Credit Analysis

The process of evaluating the creditworthiness of borrowers to determine their ability to repay loans

What Is Credit Analysis?

Credit analysis is the method through which the creditworthiness of an individual or an organization is determined. It involves identifying and evaluating the risks associated with the ability of the borrower to meet financial obligations.

In simple words, credit analysis is performed by an investor or a creditor to assess the risks involved in lending to an entity or investing in that company. This is done to determine the concerned entity’s ability to repay its debt.

It involves performing qualitative and quantitative assessments of the potential debtor, such as the amount owed, character, and the capacity of the potential debtors.

Using various financial tools such as cash flow statements, trend analysis, etc., the ability of the company to meet its financial obligations is assessed.

When a company decides to expand, it needs to raise capital. It can be done either by issuing shares, debentures, bonds, or by taking credit. To decide whether or not to invest in the company, investors, creditors, banks, and analysts perform a credit analysis of the company.

Key Takeaways

-

Credit analysis is the method through which the creditworthiness of an individual or an organization is determined.

-

It involves performing qualitative and quantitative assessments of the potential debtor, such as the amount owed, character, and capacity of the potential debtors.

-

To reduce credit risk, the lender performs a thorough credit check on the borrower by keeping the 5Cs of Credit- capacity, collateral, capital, condition, and character.

-

The process of credit analysis involves three stages, namely - a collection of information, analysis of information, and lastly, the stage of decision.

Understanding Credit Analysis

The objective of credit analysis is to examine the credit risk associated with the concerned company or individual and then determine whether the credit is to be approved or not. If the analysis gives the conclusion that the company will be able to repay the amount, then the credit is usually approved.

For example, person A wants to borrow $300 from you. In the past, you have lent them $100, but they never repaid you.

Then there is another person B, who also wants to borrow $300 from you. In the past, you lent them $100, and they did repay you in installments.

Out of the two, who will you lend the money to?: Person B, because their credit history shows they have a higher chance of repaying what was borrowed.

Similarly, any entity that is issuing credit will perform credit analysis on the borrower, which broadly involves studying their:

- Credit history

- Credit score

- Cash flow analysis

- Trend analysis

and determining the borrower's creditworthiness.

The following people are interested in the credit analysis of a company:

- Creditors: These are the people to whom a certain sum is owed, also called lenders.

- Investors: These are the people who put money into a business, organization, property, scheme, etc., with the aim of getting profits or part ownership in return. These people include shareholders, venture capitalists, angel investors, etc.

- Portfolio Managers: These are the people responsible for making investment decisions and carrying out activities related to investing on behalf of vested individuals, organizations, and institutions.

- Banks: These are the financial institutions that accept deposits and, at the same time, lend loans to individuals, organizations, etc.

- Credit rating companies: These include credit rating agencies like Moody's, Standard & Poor's, Fitch, etc.

5 Cs of Credit Risk

Credit risk is the risk that the borrower might fail to meet their debt obligations. It is the risk that a lender undertakes when they decide to lend funds. To reduce this risk, the lender performs a thorough credit check on the borrower by keeping the 5Cs of credit in mind.

The '5Cs of Credit' are characteristics that evaluate a borrower's potential. These are:

- Capacity

- Capital

- Collateral

- Condition

- Character.

1. Capacity

Capacity involves borrowers' ability to meet their financial obligations. The company should have enough cash flow to manage its day-to-day operation expenses, give the employee their salaries, etc., and still be left with a considerable amount of cash.

The lenders usually look at following to determine the creditworthiness of the company:

- Cash flow statements

- Expense statements

- Repayment history

- Credit scores

2. Capital

The investment that a borrower makes in their business shows the lender how committed the borrower is to the business. Introducing personal capital establishes trust between the lender and the borrower as it shows that the borrower has 'skin' in the business.

3. Collateral

Collateral is the secondary source of loan security in case the business fails to repay. Lenders use collateral as a guarantee to get their owed money back in case the loan payments stop for some reason.

Note

The significance of collateral depends on the type of loan borrowed.

