Venture Capital VC Interview Questions

How to Answer the Top Venture Capital Interview Questions?

Similar to other areas in finance, to be recruited into venture capital (VC), candidates will go through interviews.

Potential interviewers will ask questions to assess a candidate's knowledge of the VC industry, investment strategy, and approach to building relationships with startups and other external/internal stakeholders.

They may also be used to assess a candidate's fit with the firm's culture and investment focus.

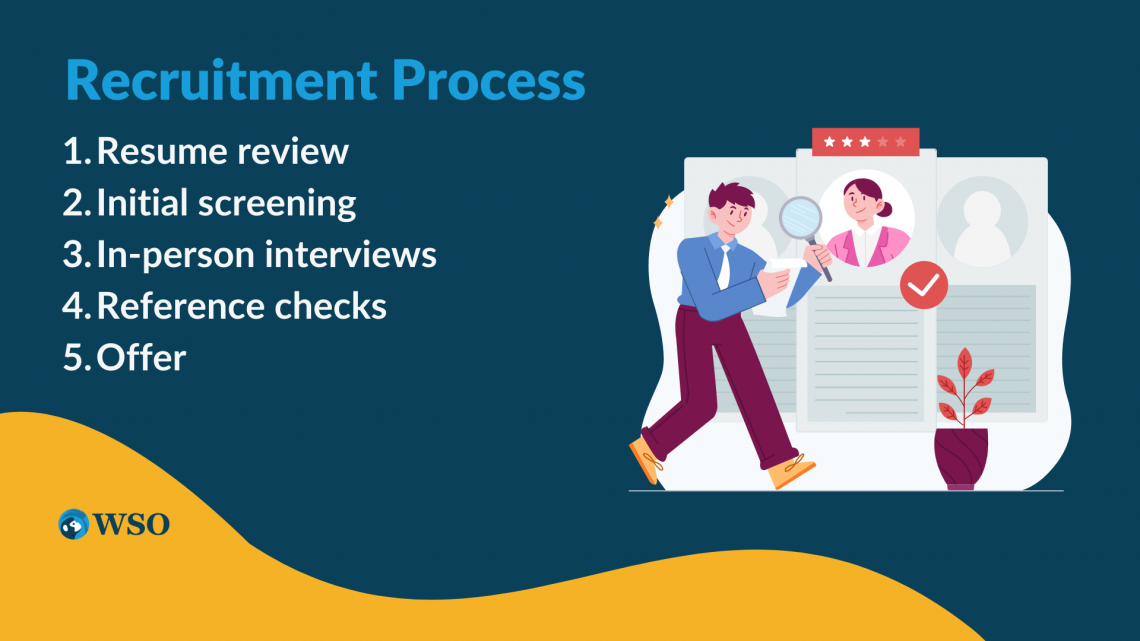

Well-established VC firms have a structured recruitment process to identify and hire talented candidates who can support the company by identifying and evaluating potential investment opportunities.

The recruitment process may involve several steps, including:

VC firms receive a lot of resumes from candidates interested in working in the industry. Therefore, firms will review resumes to identify candidates with relevant experience and skills.

2. Initial screening

Candidates who pass a resume review may be invited to participate in an initial screening, including a phone or video interview with a VC firm's team member.

This is an opportunity for the firm to learn more about the candidate's background and interests and assess their fit with the firm's culture and investment focus.

3. In-person interviews

Candidates who pass initial screening (if there is one) are invited to participate in in-person interviews with multiple members of the VC firm's team.

Interviews can be individual or group sessions and cover various topics, including the candidate's experience, investment philosophy, and approach to building relationships with startups and other stakeholders.

4. Reference checks

VC firms may also conduct reference checks to gather additional information about candidates' experience and qualifications. For example, the firm may contact a candidate's past supervisors, subordinates, or peers who have worked with the applicant.

5. Offer

If the candidate is selected for the position, the VC firm may extend an offer of employment. The offer may include details about the role, compensation, and benefits.

The VC recruitment process is designed to identify and hire talented individuals who can contribute to the success of the firm and its portfolio companies.

