Pitchbook

Essential Tools for Investment Banking

What is a pitch book?

A pitch book (or pitch deck) is a document used by investment banks to help pitch potential transactions to current and potential clients. It is among the most important tools used by investment bankers to help sell their services.

A career in investment banking requires thorough knowledge of both making and using them to pitch investment ideas to prospective investors.

They are used to try and win all types of deals including IPOs, sell-side or buy-side M&A mandates, debt offerings, restructuring, and other advisory services.

Along with acting as visual aids, pitch decks allow banks to try and convince their clients that they are the best bank for the job, essentially acting as a marketing tool. The purpose of pitch decks are essentially twofold:

- Convince the potential buyer that the companies on offer are good value, or the potential seller how the bank will help them gain the most value out of a deal

- Convince the potential buyer/ seller that the bank making the pitch is the best possible bank for the deal

If an investment bank doesn’t have enough live transactions to keep the junior staff busy, then a majority of their time is spent creating and editing pitch decks to help the senior staff pitch investment ideas to potential clients.

Key Takwaways

- A pitch book is a critical tool for investment banks to pitch potential transactions to clients, acting as a marketing tool to showcase expertise and past success.

- Key sections of a pitch deck include Market Update, Credentials, Deal Outline, Considerations, and Appendix, each serving a specific purpose in presenting information to clients.

- There are two main types of pitch decks: general pitch decks that provide an overview of the firm and deal-specific pitch decks tailored to a particular transaction.

- Sell-side pitch decks focus on making the company attractive to potential buyers, while buy-side pitch decks advise clients on potential acquisitions and how the bank can help close the deals.

- Constructing a pitch deck involves using existing templates with updated information, incorporating feedback from senior bankers, and ensuring accuracy in data and financial figures.

What is included in an Investment Banking Pitch Book?

Typically, a pitch deck is divided into five sections based on whether it is being presented to a potential corporate client or investor:

- Market Update

- Credentials

- Deal Outline

- Considerations

- Appendix

Although there can be many more topics covered such as investment highlights, key financial figures, the company's core customers and diversification of the customer base, barriers to entry for competitors, these are the five primary topics that encompass almost all of what is typically included in most pitch decks.

Market update

This section gives information to the client about the state of the financial markets, sector, and peers, such as current market trends and the environment, through charts, graphs, and comments.

The importance of this section is illustrated when in times of market turmoil, clients seek the expertise of investment banks to gain a better understanding of the direction of the market or the optimal time to perform a transaction.

This section then allows the bank to establish its reliability if it can provide the client with convincing arguments for the bank’s perspective on the market.

Usually, investment banks will find a way to claim that now is the best possible time to do the deal, possibly by detailing what’s unique and what opportunity is being presented.

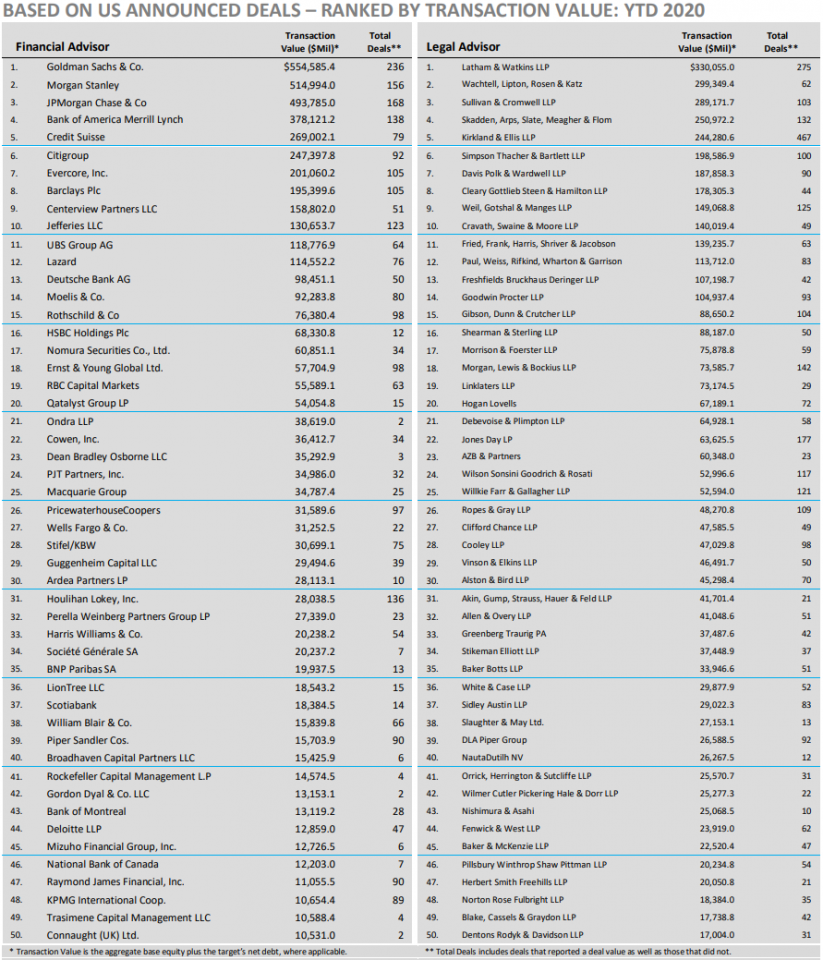

Credentials

This section introduces the bank, by using various league tables and biographies explaining why the current bank and team is the best for the job, as well as notable past transactions (typically shown in what is known as a tombstone) to enhance the credibility of the bank and provide an overview of their history.