4. Conditions

Conditions describe the objective of the credit as well as the basis of the terms on which it is borrowed. It involves conditions not only of the business but of industry and economy as well.

The lender would want to know the purpose of the loan, how it is going to be used in the business, and other factors such as competition, market position, etc.

5. Character

The final C involves the general perception of the borrower. Educational background, personal credit history, past business experience, skills, criminal history, etc. of the borrower is taken into consideration by the lender before the loan is sanctioned.

As it is said, the strongest predictor of future behavior is the past. To get a better picture of a person's character the following are evaluated:

- Credit history

- Trade references

- Educational Background

- Criminal history

Process of Credit Analysis

The process of credit analysis is extensive, as it involves various stages.

Given below are the essential stages in the process of credit analysis:

1. Collection of Information

The first stage involves collecting a wide range of information, and all of the following are studied in detail:

- Credit history of the borrower

- Purpose

- Utilization of the loan

- Character of the borrower

- Capacity of the borrower

- Financial statements of the organization

The credit history of an applicant is investigated by looking at information such as repayment records, data on bank transactions, and financial solvency.

The lender also gathers information on collateral besides the information on the purpose and utilization of the loan.

2. Analysis of the Information Collected

In this stage, the information collected is thoroughly analyzed for accuracy.

All the agreements with the clients and suppliers, documents, licenses, and financial statements submitted by the borrower are thoroughly investigated. The character of the borrower is also probed.

Note

The efficiency of the business, the financial capability of the borrower, and their experience, among other things, are taken into consideration.

3. The Stage of Decision- Approval or Rejection

After a detailed analysis of the licenses, permits, documents, and financial statements submitted by the borrower and a check into the background and character of the borrower, the lender has to make a decision.

If the lender is satisfied with the analysis and finds the risk associated with the borrower acceptable, the borrower's credit application is approved.

If the lender is not satisfied and does not find the risk associated with the borrower acceptable, the credit application of the borrower is rejected.

Ratios used in Credit Analysis

Ratios are one of the most important tools for analyzing financial statements. They help potential investors, lenders, banks, and the management the financial health of the company and determine whether the organization will be able to meet its financial obligations.

To assist in the credit analysis process, the following are used:

- Profitability Ratios: These ratios are used to assess the ability of an organization to generate profits o. For e.g., Net Profit Margin, Return on Equity, etc.

- Leverage Ratios: These ratios are used to show the amount of leverage (debt/equity) taken by the company in comparison to other metrics like capital. Assets, etc. For e.g., Debt to Asset Ratio, Debt to Capital Ratio, etc.

- Coverage Ratios: These ratios are used to assess the ability of an organization to bear the expenses associated with the debt. For e.g., Interest Coverage Ratio, Debt Service Coverage Ratio, etc.

- Liquidity Ratios: These ratios are used to assess the ability of the organization to meet its short-term obligations. Examples include the Current Ratio and the Quick Ratio.

