Silver Banana goes to...

Markets overall were down yesterday with the S&P shedding 0.5% and the Nasdaq off 1.2%. Earnings season continues with some big names reporting yesterday. Let's get to it.

What's Ripe

|

F5 Networks ($FFIV) – It’s not all doom and gloom out there, and F5 Networks is here to prove it to you. Shares in the enterprise software maker rose as much as 7.5% pre-market, closing the day up 6.2% on the back of killer earnings. F5 beat both revenue and EPS estimates while getting investors excited for the future with enticing guidance for next quarter. While I still have absolutely no idea what this company actually does, I do know that stock goes up = good job.

Raytheon Technologies ($RTX) – Unlike rival Lockheed Martin, featured in yesterday’s edition, fellow A&D player Raytheon Technologies actually got a boost after beating expectations. Shares rose 2.7% after their earnings call. Most impressively, Raytheon smashed FCF projections by just under $200mm.

Sgoco Group ($SGOC) – We haven't shouted out our ape-minded allies over at r/WSB in quite some time, so today let’s give them their due. Shares in Sgoco Group rose 29.6% yesterday on more nothing, as traders on the aforementioned forum pumped the hell out of it. At $11.00, shares have exploded over 650% YTD, making short sellers tear ducts explode. With any meme stock, the script can flip in an instant, and SGOC is no different. Things turned rotten real quick, with SGOC dropping 11.9% aftermarket last night.

|

|

|

|

Near and far, Doge enthusiasts are cheering the return of the Dogefather.

Shares of the canine-themed coin jumped 11% on Monday, after he declared on Twitter that “dogecoin is money.”

But buyer beware, there's a problem. And it goes against our own investment thesis: Dogecoin is too volatile to be money.

Imagine if the U.S. Dollar lost 70% of its value in a month.

That’s why our money is in hard asset classes like art:

- Contemporary art prices appreciated 14% annually from 1995–2020

- That’s 174% higher than the freaking S&P 500 total return over the same period

- Art has shown resilience in inflationary periods, better than gold AND real estate

The only problem? You need massive wealth to build a real portfolio of art.

Enter Masterworks.io

They’ve fractionalized expensive paintings by the blue-chips: Banksy, Basquiat, Kaws, etc.

So you can invest in art at a fraction of the normal purchase point.

Want in? Use our special Daily Peel link to skip the waitlist.*

*See important disclosures

What's Rotten

Coinbase ($COIN) – To put it lightly, Coinbase is getting obliterated. With digital currency prices hovering far below their ATH’s, trading volume on the platform has gone down with it. Furthermore, competition is heating up in the once-niche space as rivals start to gain momentum and drive down trading fees on these exchanges. Great news for traders, tough news for shareholder’s wallets. Shares were down 4.2% yesterday.

United Parcel Service ($UPS) – The Delivery Wars, perhaps the greatest war of our time, continues to shed blood on both sides. UPS beat on both earnings and revenue in Q2, but weak margin guidance and disappointing average daily shipping volume weighed heavier on the company, driving shares 7.0% lower. Fedex fell over 4.9% in tandem.

Big Tech (FAMGA) – Like when your older sibling is having a bad day and makes sure you’re miserable too, the Big Tech bois just bullied portfolios yesterday. Given that 5 companies currently represent 23% of the S&P 500, when they dip, everything else follows. As the FAMGA fam all get their releases ready for this week, the market is not at all excited. Looming antitrust action from the jacked-up Biden administration, a general sense of overvaluation, or completely random trader tantrums, all present themselves as prime suspects for poor share performance.

|

|

Macro Monkey Says

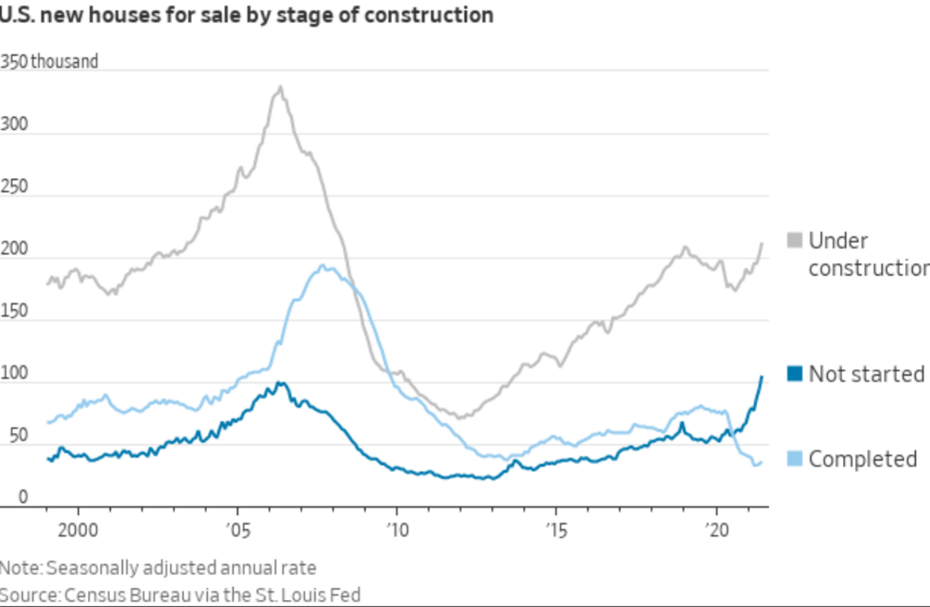

Crib Craze – That’s right, more housing talk. We’re keeping the housing train going because buyers are keeping it just...weird. In perhaps the strangest segment of a unique market position, purchases of homes not even built yet have jumped up to a new record. Now, we’re not talking about a “love at first sight” type of purchase, because there is quite literally nothing to see. Sure, the architect or contractor can show you pictures, but in an endeavor like home-building, you just never know. But buyers don’t care. They want a house and they want it now, or I should say, they want it when it's actually built. They just want the low rates now, I guess. We’ll see what JPow says about that tomorrow.

|

|

|

Food for Thought:

Drug Talk – This week Congress has a chance to do its small part in confirming a potential renaissance in drugs. Members of Congress is pushing to include legislative changes around research, commerce, and classification of certain drugs, including marijuana and psychedelics, for an upcoming appropriations bill. If passed, the bill would allow research institutions to investigate psychedelics like psilocybin (currently federally illegal) and force the FDA to allow CBD in foods as well as a dietary supplement. I don’t need to tell you how this could affect cannabis and other so-called “sin” stocks, but the larger point is we will soon find out if Congress has woken up to the benefits of decriminalized drugs and drug activity or if they’re still hardo narcs.

|

|

|

"It's not whether you're right or wrong that's important, but how much money you make when you're right and how much you lose when you're wrong."

– Robert Arnott

|

|

Culpa culpa quae deserunt mollitia voluptatem laborum aliquam. Et omnis fugit omnis mollitia voluptas. Velit vero sint non repellat autem et ut.

Quo non esse deleniti in expedita. A repudiandae enim beatae ab est blanditiis laudantium. Molestiae perspiciatis voluptatem voluptatem praesentium. Est velit eveniet voluptatem reiciendis animi qui fugit libero.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...