Owner’s Equity

A fundamental concept in business finance, referring to the residual interest in the assets of an entity after deducting liabilities

What is Owner’s Equity?

Owner's equity represents the portion of a company's assets that belongs to the owner(s). It's essentially what the owner(s) would have left over if all debts and liabilities were paid off.

In simpler terms, owner's equity is like a financial snapshot of what the owner(s) truly own in the business. This is calculated by subtracting all the debts and obligations (liabilities) from the total value of assets.

The term "owner's equity" is commonly used for businesses with a single owner, known as a sole proprietorship. However, if the business is structured as a limited liability company (LLC) or a corporation, it might be referred to as stockholder's equity or shareholder's equity.

For example, if a sole proprietorship has assets worth $100,000 and liabilities totaling $60,000, then the owner's equity would be $40,000.

It's important to note that if the owner's equity is negative, it means the business owes more than it owns. This situation requires a balance sheet entry to reflect accurately.

Failing to consider liabilities properly can lead to the misconception that the owner(s) own more of the business than they actually do, as liabilities take precedence over equity.

Owner's equity provides insight into the financial health of a business. However, it's essential to understand that due to accounting principles like the cost principle, it may not necessarily reflect the business's true market value.

Therefore, while owner's equity is a valuable metric for assessing ownership, it's crucial to recognize its limitations and not solely rely on it to determine the overall worth of the business.

Key Takeaways

- Owner's Equity represents the owner's rights to a business's assets, calculated as the difference between total assets and liabilities.

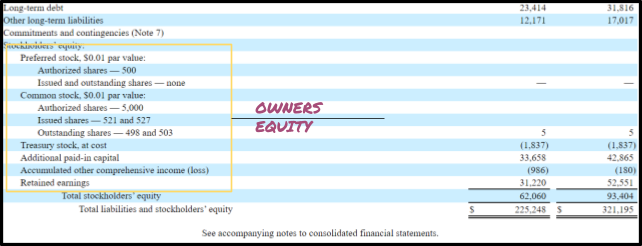

- In sole proprietorships, owner’s equity includes assets and liabilities. In corporations, it encompasses invested capital, outstanding shares, treasury stock, additional paid-in capital, and retained earnings.

- To calculate owner’s equity, add up all assets and subtract all liabilities.

- Owner's equity provides benefits such as capital infusion, absence of interest payments, and a lower risk of default.

What’s Included in Owner’s Equity?

In a proprietorship, assets and liabilities make up the owner’s equity since it is calculated by evaluating the difference between the value of the assets and the liabilities.

A) Asset: An asset is anything that you own. This might be your housing, vehicle, boat, furniture, business, or property.

B) Liability: A liability is a debt accumulated against an asset. An example of a liability would be a debt you take out against your assets (like a mortgage or loan).

In the case of a corporation or a firm, the following are the components included in the shareholder's equity:

1. Invested Capital

- Equity Share

- Preference Shares

- Additional paid-in Capital

- Outstanding shares

- Treasury Stock

2. Reserve Capital

a) Invested Capital

Invested Capital includes the shareholder's investments in the firm. It includes the following:

i) Equity Capital

Equity shares are those shares that have voting rights, but the dividend on which is paid only after the fixed-rate dividend is paid to preference shareholders. There is no fixed rate of dividend on these shares.

Also referred to as common stock, equity shareholders have voting rights and control the company's affairs.

ii) Preference Capital

Preference shares have a right to receive a fixed-rate dividend before any dividend is paid on equity shares. However, these shares do not carry any voting rights. When the company winds up, preference shareholders have a right to the return of Capital before equity shareholders.

iii) Outstanding Shares

The number of shares sold to investors but have not yet been repurchased by the company is referred to as outstanding shares. When determining the value of shareholder equity, the number of outstanding shares is considered.

iv) Treasury Stock

The term' treasury stock' describes the number of shares the company has acquired from its investors and shareholders. The number of shares accessible to investors is determined by subtracting the treasury stock amount from the total equity held by the corporation.

v) Additional paid-in Capital

The amount shareholders have paid to purchase shares over the declared par value is called the additional paid-in Capital. It is calculated by taking the selling price, the number of newly sold shares, and the difference between the par values of equity and preferred shares.

b) Retained Earnings

The returns on shareholder stock that are reinvested back into the business rather than being paid out as dividends are represented as retained profits, net income from operations, and other activities.

