Top Financial Modeling Courses

The most popular Excel modeling courses

If you have knowledge in accounting and finance but do not know how to apply this knowledge in a real-world scenario, or want to be more prepared when it comes to acing those investment banking (IB) and private equity (PE) interviews, then these courses are for you.

The following financial modeling courses offered by Wall Street Oasis (WSO) will teach you how to build amazing Excel models from the ground up that are on par with the industry standards and hone your analytical skills. Each course will focus on a specific area or skill, which, when combined, will cover everything you need to perform the best you can in the industry. These courses are:

- Financial Statement Modeling Course

- Excel Modeling Course

- Discounted Cash Flow (DCF) Modeling Course

- Valuation Modeling Course

- Mergers & Acquisitions (M&A) Modeling Course

- Leveraged Buyout (LBO) Modeling Course

This article will go through each of these six courses and provide an overview of what will be taught, a summary of the first few modules, and what financial topics they concentrate on. In addition to this, there will also be a summary of the WSO Elite Modeling Package, which offers all six courses at a discounted price as we believe the courses are most effective when used in combination with each other.

These courses provide skills that are especially important in the real world, where the valuations provided by such models influence multi-million or even billion-dollar deals.

Financial statement modeling course

Since financial statements are the basis of every decision in the finance world, it is crucial to know how to model for them. Therefore, this course contains over sixty videos, nine modules, and five hours' worth of video lessons. The first module is a simple introduction to the Financial Statement Modeling Course, such as what topics will be covered, what you will get out of the course, and instructions for setting up and getting ready.

The other eight modules contain the content of the course, and they are:

1. Fundamental Concepts

This module contains fifteen video lessons to explain best practices when building 3-statement financial models. It includes an exercise at the end of the module and a video solution to ensure you have a good base to continue. Some of the topics covered include:

- Excel shortcuts and hotkeys

- Formatting best practices

- Formulas

- Comments

- Designing for convenience and designing to prevent errors

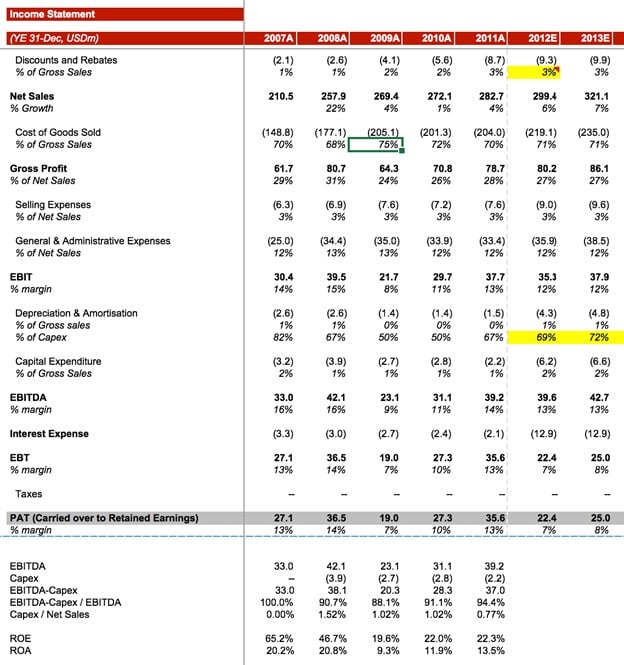

2. The Income Statement

In this module, we use five video lessons to introduce you to the income statement (IS) and how to account for historical and projected figures for a realistic use case by using the actual financials of Nike, Inc.

3. Working Capital

In this module, seven video lessons introduce you to the balance sheet and critical working capital accounts so that you don't miss any steps linking up your statements, some of which are:

- Inventories

- Prepaid expenses

- Accounts receivables (AR)

4. Bonus Module

The three video lessons in this module help you build out a more advanced model, including lessons on a detailed revenue build-up, a sensitivity analysis and macros in the context of Nike, Inc, and a final answer key with the full 3-statement financial model for Nike, Inc.

The following video from the course goes over the revenue build-up:

Excel modeling course

Excel spreadsheets are the primary tool for analysts, so this course is a must-have if you want to break into the finance industry. It has over 105 videos, ten modules, and five hours' worth of video lessons.

The first three modules are a simple introduction to the Excel Modeling Course, followed by a brief guide with eight videos on how to navigate Excel using components like hotkeys and the ribbon, and finally, a longer module on improving your Excel efficiency with tips, tricks, and best practices such as various shortcuts and using Ctrl vs. Alt.

