Middle Office

Section of a financial services firm which cannot be grouped under front office (FO/ Client Facing) or back office (BO/ Operations)

What Is The Middle Office?

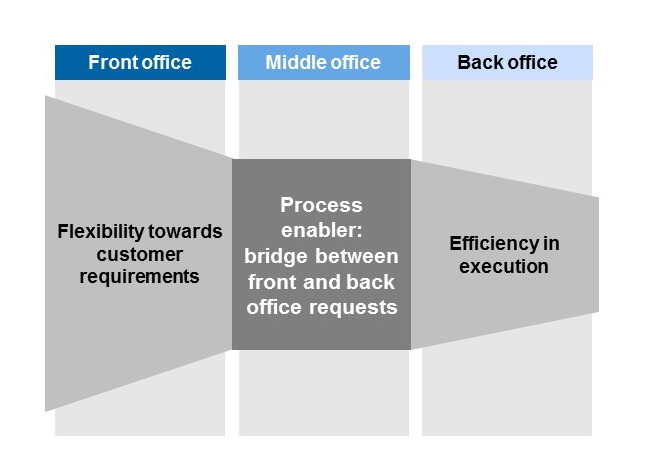

The Middle Office (MO) refers to the section of a financial services firm that cannot be grouped under the front office (FO/ Client Facing) or back office (BO/ Operations). The middle office primarily manages risk and, in some cases, handles accounting and information technology functions.

While there is some overlap between the front and back office goals, the middle office’s goals ultimately serve as the “voice of reason” in the three offices. This is primarily due to the office’s strong compliance and risk management focus.

The daily tasks of the MO include:

- Reconcile trading information to be sent to the BO

- Generate daily risk reports

- Create a standard operating procedure for client queries

- Coordinate projects with the FO and BO

- Monitor internal dealings to ensure the absence of fraud

Key Takeaways

- The Middle Office (MO) is distinct from Front Office (FO) and Back Office (BO), focusing on risk management, compliance, and some administrative tasks.

-

MO serves as a liaison between the customer-facing FO and the administrative BO, ensuring proper execution of transactions.

- The office maintains data integrity, consistency, and efficiency within financial institutions, streamlining operations and complying with regulations.

- MO staff typically hold a Bachelor's Degree and earn $60,000 to $80,000 annually, offering a better work-life balance than FO roles.

- Outsourcing to cheaper labor markets and automation with technology are changing MO roles. Adaptation to advanced tech like AI and blockchain is crucial for its future. Exit opportunities exist, including moving to the FO or pursuing an MBA.

How A Middle Office Works

A financial services corporation is typically split into 3 parts:

- Front Office

- Middle Office

- Back Office

The front office (FO) is the most customer-facing and may include Sales and Corporate Finance. FO is the primary revenue generator in a financial institution. They primarily sell their firm's financial products and services to corporations and individuals.

The MO also acts as a liaison between the front and back offices. This is done by monitoring transactions and deals done by the front office and ensuring that they are properly fulfilled and executed by the back office.

While MO is not the primary revenue generator in a financial services corporation, they are important in supporting the FO with tasks such as calculating risk, fulfilling any legal requirements of a deal, and running any necessary information technology (IT).

The back office (BO) is the least customer-facing role and may include Human Resources and Compliance departments. The back office also supports the front office by handling administrative work, compliance, and record keeping.

If a financial services corporation were a circuit, the FO would be the light bulb, the MO would be the switch, and the BO would be the battery and wires. They cannot produce much alone, but together, they can create light.

Middle Office Importance

The middle office is crucial as a financial institution's primary data hub. Without the MO, there can be inconsistencies in the firm's data quality, unnecessarily repeated information in presentations, and unnecessary time spent running reports or extracting data.

It is ultimately the job of the MO to standardize the firm's data quality, ensure a procedure for presentation creation, and streamline the reporting process. Without the middle office, a firm could devolve into a chaotic mess.

Furthermore, with the increase in new government regulations, performance returns, and unique client challenges, the Middle Office's responsibilities in a financial services company have become more complex and demanding as they develop solutions to address these issues.

Let us take a look at some of the importance of the middle office below:

1. Data Integrity and Consistency

The Middle Office serves as the custodian of a financial institution's data. Its role in standardizing and maintaining data quality ensures that the firm's information is accurate and consistent.

Without the Middle Office, data inconsistencies can arise, leading to potential errors and misinformed decision-making.

2. Efficient Operations

Middle Office operations streamline processes, such as report generation and data extraction. Establishing standardized procedures and efficient workflows minimizes redundant tasks and unnecessary time spent on administrative work.

This efficiency not only saves resources but also enhances overall productivity.

3. Adaptation to Regulatory Changes

In an environment marked by evolving government regulations and compliance requirements, the Middle Office plays a critical role. It is responsible for effectively implementing solutions and processes to meet these regulatory challenges.

Financial institutions may struggle to comply with changing rules without this function and risk non-compliance penalties.

Qualifications And Salary Of Middle Office Staff

As the MO isn’t as client-facing as the front office, the qualifications and schedule are easier, with the trade-off of a lower salary.

Compared to the front office, some key distinctions are the same minimum of a Bachelor’s Degree, a lower salary of about ~$70,000 a year, and lower work hours, allowing for a better work-life balance.

As for the future of the MO, it is becoming increasingly common for firms to outsource their back office and MO roles to overseas countries or for the work to be automated by a computer.

If you’re interested in exiting from the MO, it is possible to make it to a FO role through the use of heavy networking or a rebranding through an MBA/graduate scheme. Just be wary of being pigeonholed into a strictly MO/BO role if your end goal is to pivot out of it.