Common Types of Venture Capital Interview Questions

Over years of collecting interview information, we have found the four most asked questions: resume-related, market and trends, technical, and behavioral.

1. Resume-related

For entry or junior-level positions, interviewers will ask you to go over your resume or ask about specific experiences you wrote in your resume. Again, this is an opportunity to show why you're the best candidate for the job.

2. Market and trends

Since a big part of having a job in VC is staying up to date with the latest trends and events in the industry, the interviewers expect you can have a smooth conversation about the industry - and your views and outlooks if you're applying to more senior positions. In addition, this is an opportunity to show your knowledge and interest in the VC world.

3. Technical

You may be asked questions about your technical understanding of the VC industry (investing, fundraising, startup strategies, etc.).

You may have a technical background from prior experiences, but if you don't, you need to research, get comfortable with the technical aspects of VC, and be ready to discuss and answer questions.

4. Behavioral

Interviewers ask behavioral questions to see if you have the soft skills required for the role, your personality, and the way you think, which will determine if you are a good fit for the position. In addition, interviewers seek honest and memorable responses.

What a VC Interview Feels Like

Although VC firms have interview processes and questions, they are generally the same for entry and junior-level positions.

Here are some responses from monkeys who went through the interview process at VC firms:

Monkey A: The interview was "very chill and laid back." The interviewer asked about personal projects and other activities I listed on my resume. It felt like a conversation as he would hear something on my CV and ask me technical questions.

Monkey B: All the questions I was asked were behavioral. I took time to think before answering each question, and the interviewer didn't seem to mind.

Monkey C: My interviewer mostly asked about my past business experience related to ventures, then asked technical questions like valuations and term sheets.

Monkey D: I got asked to explain what markets I'm passionate about and describe why I'm interested in emerging markets. They also asked me to list a few markets that I think have a positive outlook for the future.

Money E: My interview seemed "less focused on the usual financial concepts and more towards my thought process." We went over only one question about present value and its real-world applications.

The respondents are kept anonymous, and their responses are summarized unless quoted in quotation marks.

There are many more responses, but the summary is as follows:

- Be prepared to talk about your resume, including the details, story, and how it relates to making you a good candidate for the position.

- Ensure you know your technicals - surf online for free courses for related technicals.

- Know the industry and the latest trends; interviewers won't expect you to have your insight on the industry but know what's going on through reading the news, etc.

- Have a good story on why you want to enter the VC world and the firm.

The actual vibe of the interview will change based on who you're talking about, which may range from an associate to a managing director. Examples of VC Interview Questions and Responses

Everyone in a VC firm is pretty busy, so when someone interviews a candidate, they would love an engaging conversation. Although you should be honest about your background and thoughts, it doesn't hurt to make the interview more fun.

Here are some examples of VC interview questions and responses:

1. Why do you want to enter the VC industry?

"I have wanted to work at a venture capital firm for a long time, mainly because I'm interested in the startup world. I enjoy learning about how companies transform an abstract idea into a concrete product and distribute it to the world.

Compared to learning about established successful companies, it's more interesting to see how startups conquer difficult issues and how founders make their creativity into real life."

This is one of the most common questions in an interview. Of course, many candidates will have the same response, so you should have a personal reason to show your enthusiasm.

There's no example response for 'why do you want to join our firm?' because such questions are unique to each VC firm. Instead, research the firm, including sources outside the VC firm's VC, and pick out the things you like the most.

2. If you could only invest in one sector, which would you choose?

"If I had to pick a sector to invest in today, it would be the life science sector. Most companies in this sector have great profitability. In addition, they have shown great investment, expansion, and innovation, so it's a safe bet as the sector will continue its growth in the years ahead.

However, I don't like how this sector has a high risk for failure because of the low success rate, but if I can get one successful company, it still has huge investment returns."

You have to research this. You should state an industry you are interested in and, preferably, the VC firm is focused on. Develop some of your own opinions, or just be diligent and search for the general opinion and expert comments.

3. How do you value a potential investment?

"I would first figure out the upper limit on the valuation, which will determine the maximum price our firm can pay for the deal to be a good investment. I find the upper limit by estimating the company's growth potential.