1. Excel formatting

In this module, we use eight video lessons to expand upon the best practices in earlier modules to learn:

- Conditional formatting

- Custom number formatting

- Default formats and some other formatting tips

It also includes an exercise with aggressive benchmarking and a video solution to make sure you keep practicing until you are very productive.

2. Excel math functions

This module contains nine video lessons to help explain anchoring as well as basic and advanced math functions that will come up frequently on the job. It also includes an exercise at the end with a video solution so you can see how an actual investment banker uses these in the real world.

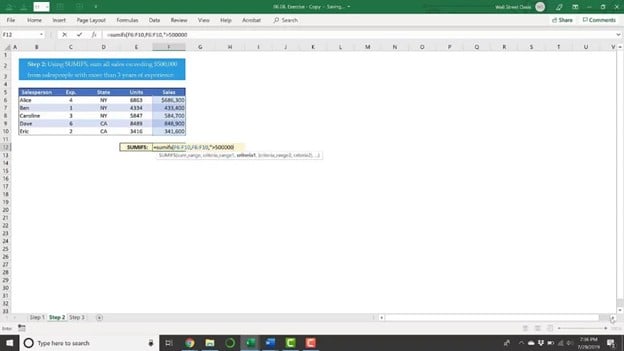

3. Excel logic and data functions

The thirteen video lessons in this module dive into some of the more complex and foundational functions used throughout financial modeling. They include:

- IF and Nested IF statements

- ISERROR

- Information Functions

- And more…

We wrap up this module with another challenging exercise.

4. Excel scenarios, data tables, and auditing

In this module, there are seven video lessons exploring data tables, naming cells, formula auditing, and scenarios so that you can take your Excel modeling to another level. This module also includes another timed benchmarking exercise.

Here is a five-minute video from the course about data tables:

DCF modeling course

Discounted cash flow (DCF) is one of the most important methods to value a company. DCF models are created by estimating the total value of all future cash inflows and outflows and then discounting them to find their present-day value. To read more about this valuation technique, we have a DCF model training free guide article that explores the concept.

Our DCF Modeling Course contains more than 75 lessons and five hours of video lessons. The first module is the usual introduction to the course, which is followed by modules that introduce you to what DCF is and the fundamentals of this valuation method, including:

- P&L terminology used in DCF valuation

- Locating relevant information to project free cash flow

- Unlevered vs. levered free cash flow

- And much more!

1. DCF - The big picture

In this module, fifteen video lessons go over the theory and logic behind valuation before we put this knowledge into practice with a Nike case. Here, you learn about:

- The valuation roadmap

- The difference between intrinsic and relative valuation

- The conceptual framework for company value

We finish off the module with a summary of the covered topics and calculations.

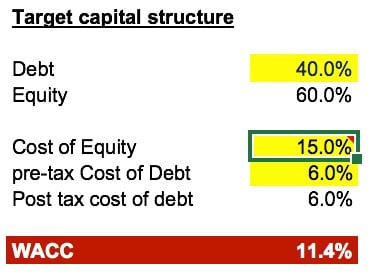

2. WACC overview

This module uses eight video lessons to cover calculating the Weighted Average Cost of Capital (WACC) and its implications on valuations.

3. Deriving share price from the NPV of future cash flows

The thirteen video lessons in this module cover how to derive a company's share price from the net present value (NPV) of future cash flows. They cover topics like:

- Bridging from enterprise value to equity value in a DCF

- Additional trading comps considerations

- Calculating the dilutive impact from options and warrants

After completing these steps, you will get the final output of a DCF model.

4. Enterprise value & equity value practice

This module contains ten video lessons that explore enterprise value (EV) and equity value, a bit more in-depth by applying the knowledge we gained so far across several practice exercises.

Here is a video from the course providing an introduction to these two concepts:

Valuation modeling course

Valuation is the process of quantifying the worth of a company or asset by placing a cash value on it. It is widely used in finance, especially by analysts in investment banking (IB) and private equity (PE) firms.

The WSO Valuation Modeling Course has over 170 courses with over ten exercises and real use cases, using companies like Google, LVMH, Nike, and many other reputable brands as examples to go through.

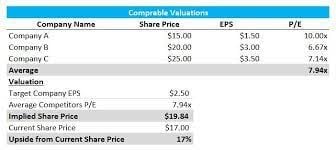

The course structure will be predominantly focused on trading comps and precedent transactions. Before this, there will be an introductory module to the course, followed by an overview of valuation as well as a lesson on EV and equity value, all of which will cover topics like:

- The valuation thought process across use cases

- The market value of equity vs. book (accounting) value of equity

- Enterprise value and equity value multiples

1. Trading comparables introduction

There are twenty video lessons in this module where we will take you on a deep dive into trading comps. Through it, you will be provided with:

- A review of key concepts like P&L terminology used in valuation

- An in-depth focus on common enterprise value and equity value multiples

- Opportunity to solidify your skills to apply these concepts with the help of a couple of practice examples, with real-life company filings and data.

