Calculating Yield on Debt

A method employed to assess the performance of debt investments

How can we calculate Yield on Debt?

The yield on Debt is the return investors can expect after holding security until its maturity. It can be calculated differently depending on what kind of security is in question.

This metric helps investors decide whether a particular security is profitable or not or if it is advantageous in comparison to other securities. This metric is used for both capital and money market securities.

It is more complicated to calculate money market securities because the maturity is less than a year. Capital market securities are used in mortgage markets for investors who want to calculate their return if the borrower defaults on a loan.

It differs from the interest rate because an interest rate is an investor's periodic return due to holding debt securities (ex: coupon payments). However, the debt yield encapsulates the interest rate and is the total return on investment.

Key Takeaways

- The yield on debt represents the return investors can expect after holding a deb instrument until its maturity.

- The calculation method varies based on the type of security being considered, such as capital market or money market securities.

- Yield on debt is relevant for both capital and money market securities. Money market securities, with a maturity of less than a year, pose additional complexities in their calculation.

- While the interest rate represents an investor's periodic return from holding debt securities (e.g., coupon payments), the yield on debt encompasses the interest rate and reflects the total return on investment.

What is the Yield on Debt?

It is the rate of return an investor can expect if they hold a debt instrument until its maturity. It is also commonly known as Yield to Maturity (YTM).

Multiple types of it are calculated differently due to their applicability to all credit securities. It can be used in both money and capital markets.

Determining investment returns is more straightforward with long-term securities. However, short-term debt securities tend to be more complicated because they use different conventions to convert the period into a year.

Investors use this metric to determine how profitable their investments will be after holding them until maturity. It is also helpful to investors because they can use this metric to compare multiple assets.

The different types of YTM can be divided into two categories:

- Money market YTM

- Capital market YTM

Money market YTMs are more complex to calculate due to their nature of maturing in less than one year.

Types of Yields on Debt

These are the main types of return metrics for short-term and long-term securities:

- Bank Discount

- Holding Period

- Effective Annual

- Money Market

- Mortgage Loan Debt

How to Calculate Bank Discount Yield (BDY)

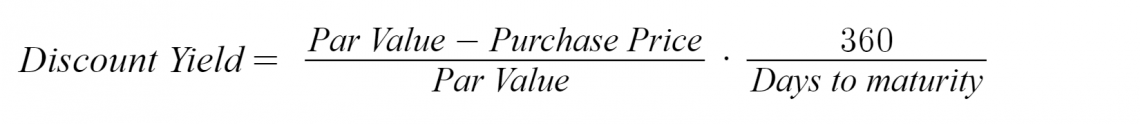

It is calculated by dividing the difference between the par value and purchase price of the security by its par value to find its discount and multiplying it by 360 over its days left to maturity.

This formula assumes there are twelve 30-day months in a year. The number 360 is used as a convention instead of 365. This can pose challenges because the calculations that use different ways will not match.

The BDY is the rate of return on a bond sold at a discount on its face value. That type of bond is called a discount bond. BDY is commonly used for money market securities such as Treasury Bills (T-Bills), municipal bonds, zero-coupon bonds, commercial paper, etc.

The formula for finding the BYD is as follows:

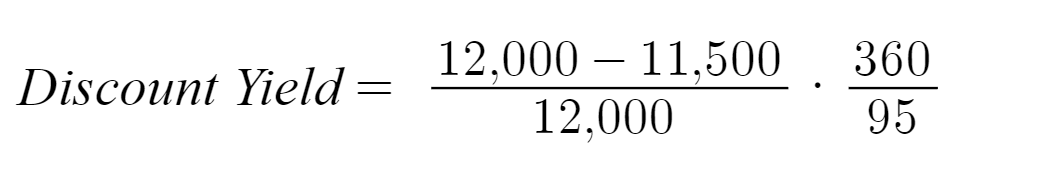

BDY Example

Say you want to purchase a bond for 11,500$, whose face value is 12,000$. It means that the bond was bought at a 500$ discount. It was issued on December 1, 2021, and will mature in 95 days. Using the formula as follows:

= 0.16 or 16%

Therefore, the return for this bond is 16%. However, if an investor chooses multiple discount bonds, they would choose the one with a higher return.

Flaws of BDY

The BDY's annualized formula is flawed and doesn't give the most accurate return on investment (ROI). For one thing, it doesn't consider potential compound returns because it assumes a 360-day year.

Likewise, the time simplification of assuming a 360-day year instead of an actual 365-day year can create errors. For example, Treasury Bills (T-Bills) are calculated on a 365-day basis. Therefore, the time convention of the formula can lead to contrasting values. The upcoming calculations are generally taught to be more accurate in determining investor returns.

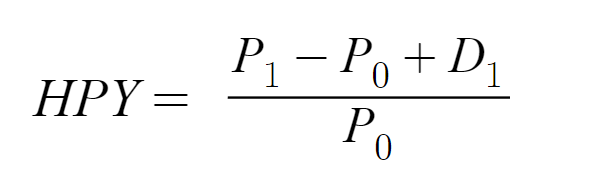

How to calculate Holding Period Yield (HPY)

An HPY calculates the return received from holding an asset or group of assets over some time, known as a holding period, and is typically expressed as a percentage.

