CFA® Salary Guide

Salary for individuals holding the Chartered Financial Analyst® (CFA) designation

What Is a Chartered Financial Analyst (CFA)?

The CFA charter is a globally recognized professional designation awarded by the CFA Institute. This global non-profit organization provides professionals in finance with highly rigorous training and education.

It is among the most recognized and prestigious designations in the field of banking and finance. The designation is awarded to candidates who demonstrate competence in investment analysis and wealth management.

You can learn more about the CFA on WSO’s dedicated article ‘What is the CFA®?’.

The highly rigorous education provided and the highly technical skills garnered in the CFA program is why charterholders usually receive a significant pay raise, starting right after finishing the program.

It is important to note that the total compensation of professionals includes many components and not just base pay.

In fact, the 2018 CFA Societies Financial Compensation Survey Report has outlined the other types of compensation in addition to base salary, as well as how common they are in the industry.

A summary of this can be seen in the table below:

| Compensation | Percentage |

|---|---|

| Cash/bonus performance | 87% |

| Employer 401(k) | 66% |

| Profit-sharing | 17% |

| Restricted stock awards/phantom shares | 13% |

| Deferred/multi-year earnings | 9% |

| Commission/sales bonus | 6% |

| Stock options | 3% |

Calculating the total compensation of a CFA charterholder is challenging, as there are a wide variety of industries and functions they work in. So let’s first understand where CFA charterholders work.

Key Takeaways

- Median compensation for CFA charterholders varies significantly based on experience. Roles like Risk Manager can earn $150,500 with less than 5 years of experience, while Chief Investment Officers with over 20 years of experience earn $393,700

- While the USA, Switzerland, and Australia boast high CFA charterholder salaries, compensation varies across countries and states. Factors like experience, industry, and location significantly influence the earning potential of these professionals.

- CFA charterholders have versatile career options, from asset management to investment banking and consulting.

Where Do CFA Charterholders Work?

CFA charterholders have a lot of opportunities in terms of where they would like to work, in terms of both industry and function. This is attributable to the extreme rigor and commitment that is required with completing the three CFA exams, as well as the profound knowledge and skills acquired.

CFA charterholders are able to apply their knowledge and skills in a wide range of roles throughout the global financial industry.

The sectors CFA charterholders typically work in include:

- Asset management

- Private wealth management

- Commercial banking

- Investment banking

- Insurance

- Hedge funds

- Private equity

- Venture capital

- Consulting

The table below has been extracted from a data report from the CFA Institute 2019 and illustrates the various roles that CFA charterholders work in, along with a rough percentage.

| Job Function | Percentage |

|---|---|

| Portfolio Management | 25% |

| Research | 12% |

| Consulting | 10% |

| Chief Level Executive | 9% |

| Investment Strategy | 7% |

| Risk Management | 7% |

| Relationship/Wealth Management | 5% |

| Credit Analysis | 5% |

| Trading | 4% |

| Accounting/Auditing | 4% |

| Financial Planning | 3% |

| Others | 9% |

As we see in the table above, the highest proportion of CFA charterholders work in portfolio management and research (i.e. investment analysis), and with good reason.

This is because the CFA curriculum focuses heavily on the investment management sector, which is most relevant for those two fields. So, how much do they make in these positions?

Median CFA Compensation by Position

In regards to the positions held by CFA charterholders, we are able to determine their median total compensation by looking at data from the 2018 CFA Societies Financial Compensation Survey Report.

This data will be portrayed below in a table format and in descending order of total compensation. The table will also break up the median total compensation, including median base salary, median bonuses, and the median of other compensation methods.

| Position | Total Comp. | Base | Bonus | Other Comp. |

|---|---|---|---|---|

| Chief Investment Officer | $393,700 | $227,500 | $85,000 | $95,000 |

| Portfolio Manager (equities) | $251,500 | $136,000 | $75,000 | $20,000 |

| Director of Investments | $234,700 | $165,000 | $46,500 | $21,536 |

| Portfolio Manager (fixed income) | $213,000 | $132,500 | $75,000 | $19,800 |

| Relationship Manager | $209,000 | $120,000 | $70,000 | $30,000 |

| Buy-side Research Analyst (equity) | $190,250 | $122,500 | $40,000 | $6,750 |

| Buy-side Research Analyst (fixed income) | $182,600 | $130,000 | $50,000 | $10,500 |

| Risk Manager | $172,500 | $126,060 | $36,000 | $7,000 |

| Private Client Portfolio Manager | $165,000 | $122,500 | $20,000 | $13,750 |

| Manager Research (equity) | $152,000 | $120,000 | $27,500 | $5,450 |

| Sell-side Research Analyst (equity) | $133,000 | $96,250 | $23,500 | $7,000 |

| Other | $133,000 | $110,000 | $22,000 | $8,500 |

| Financial Advisor/Broker | $128,375 | $110,000 | $21,000 | $8,000 |

| Consultant | $124,500 | $100,000 | $15,000 | $5,785 |

| Manager Research (alternatives) | $122,000 | $100,000 | $20,000 | $4,000 |

| Credit Analyst (rating) | $107,500 | $80,250 | $13,500 | $7,500 |

| Financial Analyst (corporate) | $105,000 | $87,500 | $12,500 | $5,000 |

| Performance Analyst | $105,000 | $83,500 | $12,500 | $4,640 |

| Client Services | $104,538 | $85,000 | $19,000 | $5,263 |

| Operations/Reconciliation | $101,420 | $89,500 | $9,200 | $6,170 |

From this table, we can see that the highest paying job for charterholders is Chief Investment Officer, with $227,500 in base salary, $85,000 in bonuses, and $95,000 in other compensation methods, for a total compensation of $393,700.

