PE Waterfall - Modelling Catch-up

Hey

I am building a distribution waterfall model at the moment to practise my modelling in Excel but cannot work out how to model a catch-up after the preferred return. Any idea where I could find help? I tried Google but without luck. Anyone familiar with modelling of catch-ups?

Thanks

Dehe

What Is a Private Equity Waterfall Distribution?

A Private Equity waterfall distribution model explains how capital is returned to LPs, GPs, etc in a private equity investment. It’s important to model the waterfall based on the terms in the partnership/LLC agreement. While every deal may be structured differently, here’s a general idea of how the waterfall works:

Waterfall Model Example

To help you build your custom models, you can start with the official WSO Private Equity Waterfall Excel template.

Distribution Waterfall Template

Your question has an element of ambiguity. Are you asking (1) what is the actual formula you'd use in excel, or (2) what is a catch-up.

If you are asking 1, I'd use a combination if an If Statement with a Min Statement; if(preferred

So any views here? Or is ke18sb correct?

Using the parameters of 80%/20%, after 8% preferred return. Put LP's cashflows on sheet, calculate excess cashflows above 8% (using GOALSEEK). Then on the line below that.

=IF(EXCESS>(SUM(ALL CASHFLOWS).25),(SUM(ALL CASHFLOWS).25),EXCESS)

Then you would meter out the remaining 80%/20% if it were there.

Looks weird because you are using 25% but that's algebra, bro.

Hi AKBOS, you seem to have experience modeling these waterfall model, would you have one you can share with me? I am having the same issue and I haven't built one before. Thank you in advance for your help!

There are a ton of different ways to model the catch-up. Once the LP has received 8%....if the GP has catch-up, the GP will now receive a disproportionate % of the distributions until the GP is caught up (this percent can vary). Might be best to find an example LP agreement that outlines a specific instance of a catch-up, then you can model it and have a point of reference for others to see the assumptions.

This gives an overview of the issues associated with hurdles and catch-ups: http://beekmanwealth.com/wp-content/uploads/2013/01/Private-Equity-Inve…

Distribution Waterfall (Originally Posted: 06/21/2011)

I recently left my old group and am putting a new one together. I have always been an operator, and have brought in a partner w a background in investment banking to help with the money side of the business. We have been going back and forth on how the waterfall pays out.

Assume a 8% preferred and a 60/40 split there after. Year 1 has a 20% return off of $1 million. So 200k for distribution. 8% preferred gets 80k. Then the 60/40 splits are 72k and 48k. Does that 72k get paid out as a divided, and the investor base investment remains at $1 million or does that 72k reduced the based investment. Basically, does the money distributed over the preferred rate go to paying down the investment or is it just an additional return. If it is paying down the initial investment, if the pref calculated going forward off the new balance, or the original capital invested?

huh?

You are starting a PE fund however you are unsure how distributions work?? Before you pay the 8% preferred return, you return the LP's commitments (some funds also return management fees and fund expenses) for the investment you liquidated. Although this is usually the case, it depends if there is a reinvestment/recycle principal clause where you can roll over the proceeds into another investment, depending on if the liquidation occurred in the investment period.

I have no idea if I even answered what you asked, however best of luck fundraising.

We will be buying and selling distressed assets, flipping houses, so each deal has a very short shelf life. The way my old fund was structured is out initial distributions went to wards the pay down of capital, and continued to reinvest the profits. My main question is if we are paying down the principal, does the preffered get calculated off the original invested amount, or off the current balance. We will be reinvesting the funds, so want to do limited distributions beyond the pref until the end of the acquisition cycle (24 mo). My question is if we distribute the 72k at the end of year 1, in year 2s pref calculated of 1MM, or the 1MM- 72k distributed profit (above the pref)?

If you are paying down the principal balance, the new pref owed is calculated off of the new balance. If you pay it based on the original balance you will end up paying a higher rate that your pref after you return capital back.

Did you ever get this question answered?

Which PE Waterfall / Catch-up Model is Best? (Originally Posted: 10/16/2012)

Trying to determine which Fund terms are optimal for the GP:

Option I: 8% preferential return to LPs with 80/20 GP catch-up, 50/50 split thereafter

Option II: 9% preferential return to LPs with 100/0 GP catch-up, 50/50 split thereafter

What do y'all think?

