Base Pay

A pay that is an employee's minimum income in exchange for their work

What Is Base Pay?

At its core, base pay is an employee's minimum income in exchange for their work. It doesn’t include extra bonuses, benefits, or insurance – rather, it’s simply the initial amount an employee will receive in exchange for their work.

Base pay can be measured hourly, monthly, or annually, but it’s a key component to help decide between two job offers or salaries.

Unlike salary bonuses or add-ons, a base salary is a fixed amount that an employee is to earn. It is a part of a company’s fixed costs, as they must pay employees for regular hour requirements.

Companies offer base pay depending on the number of hours an employee works. But companies will only offer salary compensation once the employee works a minimum number of hours rather than an exact amount for each hour of work.

Key Takeaways

- Base pay refers to the minimum income an employee receives in exchange for their work, excluding bonuses, benefits, and insurance.

- Base pay is a fixed amount that forms part of a company's fixed costs and is typically measured hourly, monthly, or annually.

- Gross pay, on the other hand, includes base pay as well as additional components such as bonuses, benefits, insurance, and overtime hours.

- When comparing job offers, understanding the expected value of compensation is essential in making effective personal finance decisions.

- Factors such as personal qualifications, context of work, longevity, and performance can influence base pay and contribute to salary variations in different careers and industries.

Base Pay Vs Gross Pay

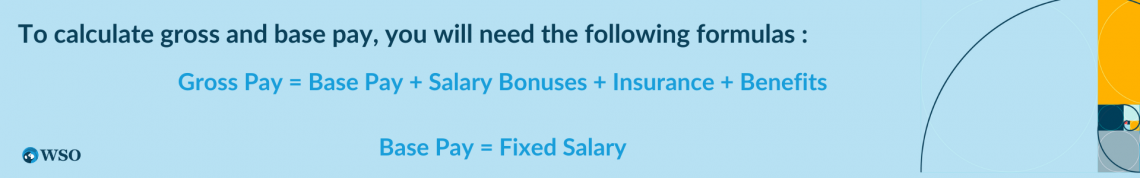

The misconceptions about base salary often involve conflation with total or gross pay. However, gross pay is the total pay of an employee before taxes.

While it includes base pay, it also takes benefits, bonuses, insurance, overtime hours, and other salary additions into account. Estimating gross pay is essential to understanding compensation offers from different employers.

Gross pay can offer a full, more thorough understanding of salary compensation, which can ultimately prove more helpful in making more effective personal finance decisions with new career opportunities.

One example is if a beauty company employee was offered $70,000 as an annual salary upfront and earned $10k bonuses based on certain numbers of sales and commissions they had.

In this case, their base pay would be $70k, but their total pay would be $80k.

The gross pay is an amount summed up from multiple different components. Therefore, the gross pay equation has multiple variables, including base pay.

Understanding the Compensation Differences

In your career, you might have faced the situation of choosing between two difficult job offers. One job offers a higher base pay but less probability of earning a bonus. In contrast, the other job offers a lower base pay but a higher probability of earning a bonus.

Ultimately, the answer lies in simple statistics. Using the expected value, a measure to determine probabilities, you would be able to decipher whether to take one offer over another.

Say your first option entails an $80k upfront salary with a 10% probability of earning a $10k bonus. To find the expected value, multiply the 10% by the 10k and add it to the initial $80k, resulting in a gross salary of $81k.

If your second option had a $70k initial salary, but a 30% probability of earning a $50k bonus, then your gross salary would total $70k + $50k(.30), or $85k. Thus, you’d want to choose the second option since it has a higher bonus probability, even with a lesser initial salary.

Below we illustrate some of the common characteristics of Base Pay.

1. Bonuses in Gross Pay

One of the factors going into gross pay that isn’t included in minimum compensation is a salary bonus. Salary bonuses are additions to an employee’s income based on performance, longevity, and other achievements or milestones that an employee has completed.

Salary bonuses are included in gross salaries, but just like other components of total compensation, they are taxable, and track must be kept for the IRS. Therefore, bonuses must be included as tax-deductible input when calculating an employee's net income.

The biggest difference between bonuses and benefits is that companies are not obligated to provide their employees with bonuses but must provide them with paid benefits. More details about how benefits are different from bonuses are right below.

2. Benefits in Gross Pay

Just like bonuses, employee benefits also add to compensation. For example, dividends, holiday bonuses, insurance coverage, and company reimbursements are different employee benefits in gross compensation, not base compensation.

While such contributions are included in an employee’s gross compensation, they are subject to tax approval and deductions from the IRS. So though different benefits in gross income are not included in the basic pay, they’re similar to salary bonuses in that they are taxable.

Benefits often vary for the types of employees there are. For example, part-time employees are typically allowed either one part of a benefits package from a company, if at all. At the same time, full-time associates are more likely to get a larger part of the benefits.

More often than not, larger corporations will also offer more benefits than smaller or early-stage companies.

Though part-time employees aren’t typically offered benefits, a company that does may differentiate itself from competitors or lure in more talent. That way, companies can drive more growth with a smaller change implemented.