A comparison with its competitors and a summary of these competitors can also be included here. Depending on the type of pitch book, various aspects and achievements of the investment bank can be highlighted.

Source: Wikipedia

For sell-side pitch decks, topics presented include:

- Previous transactions the team has successfully managed

- The team’s background and education

- Number of years of experience the team has in the industry

- The previous relevant positions the directors have held

For buy-side pitch decks, topics presented include:

- How extensive the personnel resources of the bank are

- Contributions that certain divisions of the bank can make to different elements of the transaction

- Contact information of different individuals listed

Deal outline section

This section provides the rationale behind completing the deal, the steps involved, and what options to consider. For sell-side deals, these options include:

- Valuation of the company

- Potential buyers

For buy-side deals:

- Potential target companies

- Valuations of these companies

Considerations

This section contains some basic charts and tables showing effects on EPS (or other relevant metrics) as well as any potential risks.

An important practice is to read the footnotes of the pitch decks very carefully as potential risks of the deal can be mentioned briefly within the pitch or just referred to as part of a company’s "execution" or "management" style without much elaboration, leading to missing out on this rather important section by the clients.

Appendix

Despite being placed at the end of the deck, this is probably the most important section. It contains the valuation model as well as the assumptions that have been used in calculating the future impact of the proposed transaction.

Here's a video from our M&A Modeling Course to give you a brief overview on assembling pitch decks:

Types of pitch decks

There are two main types of pitch decks: a general pitch deck and a pitch deck prepared for a specific deal.

As the name suggests, the general pitch deck contains information about the strengths of the firm, such as successful past mandates, current deals, and information about profits. It also provides a general overview of the firm with insights into various elements including:

- Key executives

- Company size

- Corporate history and global presence

- Past client list

- Main competitors and information about them e.g. performance and the firm’s market position against them.

The other type of pitch deck provides more details about a specific deal, detailing how the firm can deliver services that cater to a specific client. An example of such a specific type of deal that is starting to become more prevalent with an increasing number of successful startups is a company’s initial public offering (IPO).

Deal specific pitch decks make use of many types of graphs to explore in detail the market rates, trends, and the firm’s overview.

Since these pitch books place an emphasis on deals, they include a list of potential buyers, financial providers, and/or acquisitions, with a summary of proposals and recommendations for the client.

There are 2 main categories of deal pitch books - buy-side and sell-side - which are elaborated upon below.

Buy-side vs. sell-side pitch decks

There are two different types of pitch decks based on which side of the deal the firm is working on, i.e., sell-side and buy-side to suit their different needs and expertise.

Sell-side pitch decks are focused on how the investment bank would position the company in order to make it attractive to potential buyers i.e. telling companies how the bank can help them sell to buyers, hence the “sell” in "sell-side".

Also known as Mergers & Acquisitions (M&A) pitch decks, these are more popular among investment banks than other types.

They explain the company’s valuation and the expected price from a sale, using common elements like the football field valuation graph, output of a Discounted Cash Flow (DCF) model, precedent transactions, and comparable public companies.

After the valuation, there will be a (usually long) list of potential buyers followed by the appendix.

Apart from often being shorter than sell-side pitch decks, there are three main characteristics that differentiate buy-side from sell-side pitch decks:

- Buy-side pitch decks are positioned to be more about the types of acquisitions the company should pursue and how your bank will help close these deals i.e. telling companies what to buy, hence the “buy” in buy-side.

- There may be valuable information, but the purpose will be different: in buy-side deals, you value the client to estimate how much a stock issuance by them to fund the deal might be worth. You might also include quick valuations of potential targets, rather than the valuation of the client itself.

- Focused on potential targets as opposed to potential buyers. This list is often longer than the list of potential buyers because a large company could, in theory, choose from hundreds or thousands of potential targets to acquire.

Some examples of different types of pitch books can be found on our website.

How to write a pitch deck

The process of constructing a pitch deck in a sell-side investment bank is quite a sight to witness. Usually, the majority of the pages (especially in the Credentials and Market Update sections) are just lifted from an already-existing book with the names and financials changed.

80% of the work usually takes about 20% of the time with the rest of it being the details like:

- Various iterations and changes from senior bankers

- Make sure footnotes show the correct dates

- Make sure that all share prices and financial data are updated to the same date / fiscal quarter.

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?