Step by Step Guide to Land Your Dream Investment Banking Job

Land Your Dream Investment Banking Job - Guide and Steps to Land Your Dream Investment Banking Job

Hey there, future investment banker! If you're reading this, you're probably dreaming of landing a job at a top-tier firm like Goldman Sachs, JPMorgan or Morgan Stanley... We get it, and we're here to guide you through every step of the journey. Investment banking is a thrilling world filled with opportunities, and we're about to show you how to grab one. So, grab a coffee, sit back, and let's dive in!

A Glimpse of the Reward: Investment Banking Salaries

Before you dive headfirst into your investment banking journey, let's talk about the rewards. After all, one of the biggest draws to this field is the potential for impressive financial compensation. According to our data, as of 2023, the average investment banking analyst salary ranges from $100,000 to $120,000, with significant annual bonuses often doubling or even tripling that amount.

| Role | Base Salary ($) | Average Year-End Bonus (% of base) |

|---|---|---|

| Summer Analyst | $65,000 - $80,000 | 10% |

| Analyst | $100,000 - $120,000 | 50% - 100% |

| Associate | $150,000 - $200,000 | 50% - 100% |

| Vice President (VP) | $200,000 - $225,000 | 50% - 150% |

| Senior Vice President (SVP) | $250,000 - $500,000 | > 100% |

| Managing Director (MD) | $400,000 - $600,000 | > 100% |

Unlike most industries, an investment banker's salary is not a fixed end-of-the-month sum; instead, it has many components:

- Base Salary: This is your stable biweekly income, which increases each year and isn't heavily impacted by performance.

- Stub Bonus: Typically 20%-30% of the first-year base salary, as banks hire from target schools in the middle of the year.

- End-of-Year Bonus: Analysts and Associates often receive this entirely in cash, while larger banks may use deferred or stock-based compensation. It's determined by deal flow and individual performance and is usually a percentage of base salary.

- Deferred and Stock-Based Bonus: Associates at publicly traded banks receive part of their bonus in stock that vests over time, serving regulatory and retention purposes.

- Signing Bonus: Analysts typically get about $10,000 to $15,000, while Associates receive around $50,000 to $60,000 when accepting full-time offers.

- Other Benefits: Investment banking positions also come with perks like health insurance, 401(k) retirement plans, and vacation days.

Investment Banking Career Path

In a typical Investment Bank, you'll find four key divisions:

- Investment Banking: They handle Mergers & Acquisitions (M&A), Restructuring advisory, and raising Debt and Equity capital for clients.

- Capital Markets: This team collaborates with Investment Banking to connect clients with Equity Investors and Debt Lenders.

- Sales and Trading: They assist large Institutional Investors in buying and selling securities, including Stocks, Bonds, and Derivatives.

- Research: This division analyzes and provides insights on individual Stocks (Equity Research) and Debt securities (Credit Research).

How to Get a Job in Investment Banking?

Step 1: Understand the Investment Banking Landscape

Begin your journey by gaining a solid understanding of what investment bankers do.

- What Do Investment Bankers Do?: Get a comprehensive overview of the roles and responsibilities of investment bankers.

- Investment Banking Fit: Learn how to assess whether a career in investment banking aligns with your skills and aspirations.

- Investment Banking Job Description: Dive deeper into the specifics of what you can expect in an investment banking role.

Step 2: Self-Assessment and Education

To embark on a successful investment banking career, you must evaluate your own strengths, interests, and qualifications. Consider the following:

- Assess your passion for finance and your willingness to work in a high-pressure environment.

- Ensure that you have a strong educational foundation. Most investment bankers hold at least a bachelor's degree, often in finance, economics, or related fields.

Step 3: Skill Development

Investment bankers are known for their financial expertise. To join their ranks, focus on honing these essential skills:

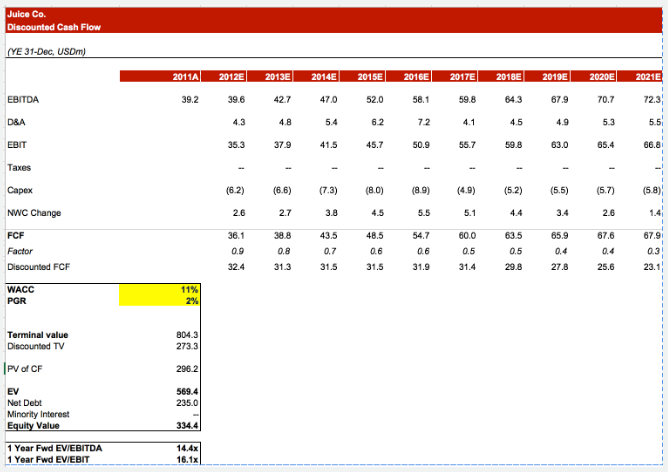

- Financial Modeling: Master the art of building complex financial models.