Thank you!

Further to the above, I would add a 'cork screw' account of the undistributed GP return available, as follows:

Opening balance +Accruals -Distributions Closing balance

So that once you get to the end of the life of the fund, you can set a binary flag that allows you to disburse all available funds available for distribution to the GP

I'm going to guess option I is better, but doesn't it depend on the size of the deals?

The size of the deal doesn't matter. The IRR, MOI and Cash on Cash metrics are the ones that will decide which is the better deal.

Is this a homework assignment? Think about it man...it depends where your returns end up. If you are looking at 9% return per year for the fund then option 1 is clearly better but draw a diagram of the returns and it should be pretty straightforward.

Scenario 1 is better, more profits to split. The 80/20 vs. 100% catch-up really has no bearing if you have decent returns you will get to the 50/50 regardless. Also depends greatly on if that pref. accrues and rolls into your equity balance at YE, if this is the case, Scenario 1 is even more appealing.

Right, the catch-up would only be in play if your IRR falls in that 8-11ish % range (or whatever the numbers work out to exactly).

Equity waterfall (Originally Posted: 07/30/2013)

Hey Guys,

About to start my PE gig and I wanted to ask about equity waterfalls. I never had to deal with them in banking, but I kept hearing the phrase being thrown out when I met up with Associates at the palce I'm going.

What are they? A calculation of how much management will make depending on exit?

It's a structure of how the 'returns' trickle down fund. How did you land a gig as a PE analyst without knowing a waterfall distribution?

^This.

This is like landing an M&A internship without understanding WACC. (Ok, maybe not that bad).

You need to get your shit together before you start.

Kind of that bad. I don't really care that he doesn't have his shit together. I just want to know what kind of techniques he used to get an analyst gig with apparently zero knowledge

Wait...you don't even know what they ARE? And you are currently in banking?

Next time you want to know something, don't make a fake online persona to ask. Also, try google.

Too much sand inside the vaginas in here.

^This

Haha I did not phrase my initial question properly.

I understand the waterfall in terms of the returns to a fund as you exit investments, your return is after return of capital and preferred return etc.

I'm more talking about management of a portfolio company. Say they have 10% equity rollover, I'm asking for specific examples of say if they have certain kickers built into their stake, or special options certain members of management may have, etc.

From my experience in PE, there are two general types of shares or units, Common and Preferred. When you buy a company, the equity will most likely be split between preferred and common. The preferred accrues a return over the life of the investment period and the common does not. When you exit, the preferred return is paid in full first, then the preferred capital invested, then the common capital invested. There is also incentive equity in deals that is usually subject to some some type of return hurdle. Once the preferred return, preferred capital and common capital have been returned, the shareholders receive their pro rata share of common ownership which can be diluted if there is incentive equity that has been triggered by hitting a certain return threshold.

^ got it, that's what I was looking for. thanks for the explanation. i'm sure this varies a lot, but is there a general ballpark range that management incentive falls into these days? Seems like back in the day funds wanted 20-25%+ returns, now seems like 15% makes funds jump in joy

Waterfalls are incredibly simple to understand and are merely meant to show how much money everyone is set to earn. For example, take a deal where there were investors 1-5, each investing different amounts. One might be the fund, another a co-invest, another additional equity thrown in after the deal closed by board members, etc. It will show the original equity investment, % ownership over all classes of shares, and the value of the equity assuming a particular exit value. There are tons of variables you have to account for when doing a cap table that are a function of the waterfall, but you'll learn those as you go.

This.

No one was judging OP's intelligence, and the OP seemed to take it pretty well. He came off as someone who said they were in banking, got a job in PE, and didn't know what a waterfall was. That's more than a little ridiculous, and is not "one tiny little thing," so people responded accordingly. OP came back in good humor and asked another question.

After re-reading the question, I now see that the OP didn't just not understand the functionality of a waterfall, but didn't even know what it was to begin with. That's rather strange. I didn't even catch the last 2 sentences where he asked "What are they?" I read too fast sometimes.

I thought he was asking about the components of how they worked, not their purpose. I stand corrected.

