Unilever Ventures Overview

The Overall Ranking is a score from 1 star (very bad) to 5 stars (excellent) generated based on the Company Reviews of current and former employees at this company, taking everything into account.

The number you see in the middle of the donut pie chart is the simple average of these scores. If you hover over the various sections of the donut, you will see the % breakdown of each score given.

The percentile score in the title is calculated across the entire Company Database and uses an adjusted score based on Bayesian Estimates (to account for companies that have few reviews). Simply put, as a company gets more reviews, the confidence of a "true score" increases so it is pulled closer to its simple average and away from the average of the entire dataset.

- 5 Stars

- 4 Stars

- 3 Stars

- 2 Stars

- 1 Star

Company Details

Unilever Ventures (UV) is the global VC arm of Unilever. UV invests in early stage companies which could:

- Become strategically relevant to Unilever,

- Benefit from access to Unilever’s assets and capabilities,or

- Provide strategic products/services to Unilever.

UV focuses its investments on:

- Personal Care,

- Digital Marketing,

- Refreshment, and

- Technology that could be deployed to help Unilever’s sustainability mission.

UV invests funds of various sizes:

- Small amounts (€100,000-€500,000) in companies where the value proposition is still being proven, and

- Larger amounts (up to €10M in stages) to fund expansion.

UV invests in companies in the following stages of development:

- Start-up capital – UV provides strategic and business planning advice and can help assemble high quality management teams around exciting new business propositions. These opportunities will typically originate from within Unilever and typically use Unilever IP or brands.

- Expansion / Development capital – UV invests in more established businesses that require funding to accelerate growth.

- Buyouts – UV considers buy-outs as a lead or co-investor in businesses with a capitalisation of up to €50M. Companies must fit UV's investment criteria either as stand-alone investments or as strategic additions to one of its existing portfolio companies.

Notable investments include: Brandtone (mobile marketing), Brainjuicer (online market research consultancy), Froosh AB (Scandinavian smoothie), Voltea Limited (water treatment) and Yummly (semantic search engine for food, cooking and recipes).

Locations

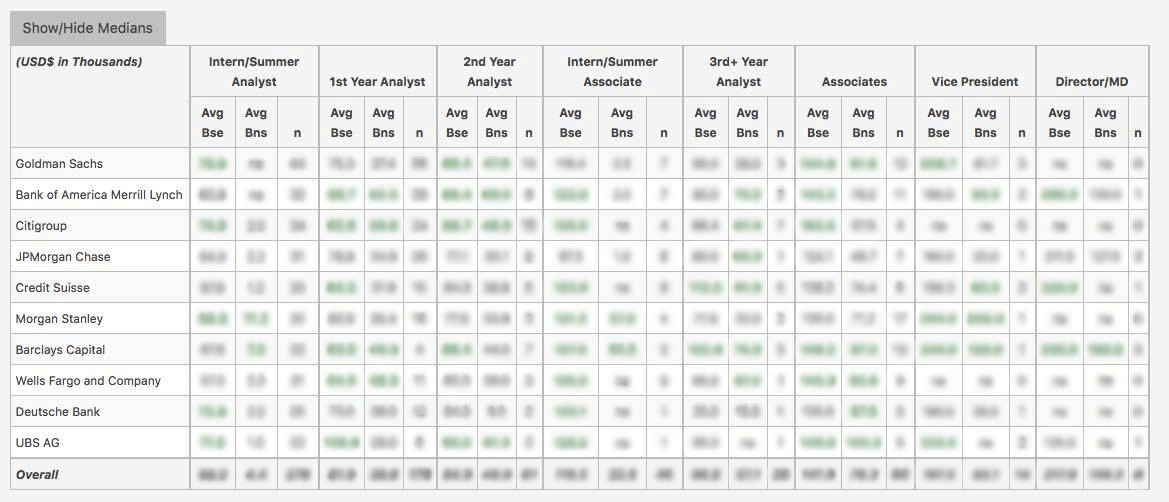

WSO Company Database Comparison Table

Unilever Ventures Interview Questions

or Want to Sign up with your social account?