- Valuation: Develop proficiency in various valuation methods such as discounted cash flow (DCF) analysis and comparable company analysis (Comps).

- Due Diligence: Learn how to conduct thorough due diligence on potential deals, including analyzing financial statements and legal documents.

Step 4: Networking

In the world of investment banking, networking is invaluable. As you embark on your career journey:

- Attend finance-related events, conferences, and workshops.

- Join online communities and LinkedIn groups to connect with professionals in the field.

- Cultivate relationships with mentors and seek advice from seasoned investment bankers. (You can find Networking Templates Here)

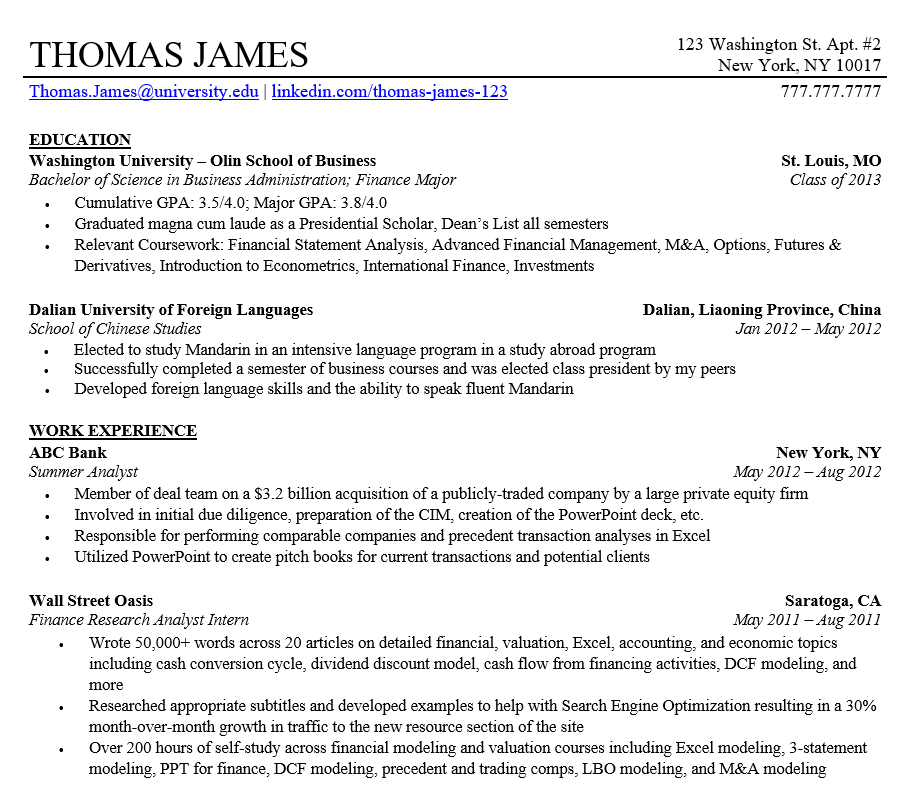

Step 5: Crafting a Winning Resume

Your resume is your ticket to securing interviews. Make it stand out:

- Highlight relevant experiences, including internships and academic achievements.

- Emphasize quantitative skills and any financial modeling or valuation experience.

- Showcase your ability to work in a team and under pressure.

Step 6: Pursue Internships

Internships are crucial for gaining real-world experience and increasing your chances of landing a full-time job in investment banking:

- Aim for internships at prestigious firms, as they can serve as valuable stepping stones.

- Leverage your network to discover internship opportunities.

Step 7: Ace the Investment Banking Interviews

Investment banking interviews are notoriously challenging. Prepare thoroughly:

- Practice technical questions and case interviews.

- Seek guidance from mentors or use interview prep resources.

Step 8: Persistence and Adaptability

Recognize that competition for investment banking jobs is fierce:

- Stay persistent in your job search.

- Be open to various paths within the industry, including boutique banks or specialized roles.

