Absolute Value Fund Overview

The Overall Ranking is a score from 1 star (very bad) to 5 stars (excellent) generated based on the Company Reviews of current and former employees at this company, taking everything into account.

The number you see in the middle of the donut pie chart is the simple average of these scores. If you hover over the various sections of the donut, you will see the % breakdown of each score given.

The percentile score in the title is calculated across the entire Company Database and uses an adjusted score based on Bayesian Estimates (to account for companies that have few reviews). Simply put, as a company gets more reviews, the confidence of a "true score" increases so it is pulled closer to its simple average and away from the average of the entire dataset.

- 5 Stars

- 4 Stars

- 3 Stars

- 2 Stars

- 1 Star

Company Details

The Fund's sole objective is to maximize annualized return. Thus far, the Fund’s strategy can best be described as long/short value. The Fund has been focused in equites and commodities. The Fund has no capitalization, country or directional bias. The Portfolio Manager seeks absolute returns through determining the overall market direction which is reflected in the portfolio's net exposure. On the equity long side, key variables used to select positions are double digit earnings yield and earnings growth. On the equity short side, the fund manager prefers to short stocks of companies that are losing money. As of December 31, 2011 no leverage or derivatives have been used.

Locations

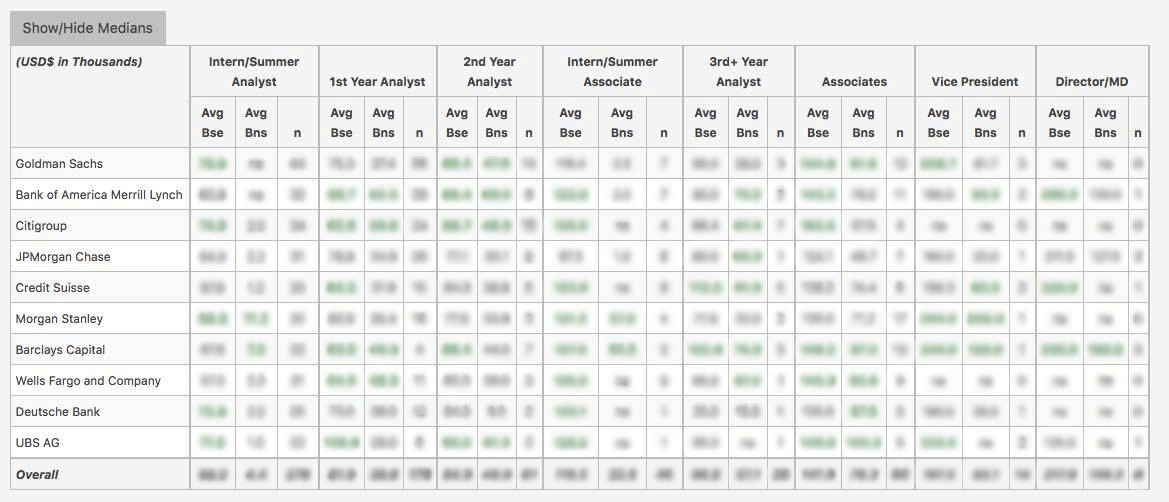

WSO Company Database Comparison Table

or Want to Sign up with your social account?