Help with Waterfalls (Originally Posted: 10/12/2015)

Hi All,

I was trying to build out a simple partnership waterfall today with a preferred return and ran into some questions which I was hoping someone might help me with. For this example, let's assume there is an Investor who contributes $90mm and a sponsor who contributes $10mm. The preferred return is 9%, of which the investor and sponsor get profits proportionate to their equity contribution. After 9%, all profits are split 80% to the investor and 20% to the sponsor.

So when calculating the split of cash flows to investor/sponsor.. what is the most effective way to do this? I am currently using Preferred Return (which is 9% * equity contribution) and adding any unpaid preferred returns and interest on unpaid to get total preferred returns due. Then I allocate my cash flows to the total preferred due and distribute the excess under the 80/20 structure

When calculating the split of proceeds from sale of the property.. does the entire net proceeds from sale minus any unpaid preferred returns get split 80/20? or do you deduct the equity contribution of each party and split the rest? For example.. say the property is sold for $150mm and there is no unpaid preferred returns. Do you split return the $90mm to the investor and $10mm to the sponsor and split the $50mm 80/20? Or do you just split the entire $150mm 80/20? Not sure how it is done in practice

I was reading Linneman's textbook and saw that he mentions the 20% promote is in addition to the 80% split to both investor and sponsor based on equity contribution.. so say you have $10mm of cash flow in excess of the preferred return in any given year.. you split it 80/20 so that $2mm is the promote to just the sponsor and the $8mm is split to BOTH the sponsor and investor based on their equity contributions (so of the $8mm, $7.2mm goes to the investor and $0.8mm goes to the sponsor, and the sponsor further receives $2mm of promote, so $2.8mm total). Is this done in practice? If so.. what is the best way to model this in without making the waterfall very large and confusing?

This is my first time using waterfalls and I was wondering how much I should really know for modeling tests and how much is actually used in practice.. for example, I saw that in addition to preferred returns, there can be IRR hurdles, IRR Look-Backs, IRR Catch-Ups, and IRR Claw-Backs. Should I be prepared for all of these?

Also, does anyone have any waterfall models they can PM me?

Your help is much appreciated as always

I am still somewhat new to waterfalls but I hope my comments can give you some insight. 1. That is how I've been calculating the pref tier. 2. Typically the amount that gets split 80/20 (or 70/30, whatever split for your next tier) is the whatever JV level equity is available for distribution after capital is returned and the pref has been paid. Then if you have another tier, let's say with a 15% hurdle rate, proceeds will continue to be distributed 80/20 until the equity partner receives a 15% IRR. Once the equity partner hits this IRR any remaining proceeds will be split at whatever the parties agree to, let's just say 50/50 in this case for discussion sake. 3. Based on my understanding of REFM content promote means percentage amount in addition to what the sponsor has put in. For example, in the 80/20 split the sponsor is getting a 10% promote because that is 10% greater than their 10% contribution to equity. The 50.50 tier would mean that the sponsor has a 40% promote. Say you have $20mm in cash flow in excess of the pref and capital return and $10mm of distributions to both the JV and equity partner will bring the equity partner to a 15% IRR. The sponsor gets $2mm and the equity partner gets $8mm. The $10mm remaining from that $20mm surplus over the pref and capital return would be split with $5mm going to the sponsor and $5mm going to the equity partner assuming a 50/50 split over the 15% hurdle rate.

Lookback is the most common method. I would familiarize yourself with Catch-ups and Claw-backs, but don't strain yourself with the nitty gritty. Not too long ago when I was first teaching myself waterfalls I made the mistake of getting lookback and clawback mixed up when putting together a model. I felt like such a doofus.

I hope this helps. Best of luck.

Thank you Blake, that was very helpful. I had some follow up questions I was hoping someone could help with.. I have attached a basic waterfall to my original post.

