Medical Cost Ratio (MCR)

It determines how much money they spend on their customers' claims.

What Is the Medical Cost Ratio (MCR)?

A medical cost ratio is a tool used by private insurance companies to determine how much money they spend on their customers’ claims, hence its other name: medical loss ratio (MLR).

This ratio is calculated by dividing the client’s healthcare claims by the insurance premiums the client has paid.

Because of the nature of the ratio, a higher quotient means the insurance company is making less money and is potentially losing money on the client if the quotient is higher than 1, and a lower quotient indicates that the company is profiting off the client.

However, in recent years, there has been a minimum ratio that companies must meet, and if they do not meet this value, they must give their customers a refund.

This minimum ratio has helped improve the quality of care available for the customers and helped them only pay for what they are getting back.

Key Takeaways

- The medical cost ratio, also known as the medical loss ratio (MLR), is used by private healthcare businesses to determine how much money it spends on their customer’s healthcare.

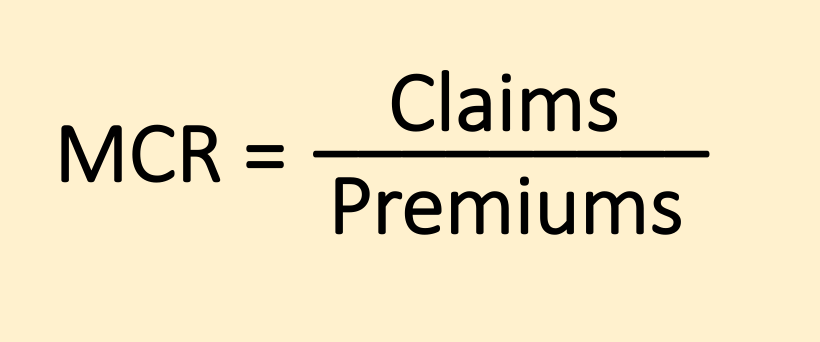

- The formula is MCR = Claims/ Premiums

- Claims include the money that the insurer pays the customer for doctor visits and treatments in accordance with the insurance policy.

- Premiums are the money that customers pay the insurance company for their service. Premiums are typically monthly.

- The Affordable Care Act, also known as Obamacare, has created changes in private healthcare. Two of these include:

- Insurance companies can have a minimum of 80% MCR when working with small groups (1-50 employees) and a minimum of 85% MCR when working with big groups (51+ employees).

- Those with pre-existing conditions cannot be discriminated against. This resulted in premiums increasing.

Understanding Medical Cost Ratio

Customers pay premiums to medical insurers, who then take on the financial responsibility of covering any future claims. The insurance company earns a return on investment by reinvesting the premiums they get. The insurer needs to collect premiums and make investment returns larger than the number of claims filed against its policies plus its fixed costs in order to earn a profit.

The medical cost ratio is a crucial indicator that insurance companies keep an eye on (MCR). This measure is calculated by dividing the total amount of compensated medical expense claims by the total amount of premiums collected.

A greater proportion denotes weaker profitability because a significant amount of premium revenue is diverted toward paying for customer claims. On the other hand, a smaller figure denotes greater profitability since it demonstrates that significant premiums remain after paying for all claims.

At least 85% of premiums paid by insurance businesses offering large plans—typically with more than 50 insured employees—must be allocated to healthcare. This implies that their MCR cannot be less than 85%.

A minimum of 80% of premiums must be allocated to healthcare by insurers specializing in small employers and individual plans, ensuring that their MCR does not go below 80%.

The remaining 20% can be used for marketing, overhead, and administrative expenses. The 80/20 rule refers to the division of spending between expenses linked to healthcare and non-healthcare.

Medical Cost Ratio Formula

This formula is one where the amount paid to the client is divided by the premium that the client paid to the insurance company. It is as follows:

Claims are a form of reimbursement that insurance companies give to their customers. Claims are made by the customer based on their insurance policy to help pay for their doctor visits and treatments.

Premiums are the (typically monthly) payments a customer pays the insurance company to keep their policy.