3. Overtime Compensation in Gross Pay

One of the last variables included in gross salary is the overtime compensation an employee owes for working more hours than normal.

Overtime compensation isn’t included in the minimum salary an individual is owed. Still, it is added to a salary whenever an employee works for more than their minimum number of hours.

Even though it’s included in gross salary, overtime compensation is not always guaranteed for workers. Federal laws prevent overtime pay for some workers while allowing it for others.

For example, federal law governs an overtime compensation requirement if a worker’s income is below a certain amount – $35,568 in the US.

Note

The Fair Labor Standards Act (FLSA) mandates that employees 16 and above who meet this requirement must get paid overtime compensation if working for a company that isn’t exempt from overtime requirements.

Base Pay Calculation

An initial salary takes many different variables into account when initially determined. It comprises an employer’s context and the typical demand of respective employees within a specific role/industry.

Though the calculation varies based on specific companies, the formula is the same for most. Basic pay is divided into payment periods and the amount paid per period, so the formula is

Where the payment period is a length of time, and the payment amount is how much is earned per that time. Salary comes from two simple components but amounts to gross pay when combined with other parts of someone’s payment.

Personal Qualifications

One of the largest (if not most important) factors in determining pay for a specific role is the evaluation of candidates’ typical qualifications, including skills and educational background.

For example, the salary for different types of doctors often reigns above the salaries of many other professions due to the vast array of specializations that doctors and medical school graduates have.

Let’s take a pediatrician with over 12 years of school. The pediatrician will have a higher initial salary than a school counselor with only a fraction of the same educational experience. Thus, the initial salaries for both professions differ based on the background of each career candidate.

Together, skillset and educational background provide a foundational combination to build upon. Salaries don’t have to be stagnant; they can improve with better employee performance outcomes.

When doctors receive bonuses, for example, they usually come from patient satisfaction or other good reviews.

And when school counselors author resources for more students, their bonus will also get added to their initial pay, resulting in an annual gross salary higher than the upfront expectation. So, initial salaries often change based on variable factors in different careers.

Context of Work

One of the biggest salary determinants in the United States is the geographical context of a certain role or career. Across the country, many locations tend to pay higher initial salaries than others due to higher living and commuting costs.

New York City in the US is known for high living expenses. This is because New York, the largest metropolitan area, pays some of the highest salaries in the nation.

However, the hidden costs behind living expenses, such as housing, dining, and energy, are far superior to other geographic areas in America's South or Central regions.

When looking for a career that will adequately meet your budgeting and salary expectations, ensure that you look for careers that supply you with a reasonable salary based on your living location.

As a common mistake that can be overlooked by many, the context of work as a salary component is significant to gaining the salary itself.

Longevity and Performance

Though extended time working for a particular company can also lead to additional bonuses, one of the key things it can do for employees is to raise an initial salary.

More time working for a specific brand will provide opportunities for growth in professional and personal qualifications under the guidance of the company hood, meaning that base pay can eventually increase with time spent as an employee.

Employers can also set a range for how much they want to pay employees. Salary ranges contain minimum and maximum pay rates while opening up middle-range possibilities for employees performing poorly, well, or as expected.

The performances of certain employees are monitored with different company trackers and indicators, like KPIs or operating margins.

Measuring performance demonstrates employee growth to determine whether or not a higher base compensation should happen for the employee. Moreover, promotions can follow initial salary raises when an employee stays longer and performs even better at a company.

Promotions occur whenever an offer for a better position within a company comes to fruition, accompanied by higher salaries and management opportunities.

Base Pay in the Military

Compared to regularly salaried employees, armed forces in the military receive a different type of base salary. Rather than being paid annually with yearly gross pay bonuses, armed forces individuals are paid monthly.

Similar to the components of salary for an employee at a typical corporation, the salary for those in the military can additionally be influenced by rank or length of time spent in the military.

As Military Pay iterates, these salary rates typically rise above other pay increases for non-military employees. The upwards trend for military payment is much higher than average.

Allowances like hazard pay, the cost-of-living adjustment, and housing are not accounted for in the initial military salary. Still, they are included in military members' ultimate gross pay.

Thus, basic payments for military members will be reflected across a distribution of months or even years.

Conclusion

All in all, base salaries are an important way to decide whether or not to take up a job, what jobs you should apply to, and how much of a livelihood you can get.

Considering an initial salary and remembering what exceptions and additions go into the total salary to get gross pay is important.

Base salaries depend on certain upfront requirements handed to employees in a contract. Still, they rely on several factors, including

- Personal qualifications, such as skills and educational background.

- Context of work, considering that some places will be more expensive.

- Longevity and performance, as measured by seniority and improvement at a company.

Compensation packages for employees should be provided in fairness and match an individual employee's talent. It’s important to gauge where your salary standards lie to make the most out of any employment possible.

To learn more about base compensation and gather even more professional advice on measuring your standards, feel free to check out WSO’s exclusive professional mentoring opportunity here!

Your most suitable career should make you feel comfortable and financially secure, so learning base and gross pay takeaways for your everyday life is crucial.

or Want to Sign up with your social account?