Founders Stock

Founders stock refers to a category of equity ownership stakes issued to a company's originators during its formative phase.

The term "founders’ stock" refers to a category of equity ownership stakes issued to a company's originators during its formative phase.

Ownership interests in a corporation, signifying a portion of the firm's ownership, are commonly granted to the founding members in recognition of their contributions towards the organization's inception, evolution, and growth.

These founder-specific shares often come with unique privileges and advantages unavailable to other shareholders.

These privileges and advantages include the following:

- extended vesting periods that can range from 3 to 5 years

- preferential voting rights that grant them a greater say in company decisions

- protection against dilution to preserve their stake during future funding rounds

Initially, these shares are designated for founders and have a relatively low value. However, as the company experiences growth, achieves milestones, and becomes more successful, the potential for a substantial increase in worth becomes more likely.

Vesting schedules are a standard practice when it comes to founders' shares. This approach means that the founders gradually secure ownership of their shares over an extended timeframe, typically between 3 and 5 years.

The vesting process often includes a "cliff" period, which requires founders to remain with the company for a specific duration, usually one year, before any shares begin to vest.

By implementing vesting schedules, companies can ensure that the founding team remains dedicated to the organization's success and avoid situations where founders obtain a large portion of the company's equity without actively participating in its growth or taking responsibility.

When a company issues founders' shares, it is essential to plan the equity distribution among the founding members carefully. This allocation should consider each founder's role, expertise, and contributions to the company.

As the company grows and raises additional capital, there may be equity dilution, where the percentage of ownership the founders hold decreases as new investors come on board.

To minimize the impact of dilution, founders often negotiate anti-dilution provisions to maintain a more significant stake in the company.

As the organization expands and seeks additional capital, obtaining funds via equity financing frequently results in equity dilution. This occurs when the ownership percentage held by founders and other shareholders diminishes as new investors obtain shares in the company.

While dilution may be an expected outcome of a company's expansion, controlling and minimizing its influence on founding members and early investors is vital.

- Founders’ shares represent a category of equity ownership stakes issued to a company's founding members during its early stages, recognizing their contributions and granting them exclusive rights and benefits.

- Careful planning of equity distribution among founding members is crucial, considering each member's role, expertise, and contributions to the company.

- Equity dilution, a natural consequence of a company's growth, requires founders and investors to manage and minimize its impact through protective measures such as anti-dilution provisions, vesting schedules, preemptive rights, and employee stock options.

- Vesting schedules, including cliffs, help to ensure founders gradually earn their equity over time, incentivizing long-term commitment and continued contributions to the company's success.

- Comprehensive founder agreements are the foundation for a healthy working relationship among founders, providing a framework for decision-making, dispute resolution, and equity management.

Safeguarding measures of dilution

To lessen the impact of dilution, founders and investors may negotiate several safeguarding measures:

1. Employee stock options and equity incentive programs

Firms can provide stock options or other equity-based compensation methods to attract and retain top talent without significantly diluting existing shareholders.

These programs align the interests of employees and the company, fostering growth and long-term value creation.

2. Anti-dilution provisions

These contractual terms safeguard investors from reducing their ownership percentage due to subsequent equity issuances at a lower price per share. Full ratchet and weighted average are the two most prevalent anti-dilution provisions.

3. Vesting schedules

A vesting schedule specifies when founders, employees, and investors acquire full ownership of their shares or options.

By adopting vesting schedules, businesses can ensure long-lasting commitment from team members, minimize the chance of excessive dilution, and maintain control over the company's ownership structure.

4. Preemptive rights

These rights enable existing shareholders to preserve their ownership percentage by buying additional shares before making them available to new investors.

Preemptive rights assist current shareholders in avoiding dilution and provide them the chance to partake in upcoming funding rounds.

5. Open communication

Transparent and open communication with shareholders and potential investors is crucial for managing expectations and minimizing equity allocation and dilution disputes.

Delivering clear information about the company's plans and strategies helps establish trust and nurture a positive relationship with all stakeholders.

Vesting Schedules and "Cliffs" for Founders’ Stock

Vesting schedules are an essential aspect of the equity allocation, particularly for founders’ shares, as they ensure that founding members gradually earn their equity over time.

This approach aligns the founders' interests with the company's long-term success and encourages commitment and continued contributions.

A common feature of vesting schedules is the inclusion of "cliffs," which are predetermined periods (usually one year) during which no shares vest for the founders.

Cliffs serve as a probationary period, allowing the company to evaluate the performance and commitment of its founding members before granting them ownership of their shares.

Once the cliff period has been completed, shares typically begin to vest monthly or quarterly over a specified vesting period (e.g., three to four years).

This gradual vesting process incentivizes founders to remain with the company and continue contributing to its growth and success.

If a founder departs from the company before the cliff period ends, they will not retain any of their founder shares.

This mechanism protects the company's equity from being distributed to individuals who may not have substantially contributed to its growth or development. Additionally, it prevents potential disputes among remaining founders regarding the departing founder's unvested shares.

In some cases, vesting schedules may include performance-based milestones or other criteria that must be met for shares to vest.

These conditions can help ensure that founders are accountable for achieving specific company goals, further aligning their interests with the company's success.

