Australian Employment report - Feb 18th 2021

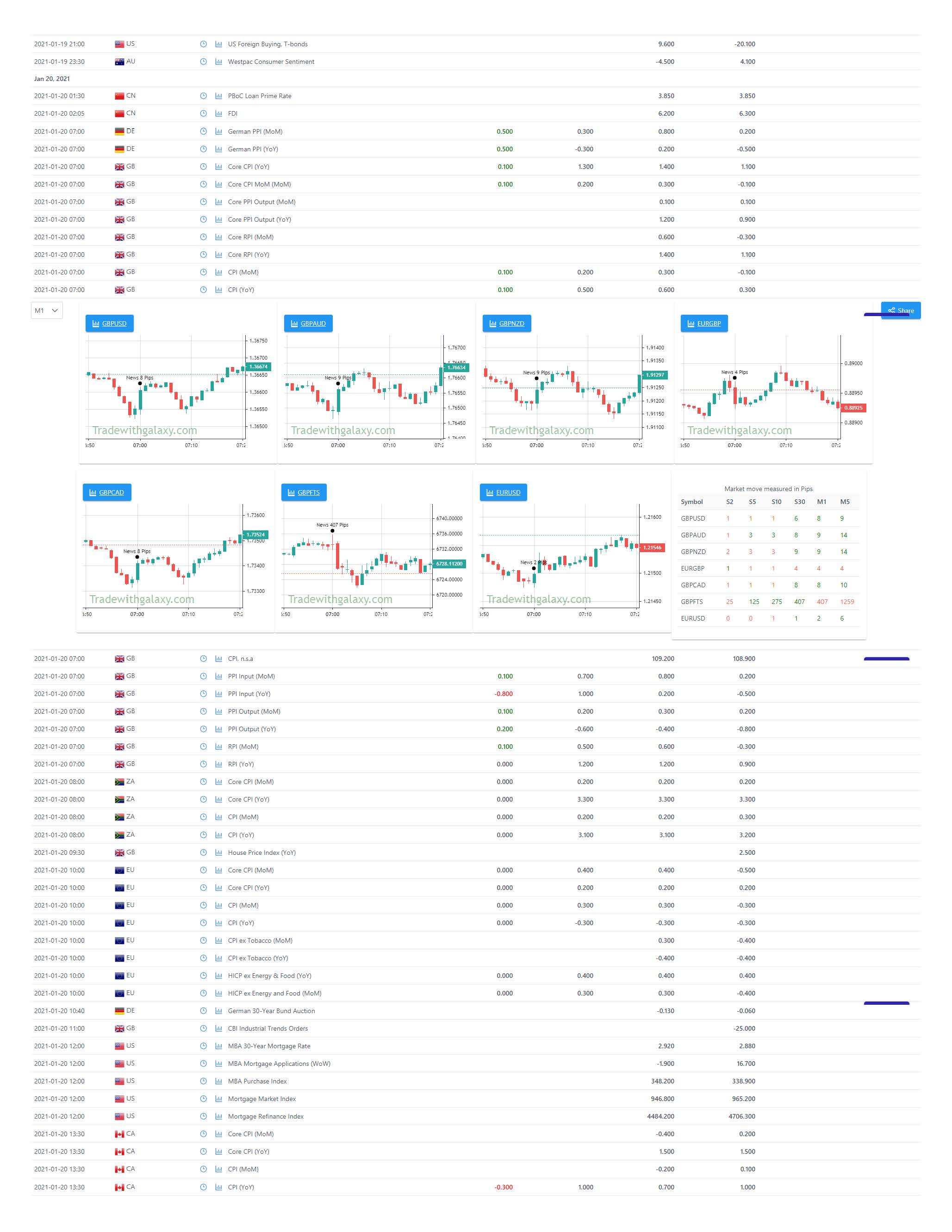

Australian data is showing more signs of pushing the Aussie dollar around when we get a good surprise. Employment is a key metric for the Aussy as the RBA is watching it! Last time we really didn't get that much  of a deviation, with just -0.1 in Unemployment creating a small 4 pip move. Not enough to trade, but does show that the Aussie is sensitive to a deviation.

of a deviation, with just -0.1 in Unemployment creating a small 4 pip move. Not enough to trade, but does show that the Aussie is sensitive to a deviation.

Check out the move here...

It is important that we consider the 3 main lines in any trading decision, Employment = The headline number of how many jobs are gained or lost.

Full Time = How many of those jobs are Full-time positions, as opposed to Part-Time. This is important as a big positive surprise in Employment number may look good initially, but if it's made up of many Part-time positions, well that's not good at all!

Unemployment= This line is important! the RBA is watching this line specifically, and will be key to any trade's success! This month the forecast ranges are tighter than normal, so that helps if our triggers are hit! Trade Plan...No Slippage control...Trade on

AUDNZD

T1 TEST = EC=50K & UE= 0.2 & FT=38K all must dev

T2 VERY SMALL= EC=50K & UE= 0.4 & FT=38K all must dev

or

T2 VERY SMALL= EC=100K & UE= 0.3 & FT=38K all must dev

T3 SMALL =EC= 50K & UE=0.8 & FT=38K all must devWith Slippage control..

Trade on

GBPAUD Slippage of = 5/7/8 pips of slippage

EURAUD Slippage of = 5/7/8 pips of slippage T1 TEST = EC=40K & UE= 0.2 & FT=38K all must dev

T2 VERY SMALL= EC=40K & UE= 0.4 & FT=38K all must dev

or

T2 VERY SMALL= EC=100K & UE= 0.3 & FT=38K all must dev

T3 SMALL =EC= 40K & UE=0.8 & FT=38K all must dev

Et consequuntur sit et dolor occaecati numquam accusantium. Vel necessitatibus consectetur provident fugit quos quaerat.

Error iusto explicabo aspernatur provident sint. Eos explicabo autem consequuntur quia quae aspernatur error. Neque dolor rerum qui consequatur dolorem voluptatem illum. Quasi culpa autem aut magni placeat amet assumenda. Aspernatur sit neque in atque ducimus ex cupiditate. Et sequi aut est repellat ut ad.

Dolorum deserunt quos natus eum et. Et accusamus qui nihil maiores. Explicabo adipisci sit dolorem dolore est aut id. Quia unde eligendi et ipsa.

Accusantium ad suscipit enim minus vel est. Dolorem totam sint cum in quidem qui non. Accusantium quo dolorem ab dolor nihil vitae corrupti.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...