I also ensure that the company is ahead of market and industry trends and development. Then I conduct due diligence about the company. If it is confirmed to be a good investment, I will make a deal with its founders for as little as possible.

Interviewers are trying to know how you think. As a venture capitalist, your goal is to find companies to invest in by analyzing the sector, the industry, the company, etc.

Although you don’t need to be an expert (or else why are you only an associate), the interviewer needs to see clear and logical reasoning for your actions.

4. Why venture capital and not start your own business?

"Being a venture capitalist is a different experience than being an entrepreneur. I'm not interested in starting my own company because I like having a big outlook on the industry and advising and helping portfolio companies increase value rather than working on an idea every day for years."

This allows interviewers to understand your interest in the VC industry. For example, many people want to enter the VC industry because they are “entrepreneurial,” but that doesn’t fully explain why they can’t be entrepreneurs.

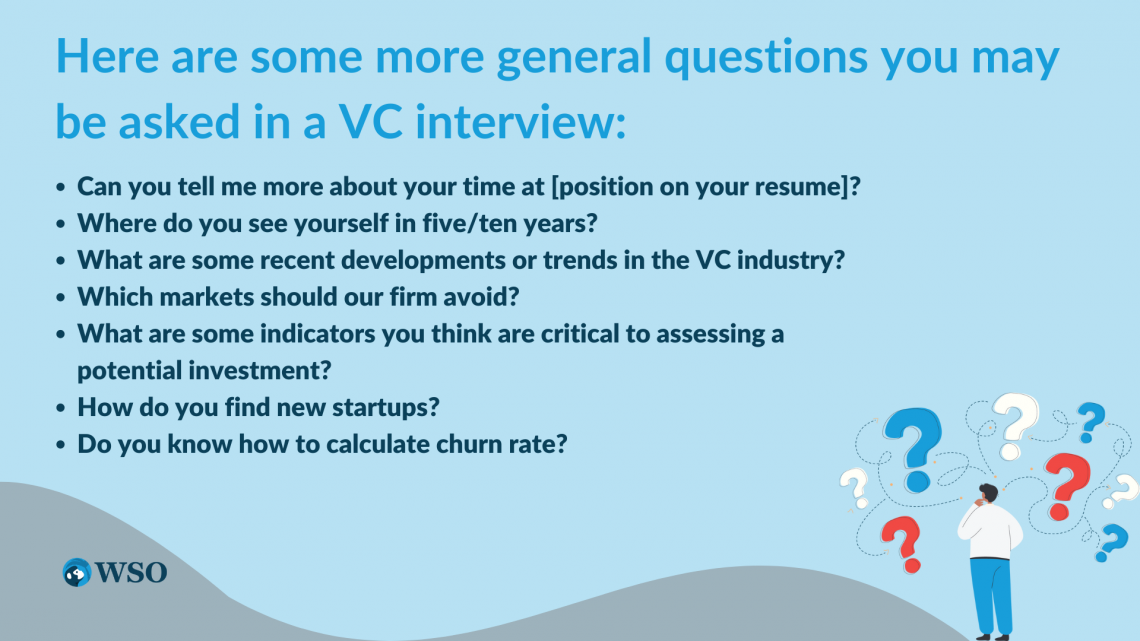

Here are some more general questions you may be asked in a VC interview:

- Can you tell me more about your time at [position on your resume]?

- Where do you see yourself in five/ten years?

- What are some recent developments or trends in the VC industry?

- Which markets should our firm avoid?

- What indicators do you think are critical to assessing a potential investment?

- How do you find new startups?

- Do you know how to calculate the churn rate?

- Can you explain the lifetime value and give me a simple example?

- What's the difference between private equity and VC?

- What startup(s) do you admire?

- Do you have a portfolio?

- Which startup in our portfolio is the most promising?

- Who do you think are our competitors?

- Do you network with entrepreneurs and investors?

- What's your approach to networking and building connections within the VC ecosystem?

Check out our Venture Capital course to better understand how the VC world works!

or Want to Sign up with your social account?