Grosvenor Capital Management Overview

The Overall Ranking is a score from 1 star (very bad) to 5 stars (excellent) generated based on the Company Reviews of current and former employees at this company, taking everything into account.

The number you see in the middle of the donut pie chart is the simple average of these scores. If you hover over the various sections of the donut, you will see the % breakdown of each score given.

The percentile score in the title is calculated across the entire Company Database and uses an adjusted score based on Bayesian Estimates (to account for companies that have few reviews). Simply put, as a company gets more reviews, the confidence of a "true score" increases so it is pulled closer to its simple average and away from the average of the entire dataset.

- 5 Stars

- 4 Stars

- 3 Stars

- 2 Stars

- 1 Star

Company Details

Grosvenor is one of the largest hedge fund sponsors globally. With estimated assets under management of $22.6 billion as of December 31, 2009, Grosvenor ranked as the third largest fund of fund firms, but the largest independent firm. The firm acts primarily as a fund of funds and invests in the hedge fund space.

Grosvenor primarily provides its services to pooled investment vehicles as well as investment companies and pension and profit sharing plans. Grosvenor's clients are mostly institutions, such as pension funds and endowments.

Grosvenor, which was founded in 1971, is based in Chicago. The firm is owned in part by Hellman & Friedman a leading private equity financial sponsor.

Grosvenor was founded in 1971 by Richard Elden and managed the first fund of hedge funds in the United States. In 1973, Elden brought on a partner, Frank Meyer, who had been a colleague at A.G. Becker. Elden left Grosvenor in 2006 to start Lakeview Investment Manager, which runs an activist fund of hedge funds, and Meyer retired from the business. Michael Sacks, who joined the firm in 1990, is the current chief executive officer of the company.

Locations

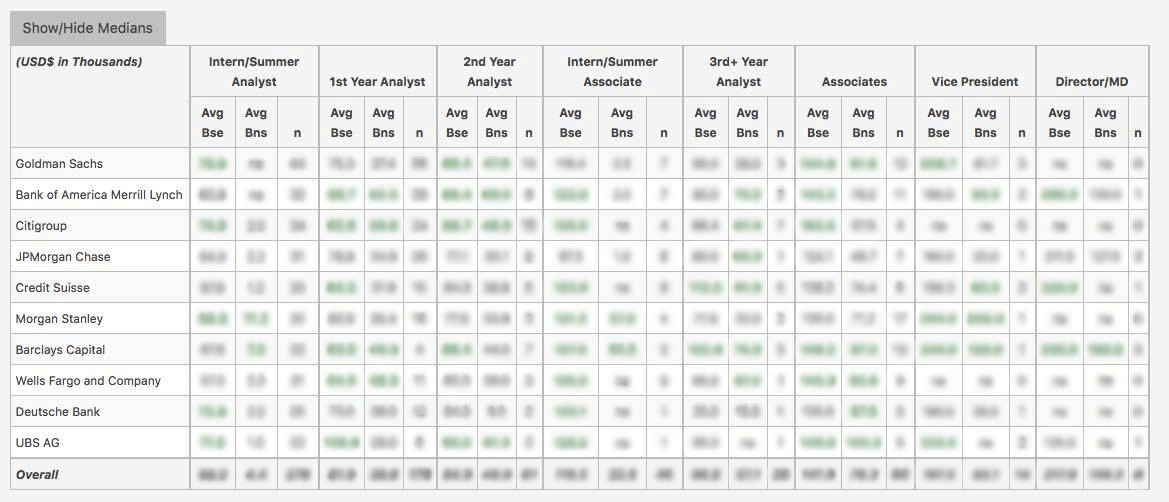

WSO Company Database Comparison Table

Grosvenor Capital Management Interview Questions

or Want to Sign up with your social account?