AXA Rosenberg Overview

The Overall Ranking is a score from 1 star (very bad) to 5 stars (excellent) generated based on the Company Reviews of current and former employees at this company, taking everything into account.

The number you see in the middle of the donut pie chart is the simple average of these scores. If you hover over the various sections of the donut, you will see the % breakdown of each score given.

The percentile score in the title is calculated across the entire Company Database and uses an adjusted score based on Bayesian Estimates (to account for companies that have few reviews). Simply put, as a company gets more reviews, the confidence of a "true score" increases so it is pulled closer to its simple average and away from the average of the entire dataset.

- 5 Stars

- 4 Stars

- 3 Stars

- 2 Stars

- 1 Star

Company Details

AXA Rosenberg offers a distinctive investment approach that combines fundamental philosophy with quantitative implementation, based on the belief that company fundamentals drive earnings and earnings ultimately drive price performance.

Alpha is captured using bottom-up stock selection, comparing the fundamentals of 21,000 companies globally at the finest level of detail and identifying the relative misvaluations that exist.

Locations

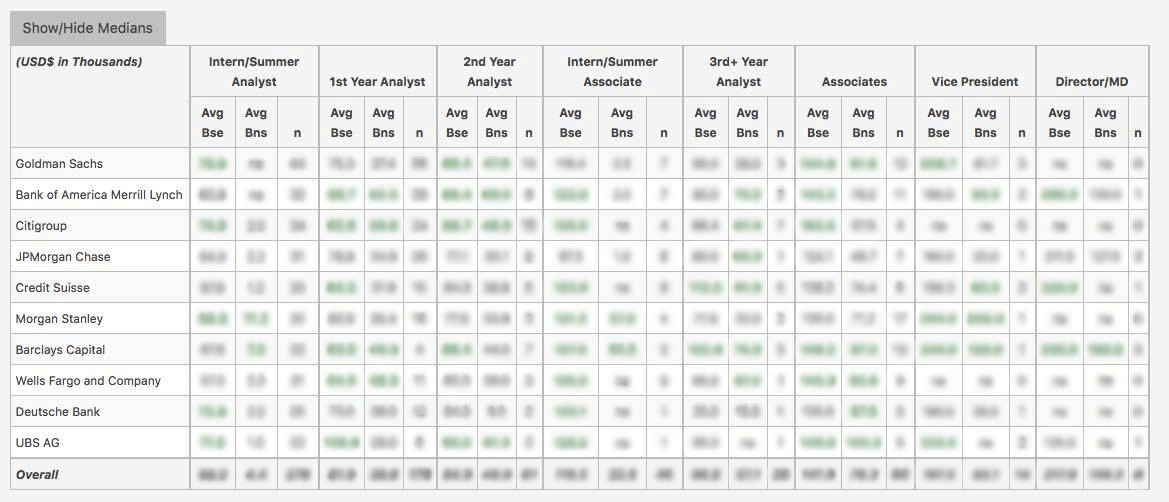

WSO Company Database Comparison Table

or Want to Sign up with your social account?