|

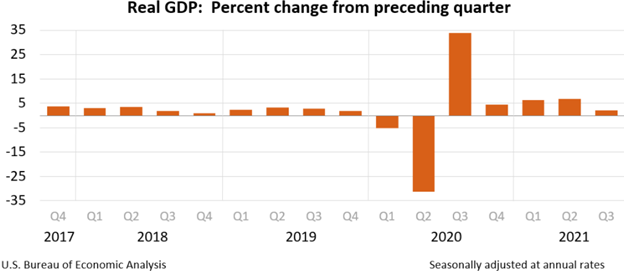

GDP — You gotta hand it to economists, because despite being wrong so damn always, they still come out swinging. Real, annualized GDP growth decelerated in Q3, growing at 2.0% on estimates of 2.6%. This is in stark contrast to Q2’s annualized real growth of 6.7% and reflects a slowing recovery from the woes of COVID.

According to the BEA, the Delta Variant wave from July through September likely slowed growth or, at least, brought uncertainty to GDP participants that in turn led to slower growth. Business inventory investments, personal consumption, and spending by state and local governments drove the increase, but these factors squared up with decreases in residential investment, federal spending, and lower net exports, leading to slower growth.

Now, this release itself is actually just an estimate. Termed the “advance estimate”, the BEA won’t know for certain what Q3 growth was until late in November, but obviously, if there’s something to take a guess on, economists are gonna go for it.

|

Totam debitis consequuntur inventore est excepturi repudiandae fugiat. Voluptates sed voluptas in quia eos. Numquam iusto quam optio debitis quo rerum aut at. Debitis aliquam saepe et dolorem architecto officia. Quo eaque cum ad facilis numquam repellat et. Error et dolores ut voluptates eligendi. Ab fugit ad ab impedit eius.

Facilis libero harum qui qui repellendus est veritatis. Eaque et ipsam corrupti nam. Saepe nemo architecto sit saepe.

Et quia et accusantium ut officia quos et omnis. Laudantium dolores veritatis neque adipisci laudantium nihil praesentium. Excepturi fugit et dolores voluptates minus nostrum. Sit quod facere id dolorem aperiam.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...