These earnings, as opposed to being distributed as dividends, were moved to the balance sheet and are included under shareholder's equity.

Retained profits increase in size over time due to the firm reinvesting some of its earnings. As a result, firms with a strong history may represent a majority of shareholders' equity.

How to Calculate Owner’s Equity

Calculating the equity involves adding all of the company's assets (including real estate, plant, & equipment, inventory, capital goods, etc.) and subtracting all of its liabilities (debts, wages, salaries, loans, creditors, etc.).

For example: If a real estate project is valued at $700,000 and the loan amount due is $500,000, the amount of owner’s equity, in this case, is $200,000.

When the owner or investors (in the case of a company) raise the amount of their capital contribution, the value of the equity increases. It is also increased by higher profits brought on by higher sales or lower costs.

In the case of a partnership, withdrawals by a partner might reduce the equity total. Also called capital gains, the tax must be paid on them by the owner/ partner based on the amount of the withdrawals.

Taking out a loan to buy an asset for the company, which is listed as a liability on the balance sheet, is another approach to reducing the stockholder's equity.

It can have a positive or negative value. When liabilities outweigh assets in value, there is a negative value. A change in the value of assets relative to liabilities, share repurchases, and asset depreciation are a few factors that might affect the amount of equity.

Owner’s Equity Examples

Example 1

Sharp International Ltd. started the business a year back, and at the end of the financial year ending 2020, it owned:

- Land worth $ 30,000

- Factory worth $ 20,000

- Equipment worth $ 11,000

- Inventory worth $4,000

- Debtors of $5,000 for the sales made on the credit basis

- Cash of $10,000

Also, the company owes $15,000 to the bank as it took a loan from the bank and $5,000 to the creditors for the purchases made on a credit basis.

The company wants to know the owner’s equity.

Solution:

Owner equity = Assets – Liabilities

Where,

Assets = Land + Factory + Equipment + Inventory + Debtors + Cash

= $ 30,000 + $ 20,000 + $ 11,000 + $4,000 + $5,000 + $10,000

= $ 80,000

Liabilities = Bank loan + Creditors

= $ 15,000 + $ 5,000

= $ 20,000

Therefore, the calculation is as follows,

Owner’s Equity = $ 80,000 – $ 20,000

= $ 60,000

Example 2

Bob is the owner of the machine assembling firm Jonto Ltd. and is interested in knowing the owner's equity of his business. The previous year's balance of Jonto Ltd. shows the following details:

| Particulars | Amount ($) |

|---|---|

| Factory Equipment | 250,000 |

| Warehouse | 1,000,000 |

| Inventory | 350,000 |

| Debtors | 100,000 |

| Cash | 300,000 |

| Loan | 1,000,000 |

| Creditors | 450,000 |

| Other Liabilities | 160,000 |

Solution:

Assets = Factory Equipment + Warehouse + Inventory + Debtors + Cash

= $250,000 + $1,000,000 + $350,000 + $100,000 + $300,000

= $2,000,000

Liabilities = Loan + Creditors + Other Liabilities

= $1,000,000 + $450,000 + $160,000

= $1,610,000

Owner’s Equity = Assets - Liabilities

Owner’s equity= $2,000,000 - $1,610,000

= $290,000

Thus from the above calculation, it can be said that the value of Bob's worth is $ 290,000 in the company.

Example 3

The data relating to Star International Co. Ltd is as follows:

| Particulars | Amount ($) |

|---|---|

| Common Stock | 3 million |

| Preferred Stock | 1.5 million |

| Retained Earnings | 4 million |

| Debentures @10% | 1.5 million |

| Bank Loan | 2.4 million |

Calculate Shareholder's Equity.

