One day, three bankruptcies

MARKETS

- U.S. markets: With the coronavirus dominating headlines, U.S. stocks had their worst day in over three months. But if you think the whole thing is overblown as an economic risk...you’d have history on your side. In 2003, the S&P gained more than 10% from the start of the SARS outbreak to when it was contained.

- Oil: The price of Brent crude is down roughly 10% since China confirmed the death of a second person from the virus. Investors are worried that the virus will slow the global economy and reduce demand for fuel.

Want Morning Brew Daily Served Fresh to Your Inbox?

Drop Your Email Below...

TRADING

Slow and Steady Doesn't Win the HFT Race

We like to race Google Maps to turn that 13 minute walk into a brisk 11. But in the financial markets, high-frequency traders are scurrying to execute trades by margins of 0.000005 seconds. According to a study released yesterday by British regulators, that head-to-head could cost investors $4.8 billion annually, the WSJ reports.

Let's start slow

High-frequency trading (HFT): using complex algorithms to execute trades in hyperspeed. It's been criticized for amplifying market swings and benefitting big traders.

Latency arbitrage: when high-frequency traders are able to profit from a split-second advantage in executing a particular trade.

According to the study, latency arbitrage imposes a $55,000 "tax" on every $1.3 billion traded. In the U.S. in 2018, traders made an estimated $1 billion off the NYSE and $862 million off the Nasdaq.

What it means

Latency arbitrage can increase costs for investors. As experts told the Journal:

- Investors are "less likely to post competitive price quotes for stocks, knowing that those quotes could get picked off by speedy traders."

- "That, in turn, means investors get slightly worse prices whenever they buy or sell shares."

The study's authors said latency arbitrage's costs are concentrated among larger investors and imperceptible to average households.

- The profits are also skewed. Just six firms won over 80% of "races" (when firms compete to make a trade first) measured in the study.

- The authors said eliminating latency arbitrage could cut trading costs by 17%.

Not everyone is upset. Kirsten Wegner, CEO of an HFT lobbying group, said the paper seems to have a political agenda and latency arbitrage actually helps investors by reducing transaction costs.

Big picture: You just read about companies quietly getting billions to the detriment of others, so you know what's coming next. Presidential candidates Sens. Bernie Sanders and Elizabeth Warren want financial transaction taxes to slow down high-frequency trading.

IPO

Pack Your Horns and Go

Casper Sleep is no longer a unicorn. According to new IPO docs, the mattress startup would be valued at $768 million if it went public at the top of its price range. It was worth $1.1 billion last March.

- Jargon alert: A "unicorn" is a privately held company valued at $1 billion or more. The term was coined by venture capitalist Aileen Lee in 2013.

- A company—such as Casper—that loses its $1 billion valuation is called an "undercorn."

Zoom out: Casper was the most typical 2019 unicorn you've ever met. In the nine months ending Sept. 30 revenue grew really fast (up 20% to $312 million), but losses also widened (to $67 million).

As it prepares to IPO, Casper will have to convince investors it has a path to profitability. Because if not, we have two words smushed awkwardly together for you: WeWork.

Looking ahead...the IPO market is starting to heat up with big offerings. Pantry staple Reynolds Consumer Products is hoping to raise $1.3 billion this week.

TOURISM

Chinese Tourism Is Canceled

More than 80 people are dead, 56 million across China are on lockdown, and millions more are scared to leave home. The tourism industry is close to panic mode.

The Lunar New Year holiday, which began last Saturday, is one of China's busiest shopping and travel periods. Except that's not happening because of the spreading coronavirus.

- Last year, Chinese consumers spent ~$148 billion on retail and catering during the Lunar New Year week. Domestic tourism generated $74 billion across 415 million trips.

- China's movie industry earns about 10% of its annual revenue during this period.

But right now, airlines are refunding tickets, premieres are canceled, and rail and air travel on Saturday was down 41% annually.

Zoom out

China's economy was slowing before the outbreak. If coronavirus isn't contained by March, GDP growth could slip below the symbolic 6% mark, experts said.

Meanwhile, countries including Japan, Vietnam, and South Korea depend on a steady inflow of Chinese tourists. They spent ~$18 billion in Thailand last year, and yesterday, Thai stocks dropped the most since 2016.

BANKRUPTCY

Not a Good Day to Be a Lucky Blue Louie

When our newsletter takes a trip to Wilmington, DE, it's not to grab a brew at Iron Hill. It's to report on the chains that filed for chapter 11 in U.S. Bankruptcy Court yesterday.

Lucky's Market

Not even backing from the largest supermarket chain in the country could save Colorado-based specialty grocer Lucky's Market. Kroger bought a stake in the company almost four years ago, but said last December it expected to write down the value of its investment by $238 million.

- The plan forward: Lucky's has already started to close 32 of its 39 stores. It's looking to sell at least some to discount grocer Aldi.

American Blue Ribbon Holdings

The owner of restaurant chains Bakers Square and Village Inn couldn't withstand an onslaught from a) higher wages and b) competition from family dining spots like IHOP and Denny's.

- Fun fact: 30% of Bakers Square's sales are pies.

Bar Louie

Your favorite strip mall burger joint closed 38 stores and arranged a sale to lenders. It expects to emerge from bankruptcy within three months.