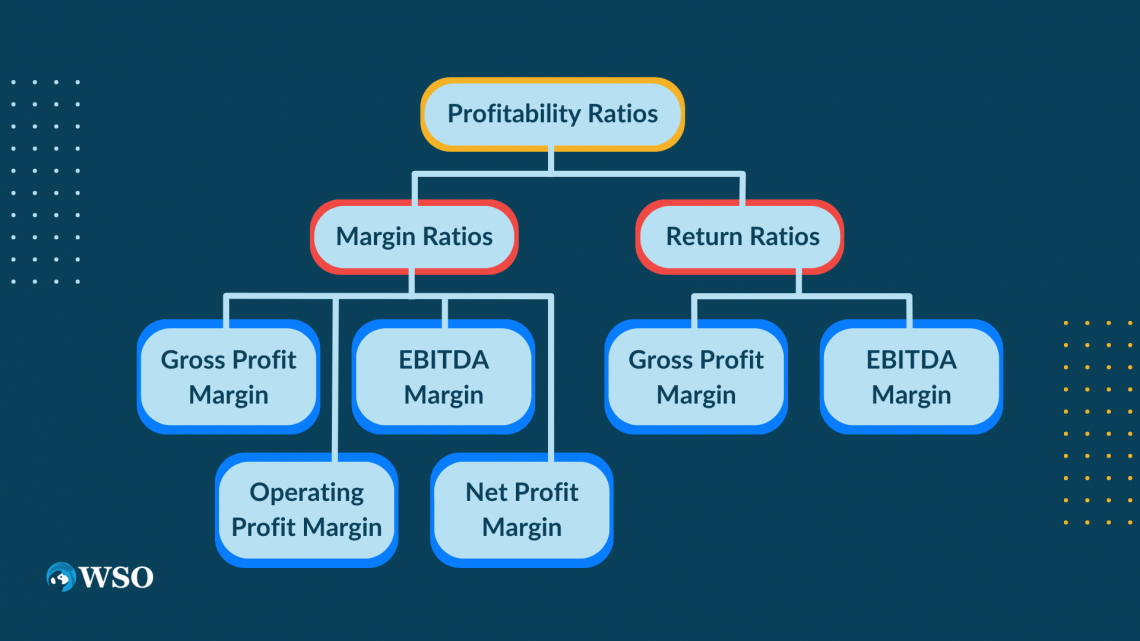

Profitability Ratios

Profitability ratios are ratios that assess the ability of a company to generate profits. These ratios are effective and provide more information when companies of similar industries are compared.

The higher the ratio, the more favorable it is for the company, as it shows it has a higher chance of meeting its financial obligations.

Profitability ratios can be classified into two types:

- Margin Ratios

- Return Ratios

1. Margin Ratios

Margin ratios are ratios that show the ability of the firm to convert its sales or revenues into profits. There are four ratios included under this category:

-

Gross Profit Margin

-

EBITDA Margin or Operating Margin

-

Operating Profit Margin

-

Net Profit Margin

2. Return Ratios

Return ratios are ratios that show the overall ability of the firm to generate profits for shareholders. There are two ratios included under this category:

-

Return on Assets

-

Return on Equity

Example: A company earns a gross profit of 25% on cost. Its credit revenue from operations is twice its cash revenue of operations. If the credit revenue of operations is $800,000, calculate the gross profit ratio of the company.

Solution

Net revenue from operations = Cash revenue from operations + Credit revenue from Operations

Net revenue from operations = ½ (800,000)+ 800,000

Net revenue from operations = $1,200,000

Gross Profit = Revenue from Operations - Cost of revenue from Operations

25% of Cost of revenue from Operations = 1,200,000 - Cost of revenue from operations

25% of Cost of revenue from Operations + Cost of revenue from Operations = 1,200,000