Now, let's check out both the required qualifications and the salary below:

1. Qualifications for the Middle Office Staff

Typically, people in the MO hold at least a Bachelor’s Degree. However, it is common for them to hold a Master’s Degree or an MBA. Much like a position in the front office, it helps to be from a target school, but as strongly recommended, the MO isn’t as competitive as the FO.

2. Salary of Middle Office

Employees in the middle office are usually better paid than back office staff but not as well paid as front office staff. Salary ranges from about $60,000 - $80,000 a year. To compensate for this, their work hours are not nearly as grueling as the front office, allowing for a better work-life balance.

Daily Schedule Of A Middle Office Role

Compared to the front office, the hours in the MO are not nearly as grueling. It isn’t uncommon to leave the office by 5 P.M. or 6 P.M. at the latest.

For a more detailed breakdown of the hours in an MO role, we’ve referenced a fellow user’s experience below:

| Time | Activity |

|---|---|

| 6:20 A.M. | Rise. My office isn't in NYC, but we work the hours. MO roles can be elsewhere to save the firm $$$ on compensation and rent. |

| 7:05 A.M. | Out the door, and either biking or taking the bus (psh subway, you think this is NYC?) |

| 7:15 A.M. | Arrive at the office. The building looks gorgeous, but the inside is the same as any open-plan office. We even have lockers for our stuff--who knew a BB was so like middle school? Then again, it's MO. Also, keep cereal in the locker (like everyone else's) since the milk is free. Ever wonder what goes into SG&A expenses? |

| 7:15 - 8:15 A.M. | Catch up on the news and the companies I cover. I'm in credit risk, so each day starts with me scanning SNL, WSJ, Bloomberg, etc., for information on mergers, bankruptcies, and especially rating agency actions (our contracts with counterparties often have rating-based breaks). If something occurs (Moody's writes an analysis of a sector, Crappy Bank Inc. defaults, Muppets & Co. defrauds clients...) I write a summary post and email the rest of my credit team (i.e., corporates/banks/funds/leveraged fin group) in my office and in NYC. If it's good, it gets posted to the MDs, and if you're really golden, they write back "thx"...or a list of 25 questions... |

| 8:15 - 9:15 A.M. | Generally, the day's first meeting is slotted in here. Planning for our monthly credit review meetings, for some change in our rating methodology, or a rearrangement of our portfolios. |

| 9:15 - 9:30 A.M. | Starbucks, because our coffee in the office is ________. |

| 9:30 - 11:30 A.M. | Review writing, part 1: We operate on a monthly review cycle--each analyst covers several hundred counterparties (not like equity research!) sorted by industry and/or geography. So a corporate group will have an analyst for TMT, for airlines/transport, for resources; financials will have insurance analysts, emerging markets coverage, munis may or may not be thrown in here; some firms may also split off their fund's coverage from FIs while others include it. |

| 11:30 A.M. | Lunch! Not everything about MO is bad. IBD may get the pay and prestige, but we get hour-long lunches most days (at least if you're productive). Christmas is over, though, so no more 2-hour sushi lunches with sake... |

| 12:30 - 4:00 P.M. | Reviews, part 2. There may also be more meetings on side projects--credit risk tends to get pulled into some interesting firmwide projects since the higher-ups like a range of views. So it could be on tax policy, regulatory strategy, the Fed's latest diktats...it's a nice break from the more tedious review writing.. |

| 4:00 P.M. | Is it a Friday? Go home since your VPs left at 3:45. Is it not a Friday? Is the MD gone? Leave 5 minutes after the VPs; yes, facetime also matters here. |

| 5:00 P.M. | Facetime only matters so much. GO HOME. Seriously--the VPs don't care after this point. Unless your work isn't done, in which case you stay late. Or you have a call with an Asian office. |

| 6:30 P.M. | If you're finishing up that team call with Tokyo/HK/SG, send some pings to your team about dinner. Order dinner--make sure also to get lunch for tomorrow. Our dinner is the same as NYC's but goes much farther. Time it so you're done eating by 8:05. Leave.. |

| 8:10 P.M. | No one is here. Not even the cleaners; they left at 7:45 |

| 10 - 10:30 P.M. | Bed. This city isn't known for its nightlife. Seriously. |

How Middle Offices Are Changing

To cut costs, financial service corporations have been moving their middle office and back office positions to overseas countries where the populous is still well educated, but the labor is significantly cheaper. Some countries where the work has been exported are India and Ireland.

Financial firms have also been shifting to automate their MO and BO positions with computer systems as technology advances. These computer systems allow the firm to reduce operation costs and increase efficiency.

In the future, the Middle Office must embrace advanced technologies like AI and blockchain to enhance data management, automate processes, and ensure compliance with increasingly complex regulations.

Adaptability, cybersecurity measures, and a focus on strategic insights will be crucial for its continued relevance in the evolving financial landscape.

Middle Office Exit Opportunities

While you can continue to progress your career to more senior roles in the MO, many people exit the MO through an MBA or alternative graduate scheme.

It can be very easy to get pigeonholed into a MO or back office position, and if your end goal is to make it to the front office, then it is recommended to network as much as possible continually.

It can ultimately be possible to make it to a FO role. However, the skills you will have learned through your time in MO act more as “the basics” rather than some of the more hard marketable skills gained from FO.

To learn more users' thoughts on exit opportunities out of MO, reference this forum.

Professionals in the Middle Office can transition to various roles, including risk management, data analysis, compliance, and operations.

They can explore career paths in the Front Office, such as trading or client relations, or move into management roles within the Middle Office or Back Office. Cross-industry opportunities in analytics and finance also exist.

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?