Ares Management Corporation Overview

The Overall Ranking is a score from 1 star (very bad) to 5 stars (excellent) generated based on the Company Reviews of current and former employees at this company, taking everything into account.

The number you see in the middle of the donut pie chart is the simple average of these scores. If you hover over the various sections of the donut, you will see the % breakdown of each score given.

The percentile score in the title is calculated across the entire Company Database and uses an adjusted score based on Bayesian Estimates (to account for companies that have few reviews). Simply put, as a company gets more reviews, the confidence of a "true score" increases so it is pulled closer to its simple average and away from the average of the entire dataset.

- 5 Stars

- 4 Stars

- 3 Stars

- 2 Stars

- 1 Star

Company Details

Ares Management LLC (“Ares”), an SEC registered investment adviser, is a leading investment firm focused on alternative credit-based strategies, including private equity, private debt and capital markets activities. The Firm has 452 employees and approximately $46 billion* of committed capital under management. Ares has a global presence with offices located in Los Angeles, Atlanta, Chengdu, Chicago, Dallas, Frankfurt, Hong Kong, London, Luxembourg, New York, Paris, Shanghai, Stockholm & Washington D.C.

Ares’ investment activities are conducted through three business platforms:

· Capital Markets Group: Manages U.S. and European senior secured bank loans, high yield bonds, distressed debt and other fixed income investments in a variety of funds and investment vehicles. The group has 38 investment professionals and manages approximately $24 billion of committed capital.

· Private Debt Group: Manages the assets of Ares Capital Management and Ares Capital Europe and invests primarily in self-originated / lead- agented first- and second-lien senior loans and mezzanine debt of private middle market companies. The group has 135 investment professionals and manages approximately $16 billion of committed capital.

· Private Equity Group: Makes opportunistic majority or shared- control investments, principally in under-capitalized middle market companies. The group has 34 investment professionals and approximately $6 billion of committed capital.

Locations

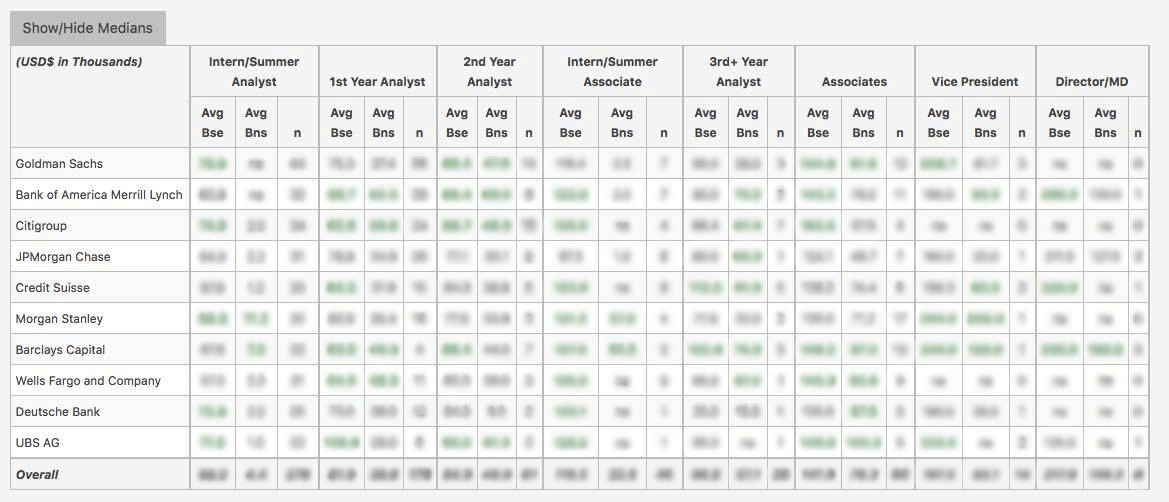

WSO Company Database Comparison Table

Ares Management Corporation Interview Questions

or Want to Sign up with your social account?