Balloon Payment

The payment made to repay the outstanding balance at the end of a loan term

Balloon payment is the payment made to repay the outstanding balance at the end of a loan term. It's usually a lot more than the prior installments on the loan.

- Alternate name: balloon mortgage.

A balloon mortgage is a type of mortgage that does not fully amortize during the loan's term. For example, instead of paying equal monthly payments over 30 years, a homeowner would make payments for only five to seven years, after which the remaining balance would be due in one lump sum payment.

This form of loan could work if consumers are aware of the danger and are willing to pay out of pocket rather than depending on the value of the house to cover the large payment. Apart from that, these types of real estate loans might be very risky.

Having understood this, let us move on to an important question that will help you understand this concept even better.

When does this make sense? Let us try to answer this question from the point of a business.

Consider a small business preparing to introduce a new product in the market. The project will require a financial investment and not generate cash flow for the first few years.

As the initial installments are lower, a balloon loan will relieve the financial burden on the company during the development phase.

The company will be able to produce enough cash flow to satisfy the balloon payment at the end of the loan as it grows and prospers. In addition, payments can be altered to meet the company's current financial status, which helps with financial planning.

How does it Work?

The term "balloon" suggests that the final payment will be sizable. Such payments are typically at least twice as high as the loan's previous installments.

These payments are more typical in commercial lending than in consumer lending since the ordinary homeowner cannot make a large balloon payment at the end of the mortgage.

Most homeowners and borrowers expect to refinance their mortgages or sell their homes before maturity as the lump sum payment approaches.

These payments are common with two-step mortgages.

A “balloon mortgage” requires the borrower to pay a fixed interest rate for a set period of time. Then, at the end of the term, the loan is reset, and the lump sum payment at the end is rolled into a new or continuing amortized mortgage at market rates.

The reset process isn’t always automatic with two-step mortgages. Instead, it is determined by a number of factors, including whether the borrower has made on-time payments and maintained a stable income. In addition, the balloon payment is necessary if the debt doesn’t reset.

What are some meaningful relationships for this concept? Here’s a brief explanation below:

A) Constant Payment

Here we have a linear relationship with the size of steady payments. As the consistent payments increase, the lump sum payment at the end decreases linearly until it reaches $0.

When the balloon payment is zero, the constant payment is the same as the constant payment on an identical fully amortized loan. As a result, a fully amortized loan is a particular instance of a balloon loan.

B) Interest Rate

The interest rate and the balloon payment have a non-linear relation. It indicates that if the loan's interest rate rises, the lump sum payment may become very big.

It's crucial since, at higher interest rates, the reduction in the lump sum payments necessitates increasingly greater continuous payments, which could impact the company's financial management.

Definition of a Balloon Mortgage

A balloon mortgage is a loan with low monthly payments for most of the term and a one-time lump-sum payment at the end.

Until the final lump sum payment is due, your payments on an interest-only balloon mortgage are solely applied to interest. Payments on various types of balloon mortgages can be applied to the interest and the principal.

Balloon mortgage interest rates are frequently lower than ordinary mortgage interest rates. Furthermore, the payback period is usually much shorter, spanning between five and ten years.

Many balloon mortgages are interest-only loans, which means that your monthly payments are only used to pay the interest.

This arrangement results in a lower monthly payment than a traditional mortgage in most cases. You'll defer paying on the principal until the end of your loan term, when you'll make a lump-sum payment.

Some homeowners prefer a balloon mortgage because it is a more cost-effective way to purchase a home. In addition, lower mortgage payments can free up funds in your budget for other expenses.

Even if your payments are little, the balance will be due at the end of your mortgage term. So make sure you have a plan in place to pay off this potentially large expense.

| Pros | Cons |

|---|---|

|

Low mortgage payments: A balloon mortgage, by definition, has low payments over the majority of the term. This may make it easier to pay for other homeownership costs. |

You'll have a small amount of equity in your home: You'll make little or no progress on paying down the debt during the term because your payments are either fully or primarily directed toward the interest; as a result, you'll have developed very little home equity.(The percentage of your home that you genuinely "own" is known as home equity. Although you are still the owner of the property, your lender has a claim on it until you pay off your mortgage.) |

|

For borrowers searching for a short-term loan, this is a good option: A balloon mortgage may be a smart alternative if you plan to sell your house before the conclusion of the mortgage term since the proceeds from the sale could help you cover the payment. |

