ACG San Francisco

It is an expert association that drives center market development.

What Is ACG San Francisco?

ACG San Francisco stands for Association for Corporate Growth San Francisco. It is an expert association that drives center market development. The association is vital for ACG Global, which comprises more than 14,000 individuals across North America, Europe, and Asia.

The main motive of the association is to drive center market development through systems administration, bargain-making, and training.

The association's occasions, gatherings, roundtable conversations, and different contributions allow center market experts to interface and team up, share thoughts and best approaches and gain from industry pioneers.

In addition, ACG San Francisco (ACG SF) suggests giving assets, data, and bits of knowledge to assist its individuals with analyzing the center market scene and settling on better business choices.

ACG SF serves a group of experts across various ventures. It includes private value firms, speculation banks, law offices, bookkeeping firms, corporate advancement experts, and other center market business pioneers.

Moreover, ACF SF assists its individuals with driving development, making arrangements, and assembling productive center market associations through its organization, occasions, and schooling programs.

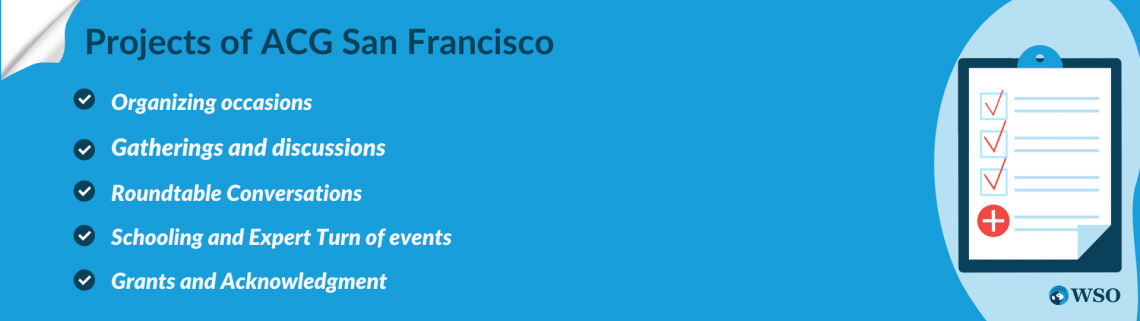

Projects of ACG San Francisco

It offers various projects and occasions intended to help the expert turn of events and progress of its individuals.

These projects and occasions might include:

1. Organizing occasions

The organization has established a system for administration occasions. For example, cheerful hours and morning meals open doors for individuals to associate and fabricate associations with other center market experts.

2. Gatherings and discussions

The association might sort out meetings and conferences on subjects important to center market experts, like confidential value, mergers and acquisitions, and arrangement making.

3. Roundtable Conversations

This stage allows individuals to discuss straight points and offer their companions bits of knowledge and best practices.

4. Schooling and Expert Turn of events

They offer online courses and studios to assist individuals with keeping awake to date on the most recent patterns and best practices in the central market.

5. Grants and Acknowledgment

The association may have occasions to perceive and respect people and associations for their commitments to the central market.

NOTE

It's worth mentioning that these occasions or ventures can shift by part and are liable to change over the long haul. The association might add new occasions or projects, or stop existing ones, given the requirements and interests of its individuals.

Membership of ACG San Francisco

ACG (Relationship for Corporate Development) enrollment is available to experts engaged with the center market, including private value firms, speculation banks, law offices, bookkeeping firms, and corporate advancement experts.

In addition, the association offers various sorts of participation to suit the necessities of its assorted enrollment base.

Enrollment Levels and Expenses

- Individual Enrollment: The essential degree of participation is open to any expert associated with the central market, with yearly charges.

- Corporate Enrollment: It is accessible for associations that need to give ACG participation to different workers, with yearly charges.

- Youthful Expert Enrollment: A unique participation rate for experts under 35 years of age with yearly expenses.

- Lifetime Enrollment: A unique participation for the people who needs to be lifetime individuals with one-time charges.

NOTE

Notwithstanding yearly expenses, ACG may charge for explicit occasions and projects, like gatherings and discussions. Spending to specify charges and participation advantages might change depending on the section and the area. A few parts may likewise have extra charges or participation choices.

