Scotiabank Overview

The Overall Ranking is a score from 1 star (very bad) to 5 stars (excellent) generated based on the Company Reviews of current and former employees at this company, taking everything into account.

The number you see in the middle of the donut pie chart is the simple average of these scores. If you hover over the various sections of the donut, you will see the % breakdown of each score given.

The percentile score in the title is calculated across the entire Company Database and uses an adjusted score based on Bayesian Estimates (to account for companies that have few reviews). Simply put, as a company gets more reviews, the confidence of a "true score" increases so it is pulled closer to its simple average and away from the average of the entire dataset.

- 5 Stars

- 4 Stars

- 3 Stars

- 2 Stars

- 1 Star

Company Details

Scotiabank, through our Global Banking and Markets division, provides corporate and investment banking and capital markets products and services to corporate, institutional and government clients around the globe. We have over 30 offices globally and more than 300 relationship managers organized around industry specialties. Our global operations are divided into two primary business units: Global Corporate and Investment Banking and Global Capital Markets.

The Global Corporate and Investment Banking division is organized geographically and provides products that are relevant to the financing and strategic development needs of our clients. The unit includes the following departments:

Corporate Banking

Canada, United States, Mexico, Colombia, Peru, Chile, Europe

Global Investment Banking

Equity Capital Markets

Mergers & Acquisitions

Global Oil and Gas M&A (Scotia Waterous)

Global Infrastructure Finance

Global Loan Syndications

Loan portfolio management

The Global Capital Markets division provides a broad range of financial products and services to institutional investors and represents our trading business. The unit is organized functionally along the following global product lines:

Global Fixed Income

Global Equity

Global Foreign Exchange

Precious and Base Metals (ScotiaMocatta)

Global Infrastructure Finance

Global Energy Solutions

Buy-Side Relationship Management

Risk Management

Global Capital Markets Banking

Each of our business units has been structured to provide clients with the highest possible level of service and product expertise.

Locations

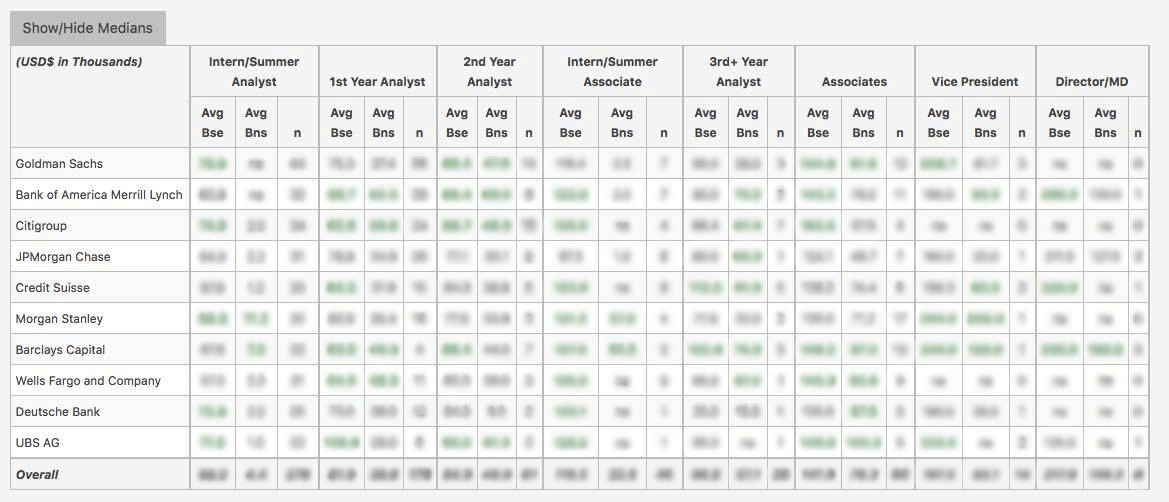

WSO Company Database Comparison Table

Scotiabank Interview Questions

or Want to Sign up with your social account?