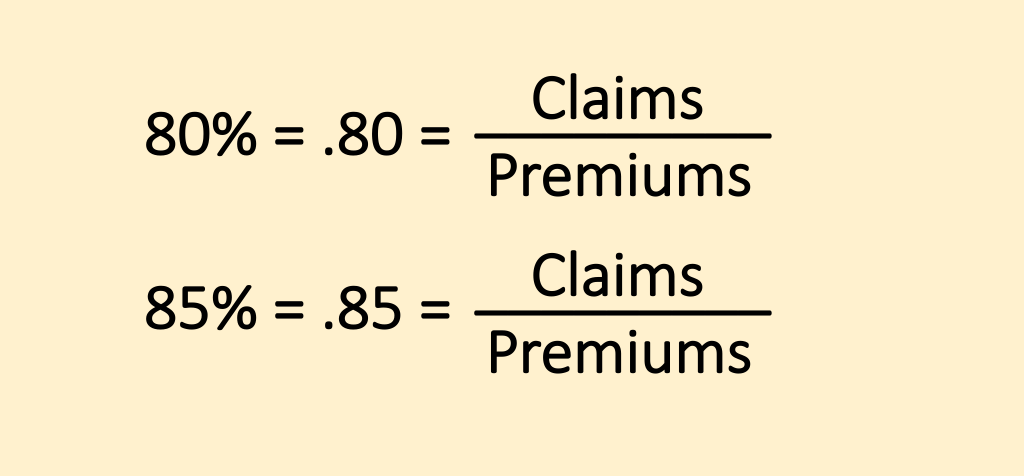

The standard MCR for a small group is 80%, whereas, for a big group, it is 85%. A small group has up to 50 employees, and a big group has over 50 employees.

We can break this down to better understand what these ideal values mean.

80% in decimal form is .80, and 85% in decimal form is .85.

When the MCR is 85%, for every $1.00 made, the insurance company puts $.85 towards the customer’s healthcare and makes a $.15 profit. When it is 80%, the company makes a $.20 profit per $1.00 paid in premiums and uses $.80 to fund its service.

After the Affordable Care Act was passed, these percentages became much more critical. Before the act, companies could have allocated even less towards claims and improving healthcare.

The ACA helped customers gain the most help while still helping insurance companies turn a profit.

If an insurer does not meet the use of 80% of premiums to pay for claims and improve healthcare, it must refund its customers.

In 2021, $2.01 billion was refunded to 10 million people across America. This averages to $150 in the small group market $1191 in the big group market, and $279 in the individual group.

Interestingly enough, in 2017, the Better Care Reconciliation Act was proposed with several functions, one of which would have removed the minimal MCR of 80%.

This could have reduced the quality of care that customers receive. However, this section was not passed, and the 80% minimum continues to be enforced.

Examples Of Medical Cost Ratio (MCR)

Now that we have understood the formula and know about the current rules of the Affordable Care Act, we can combine this information and look at examples.

Example 1:

In 2009, Very Good Insurance Company collected $200,000 in premiums from its small group customers and paid $150,000 in claims for its small group customers’ doctor’s visits and treatments.

We can calculate the company’s MCR by dividing the claims by the premiums:

MCR = Claims / Premiums

MCR = $150,000/ $200,000 = .75 = 75%

Very Good Insurance Company’s MCR is 75%.

If this happened after the ACA was signed, it would be a problem because it is less than 80% MCR. So, the company would need to issue rebates to its customers.

Example 2:

The Very Good Insurance Company is preparing for their next year and would like to calculate how much money they need to put towards claims and to improve healthcare for their clients by not giving refunds. The company anticipates $200,000 in premiums again.

We can use the same formula to calculate this:

MCR = Claims / Premiums

80% = Claims/ $200,000

.80 = Claims/ $200,000

Claims = $160,000

From this, we can understand that the company needs to pay its clients $160,000 in claims and other healthcare improvements.

Example 3:

The Very Good Insurance Company wants to know how much they lose due to the new ACA provisions.

In Example 1, $200,000 was collected in premiums, and $150,000 was paid in claims. This means there was a $50,000 profit. Therefore, as a percentage of the revenue from premiums, there was a 25% profit.

In Example 2, the company makes a 20% profit on the $200,00 collected in premiums, which is $40,000.

This means Very Good Insurance Company loses $10,000 in profit, which is 5% of the collected premiums.

The Affordable Care Act (ACA)

The Affordable Care Act (ACA) was signed into effect on March 23, 2010, by President Barack Obama. Also known as Obamacare, this law expands upon healthcare policies to help uninsured Americans access insurance.

It also helped expand the scope of private healthcare for those already insured. This act requires that insurers put 80% of their client’s insurance premiums towards healthcare improvement and expenses.

This act also helped get more older adults to get insured. Customers pay their insurance companies a premium based on their health factors; the more unhealthy a person is, the higher their premium tends to be.

However, companies cannot charge senior citizens extra for pre-existing conditions under this act. This increased premiums across the board to help insurers afford the change.

Currently, the Inflation Reduction Act of 2022 will extend the effects of the Affordable Care Act until 2025.

The act has already been extended through 2021 and 2022 as a part of the American Rescue Plan Act. The continuation of the ACA will help people through the current harsh economic times.

The American Rescue Plan Act was created to help those with financial struggles during COVID-19. This act, signed by President Joe Biden, has a direct relief section responsible for stimulus checks, unemployment insurance, small business support, and more.

or Want to Sign up with your social account?