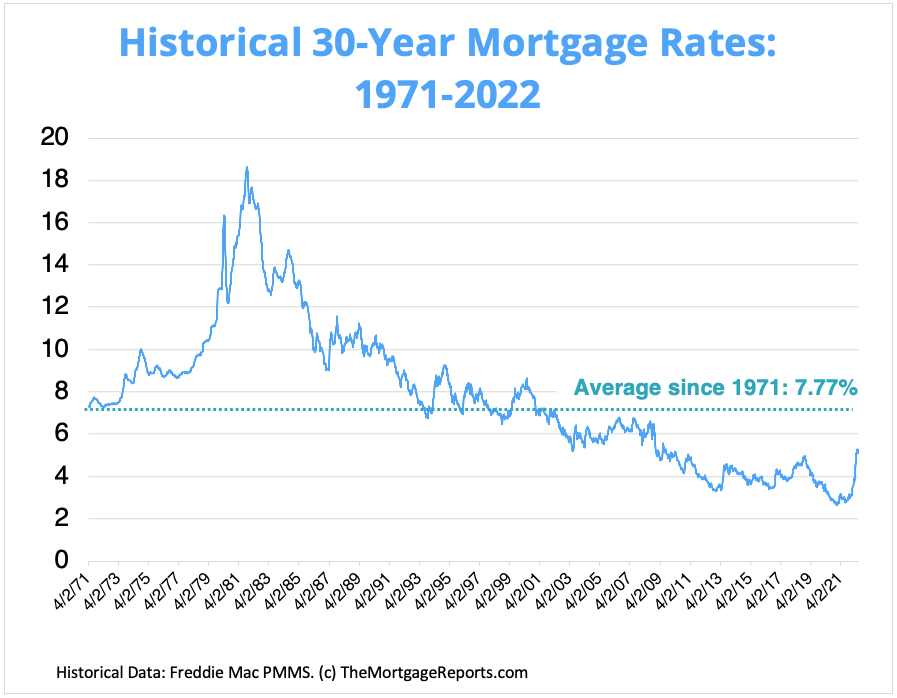

Present Mortgage Rates

As inflation rises, the focus has shifted towards the Federal Reserve to constrict the rate at which it is accelerating. The original target for the Fed was a 2% rate, but it has dramatically exceeded the target reaching a peak of 8.5% in 2022.

A monetary tool central banks use is the changing of interest rates, which are anticipated to rise, tightening the economy's growth. This directly affects mortgage rates and the demand for housing as borrowing money becomes more expensive.

With the benchmark rates set to increase, associated mortgage rates will see a sharp rise that will settle the activity of home buyers due to the unfavorable conditions and uncertain future ahead.

Mortgage rates have been declining since the 2008 financial crisis. As a result, the central bank has re-stimulated the economy by introducing monetary policies consisting of quantitative easing and low interest rates, creating a favorable housing market that caused a consistent gain in house prices.

The pandemic resulted in the Federal Reserve purchasing mortgage-backed securities (MBS), increasing its holdings from $1.4 trillion to $2.7 trillion. As a result, mortgage rates plummeted from this operation as mortgage demand was high, incentivizing banks to lend more money and people to buy homes.

Supply constraints provoked by the pandemic and the disturbance to work ethic in construction due to self-isolation measures caused a delay in the supply of new homes.

In addition, home occupants were interested in moving properties as the pandemic altered many lifestyle decisions, increasing the demand for housing.

Now the Fed has decided to tighten its balance sheet, a reversal could see mortgage rates increase further if the Fed decides to sell its MBS on the open market and will result in a significant loss as the price has depreciated since it was bought at a time of low interest, which is not the case anymore.

An excessive rise in interest rates could purge the financial well-being of adjustable-rate mortgage holders forced to make more significant payments. Therefore, it will be a tedious challenge for the Fed to balance inflationary pressures with the economy's financial stability.

or Want to Sign up with your social account?