Solution:

Shareholder’s Equity = Common Stock + Preferred Stock + Retained Earnings

= $3,000,000 + $1,500,000 + $4,000,000

= $8.5 million

Example 4

The balance of Xcel Industries Ltd. shows the values as given below. Calculate the value of the stockholder's equity at the end of the Financial Year 2019 and 2020 using the same information.

The balance sheet details of Xcel Industries Ltd. are given below:

| Particulars | 2019 ($) | 2020 ($) |

|---|---|---|

| Assets: | ||

| Current Assets: | ||

| Cash | 25,000 | 30,000 |

| Accounts Receivables | 10,000 | 15,000 |

| Inventory | 15,000 | 10,000 |

| Non-Current Assets | ||

| Land | 150,000 | 200,000 |

| Building | 100,000 | 140,000 |

| Goodwill | 50,000 | 65,000 |

| TOTAL ASSETS | 350,000 | 460,000 |

| Liabilities and Owners Equity | ||

| Current Liability | ||

| Accounts Payable | 30,000 | 45,000 |

| Non-Current Liabilities | ||

| Bank Loan | 100,000 | 150,000 |

| Other Non-Current liabilities | 40,000 | 55,000 |

| Owners Equity | ||

| Common Stock | 100,000 | 110,000 |

| Retained Earnings | 80,000 | 100,000 |

| TOTAL LIABILITIES AND OWNER'S EQUITY | 350,000 | 460,000 |

Solution:

For the year 2019:

Total Assets = $350,000

Total Liabilities = Current Liabilities + Non Current Liabilities

= Accounts Payables + Bank Loan + Other Non-Current Liabilities

= $30,000 + $100,000 + $40,000

= $170,000

Stockholders Equity = Total Asset - Total Liabilities

= $350,000 - $170,000

= $180,000

It equals the sum of common stock ($100,000) and retained earnings ($80,000).

For the year 2020:

Total Assets = $460,000

Total Liabilities = Accounts Payables + Bank Loan + Other Non-Current Liabilities

= $45,000 + $150,000 + $55,000

= $250,000

Stockholders Equity = Total Asset - Total Liabilities

= $460,000 - $250,000

= $210,000

It equals the sum of common stock ($110,000) and retained earnings ($100,000).

Owner’s Equity Benefits

The following are some benefits:

1. Capital Infusion

It has the advantage of being split between the business owners or partners. New investors may purchase the shares, or other partners may join the company.

Until it becomes a corporate entity, the new influx of cash is not subject to many constraints. New partners imply additional expertise for the firm.

2. Not a Liability

Businesses do not have to pay interest on the equity the same way they do for borrowed Capital since the owner’s equity is not a liability. There are no financing expenses that the company can end up owing.

However, the company might choose to pay a dividend to equity owners or a set dividend for preference capital.

3. Low risk of default

A company is said to be self-reliant if it depends more on equity than on external parties like creditors. In the event of the dissolution of a company, creditors may file for bankruptcy, but owners will never do so.

Therefore, banks and other financial institutions associate more equity with a lower risk of default.

Owner’s Equity Drawbacks

In most cases, having the owner's equity on the balance sheet has no negative effects. But from various perspectives, we can identify the following things as drawbacks:

1. Cost of Equity Capital

Even though owners of equity capital are not required to pay interest, they nonetheless anticipate a healthy return on their investment. This expectation cost is significantly more than the borrowed capital interest cost.

2. Ownership Dilution

The influx of new funds is welcome. However, this frequently occurs in large corporations, where the principal owner's share or stake (who founded the corporation) decreases as and when additional investors enter the business.

This decrease in owned shared percentage alludes to ownership dilution.

3. Decrease in Control

Voting rights are connected to equity capital. More stake dilution indicates that control is distributed among more people.

Every suggestion in such a circumstance must get the assent of the majority of the shareholders, causing the management's decision to be delayed.

Therefore, a rise in owner equity results in a decrease in percentage ownership and, consequently, a proportional decrease in control.

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?