However, it is vital to consider the experience of the CFA charterholders, as it plays a significant factor in determining one’s income.

Median CFA Compensation by Experience

The median compensation of CFA charterholders changes dramatically as they gain more experience in their specific job function.

From the data in the 2018 CFA Societies Financial Compensation Survey Report, we are able to create a table for a whole range of different roles and the median compensation for each role based on whether you have:

- Less than 5 years of experience

- 5 to 10 years of experience

- 10 to 20 years of experience

- More than 20 years of experience

| Position | Total Compensation | |||

|---|---|---|---|---|

| Experience | < 5 years | 5 to 10 years | 10 to 20 years | >20 years |

| Buy-side Research Analyst (equity) | $93,500 | $196,250 | $264,300 | N/A |

| Portfolio Manager (fixed income) | N/A | $196,000 | $247,500 | N/A |

| Financial Advisor/Broker | $90,100 | $186,200 | N/A | $261,000 |

| Buy-side Research Analyst (fixed income) | $95,000 | $180,000 | $280,000 | N/A |

| Relationship Manager | N/A | $162,000 | $373,000 | N/A |

| Risk Manager | $150,500 | $160,060 | $214,166 | N/A |

| Consultant | $80,950 | $152,000 | $270,164 | N/A |

| Sell-side Research Analyst (equity) | $112,500 | $151,000 | N/A | N/A |

| Manager Research (alternatives) | $92,000 | $130,000 | N/A | N/A |

| Private Client Portfolio Manager | $78,000 | $103,750 | $170,000 | $271,000 |

| Chief Investment Officer | N/A | N/A | N/A | $393,700 |

| Portfolio Manager (equities) | N/A | N/A | $253,000 | $260,000 |

| Investment Banker | $148,600 | N/A | N/A | N/A |

| Accountant/Auditor | $85,000 | N/A | N/A | N/A |

| Financial Analyst (corporate) | $92,750 | $107,000 | $190,500 | N/A |

| Other | $75,000 | $130,000 | $200,000 | $241,100 |

Based on the data above, the highest paying roles, along with the total compensation for each experience bucket, is as follows:

- Less than 5 years of experience: Risk Manager - $150,500

- Five to ten years of experience: Buy-side Research Analyst (equity) - $196,250

- For 10 to 20 years of experience: Relationship Manager - $373,000

- For more than 20 years of experience: Chief Investment Officer - $393,700

However, these figures are the median figures for CFA charterholders in the US by experience.

Since there are so many charterholders worldwide, we will be outlining the median salary of CFA charterholders by country and state.