David Solomon's Insight

Just to drive the point home, Goldman Sachs CEO David Solomon revealed that they received a whopping 260,000 applications for analyst roles, accepting only 1% of them. This jaw-dropping stat shows the fierce competition out there. But hey, don't let it discourage you.

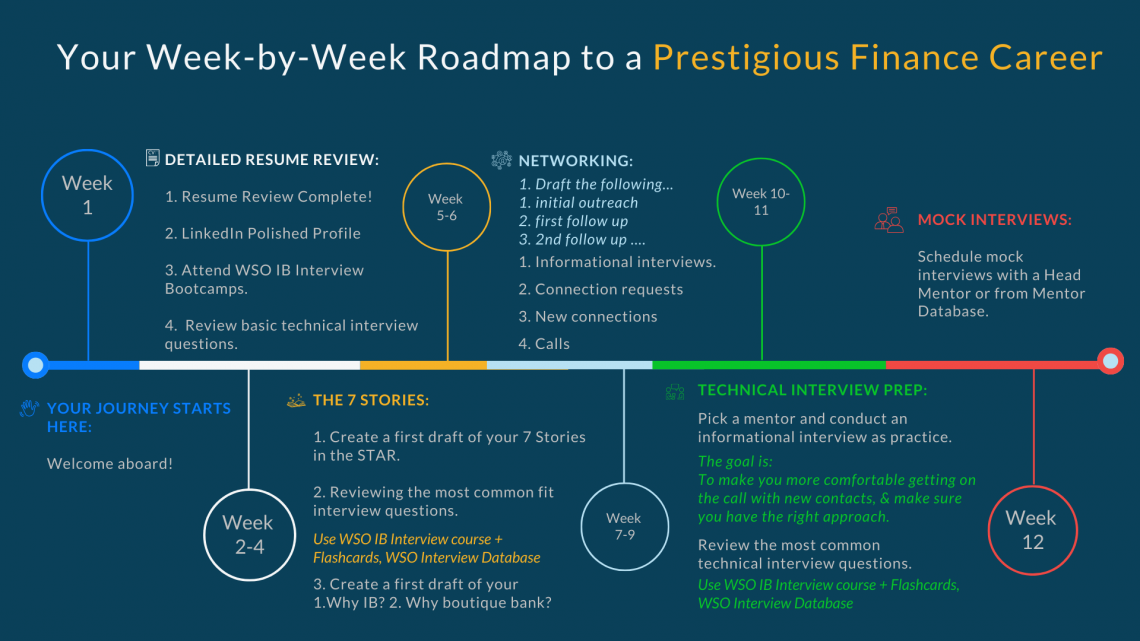

Investment Banking Recruiting Timeline

Undergraduate: If you're eyeing investment banking straight out of college, the clock starts ticking early. You'll want to kick off your efforts in Year 1, securing internships and connecting with alumni. The big U.S. banks recruit for junior-year internships well in advance, so by Year 2, you'll be applying and interviewing. Solid experience is a must by then.

Master's Degree (non-MBA): Even if you're pursuing a master's degree, the timing aligns with undergrads. You'll interview for Investment Banking Analyst roles over a year ahead of summer internships, especially if you're targeting top-tier banks.

MBA Level: MBA programs offer a bit more breathing room. Banks can't scoop you up before your MBA journey begins, so recruiting here is more manageable. You'll interview for summer internships after your first year of business school, a few months into the program. However, prep work should start well before you set foot on campus.

Lateral Hires: For those outside traditional programs, the timing is less predictable. Banks hire on an "as needed" basis, typically when a sudden vacancy opens up due to someone leaving.

Remember, in the world of investment banking, preparation is key, no matter your level. Whether you're a fresh-faced undergrad or a seasoned MBA student, staying ahead of the game is the name of the recruiting game.

WSO Academy - Your Ace in the Hole

Now that you know what it takes, let's talk about the WSO Academy. It's your secret weapon. WSO Academy offers a comprehensive curriculum, helping applicants from different backgrounds, designed to prepare you for interviews and the job itself. With mentors, mockup interviews, Behavioral/Technical Interview Masterclasses, Financial Modeling and Valuation Courses, networking, and much more. It's your shortcut to success in the world of high finance.

With dedication, continuous learning, and the right resources, you can turn your dream of an investment banking career into a reality. It's a journey that offers both challenges and rewards, and with each step, you'll be one step closer to achieving your goal. Good luck on your path to a thrilling career in investment banking

or Want to Sign up with your social account?