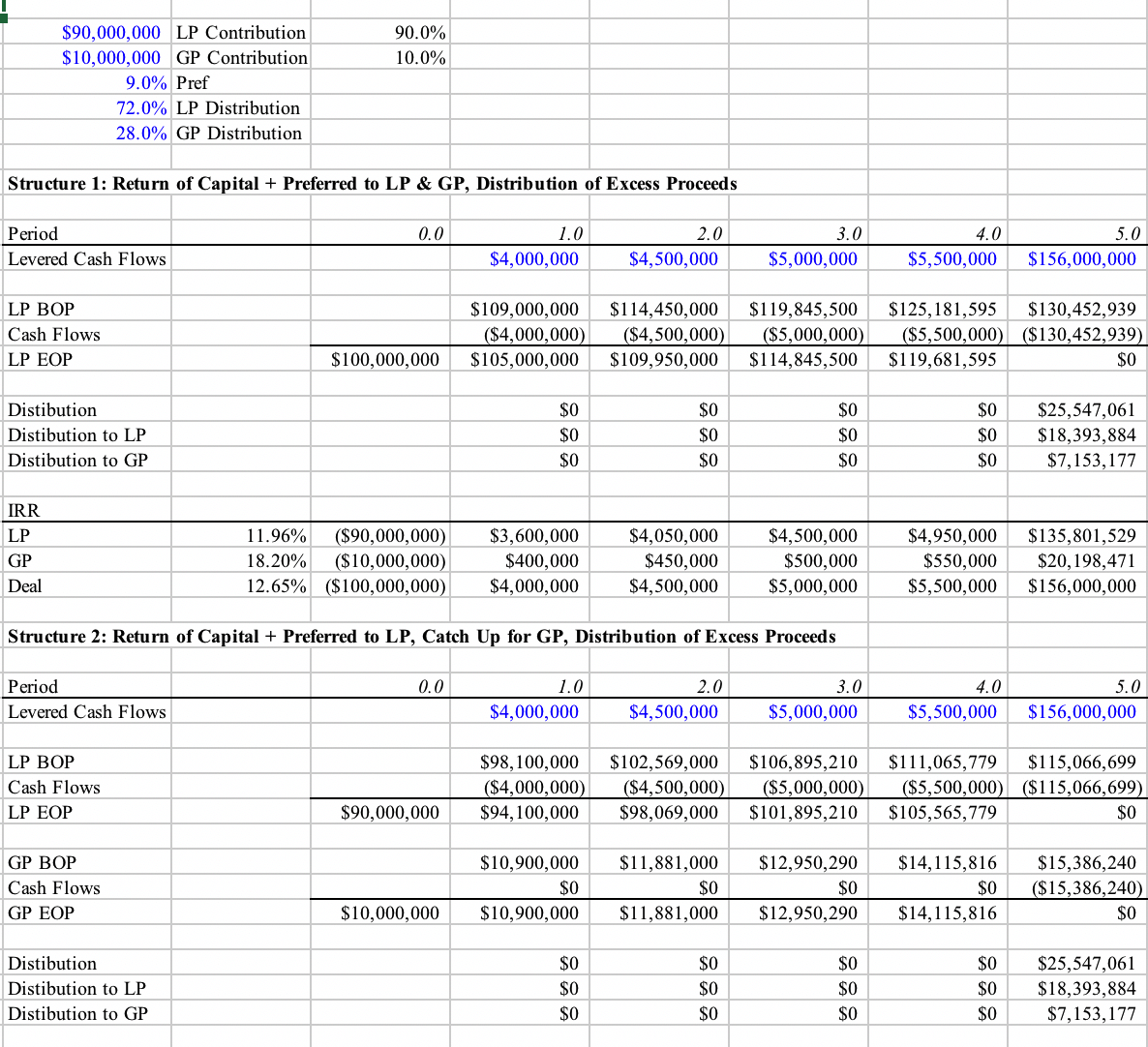

For example purposes, let's assume LP contributes $90mm and GP contributes $10mm and the preferred return is 9%, after which excess profit is distributed 72% to LP and 28% to GP

So how exactly is capital returned? Is it through levered cash flows or proceeds from sale? And who's capital is it? Both the LP and GP? Or just the LP? If just LP, then does LP also get its preferred return before GP gets its Capital or preferred return?

When capital is returned.. how does this affect preferred return? For example, does the return due get calculated based on capital remaining? (year 2 pref will be 9% of capital after payoff in year 1?)

I have tried to model out three structures based on my questions above, the first is if LP and GP both get capital back and pref return before excess profits are distributed. The second is if LP gets capital + profits, then GP gets capital + profits, then there is a distribution of excess profits. I got stuck on the third one.. if LP and GP got capital back before pref was returned.. how do you model this (related to question 2)?