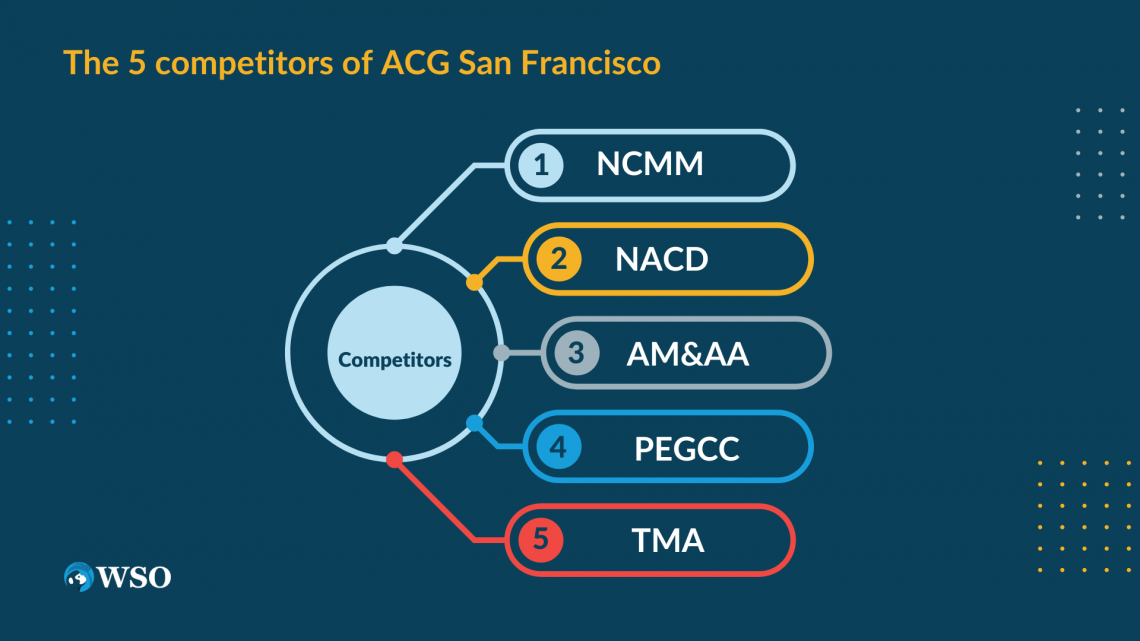

Potential competitors of ACG San Francisco

ACG SF is a professional association that emphasizes driving middle-market growth.

Some of the associations that might be deemed opponents are

1. The National Center for the Middle Market (NCMM)

The NCMM is a focal point of excellence at The Ohio State College Fisher School of Business that analyses, gives training and projects, and offers many administrations to help the middle market.

2. The National Association of Corporate Directors (NACD)

NACD is an ace association for corporate leaders and sheets. It highlights the teaching and promotion of corporate administration issues.

3. The Alliance of M&A Advisors (AM&AA)

AM&AA is a professional association for center market M&A experts, which deals in training, organizing, and facilitating different assets for its individuals.

4. The Private Equity Growth Capital Council (PEGCC)

PEGCC is an exchange organization that addresses the confidential value industry. It emphasizes sponsorship, schooling, and questioning confidential value and development capital.

5. The Turnaround Management Association (TMA)

TMA is a professional association for corporate rebuilding and circle-back experts. It emphasizes training, strategic management, and support on issues connected with corporate rebuilding.

NOTE

The competitors mentioned above are a few of the many ACG SF competitors. These can vary according to the viewpoint and location.

Network: ACG University

A major mission of ACG San Francisco is to give informative and proficient improvement to the M&A people group and help M&A experts simulate and extend their arrangement organizations.

Education is an essential part of human life. One of the schemes ACG SF delivers is ACG University (ACGU). It helps firms in prepping their remarkable new youthful experts. It might be worth it to old pros who want a more top-to-bottom comprehension of various parts of the arrangement stream.

In addition, ACGU is a powerful instrument for future M&A bargain-making. This 7-week leader training drive will be driven by some of the locale's best and most experienced M&A dealmakers.

The program brings bargain experts (addressing various capabilities inside the arrangement interaction) into the existing exchange pattern, showing the crucial components of obtaining, valuing, funding, arranging, organizing, and settling a negotiation.

Like any other educational institution, ACGU has various accompanying advantages:

First, it shows an extensive scope of fundamental arrangement-making abilities and strategies through discussion to make insightful, learned, and talented dealmakers.

The university makes companions to work with long-haul bargain networks among current and future M&A pioneers. Each class comprises confidential value and corporate purchasers, speculation brokers, lawyers, bookkeepers, moneylenders, and other M&A experts.

NOTE

The university offers admittance to every asset of ACG and San Francisco through participation (1-year enrollment included).

The graduates will be welcomed to turn out to be essential for Young ACG, as proper. In addition, the acknowledged ACGU scholars that are, as of now, ACG or Young ACG people will get a markdown to ACGU.

DEI Committee Mission and Resources

The ACG DEI Committee Mission and Resources accept that everybody wins when everybody is included. Therefore, it visualizes an M&A that apprehends the benefits of variety and how it advances central market organizations by making them more grounded and stronger.

As a consequence of the ideology, DEI believes that various individuals from the central market are completely addressed at all levels with the purpose that all individuals will want to arrive at their true abilities.

Sometime back, ACG became a forerunner in variety, value, and consideration in the M&A people group by developing the ACG Panel. In addition, it enlisted different pioneers nationwide to direct the new board of trustees that would rouse individuals to address inclinations and advance variety throughout the middle market.

NOTE

On Feb. 24, 2021, the DEI Advisory group finished one of its most memorable responsibilities - making the ACG Strategy Proclamation that frames ACG's DEI objectives and systems inside and out.

The DEI Board of trustees is a promoter and asset for variety, value, and consideration in the M&A people group. Through different associations and diverse media drives, this volunteer board of trustees shows the advantages of variety and advocates for the support of underrepresented bunches.

It endeavors to develop an organization of ACG parts that perceives and advances the advantages of multiculturalism. In addition, it energizes varied individuals from the M&A people group to add disciplines through support from all levels at ACG.

or Want to Sign up with your social account?