SPORTS

I LIV for This

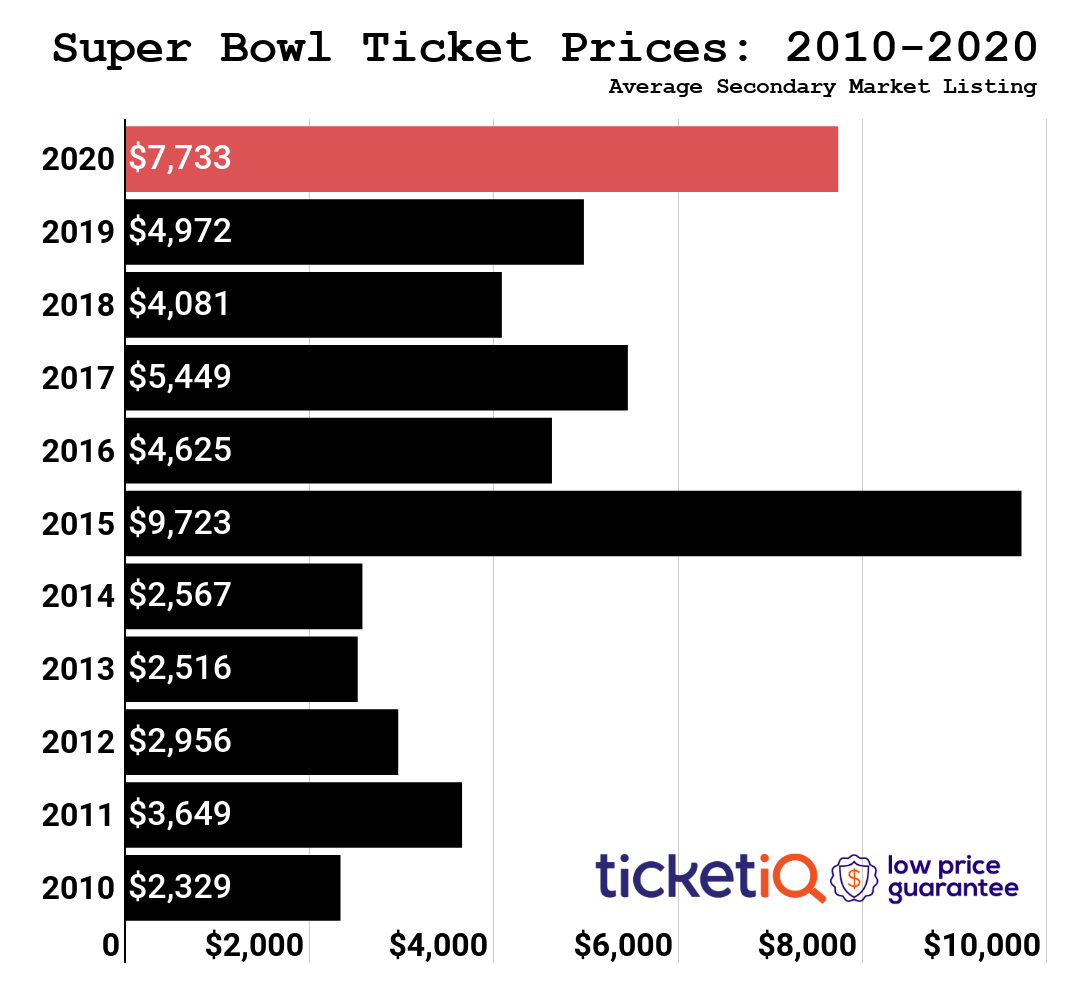

Stay one step ahead of Darren Rovell with this chart from TicketIQ. It shows the average secondary market listing price of Super Bowl tickets over the last 10 years.

Key takeaways:

- If the numbers hold, Super Bowl LIV between the Kansas City Chiefs and San Francisco 49ers will be the second most expensive secondary Super Bowl ticket of the decade. Only the 2015 Super Bowl would be more expensive (do you remember who played? Answer at the bottom of the newsletter).

- TicketIQ says that historically, secondary market tickets fall to their lowest average asking price a week before the game and on Super Bowl Sunday itself.

- As of last night, the most expensive ticket costs $41,644 in The 72 Club.

If you're gunning for The 72 Club but don't necessarily want to sell your house to get in, there are some creative options to explore. StubHub is partnering with fintech company Affirm to offer payment plans for ticket buyers. Annual interest rates range from 10% to 30%.

WHAT ELSE IS BREWING

- GM said it will invest $2.2 billion in a Detroit plant to make electric cars and SUVs.

- The NBA postponed tonight's game between the Lakers and the Clippers following Kobe Bryant's death.

- Bird, a big name in e-scooters, confirmed it's acquiring European competitor Circ.

- The coronavirus has been helping one sector: companies that make cleaning products.

- Atari-branded hotels are coming to a U.S. city near you.

- India wants to sell its 100% stake in Air India, the national carrier.

MAPQUEST

What do the colors on this map represent?

Want Morning Brew Daily Served Fresh to Your Inbox?

Drop Your Email Below...

Map trivia

Hours of sunshine per year

Aut eum possimus iusto ea maiores ea sit. Recusandae culpa quam aut quidem consequatur. Iste eaque architecto voluptas fugiat in voluptas maiores. Autem mollitia consectetur ut laboriosam.

Harum porro voluptatum eos praesentium unde consequatur quibusdam. Omnis consequatur odit rerum molestias. Quia numquam odio autem fugiat. Consequuntur autem laborum vel aspernatur similique laudantium ratione nam.

Repudiandae deserunt deleniti eveniet vel eos eveniet esse. Et sit mollitia praesentium eum in iure culpa. Esse repudiandae nam molestias sit voluptatem rerum sequi quidem. Quo et repellat explicabo illo. Alias autem saepe impedit unde cumque aspernatur quis.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...