CASE STUDY HELP: How to Model Rents with High Vacancy?

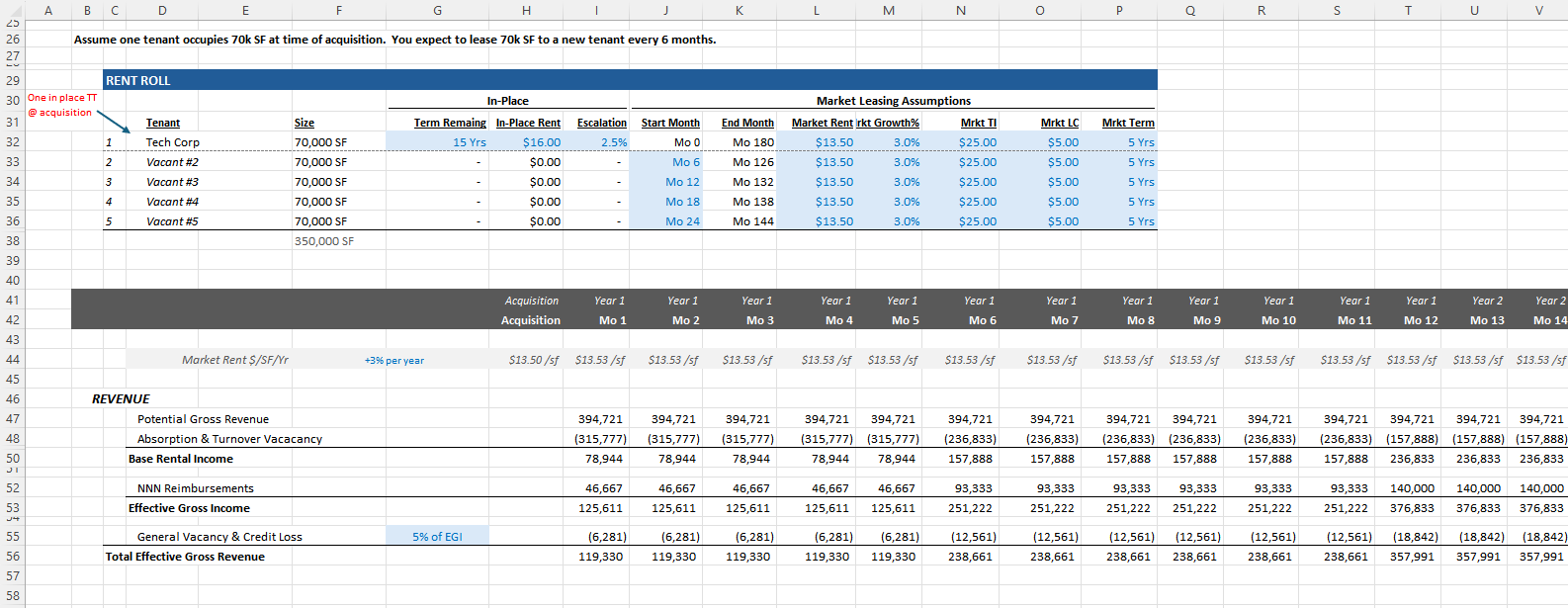

What's the best way to model revenue for an value-add office/retail/industrial deal? I'm working on a case study (screenshot below of what I have so far), and I don't think I'm doing it correctly.

With an office property that has super high vacancy and will have an extended lease up period, should I approach it by modeling 1) the actual rental income I expect (i.e. in-place lease + market lease assumptions), not use GPR - Vacancy =EGI, or 2) calculate the GPR (as if 100% occupied & 100% @ market rate) and then subtract the vacancy the accounts for all the vacant units? If I take the 2nd approach, wouldn't I need to include (gain)loss-to-lease because the one in-place tenant is paying above market rents?

Sorry I'm super confused on how to do this. I don't have much experience modeling office leases. Thanks for any help!

Case Study Background: the property consists of five office buildings, each having 70k sf (combined total of 350k). Only one of buildings is occupied (Tech Corp) at the time of acquisition and will remain for the entire analysis. Tech Corp, the in-place tenant, is paying $16.00 psf, which is above the market rent of $13.50 psf. Assume that you will lease one building (70k sf) every 6 months until the property if full occupied.

You can take either approach and arrive at the same answer, though for #2 you would want to do the gain to lease for that above market rent and loss to lease for any downtime. I think when it comes to modeling/forecasting #2 is preferred.

Awesome, thank you! Is one of the approaches more common than the other or it doesn't really matter?

Natus asperiores reiciendis itaque. Nemo et aliquam odio libero et. Et voluptatem molestiae voluptas qui doloribus. Non maxime quia quasi voluptas.

Repellat dignissimos tempore est eum iusto adipisci. Eius est hic cum ab fuga sit ullam. Ad pariatur maiores eum quo nostrum consequuntur. Iure quia dolorum corporis eligendi id similique. Iure in nostrum rerum inventore praesentium qui. Ut repellat necessitatibus corporis omnis.

Recusandae et tenetur qui consequatur. Minima eius autem laboriosam natus aut. Quasi molestias quia natus vero quia suscipit tenetur.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...