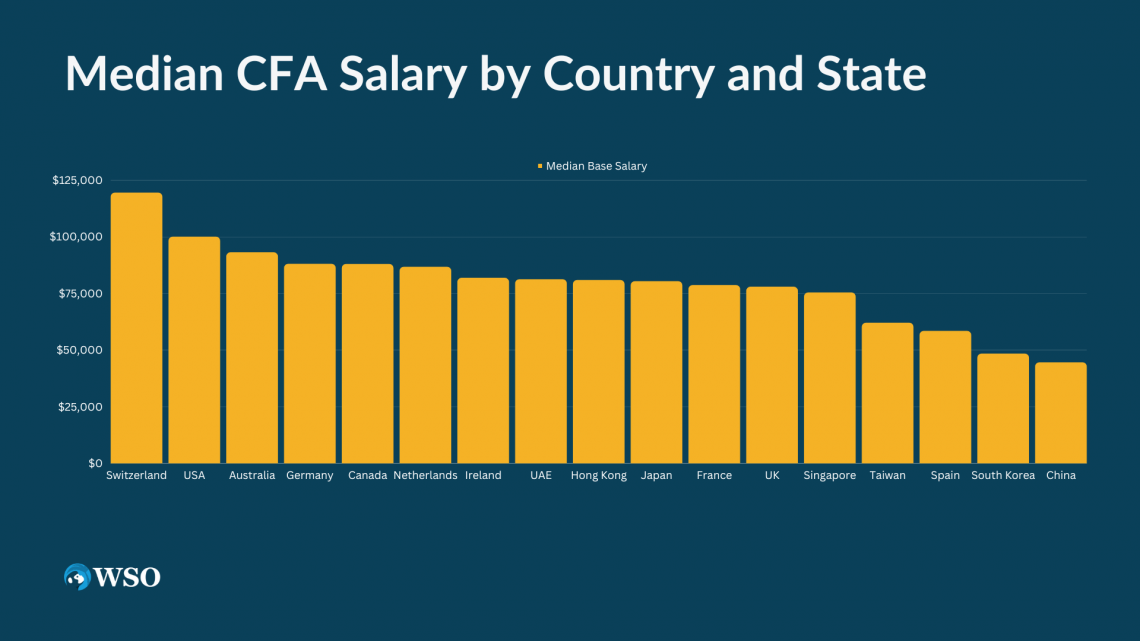

Median CFA Salary by Country and State

By extracting data from the CFA Institute website and salaryexpert.com, we have created a table of the top countries with the most CFA Charterholders as well as the median base salary for that country. All figures have been converted to USD.

| Country | CFA Charterholders | Median Base Salary |

|---|---|---|

| Switzerland | 3,782 | $119,530 |

| USA | 76,686 | $100,071 |

| Australia | 3,271 | $93,138 |

| Germany | 3,420 | $88,074 |

| Canada | 18,866 | $88,011 |

| Netherlands | 1,358 | $86,737 |

| Ireland | 608 | $81,873 |

| United Arab Emirates | 1,385 | $81,251 |

| Hong Kong | 8,585 | $80,930 |

| Japan | 1,466 | $80,402 |

| France | 1,372 | $78,666 |

| United Kingdom | 12,459 | $77,936 |

| Singapore | 4,525 | $75,391 |

| Taiwan | 612 | $62,041 |

| Spain | 864 | $58,416 |

| South Korea | 1,104 | $48,401 |

| China | 6,617 | $44,540 |

| Poland | 770 | $33,835 |

| South Africa | 2,288 | $33,497 |

| Malaysia | 903 | $30,022 |

| Thailand | 642 | $25,051 |

| Brazil | 1,384 | $23,982 |

| Russian Federation | 664 | $17,700 |

| India | 2,843 | $14,238 |

So it seems that the highest paying CFA charterholders are in Switzerland, USA, and Australia.

However, it is essential to note that these figures are just for the median base salary. The total compensation might be completely different in terms of ranking the data for which was not available.

As WSO’s audience is primarily from the United States, this post will go over the highest base salaries for CFA charterholders in different states and cities as it changes dramatically.

The following data has also been extracted from the CFA Institute website as well as salaryexpert.com, and presents the highest paying states and cities along with the number of CFA charterholders there in that state.

| State and City | CFA Charterholders in State | Median Base Salary |

|---|---|---|

| San Francisco, California | 9,384 | $125,777 |

| New York-Manhattan, New York | 13,288 | $119,635 |

| Boston, Massachusetts | 6,488 | $115,684 |

| Washington, District of Columbia | N/A | $115,640 |

| Anchorage, Alaska | 45 | $112,774 |

| Seattle, Washington | 1,435 | $112,461 |

| Chicago, Illinois | 5,421 | $107,630 |

| Philadelphia, Pennsylvania | 3,127 | $106,999 |

| Detroit, Michigan | 761 | $105,427 |

| Baltimore, Maryland | 1,563 | $105,376 |

| Denver, Colorado | 1,740 | $104,506 |

| Las Vegas, Nevada | 193 | $104,403 |

| Minneapolis, Minnesota | 1,507 | $104,222 |

| Houston, Texas | 4,250 | $104,195 |

| Manchester, New Hampshire | 301 | $100,848 |

| St. Louis, Missouri | 1,094 | $99,315 |

| Cleveland, Ohio | 1,629 | $99,184 |

| Miami, Florida | 2,571 | $98,622 |

| Atlanta, Georgia | 1,810 | $98,580 |

| Raleigh, North Carolina | 1,724 | $98,263 |

| Phoenix, Arizona | 612 | $96,709 |

| New Orleans, Louisiana | 162 | $96,344 |

| Indianapolis, Indiana | 523 | $95,325 |

| Birmingham, Alabama | 269 | $95,019 |

| Memphis, Tennessee | 688 | $94,452 |

| Louisville, Kentucky | 280 | $92,957 |

| Charleston, South Carolina | 283 | $92,511 |

| Wichita, Kansas | 410 | $92,192 |

| Oklahoma City, Oklahoma | 212 | $88,237 |

From the table above, the highest paying cities and states for a CFA charterholder are:

- San Francisco, California

- New York-Manhattan, New York

- Boston, Massachusetts

This article has outlined the different median compensation and salary for CFA Charterholders based on position, experience, country, and state.

However, there are a lot more factors that contribute to their median compensation, including the size of the company, the industry, firm performance, individual performance, and more.

Overall, the CFA charterholder is one of the most prestigious and arguably hardest designations in the world, and as the data suggests, they are compensated quite well for it.

Free Resources

Please check out the following additional resources to help you advance your career:

or Want to Sign up with your social account?