Centerboard Group Overview

The Overall Ranking is a score from 1 star (very bad) to 5 stars (excellent) generated based on the Company Reviews of current and former employees at this company, taking everything into account.

The number you see in the middle of the donut pie chart is the simple average of these scores. If you hover over the various sections of the donut, you will see the % breakdown of each score given.

The percentile score in the title is calculated across the entire Company Database and uses an adjusted score based on Bayesian Estimates (to account for companies that have few reviews). Simply put, as a company gets more reviews, the confidence of a "true score" increases so it is pulled closer to its simple average and away from the average of the entire dataset.

- 5 Stars

- 4 Stars

- 3 Stars

- 2 Stars

- 1 Star

Company Details

Centerboard was founded in early 2009 as a boutique merchant bank providing private equity, Asset Management and advisory services. Centerboard strives to create lasting value for our partners, clients and the companies in which we invest through the breadth of our experience and the depth of our execution capabilities. Centerboard and its affiliates have offices in New York, Denver and Calgary and participate primarily in the real estate, natural resources, industrial and technology industries. Through our affiliate Centerboard Securities, LLC, we also provide a range of investment banking services, including mergers and acquisitions advisory and capital raising.

Experience

The founding members of Centerboard have over 50 years of experience in M&A and capital formation transactions, having executed over $75 billion of capital raising and over $175 billion of mergers, acquisitions and other related assignments. In addition to extensive Wall Street experience, industry knowledge and sophisticated deal acumen, Centerboard senior team members are able to provide practical, hands-on operating expertise, having previously served in various operating positions including Chief Executive Officer, Chief Operating Officer, Chief Financial Officer, General Counsel, Head of Strategy and Business Development and Board positions.

Approach

Centerboard has repeatedly demonstrated its ability to adapt to the changing needs of its partners and clients by providing thoughtful, strategic counsel and having clarity of focus on achieving the best outcome, often in the absence of a “transaction”. The firm is committed to aligning long-term economic and strategic interests, resulting in broad and lasting relationships with private equity firms, corporations, institutions, government entities and high net worth individuals.

Locations

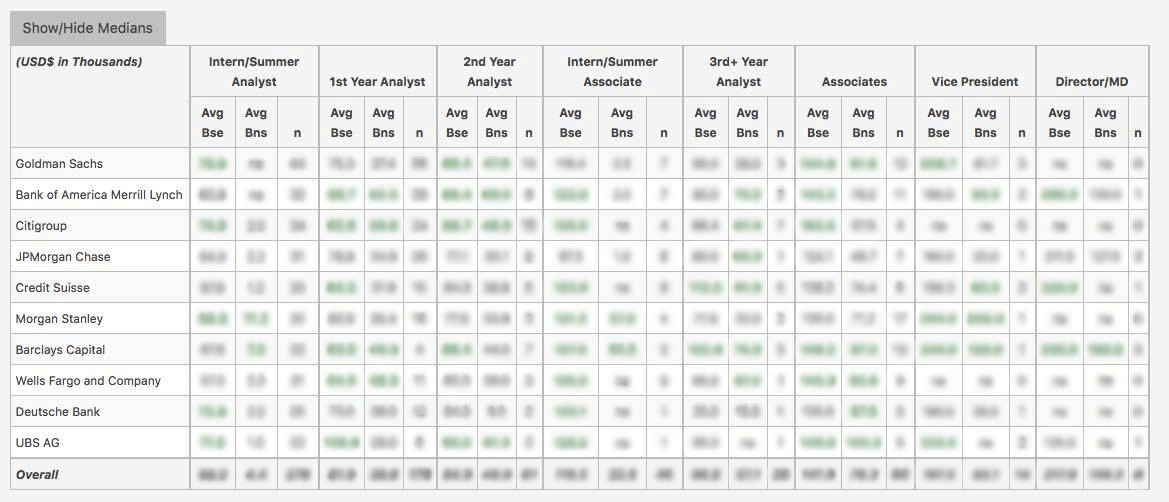

WSO Company Database Comparison Table

Centerboard Group Interview Questions

or Want to Sign up with your social account?