Debit Note

It is an accounting document that sellers issue to buyers to record ongoing debt obligations.

A Debit note, or debit memo, is an official accounting document that sellers issue to buyers to record ongoing debt obligations. It’s typically only used in business-to-business transactions, and buyers can also give this document when making returns.

The definition of debit, in accounting, means an increase to either a company's assets or expenses. Therefore, it represents money incoming or owned. Conversely, in accounting, credit means the money you owe.

Debit, when issued by the seller, is the money incoming to the seller in the form of a note. In the accounting records, a seller would debit this, whereas a buyer would credit it as money owed. Knowing this, we can apply this to the word, debit note.

It’s important to note that Debit memos and invoices are two separate documents. Invoices are itemized bills representing each sale and indicating its completion, whereas memos only indicate a change or adjustment in the previous balance. Credit transactions occur in both cases.

Debit notes play a part in indicating a debit being applied to the balance owed rather than initiating any action to take place. They are also issued before an official invoice hence why they are used in accounting as an excellent record-keeping technique.

Businesses sometimes use debit notes instead of invoices when recording transactions outside their central business avenue. Companies want to keep invoices strictly for their services or the sale of their goods.

These notes are also helpful when correcting a mistake made on the invoice, which can happen frequently when a product is in high demand. For example, if an invoice is underestimated, a company can send a debit note to increase the money that was supposed to be owed.

Businesses find these notes most useful for tracking purposes. Examples of business sectors that need to be tracked include shipments, orders, inventory costs, sales, and payments owed or due.

Some purchasers may never receive debit notes at all based on company standards. Some companies will systematically send out notes to their customers or if a customer repeatedly fails to meet payments on time.

Key Takeaways

- Sellers use debit notes to inform buyers of an adjustment in their balance due.

- Not all companies use debit notes.

- Some companies use debit memos to record transactions outside their primary business activities.

- Invoices are different from debit notes.

- Debit memos are used in business-to-business transactions.

Why are debit notes important?

As stated, debit notes represent adjustments in a purchaser’s balance with a company. Therefore, they are essential for maintaining accurate financial records and ensuring transparency in business transactions.

They communicate formally between buyers and sellers, clearly documenting adjustments, additional charges, or returns.

Sellers can update and rectify any errors or changes in the original invoices by issuing debit notes, ensuring the financial information reflects the correct amounts owed.

Since debit memos are between business to business, their accuracy fosters trust and promotes transparency between business partners, reducing the risk of complications or disputes.

Notes are just as important to sellers as they are to buyers by playing a crucial role in dealing with returns and allowances. There can be several reasons why buyers would want to return items, and in these cases, debit notes become indispensable.

Examples of scenarios where a purchaser would want to return an item:

- Delivery Delays

- Overpaying for an item

- Defective items

- Items no longer needed

- Wrong item delivered

Issuing a debit note for a return allows sellers to reduce the invoice amount by the appropriate value, reflecting the return or allowance granted. This helps prevent discrepancies in financial statements and helps both parties reconcile their accounts accurately.

NOTE

Using Debit memos as a systematic approach to handling such situations reduces the likelihood of mistakes and helps maintain positive customer relations and experiences.

Returns are not the only scenario where a debit note can be used. They are helpful in any situation involving an additional charge to the purchaser's account, which is not included in the invoice.

These charges may include freight costs, late payment penalties, or other supplementary fees. Even when a note is not issued due to an error, return, or additional fee, they still prove their importance to a company's overall success through accounting and communication methods.

How are debit notes used?

There are many situations where it would be used from both a seller's and a buyer's perspective.

Here are the most frequent issuances of a debit memo:

- Systematic approach

- Accounting purpose

- Returns

- Pricing errors

1. Procedural Aspects

Some companies follow a structured procedure with notes to ensure consistency in business transactions. They usually include critical information such as buyer and seller details, original invoice number, the reason for the debit note, revised amount, and supporting documentation.

Sellers sending out notes to all customers with each order can help to remind them of their payments. However, this is only sometimes necessary, especially if the customer consistently pays their dues on time.

A company may resort to debit notes when a buyer repeatedly fails to pay their balances promptly or if the buyer requests a note.

NOTE

An invoice is typically sent regardless, so companies will sometimes get rid of the middleman according to the type of business.

2. Financial Reporting

Notes can be critical in assessing financial performance by accurately capturing adjustments, returns, allowances, and charges.

These records enable businesses to maintain transparency, ensure compliance with accounting standards, and produce reliable financial statements.

By providing an audit trail and facilitating the proper allocation of costs and revenues, they contribute to the integrity of financial reporting. Transparent communication through debit notes lets both parties understand the adjustments made clearly.

