3-Sigma Value Investment Management Overview

The Overall Ranking is a score from 1 star (very bad) to 5 stars (excellent) generated based on the Company Reviews of current and former employees at this company, taking everything into account.

The number you see in the middle of the donut pie chart is the simple average of these scores. If you hover over the various sections of the donut, you will see the % breakdown of each score given.

The percentile score in the title is calculated across the entire Company Database and uses an adjusted score based on Bayesian Estimates (to account for companies that have few reviews). Simply put, as a company gets more reviews, the confidence of a "true score" increases so it is pulled closer to its simple average and away from the average of the entire dataset.

- 5 Stars

- 4 Stars

- 3 Stars

- 2 Stars

- 1 Star

Company Details

3-sigma Value Investment Management, a New York-based investment firm managed by Benjamin Weinger.

3-sigma Value launched in March 2007 and utilizes a deep-value, fundamental-based, long-short investment strategy. Weinger, the firm’s portfolio manager, previously founded and was CEO of Blackwood, Inc., a trading and software development company. Weinger also held positions at Bear Stearns & Co. and Cramer Rosenthal McGlynn.

The firm’s chief operating officer, Kareen Mozes Laton, previously worked for Goldman Sachs & Co. in private wealth management.

Locations

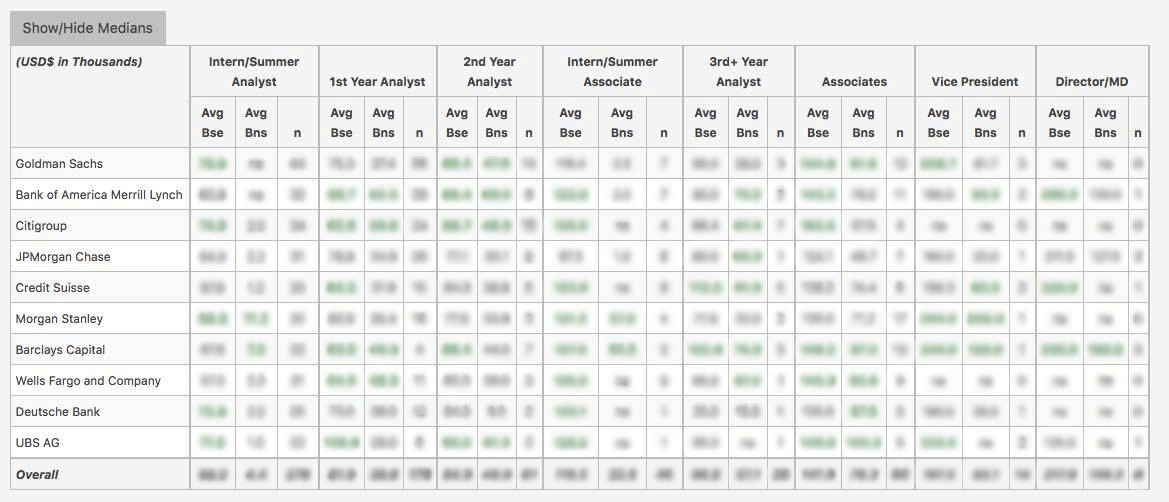

WSO Company Database Comparison Table

3-Sigma Value Investment Management Interview Questions

or Want to Sign up with your social account?