2. Trading comps: The setup

This module uses 22 video lessons to do a much deeper dive into setting up trading comps. First, we cover a step-by-step process for building comps, then give you a walkthrough of an excel-based trading comps template, and finally set the foundation for our case study with a real company.

3. Precedent transactions introduction and setup

These two modules on precedent transactions contain twenty video lessons that provide an overview of the theory behind these transactions and explore the process of setting up a precedent transaction analysis using a step-by-step process. There are two examples to help students better understand the analysis, which involves topics like:

- Selecting a peer group

- Locating relevant financial information

- Spreading key financial metrics

- Benchmarking a peer group, and more.

4. Spreading real firms

To demonstrate how to spread firms, we dive into analyzing four real companies and six real-world acquisitions, which are covered in eleven modules through 83 video lessons. Trading comps are built out for the companies, and transaction comps are spread for the acquisitions, with reviews and adjustments after each one. The companies that will be analyzed are:

- Nike

- Adidas

- Lulumelon

- Under Armour

- Tiffany & LVMH

- Fitbit & Google

- Jimmy Choo & Michael Kors

- Dickies & VF

Here is a video putting everything together and wrapping up the course:

Mergers & acquisitions (M&A) modeling course

Mergers & acquisitions (M&A) is a group in an investment bank that provides advisory services to clients on the purchase, sale, and merger of private or public companies. Therefore, financial models are frequently used by M&A analysts and are an important skill to have.

Our M&A Modeling Course contains over sixty lessons covering the buy-side and sell-side process, among other topics that will prepare you to become an M&A analyst at the some of the most prestigious firms around the world.

The first few modules will focus on some basics and contextual information of these types of deals, like:

- What M&A deals are

- The importance of M&A deals

- An overview of synergies

- The three types of M&A engagements

- Pitch books

- Investment banking 101

1. Buy-side and sell-side processes

In these two modules, there are eleven video lessons - 5 that focus on buy-side mandates and six that focus on sell-side mandates. The instructor will walk you through a typical M&A process, including all key stages.

For the buy-side process, this would be:

- Initial contact and transaction assessment

- Detailed due diligence

- Agreement on price

- Transaction closing.

For the sell-side process, this would include:

- Process setup

- Initial buyer contact

- Buyer meetings

- Agreement on price

- Transaction closing.

2. Model setup

The seven video lessons used in this module give an overview of the balance sheet and transaction adjustments. You will be introduced to M&A purchase price accounting, learning how to prepare a proforma balance sheet, including assets, liabilities, and shareholders' equity to ensure they balance.

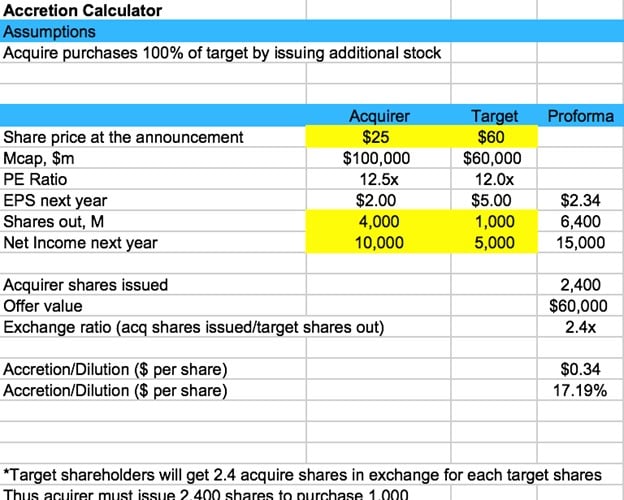

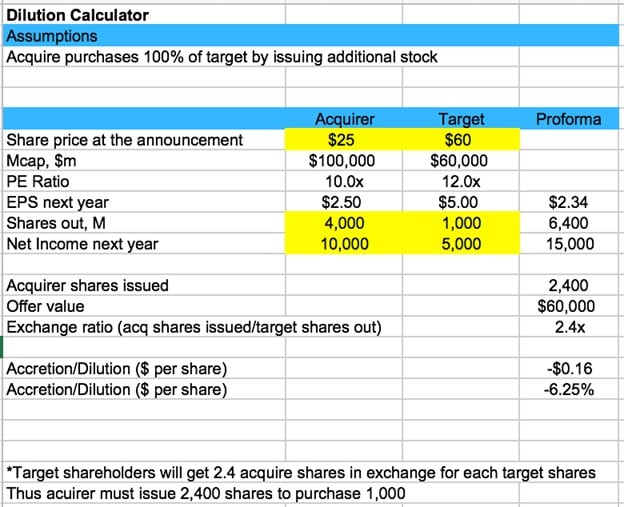

3. Simplified analysis

This module contains five video lessons to explain accretion/dilution modeling. You will use our M&A template to estimate synergies, make transaction-related adjustments, and build an accretion/dilution analysis.