3. Returns

When purchasers want to return an item, they will issue a debit memo as a formal record of returned goods. This serves as evidence that the return transaction has taken place.

NOTE

This documentation ensures that the financial records accurately reflect the adjustments resulting from the return. They enable businesses to reduce the original invoice amount by the value of the returned goods.

In the case of a return, the note includes essential information such as invoice number, the return date, quantity, reason for return, and any associated costs or deductions like restocking and transportation expenses.

To optimize the use of debit notes for returns, businesses will usually consider the implementation of clear return policies, such as:

- Timely processing

- System Integration

- Credit options

- Disclosure fees

4. Pricing Errors

Accurate pricing is crucial in business transactions, but pricing errors can occur for various reasons, such as system glitches, data entry mistakes, or miscommunication.

Debit notes can rectify pricing errors by allowing businesses to adjust the invoice amount and communicate the corrections to the buyers.

NOTE

The Notes are formal documents; they provide both parties with a transparent record of the correction.

Sellers communicate the pricing error to the buyer with the note. It serves as a formal notification, clearly stating the correction made, explaining the error, and outlining the revised invoice amount.

Companies like this method because it showcases a clear audit trail of pricing errors and their subsequent corrections.

Debit note Examples

The seller or purchaser receives the documents as a piece of paper, and this varies depending on the company. Some companies send it as a payment slip, while others send it after the delivery in a more formal manner as a letter.

Whichever way businesses decide to deliver it, they all include the same information of the note date, company name, serial number, invoice number reference, a brief description of the transaction taking place, items and price, address, and authorized company signatures.

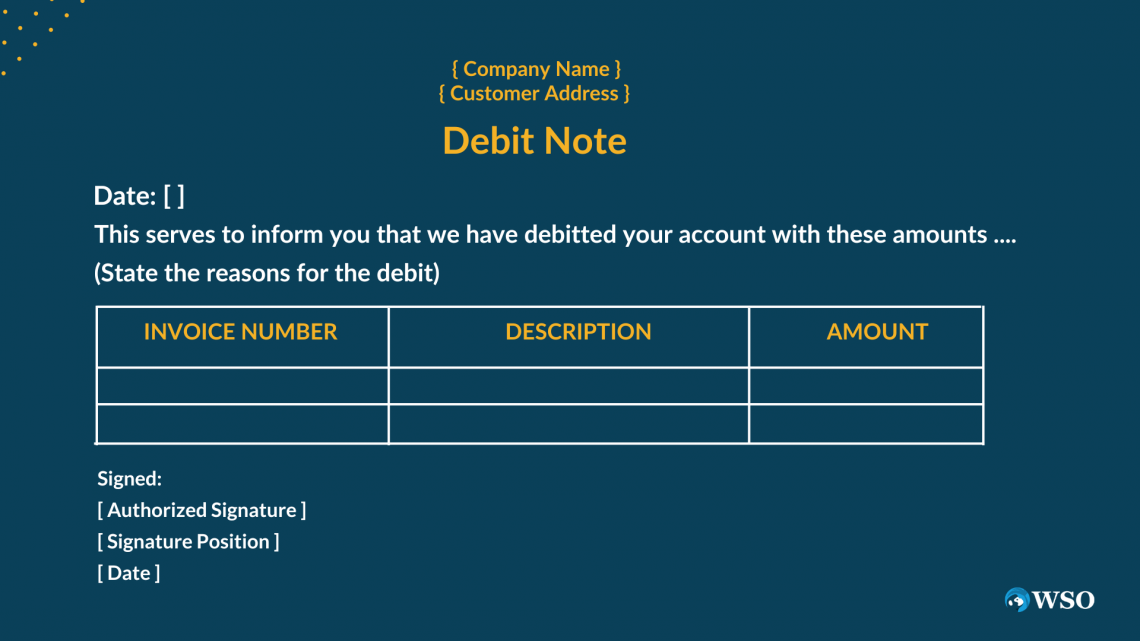

As a Letter, the debit note will typically look like this

The letter clearly states the reasoning behind the note, including the amount, description, date, company name, invoice number, and signature. This provides formal notification of any adjustments to the purchaser's account.