125/100 Cost of revenue from Operations = 1.200,000

Cost of revenue from Operations = $960,000

Gross Profit = $240,000

Gross Profit Ratio = Gross Profit /Net revenue from Operations *100

Gross Profit Ratio = 240,000/1,200,000 * 100

Gross Profit Ratio = 20%

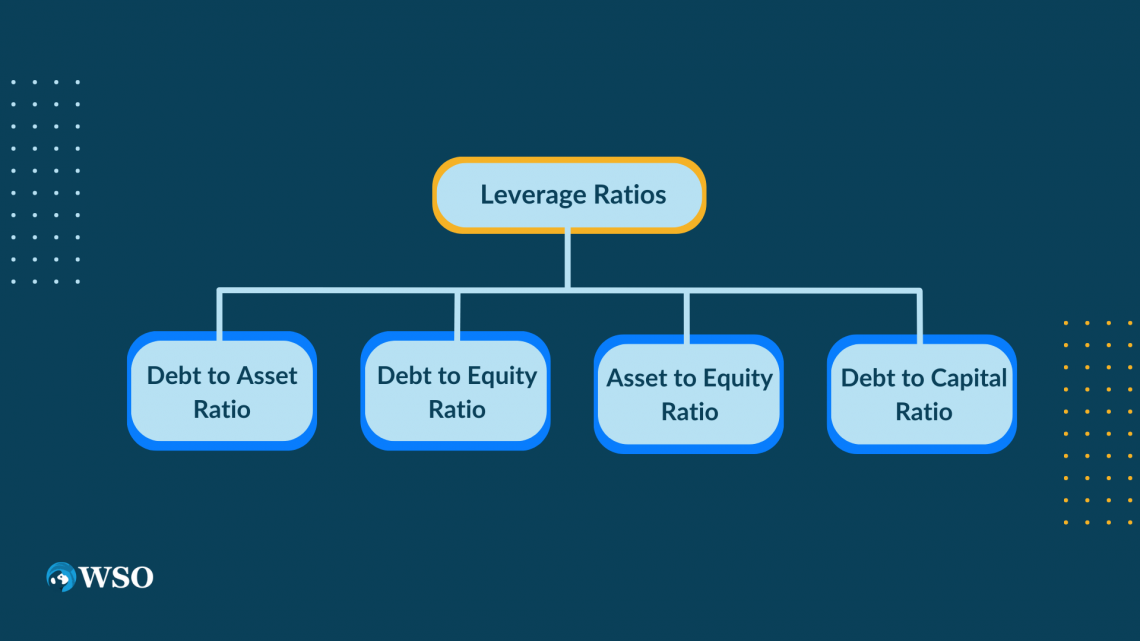

Leverage Ratios

Leverage ratios measure the leverage(debt/equity) of a company that it undertakes to meet its financial obligations. These ratios also reveal the amount raised through shares in the capital and the amount borrowed from outside sources.

A lower leverage ratio is favorable as it means lower risk, thereby providing sufficient protection to long-term lenders.

The following ratios are categorized under this:

-

Debt to Asset Ratio

-

Debt to Equity Ratio

-

Asset to Equity Ratio

-

Debt to Capital Ratio

Example: Calculate the Debt to Asset ratio on the basis of the given information:

| Long term Borrowings | $700,000 |

| Long term Provisions | $225,000 |

| Non Current Assets | $1,200,000 |

| Current Assets | $540,000 |

| Current Liabilities | $140,000 |

Solutions:

Total Assets = Current Assets + Non Current Assets

Total Assets = 540,000 + 1,200,000

Total Assets = $1,740,000

Debt = Long term Borrowings + Long Term Provisions

Debt = 700,000 + 225,00

Debt = $925,000

Debt to Total Assets Ratio = Long Term Debt / Total Assets

Debt to Total Assets Ratio = 925000/ 1740000

Debt to Total Assets Ratio = 0.53: 1

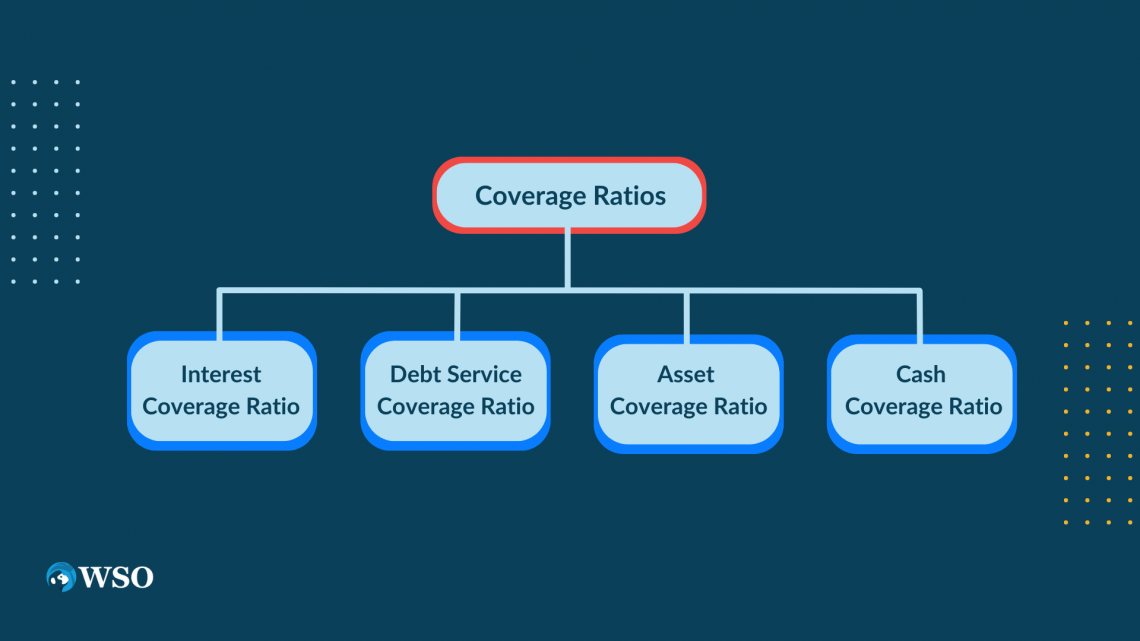

Coverage Ratios

Coverage ratios are ratios that evaluate the ability of a company to bear the expenses associated with its outstanding debt.

These ratios are used to review the financial statements of a prospective borrower by a creditor to assess if the borrower will be able to meet its debt obligations, such as interest and other expenses.

A higher ratio is generally preferred.

The following ratios are categorized under this:

-

Interest Coverage Ratio

-

Debt Service Coverage Ratio

-

Asset Coverage Ratio

-

Cash Coverage Ratio

Liquidity Ratios

Liquidity ratios assess the ability of a firm to meet its current obligations out of current resources. This is why liquidity ratios are also called ‘Short-term Solvency Ratios.’

The term ‘current’ here means within the period of one operating cycle. Therefore, current assets mean assets that can be converted into cash or cash equivalents within one operating cycle, and current liabilities mean liabilities to be paid within one operating cycle.

Higher ratios indicate a higher percentage of current assets that can be liquidated. A low ratio indicates a lack of liquidity and a shortage of working capital.

On the other hand, a ratio too high indicates either inventory pile-up, a large amount locked up in trade receivables, or a lack of proper investing on the company’s behalf.

The following ratios are included under this:

-

Current Ratio

-

Quick Ratio

Example of Credit Analysis

Based on the given information, calculate the following ratios:

-

Debt to Equity Ratio

-

Interest Coverage Ratio

-

Current Ratio

-

Working Capital

| Particulars | Amount($) |

|---|---|

| Equity Share Capital | 200,000 |

| 5% Preference Share Capital | 60,000 |

| General Reserve | 120,000 |

| Fixed Assets | 505,000 |

| Current Assets | 120,000 |

| Current Liabilities | 40,000 |

| Loan @ 10% interest | 500,000 |

| Tax paid during the year | 30,000 |

| Profit for the current year after interests and taxes (available for the shareholders) | 90,000 |

Solution:

1. Debt to Equity Ratio

Debt to Equity Ratio = Debt / Equity or Long Term Debts / Shareholder's Fund

Debt = Loan i.e. $500,000

Shareholder’s Funds = Equity Share Capital + Preference Share Capital + General

Reserve + Profit for the current year

Shareholder’s Funds = $200,000 + $60,000 + $120,000 + $90,000

Shareholder’s Funds = $470,000

Debt to Equity Ratio = 1.06: 1

2. Interest Coverage Ratio

Interest Coverage Ratio = Net Profit before Interest and Tax / Fixed Interest Charges

Fixed Interest Charges = 10% Interest on $500,000 Loan

Fixed Interest Charges = $50,000

Net Profit before interest and tax = Profit after interest and tax + Interest + Tax

Net Profit before interest and tax = $90,000 + $50,000 + $30,000

Net Profit before interest and tax = $170,000

Interest Coverage Ratio = 170,000/ 50,000

Interest Coverage Ratio = 3.4 times

3. Current Ratio

Current Ratio = Current Assets / Current Liabilities

Current Assets = $120,000

Current Liabilities = $40,000

Current Ratio = 120,000/ 40,000

Current Ratio = 3:1

4. Working Capital

Working Capital = Current Assets - Current Liabilities

Current Assets = $120,000

Current Liabilities = $40,000

Working Capital = 120,000 - 40,000

Working Capital = $80,000

Researched and Authored by Aqsa Wasif | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?