It is calculated based on total asset returns from the asset or portfolio (income + changes in value). Stocks and other securities are considered financial assets.

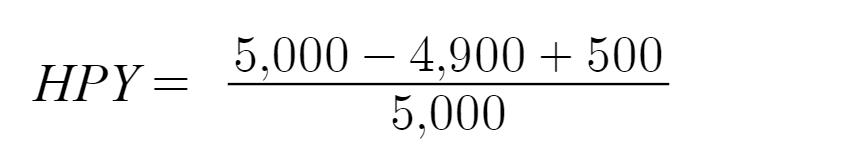

A holding period can be used in both money and capital markets. It is not annualized, so the number of days isn't included. The formula for HPY is as follows:

Where;

- P1= Amount received at maturity

- P0= Purchase price of the investment

- D1= Distribution paid at maturity

HPY Example

Say you have a security that you hold until maturity. You received 5,000$ on maturity and purchased 4,800$ prior. The distribution you received was an additional 250$. Using the formula as follows:

= 0.03 or 3%

Therefore the return on holding this security is 3%. The security that pays dividends is usually stocks. However, in the case of T-Bills, there would be no distribution or dividend because they don't pay any. So, in that case, D1 would be 0.

HPY Applications

HPY is very useful to investors because it allows them to compare the return on different assets held for a given time. That way, investors can determine which one is more profitable.

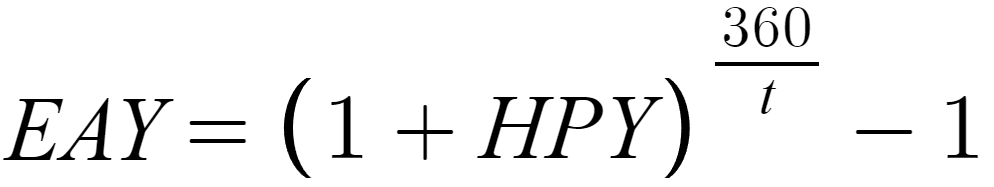

How to Calculate Effective Annual Yield (EAY)

The EAY is the rate of return on a bond with its interest payments reinvested at the same rate as its bondholder.

It is usually expressed in percentage form and can give a more accurate return than HPY because it is annualized. This is especially true when alternative investments are available, which can compound the returns.

This formula incorporates the previous calculation of the HPY and is as follows:

Where;

- t= number of days until maturity

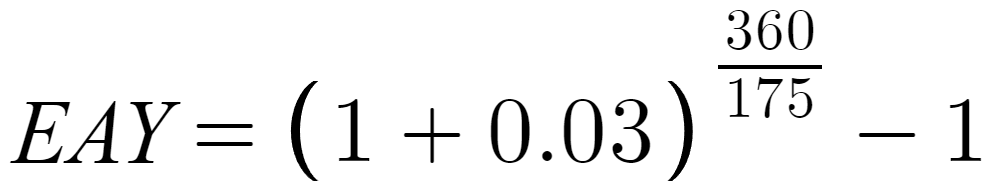

EAY Example

For instance, to build up on the previous example, if the HPY on your investment is 3% and there are 175 days left until maturity:

= 0.0635 or 6.3%

Note that the compounding frequency can significantly alter the results of the equation.

EAY Applications

The EAY gives a more realistic interest rate for investment than the simple nominal rate because it considers compounding. That is why investors use it to calculate the actual ROI and evaluate whether an instrument is trading at a discount or premium.

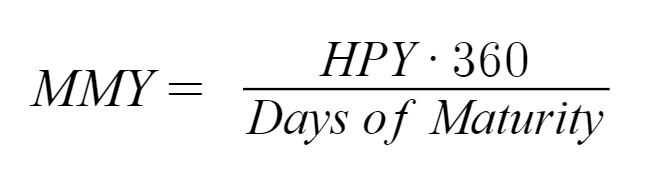

How to calculate the Money Market Yield (MMY)

MMY is calculated by multiplying the HPY with 360 and dividing it by days left to maturity. It is only used to assess returns in the money market. Therefore, an interest rate is earned by investing in securities with high liquidity and maturities of less than a year.

MMY (also known as a Credit Deposit equivalent ) allows the quoted return (on T-Bills) to be compared to an interest-bearing money market instrument.

This is because Treasury Bills have zero default risk and their returns are low compared to most corporate bonds and some certificates of deposit. Therefore, they are a safe investment and a good base comparison for other money market instruments.

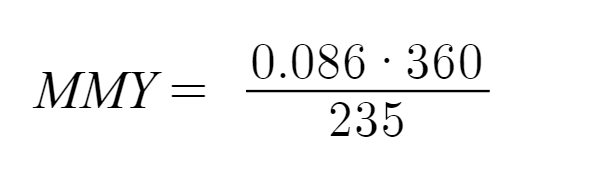

As money market instruments quote on a 360-day basis, the MMY formula also uses 360-days in its calculations. The formula goes as follows:

MMY Example

An example would be if an investor had security with an HPY of 8.6%, with 235 days left to maturity.