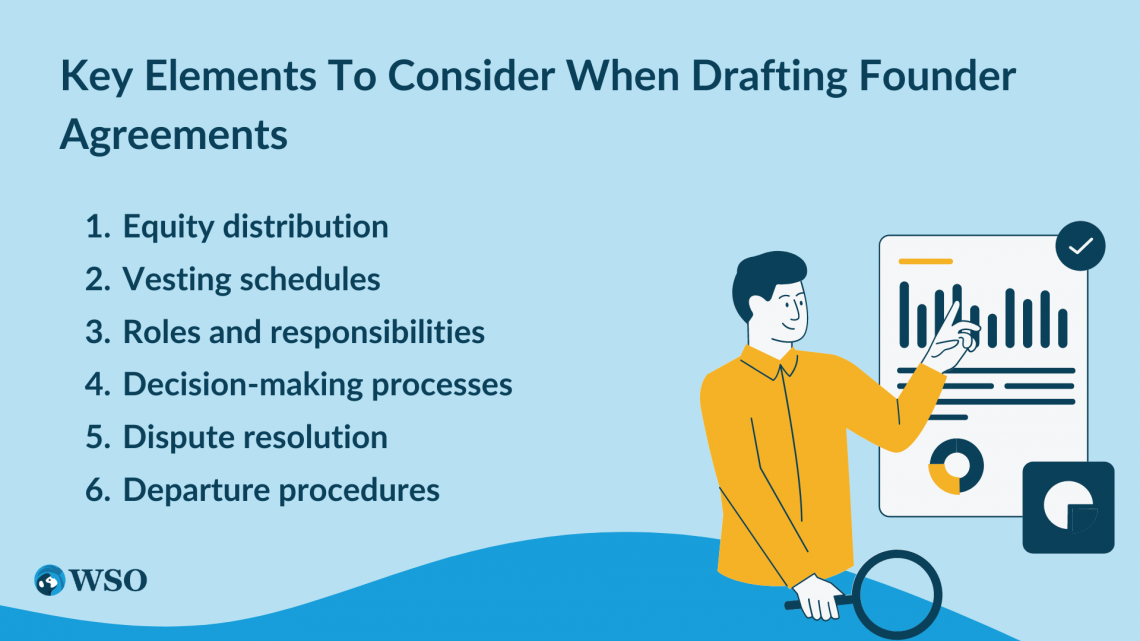

Founder Agreements

To avert potential conflicts and miscommunications among founding members, it is essential to develop comprehensive founder agreements.

These agreements are the foundation for the working relationship between founders and provide a framework for decision-making, dispute resolution, and equity management. Key elements to consider when drafting founder agreements include

1. Equity distribution

This outlines the ownership percentage for each founding member, considering their roles, expertise, and contributions to the company.

This helps establish a fair and transparent equity allocation, crucial for maintaining a positive working relationship among founders.

2. Vesting schedules

These are incorporated into the agreement to ensure that founders earn their equity over time, promoting long-term commitment and continued contributions to the company's success.

3. Roles and responsibilities

Define each founding member's specific roles, responsibilities, and expectations, ensuring that everyone understands their duties and how their performance will be assessed.

4. Decision-making processes

Establish a decision-making framework that details the procedures for making key decisions, such as hiring, fundraising, and strategic planning.

A decision-making framework can help prevent disagreements and ensure that all founders have a voice in shaping the company's future.

5. Dispute resolution

This includes provisions for resolving disputes that may arise among founders. This can involve mediation, arbitration, or other forms of dispute resolution to address conflicts fairly and promptly.

6. Departure procedures

These outline the process for handling the departure of a founder, including the treatment of their unvested shares and any non-compete or non-solicitation clauses that may apply.

By putting a well-drafted founder agreement in place, the founding team can concentrate on the company's growth and success with a clear understanding of each member's rights and obligations.

This agreement also serves as a reference for resolving future disputes or issues that may arise, helping maintain a cohesive and productive working relationship among the founding members.

Founders' shares are pivotal in the early stages of a company's journey. Comprehending the various aspects, such as equity distribution, dilution, vesting schedules, tax implications, and founder agreements.

Equity Distribution and Dilution for Founders’ Stock

When issuing founders’ shares, planning the equity distribution among founding members carefully is crucial. This distribution should consider each founder's role, expertise, contributions to the company, and any potential future changes in the business structure.

As the company grows and raises additional capital, instances of equity dilution may occur, where the percentage of ownership held by the founders decreases as new investors enter the scene.

This can happen during various stages of financing, such as seed rounds, series A, B, C, and so on.

To mitigate the dilution impact, founders often negotiate anti-dilution provisions to maintain a more substantial stake in the company.

Some strategies for managing equity dilution include:

1. Planning equity distribution wisely

Allocating equity in the company's early stages can help minimize future dilution.

Establishing a clear understanding among founding members about their equity stakes and potential dilution from future financing rounds can help set expectations and maintain a cohesive relationship among the founders.

2. Retaining control

Founders can retain control over major company decisions by implementing protective provisions in shareholder agreements.

These provisions may require the approval of a majority or supermajority of founders for specific actions, such as issuing new shares, changing the company's capital structure, or entering into significant agreements.

3. Using convertible securities

Founders can use convertible securities, such as convertible notes or SAFE (Simple Agreement for Future Equity) agreements, to raise capital without immediately diluting their equity.

These instruments allow investors to convert their investment into equity at a later date, often during a subsequent financing round, at a predetermined price or valuation.

4. Negotiating favorable terms

Founders can negotiate favorable terms with investors to minimize dilution. These may include setting a higher valuation for the company, seeking investments with a smaller equity stake, or negotiating a smaller liquidation preference for preferred stock.

5. Employee Stock Option Pool (ESOP)

Establishing an ESOP can help incentivize founders and early employees without excessively diluting the founders' equity.

ESOPs are generally created before raising capital, and investors often require allocating a certain percentage of shares for the pool.

Although dilution may be an expected outcome of a company's expansion, managing and minimizing its influence on founding members and early investors is crucial.

By adopting the strategies mentioned above and maintaining open communication with all stakeholders, founders can better manage equity dilution and continue to drive the company's growth and success.

or Want to Sign up with your social account?