Mortgage Originator

It can be a bank or other financial institution that makes and sells mortgages or a person employed by one that helps customers get a mortgage.

What Is a Mortgage Originator?

A mortgage originator (also called an MLO) can either be a bank or other financial institution that makes and sells mortgages or a person employed by one that helps customers get a mortgage.

A mortgage is a loan in which property, land, or other real estate is used as collateral. These can be found either in the primary or secondary mortgage markets.

As the name suggests, the primary mortgage market is where the mortgage originated, i.e., where the mortgage loan is created. However, once originated, servicing rights to mortgages can be sold between financial institutions on the secondary market.

Imagine the primary market is a factory that makes mortgages. Then, once the mortgage is made, the factory can either keep it or sell it. Now, imagine the secondary market where those mortgages can be sold and sought out to be purchased.

What does a mortgage Loan originator do?

An MLO is a licensed and registered financial professional who helps customers with mortgage applications via loan origination.

Loan origination is when a borrower applies for a new loan, and a lender processes said application.

Banks and mortgage companies usually employ an MLO to help clients (potential borrowers) throughout the mortgage approval process. Thus, if a customer goes to Bank X and applies for a mortgage, that bank’s MLO would be the one to work on originating it.

The mortgage approval process is as follows:

1. Submit your application

Once the client (borrower) has chosen the property they want to buy, they fill out an application with the mortgage originator (lender).

This might require providing documentation relating to their income, debts, and assets. The lender works with underwriters and loan processors once the application is submitted.

2. Order a property inspection

This allows better negotiation with the seller if the inspection reveals any unforeseen issues with the property.

3. Conditional approval

If the borrower qualifies for the mortgage, they'll receive conditional approval. They might then have to provide additional information or documentation to their lender.

4. Provide homeowners/property insurance:

The lender will require proof of insurance before the mortgage can receive final approval.

5. Property appraisal

The lender will order a property appraisal to ensure its value aligns with the purchase price.

6. Avoid taking on new debt

The borrower is reminded to avoid opening new credit cards or taking on any other new financial debts since these will affect their debt-to-income ratio, getting in the way of their mortgage’s interest rate.

NOTE

The debt-to-income ratio is the ratio of how much you owe to how much you earn (usually monthly).

7. Lock in your interest rate

The interest rate should be locked no later than 10 days before the closing date.

8. Document revision

Once the mortgage is approved and the inspection, appraisal, and title search are complete, the lender sets a closing date.

9. Paying closing costs

The borrower then makes the down payment and any closing costs required to finalize the process.

10. Close on your property

After all the documents are signed and finalized, the borrower receives their property.

An MLO also develops relationships within the real estate industry, such as building contractors and real estate agents, to attract future mortgage loan applicants.

NOTE

A real estate agent, or realtor, is someone who markets and lists properties. They work directly with homeowners and buyers in selling and purchasing these properties.

Depending on their employer, an MLO might also work in the telesales department, calling customers and clients who might be potential borrowers with prequalified mortgage offers. However, it should be noted that prequalifying for a mortgage doesn’t guarantee qualification after applying.

Since lenders seek to profit through interest rates and costs associated with providing mortgages, they prefer borrowers with a high capacity to repay the loan. This involves the borrower having a low credit risk.

Low credit risk involves the borrower having a low debt-to-income ratio, a qualifying credit score (the higher, the better), a positive employment history, income stability, assets, and collateral. In this case, the mortgaged property would be the collateral for the loan.

How does an MLO originate a mortgage?

After the customer qualifies for the mortgage and completes the application process, they receive their property upon closing. The result is receiving a loan from the lender. So naturally, the interest paid on the mortgage is a source of profit for the lender.

However, the lender has other sources of profit. They gain money from servicing loans and all of the fees associated with the application process.

Loan servicing involves the administrative aspects of handling the loan during repayment. This includes collecting payments, following up on delinquencies, and paying taxes and insurance, among other processes.

They also generate income from mortgage-backed securities. Mortgage-backed security (MBS) refers to a group of loans of varying levels of profitability. Lenders group these mortgages to selling on the secondary market.

Selling these MBS to pension funds, insurance companies, and other investment entities generates money to fund additional mortgage origination and handle operational expenses.

A lender can borrow funds from a larger financial institution at a lower interest rate to originate the mortgage. Since this generates a debt to the lender, they make up for it via the yield spread premium. This turns that debt into a source of income.

What Is Yield Spread Premium (YSP)?

The yield spread premium (YSP) is the difference between the interest rate charged by the lender to the borrower and the rate the lender pays for the money lent to them, as seen in the following formula:

Yield spread premium = interest rate charged to the borrower - interest rate to the lender

For example, if the lender borrows funds at 3.2% and approves the mortgage at 6.3%, they earn 3.1% interest. This is the yield spread premium.

Therefore, if a lender originates the loan from another financial institution, they can pay it back with the borrower’s mortgage payments, generating profits via the difference in interest.

If interest rates are high (due to inflation or some other socioeconomic factor), the lender will have to charge a higher mortgage rate to the borrower. This compensates for the higher interest rate they’d have to get the loan from another financial institution.

If the lender is originating the funds for the mortgage loan with their capital, they might offer the mortgage at a competitive rate. But, again, this attracts potential borrowers within the mortgage market to get their loan here and not at some competitor.