You will then learn to evaluate the merit of a proposed M&A deal and the impact of the transaction on shareholders. Below is a screenshot of our dilution calculation template, which allows you to input different numbers to see the effect of these changes.

4. Detailed analysis

This module uses nine video lessons to build P&L projections required for a more robust accretion-dilution analysis. Learn the difference between simple and detailed accretion/dilution analysis, key changes to the three accounting statements, how to create pro forma P&L, debt schedule, among other important details.

Here is a video from the course that explores the different types of M&A engagements:

Leveraged buyout (LBO) modeling course

A leveraged buyout (LBO) refers to the purchase of a company while using mainly debt to finance the transaction and is usually done by private equity firms. The expectation with leveraged buyouts is that the return from the acquisition will more than outweigh the interest paid on the debt, making it a very good way to generate high returns while only risking a small amount of capital.

LBO models are used to figure out what potential returns are and to address potential risks. Knowing how to model an LBO is key if you intend to work in a PE or even a sell-side firm.

Our LBO Modeling Course contains more than 110 lessons, twelve modules, and eight hours of video lessons to demonstrate how these models work. The first module will outline the purpose of this course and provide definitions for some key terms. The second module will provide the big picture of LBO modeling before the course starts going in-depth into content regarding creating such a model. Topics that are covered in the second module include:

- How leverage magnifies returns and losses

- Debt paydown and returns

- Key drivers of return

- IRR vs. WACC

- What makes a good LBO?

1. The theory of sources and uses of cash in an acquisition

In this module, we use fourteen video lessons to provide you with an overview of sources and uses of cash in an acquisition and help you build a robust understanding of the fundamentals you need to know. You will be focusing on the theories, learning about key terms and definitions, with applications of this knowledge practiced in other modules.

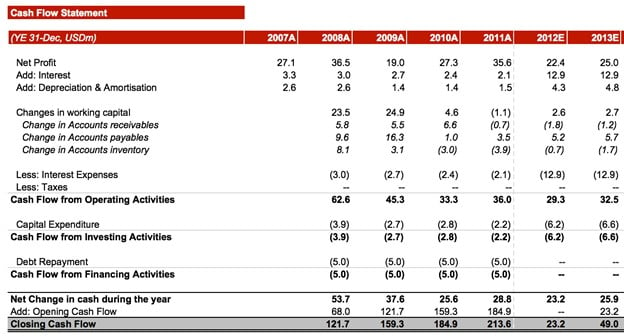

2. P&L projections and LBO adjustments

In this module, there are three video lessons to walk you through some of the key changes in P&L and adjustments made for LBO. In addition, you will be allowed to practice your modeling and linking skills for the income statement (IS) and cash flow statement (CFS).

3. Valuation and transaction assumptions

The five video lessons in this module provide you with a basic understanding of the valuation and transaction assumptions when building LBOs. You will be learning how to calculate and apply:

- Adjusted EBITDA

- Acquisition multiple

- Building enterprise value to equity value

- Implied share price and other key assumptions.

4. Debt schedule

This module contains sixteen video lessons that arguably teach the most important part of an LBO. This module provides a walkthrough on how to build a debt schedule in excel and also includes a variety of topics such as calculation of cash flow available for:

- Debt service

- Revolver schedule

- Subordinated debt schedule

- Credit metrics, and so on.

To understand why we learn this material, here is a video from the course explaining the reason:

WSO's Financial Modeling Training Courses

The WSO Elite Modeling Package is essentially an aggregation of all six modeling courses with a discount of over 50 percent. It contains over 300 lessons, fifty modules, and thirty exercises.

With this course, you will have all the technical skills required to start working in any finance career in investment banking or private equity.

Update: WSO now offering discount (76% off) for Elite Modeling Package!

*Limited time offer: Expires ...or potentially earlier once additional bonuses are announced

WSO vs competitors

Check out the following pages for unbiased comparison between our courses and those of other competitors in the market:

More about financial modeling

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?