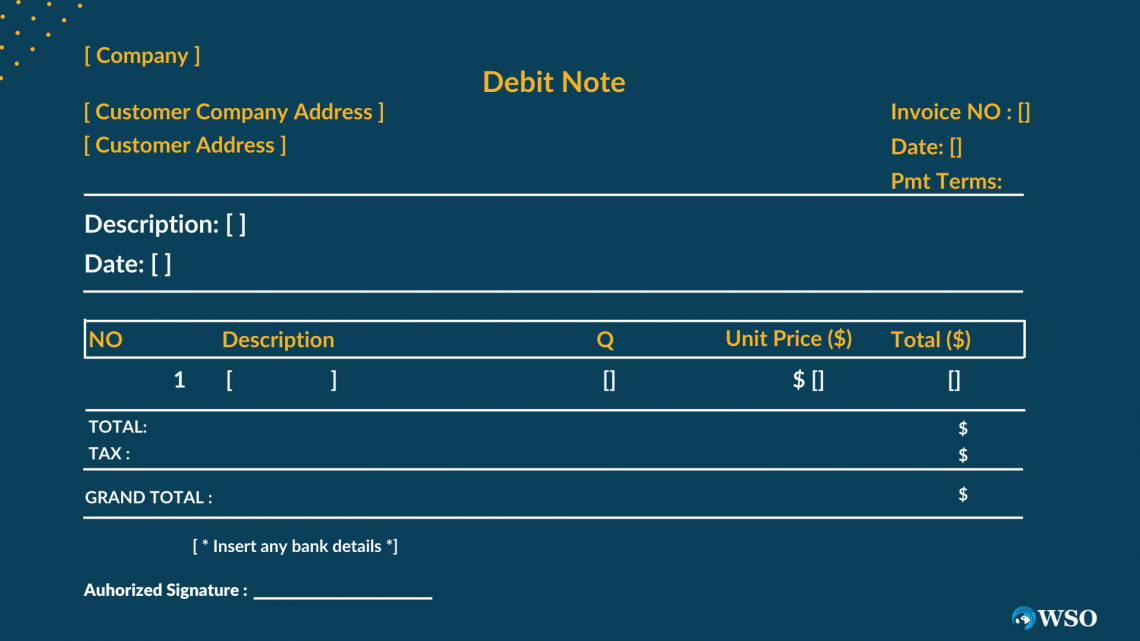

As a postcard, the document will look like this:

As you can see, the postcard contains the same information as the letter. It is just a different way for companies to deliver the note.

When sending a note to a client with an overdue balance, it might be wiser for a company to go with the letter format because it directly brings attention to the balance. The description reason is highlighted and addresses the problem directly.

This increases the chance that the balance will be paid promptly. When a seller routinely sends out a note, they usually use the postcard approach because the format is more systematic.

A critical takeaway from reviewing each of these formats is to make sure whichever method is used contains the information you need to convey.

Debit Note Vs. Credit Note

One of the most common misconceptions upon issuance of these notes is that a debit and credit note are the same thing. From an accounting standpoint, keeping these two notes the same is critical for record keeping.

We already addressed the literal definition of a debit note earlier. Now let us talk about the word-for-word meaning of a credit note.

A credit is represented by the right side of a ledger account and means it is a liability to the account. For example, accounts payable is a credit because it represents the money you owe to someone else. After all, you paid with credit and have yet to exchange hands.

A credit note is a document issued by a seller to a buyer, indicating a reduction in the amount owed or a refund due to overpayment, returns, pricing errors, or allowances. It decreases the buyer's liability or reduces the seller's accounts receivable.

Typical uses of credit notes include returns, discounts, or pricing discrepancies. Each of these increases the amount a seller will owe a buyer. Nothing is being exchanged physically, but it's issued for accounting purposes to offset an incorrect amount on the debit side.

This differs from debits because debits represent an increase in the seller’s liquidity instead of a decrease like credits.

Both credits and debits are used for the same purposes. However, the difference is in whether the buyer or the seller is sending it out to coincide with which account gets either debited or credited.

Summary

A debit note is a financial document issued by a seller to inform a buyer of an increase in the amount owed or a correction in a previously issued invoice.

It is a formal request for payment from the buyer for additional goods, services, or adjustments to the original transaction.

When a seller realizes that the original invoice was undercharged, additional items were delivered, or errors were made in the invoice, a debit note is created. It is helpful as a notification to the buyer, specifying the reasons for the increase in the outstanding balance.

Not all businesses use these notes. In fact, some companies will never see a debit note. However, it is useful for sellers to send it to purchasers with a history of missing payments as a reminder of their balances.

Credit memos and Debit memos differ in who sends the note and what it does to their accounting statements. For example, if a company sends a debit memo to a buyer, it is because the buyer owes a debit to the company's account and vice versa.

These notes have many uses, such as a formal reminder, an accounting record, transparent customer communication, or a correction method. Understanding its different uses as a company is critical for decision-making processes.

Researched and authored by Emily Rustom | Linkedin

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?