72/28 is returned after the pref return is hit pari passu from the cash flow distributed from operations. So if you have 10k extra to distribute in year 2 (after the 9% pref is hit) then $7,200 and $2,800 is distributed that year, respectively. When the sale comes, the GP and LP get their initial equity back and, after the IRR hurdle has been hit (distribution of sale), the proceeds will be split to whatever is decided in the agreement (50/50 70/30 etc).

The Pref and IRR hurdle need to be hit before any straight line split takes place--whether it be Distribution from Operations or Distribution from Sale (the distributions will always reflect this until they are hit). So if the capital returned from operations does not get the LP to 9% then you will use the sale proceeds to hit that 9% (paying the unpaid returns and also the interest on those unpaid returns at the rate of the pref %). Then you will proceed with whatever is next (if the pref wasn't hit and you had to use residual money to pay the pref and unpaid interest then the next step is probably your "Distribution from Sale" IRR hurdle and not a 72/28 split). After the IRR hurdle is hit then you will be talking about a 50/50 split or whatever is agreed upon. However, Its likely that an additional IRR hurdle comes after that 1st IRR hurdle and THEN the 50/50 extra proceeds split will be distributed. No matter what happens, the pref and IRR have to be hit first and only THEN will any 72/28 distribution from operations straight line split or 50/50 distribution from sales residual straight line split take place.

The key to understanding this is there is a difference in the "Distribution from Operations" splits and the "Distributions from Sale" splits. Pref does not equal IRR. The Distribution from Operations splits does not equal the Distribution from Sale second splits. They can be the same number but they don't have to be.

I re-read this and its confusing but oh well. Maybe post your waterfall model to this forum.

"Don't go chasing waterfalls Please stick to the rivers and the lakes that you're used to I know that you're gonna have it your way or nothing at all But I think you're moving too fast"

Looked at your spread sheet example, math checks out for IRR's, however I would caution about combing your pfd return calcs with returns on excess CF. In practice, you model these waterfall's based on the terms disclosed with in the partnership / LLC agreement, meaning, every deal's waterfall can be different based on the transaction. As such, I've seen some very complicated structures, with multiple investors and management incentives, and it's important that you incorporate adequate "checks" / error handlers to keep track of everyone's payouts.

I would also suggest having inception to date checks built in to ensure that you are never above 80/20 (or whatever your split is per LPA). I recently did this and found we were below 80/20 due to something that happened years before I started. Re-read your LPA over and over and do every calc one step at a time. Do not combine steps or calcs. You will need to explain this calcs to a wide variety of people over time. Keep it simple.

Also, keep in mind that fund docs change within the same GP over time.

Consectetur harum possimus eius impedit fuga quo ut. Perferendis quo aut quis. Enim sequi libero consectetur. Perspiciatis unde pariatur error debitis magni. Laborum qui maxime praesentium nihil tempore voluptas veniam.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...

Ipsa id et possimus nemo vel. Qui odio rerum molestiae esse.

Fugit consequuntur dolore quo aliquam. Architecto optio inventore sit quibusdam at sequi eveniet non. Iure accusamus nostrum aut repellendus natus earum.

Velit dolor fuga mollitia placeat molestias sed ea. Qui et qui quod ea. Reprehenderit voluptatem voluptatem nihil neque odit. Aut distinctio et a iure sit ratione officia. Velit eius saepe labore sequi laborum nostrum.

Et et omnis ea magnam placeat eos ut. Autem repellendus omnis vel molestiae eum. Repellendus esse similique vitae fugiat dolorum alias et. Quos sapiente quo accusantium facilis. Sed illo est facere qui eum. Nemo vero magni illo quia voluptatem autem.

Fugiat sit sapiente fugiat id aliquid sint. Esse in laborum eligendi libero labore occaecati minus. Facere ut eius quis nihil. Rerum fugiat rerum sit voluptatibus autem numquam est. Officia possimus eos nemo est enim. Aliquam ad minus veniam nihil exercitationem aspernatur occaecati.

Cupiditate voluptatem consequatur rerum eum aut et velit. Architecto consequatur veniam dolorum et praesentium doloremque dolores. Consequatur reiciendis eligendi aut. Occaecati est officia voluptas amet quam corrupti nihil.