= 0.131or 13%

Therefore, the return on this money market security would be much higher than on T-Bills, because the return on T-Bills does not exceed 5%.

Assuming the year is 360 days also helps investors compare returns of securities that pay coupons annually, semi-annually, and quarterly.

Debt Yield in Mortgage Markets

It is an essential assessment of risk for lenders in mortgage markets. It evaluates how quickly it would take lenders to regain their losses should they possess a property after a loan default.

It also ensures that the loan amount isn't inflated due to low market cap rates, low-interest rates, and high amortization periods.

Mortgage markets are a subcategory of capital markets that deal with long-term credit securities (more than a year). Therefore, the formulas for calculating returns in these markets use capital market principles.

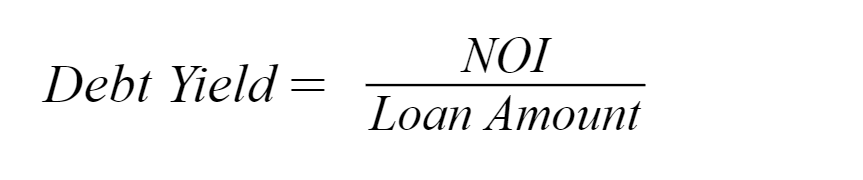

► How to Calculate the Debt Yield in Mortgage Markets:

The formula is as follows:

Where;

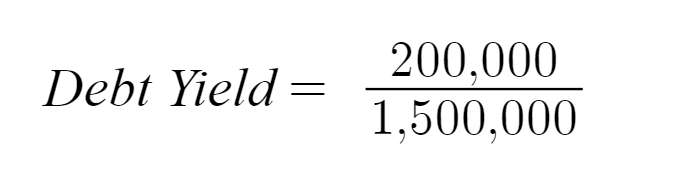

So, as an example, let's say that the commercial property's NOI is 200,000$, and the loan amount was 1,500,000$. Then, according to the formula, the answer would be:

= 0.133 or 13%

Application of Debt Yield in Mortgage Markets

The formula given is quite simple and should not be the only criteria used to determine if the investment is worthwhile. However, it creates a good base since most loan lenders require a minimum return to approve a loan. Generally, 10% is considered to be the minimum rate required.

Other factors that lenders consider are market conditions and property type. Likewise, it provides investors with a measure of risk independent of interest rate and amortization periods, which is necessary when calculating the Debt Service Coverage Ratio (DSCR) and the Loan to Value ratio (LTV).

The Bottom Line

There are four ways of calculating money market credit returns: BDY, HPY, EAY, MMY, and Mortgage Loan Debt Yield. They are all mainly used as tools for comparing and evaluating investments.

Likewise, in capital markets, the debt yield is used to calculate the return a lender would receive if the borrower were to default on the loan. It is a handy metric for decision-making, but it is pretty basic and should be used in addition to other metrics.

To address some commonly asked questions, the difference between a yield and an interest rate is that the yield considers the interest rate.

It is important to lenders because it lets them compare and assess the profitability of different securities.

Lastly, it has an inverse relationship with the price because coupon payments stay the same when the price decreases. Therefore, the value of the coupon payments increases, and the bond is sold at a premium.

Yield on Debt FAQs

The YTM is the earnings an investor can expect to get at the maturity date of the investment they are holding, usually expressed as a percentage. It considers all the dividends and coupon payments and refers to the total.

However, an interest rate is a regular return an investor can expect from a debt instrument. It is usually expressed as a percentage of the face value.

Ultimately, the interest rate gets reflected in the YTM. There are different ways of calculating both; the formula used depends on the nature of the security in question.

It is important to lenders because it calculates the rate of return on their investment and can be used in discounting cash flows to find the total expected monetary return.

It lets lenders know if the investment is worthwhile and which particular asset would be the most profitable in comparison.

Likewise, it can be used to calculate the return a lender would receive if the borrower were to default on a loan. Again, it measures the risk and ensures that the loan amount isn't inflated.

They have an inverse relationship. The YTM goes down as the price goes up, and it's true for the opposite.

This phenomenon occurs because bonds are not negatively affected by price drops due to the obligation of paying the same coupon rate as the beginning.

Therefore the interest rate will now be higher than the prior. The higher coupon rate makes these bonds attractive to investors willing to buy them at a premium.

The acceptable return for investors on bonds is more than the value of the coupon rate on a bond. If that is the case, it's said that the bond is trading at a "premium."

When the return is the same as the coupon rate, it trades at par. Lastly, when it's lower than the coupon rate, the bond is said to be trading at a discount.

Wall Street Oasis has a course on real estate modeling and other types of financial modeling courses where YTM is applicable.

Researched and authored by Anja Corbolokovic | Linkedin

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?