It may be difficult to refinance or adjust your payment conditions because you won't be able to create much equity. |

|

Lower monthly payments may allow you to put more money toward your down payment or other obligations, potentially allowing you to buy a home sooner. |

One of the most significant disadvantages of a balloon mortgage is the astronomical amount that must be paid at the conclusion of the term. Nothing is compelling you to save toward that payment, which may or may not be sufficient motivation for everyone. Even if you expect to sell the house shortly before the end of the term, a market collapse could result in the sale proceeds falling short of the lump sum payment. |

|

|

Your lender may foreclose on your house if you are unable to make the payment at the end of your loan term. Your credit score and ability to qualify for future mortgages will be significantly impacted by foreclosure or short sale. |

Balloon Loan vs. Fully Amortized Loan

The main difference between these two is that the first is a balloon loan consisting of monthly payments followed by a large final payment. Meanwhile, a fully amortized loan consists of equal installments made over the loan term. The balance at the end of the payments is zero in this case.

The consistent payments in a balloon loan arrangement are less than those in a fully amortized loan for the same loan size. Therefore, it is the most significant benefit of balloon loans.

If you make all of your payments according to the original schedule, your term loan will be completely paid off by the end of the term.

The term "amortization" is a term used in peak lending that deserves its explanation. Amortization refers to the amount of principal and interest paid each month throughout the life of your loan.

Near the beginning of a loan, most of your payment goes toward interest. After that, the scale gradually tips in your favor over the duration of the loan term.

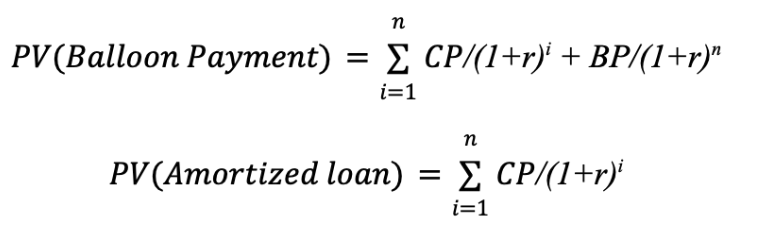

Let us compare the formulas of the two:

Where,

CP = Constant payment

BP = Balloon payment

n = Number of payments

r = Discount rate

Aspects of History

In the 1970s, the concept was extensively used in real estate finance.

To generate cash flow or a breakeven point for the real estate investor, it was usual practice to obtain title subject to the present loan and offer the seller a second mortgage with no payments. It was referred to as a straight note.

As long as the second mortgage was small, possibly less than 10% of the purchase price, making no payments was one technique for generating cash flow.

An investor may produce positive cash flow since the current mortgage payment, plus insurance and taxes was often low enough to see some form of return from the rental.

The premise behind this technique was that the property would appreciate throughout the second mortgage's three-year term. This isn't a predetermined conclusion by any stretch of the imagination.

Because housing values were rising at 10% or more per year in the late 1970s, this strategy worked quite well.

In reality, a $100,000 home may be worth $133,100 after three years of 10% gain, more than enough to repay a $10,000 promissory note with 10% interest, even when compounded.

Inherent Risks

What if the market doesn't rise—or, even worse, falls?

These payments might be a huge problem in a falling housing market. As house prices decline, the likelihood that homeowners will have positive equity in their homes lowers, and they may not be able to sell for as much as they had hoped.

When faced with an unaffordable balloon payment, borrowers often have little choice but to fail on their loans and go into foreclosure, regardless of their household income.

Some homeowners found themselves in hot water in 2007 due to dealing with subprime mortgage lenders. Option ARM mortgages were a popular financing option, combining interest-only payments with a balloon payment.

During those years, a homeowner could purchase a home with no money down and take out an 80/20 combination loan, with both loans due and payable, with a sizable payment at the end of the term.

When the debtors bought the house, none of these possibilities occurred. Instead, they thought that real estate prices would keep rising indefinitely. Instead, they owed more on the house than it was worth, and they couldn't afford the lump sum payment.

Key Takeaways

- A balloon payment is a one-time lump sum payment payable after five to seven years to pay off a mortgage.

- These are high-risk funding options.

- Balloon mortgages are appropriate for people who are confident that they will pay off their mortgage without relying on property appreciation.

- Balloon mortgages can make housing appear more inexpensive than it is.

- Home equity refers to the owner's stake in the property. If property values rise or as you pay down your mortgage loan sum, it has the potential to rise over time.

Researched and authored by Rhea Rose Kappan | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?