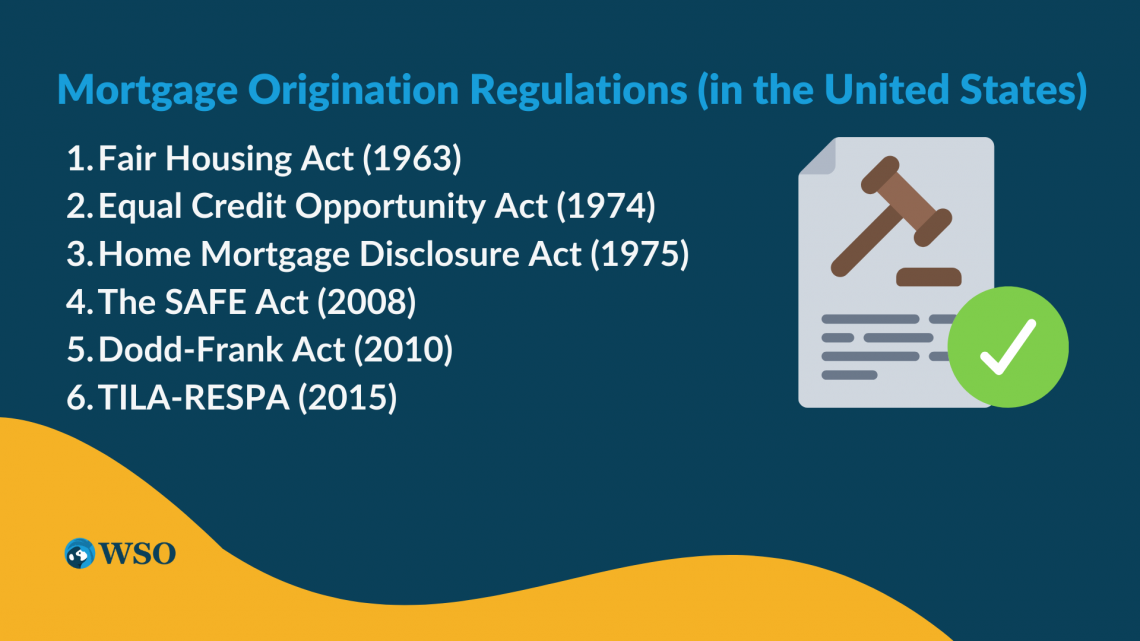

Mortgage origination regulations (in the United States)

In the United States, the process of originating mortgages requires compliance with the following regulations:

- Fair Housing Act (1963)

- Equal Credit Opportunity Act (1974)

- Home Mortgage Disclosure Act (1975)

- The SAFE Act (2008)

- Dodd-Frank Act (2010)

- TILA-RESPA (2015)

These laws encompass all aspects of the entire process of acquiring a property. Throughout the application process, it’s illegal to discriminate against someone based on age, sex, race, color, ancestry, national origin, religion, disability, familial status, or military status.

They also hold financial institutions accountable for following their regulations. These include laws requiring financial institutions to be transparent with all customers and the government. There are even ones for the US financial system to be transparent and held accountable.

They even outline the minimum standard necessary for licensing and registering an MLO, as with the SAFE Act.

What are the different types of mortgage loan originators?

The mortgage market has multiple financial institutions where a borrower might go to apply for a mortgage. So not only do borrowers have options in terms of different banks and financial institutions for which to get their mortgage, but different types of institutions.

1. Mortgage Broker

A mortgage broker is a middleman who oversees the application process for mortgage loans for individuals or corporations. In essence, they create connections between mortgage lenders and borrowers without using any of their own money to do so.

Mortgage brokers familiarise themselves with the borrower's financial situation and make an effort to match them with a lender who offers a competitive interest rate and is a suitable fit. Additionally, they obtain from the borrower any pertinent documentation that needs to be processed and/or approved by the potential lender.

2. Mortgage Banker

In opposed to this, a mortgage banker is a person who works for a bank, credit union, or lending organization that carries

Mortgage Originator FAQs

When wanting to complete a real estate transaction, you will inevitably need a mortgage, which originates with a mortgage originator (hence the name). This original lender funds the mortgage by lending the money to the borrower, using the land or property as collateral.

The loan originator funds the mortgage with the financial institution’s capital or borrows that money from another (usually larger) bank or financial institution.

The borrower might go to a financial institution that will originate their loan, or the borrower might go to a mortgage broker to obtain the loan. However, the broker does not originate the loan; they simply broker the loan between the borrower and the lender.

The main difference between a mortgage loan originator and a mortgage broker is that the MLO interacts directly with the borrower as the lender; the mortgage broker is a middleman between the lender and the borrower.

The benefit of being a broker over an originator is that the broker doesn’t risk lending their money to the borrower. In addition, the broker doesn’t have to borrow money from another financial institution to help fund the mortgage loan.

The benefit of being an originator over a broker is having the option of selling the mortgage on the secondary mortgage market. Mortgages are usually sold when there’s more financial benefit to selling them than keeping them. They can group mortgages into an MBS.

The requirements to become an MLO are

- Be at least 18 years old.

- Obtain an NMLS number by registering with the Nationwide Mortgage Licensing System and Registry (NMLS).

- Take 20 hours of pre-licensure education courses approved by NMLS. In certain states, state-specific education and preparation are also necessary.

- Pass a national exam, per the SAFE Act.

- Pass an FBI criminal background check and provide a credit score report to the NMLS.

or Want to Sign up with your social account?